| What is an Early Payout on Terminal Illness? An early payout on terminal illness (also known as an accelerated death benefit, terminal illness benefit, payout accelerator or living benefit) is a life insurance feature that allows you to access part (or sometimes all) of your death benefit while you’re still alive, if you are diagnosed with a terminal illness. In many modern term life insurance plans, the early payout for terminal illness is included as a built-in benefit. This sounds reassuring, but in reality, such claims are complex to make. |

What if your life insurance could support you while you're still alive, when you need it the most? That's what the early payout for terminal illness is designed for.

If you're diagnosed with a severe disease and have limited time left, this feature allows you to access part of your life cover early. The money can help with medical expenses, daily needs, or even making the most of your remaining time, without waiting for the policyholder's death.

In this guide, we'll break down how it works, its benefits, the claim process, real-life examples, and why it matters. By the end, you’ll be able to confidently decide whether it's the right safety net for you.

Still unsure how to claim your early payout benefit? Book a call with us, and let our experts guide you through the process.

Leading Insurers That Offer Early Payout on Term Insurance

| Before we discuss the list, here’s how we decide what plans to feature. At Ditto, every term insurer/plan goes through our six-point evaluation framework. It doesn’t mean these are the only good plans, but that they stand out after being scored across all six pillars. |

| Term Insurer | Plan Name | Terminal Illness Cover (Accelerated Payout) |

|---|---|---|

| HDFC Life | Click 2 Protect Supreme | Up to ₹2 Crore |

| Axis Max Life | Smart Term Plan Plus | Up to ₹1 Crore |

| ICICI Prudential | Iprotect Smart Plus | Entire Base Plan |

| Bajaj Allianz Life | E-Touch II | Up to ₹2 Crore |

| TATA AIA | Sampoorna Raksha Promise & Maharaksha Supreme Select | Up to 50% of Base Cover Amount |

What are the Benefits of the Early Payout Option?

If you're diagnosed with a terminal illness, an early payout from your life insurance plan can offer more than just money. Here are some key benefits to know:

- Immediate Financial Relief: It helps cover high medical costs, such as hospital care, palliative treatment (ie, medical care that helps improve the quality of life for people with serious illnesses by providing relief from symptoms and stress), home nursing, or travel for treatment.

- Complete Flexibility: The payout can be used however you need, for medical bills, daily expenses, loan repayments, or even quality-of-life travel or home care.

- Peace of Mind for the Family: It eases financial stress, allowing your loved ones to focus on caregiving and emotional support, rather than scrambling for funds.

- No Repayment If You Recover: If your condition improves after the claim, you typically don't have to return the payout, as it's based on medical reports at the time of the claim.

- Possible Waiver of Premiums: Some policies also include a premium waiver. If a partial sum assured is paid out under the Terminal Illness Benefit, you won’t have to pay future premiums for the remaining coverage amount.

How Does Early Payout in Terminal Illness Work?

If you’re diagnosed with a terminal illness, your life insurance policy may allow you to access part of the death benefit early. Here’s how the process typically works from a policyholder’s perspective:

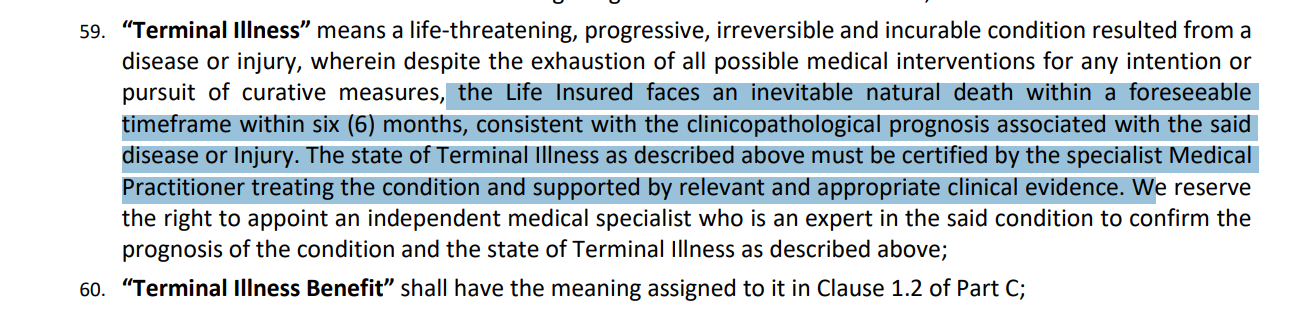

a) Medical Diagnosis: You must be diagnosed by a qualified doctor with a terminal illness. Most insurers define this as having a life expectancy of less than 6 months, depending on the policy.

Here’s a snippet from Axis Max Life about terminal illness:

b) Submit Required Documents: You’ll need to provide the correct medical reports, test results, the doctor’s prognosis (prediction of future health condition), and a completed claim form. The insurer may also ask for an independent medical opinion to confirm the diagnosis.

c) Claim Review and Approval: The insurer reviews your case to ensure all policy conditions are met, including that the policy is active, waiting periods have been completed, and no exclusions apply.

d) Payout Calculation: The insurer determines how much of the death benefit can be paid early. This could be a fixed amount (like ₹1 or ₹2 crore), a percentage (such as 25% or 50%), or even the full sum assured, depending on the policy terms.

e) Disbursement and Policy Update: Once approved, the payout is transferred to your bank account. The remaining benefit is either paid to your nominees later or when the policy ends, depending on the payout structure.

Here’s how the early pay out works:

Let’s say a 45-year-old person has a ₹2 crore term plan with an Accelerated Death Benefit (ADB) rider. The insured is diagnosed with stage IV pancreatic cancer, and doctors have confirmed a life expectancy of less than six months. The insurer reviews the medical reports, approves the claim, and pays ₹1 crore upfront, helping the family manage medical bills, care, or other urgent medical needs.

However, early payouts are usually capped. Even if your total cover is higher, most insurers limit the accelerated benefit to ₹1 or ₹2 crore. The remaining amount will be paid to your nominee after death, as per the policy terms.

| Did You Know? Most insurers have a 1–3 year waiting period before you can claim an early payout. If a partial payout is made, the remaining coverage continues; premiums may still be payable or could be waived, depending on the specific policy terms. If the full sum assured is paid out, the policy terminates. |

Ditto’s Take on Early Payout

At Ditto, the focus is on helping users make informed insurance choices, rather than chasing a single feature. Here's what we usually advise:

- Check if it's included by default: Many term plans now offer terminal illness (accelerated death) benefits without extra cost.

- Don't buy the rider just for this benefit: Since early payout claims are tough to approve, paying extra for the rider may not be worth it unless it adds real value.

- Understand the fine print: Insurers differ in how they define "terminal illness," how much they'll pay, waiting periods, and age limits.

For instance, With HDFC Life Click 2 Protect Supreme, the Terminal Illness Benefit is available only until age 80. If diagnosed after that, you won’t receive an early payout. Even before 80, the maximum early payout is capped at ₹2 crore, regardless of your total sum assured, so plan accordingly to avoid surprises during critical times.

- Expect a strict claims process: Doctors may hesitate to provide precise prognoses, and insurers often require strong evidence.

To delve deeper into this, we spoke to a chief underwriter at a leading life insurer, who confirmed that Early Payouts /Accidental Death Benefit (ADB) claims are quite rare. While they didn’t share exact numbers, they emphasized that every claim is thoroughly investigated. Even our in-house medical experts have the same opinion that ADB claims are uncommon and are constantly closely scrutinized.

- Think beyond one feature: Choose your policy based on total coverage, consider your debts, your family's future needs, inflation, and health, not just early payout options.

Why Talk to Ditto for Your Life Coverage?

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Arun below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 5,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

Final Thoughts

- Early payout for terminal illness (also called an Accelerated Death Benefit) lets you access part of your life cover while you're still alive, if diagnosed with a qualifying terminal illness.

- The money can help with medical bills, daily expenses, or personal needs, but it reduces the amount your family receives later.

- Claiming it isn’t easy; you’ll need strong medical proof and must meet all policy conditions.

- Not all policies are the same. Definitions, payout limits, and waiting periods can vary, so read carefully.

- For many, this benefit offers peace of mind, financial control during a crisis, and reduced stress for loved ones.

Still unsure how to claim your early payout benefit? Book a call with us, and let our experts guide you through the process.

FAQs

Does Terminal Illness Benefit Apply to Pre-existing Illnesses?

If the insurer underwrites and accepts the risk due to the declared PED, the terminal illness and death due to that PED are also covered.

Is early payout the same as a regular death benefit?

No. It is an advance on the death benefit, paid while you are alive if you qualify. The amount you receive early is deducted from the final payout.

What illnesses qualify as “terminal illness”?

There is no universal list. Usually, it’s an incurable condition with a prognosis of limited life expectancy (often 6 months). The exact definition depends on your insurer’s policy.A few examples that may qualify are end-stage cancer, ALS, or multi-organ failure.

Is the early payout taxable?

No, under Section 10(10D) of the Income Tax Act, the terminal illness payout for a term plan is tax-free.

Will claiming this benefit cancel my policy?

It depends. If you claim the full sum assured early, the policy often terminates. If only a partial amount is accelerated, the remaining cover may stay active (sometimes without further premiums).

Last updated on: