Quick Overview

Suppose you have a ₹1 crore term plan that you have paid for all these years. But what happens when you are no longer around and the claim is triggered? If the nominee listed on the policy is an outdated name that you forgot to update, the claim could be delayed or even stuck.

This article addresses exactly that situation.

We’ll guide you through understanding who a nominee is, how and when to change them, and how to make sure your term plan actually reaches the people you care about.

What is A Nominee In Term Insurance?

Can You Change The Nominee After Buying Term Insurance?

Yes, you can change your nominee in term insurance any time while the policy is active. You are not locked into the name you gave when you bought the plan.

Under Section 39 (Nomination by policy-holder) of the Insurance Act, 1938, the nomination can be made or changed at any time before the policy matures, through an endorsement that updates the insurer’s records.

Here are a few practical points to remember:

- You can change your nominee multiple times. Insurers treat each new nomination as the latest valid one.

- There is no charge to change the nominee. It is a free servicing request.

You do not get a fresh policy document each time. The insurer issues an endorsement letter with the new nomination, and it replaces what was printed on the original policy document.

Example: You bought a term plan at 25 and nominated your mother. At 32, you get married and have a child. Hence, you can change the nomination to match your current financial responsibilities.

Types of Nominees In Term Insurance

Blood Relative Or Beneficial Nominee

When you nominate a spouse, children, or parents, they are generally treated as beneficial nominees. Insurers pay them smoothly as they are your natural legal heirs.

Non-family Nominee

This category includes your friends, distant relatives, or a business partner. Insurers may ask for extra clarification or documentation to show why this person should get the money.

Minor Nominee

If your nominee is under 18, you must add an adult appointee who will receive and manage the money till the child turns 18.

Moral Hazard in Term Insurance

Steps To Change Nominee In Term Insurance

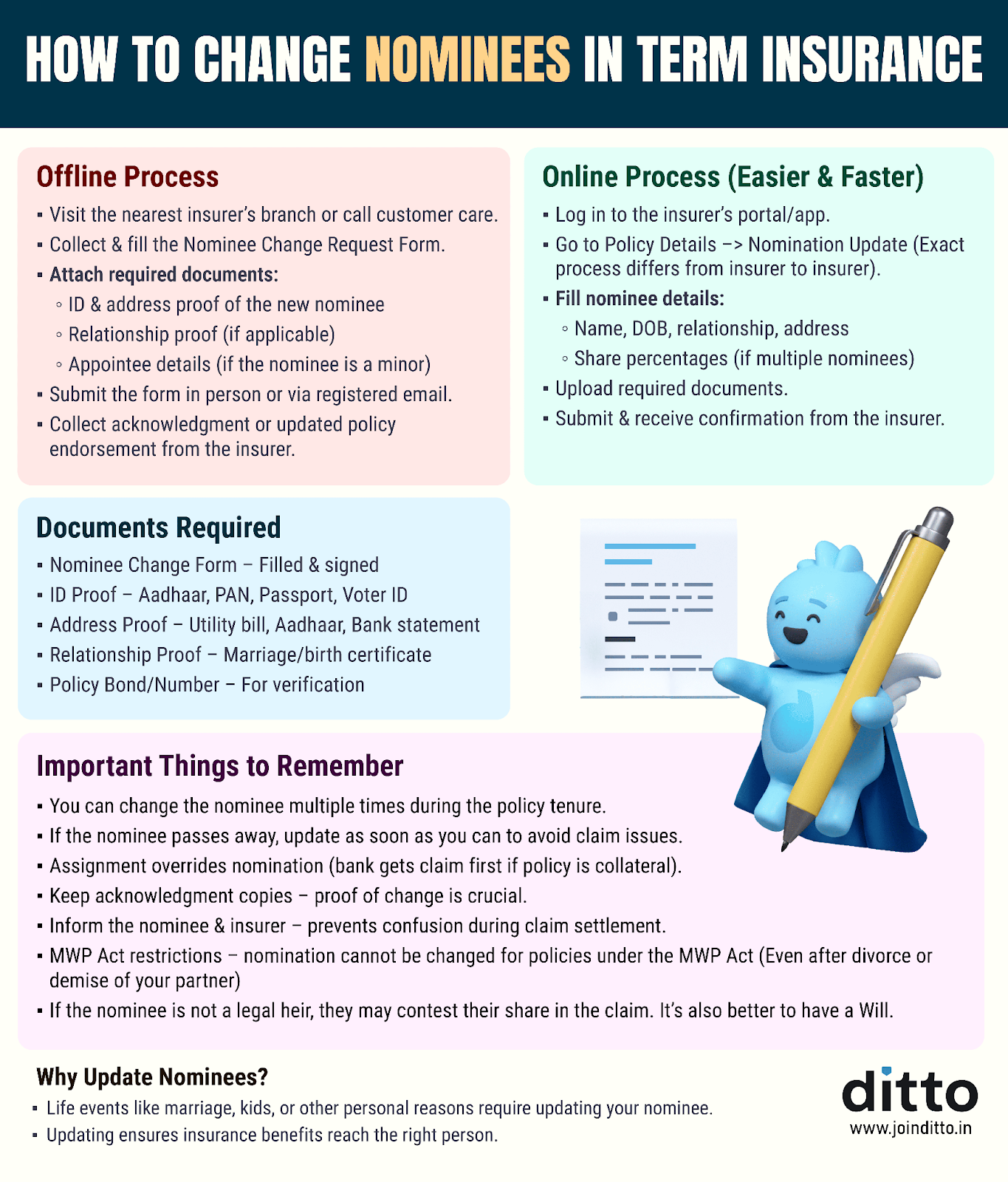

Changing your nominee is treated as a simple servicing request. You can do it either online through the insurer’s portal or offline at the branch. The change is confirmed through an endorsement on your policy records.

For a step-by-step checklist of the process, you can use the visual guide below.

Documents Required To Change The Nominee In Term Insurance

In most cases, insurers only need a signed nomination change request, KYC documents of the new nominee (and appointee if the nominee is a minor), and your policy details. For a detailed document checklist, you can refer to the visual guide above.

How To Choose The Right Nominee For Term Insurance

Start with a simple question: If your income stopped tomorrow, who would face the biggest financial shock?

In most cases, that list will read spouse, children, and sometimes dependent parents. These are your natural nominees. If you want to include others, such as a sibling who lives with you, keep their share reasonable and ensure your main dependents are fully protected.

Common Mistakes People Make While Choosing A Nominee

- Keeping parents as sole nominees even after marriage and children

- Forgetting to change the nominee after divorce or the death of a nominee

- Not adding an appointee when the nominee is a minor

- Using nicknames or incorrect spellings that do not match Aadhaar (official name)

- Assuming the insurer will send a new policy document and ignoring the endorsement

- Never telling your nominee about the policy or where the documents are kept can leave them confused when they need the money most.

Bottom Line: A simple annual check of your nomination, along with your policy, can prevent messy disputes later.

Why Choose Ditto for Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call now, slots fill up fast!

Ditto’s Take On Changing Nominees

Your term plan exists to replace your family’s income and the nomination should reflect it clearly at every stage of life. This means you should:

- Prefer first-degree relatives as nominees

- Split the benefit in line with who actually depends on you

- Keep names and birth dates exactly as per official government IDs

- Save every endorsement that confirms a change

If you want help reviewing your existing term plan and nominee details, you can book a free call with Ditto. We will walk you through the options for your family at no extra cost and with zero spam.

Frequently Asked Questions

Last updated on: