What is ESIC number?

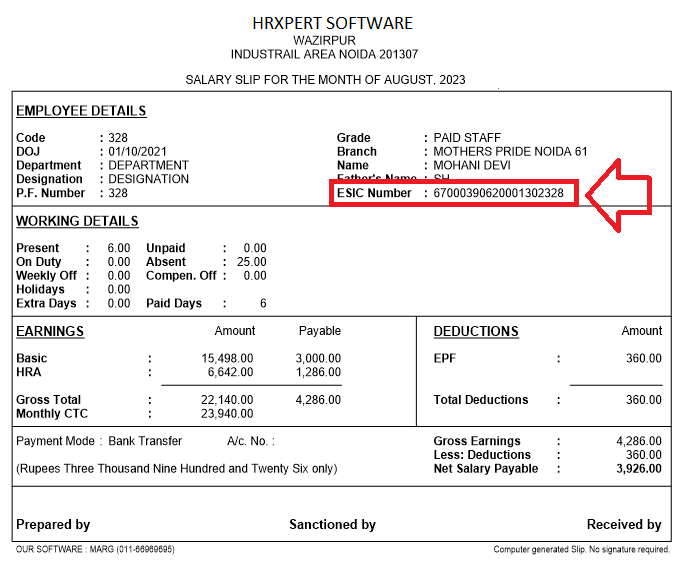

If you’re earning less than 21,000/- per month, it’s likely you’re covered by ESIC for government-backed healthcare benefits. For most employees, the easiest way to confirm ESIC coverage is through their payslip (watch out for a 10-digit number).

Already covered by ESIC? Great! Now add what ESIC doesn’t cover, like choice of hospital, room flexibility, and continued cover even if you switch jobs. Talk to Ditto’s IRDAI-certified advisors to build your ideal healthcare insurance plan.

Here’s a snapshot for a sample payslip with ESIC number:

However, not many are aware that the extended benefits of ESIC coverage is limited to empanelled hospital tie-ups and the wage limit. For a comprehensive protection with wider cashless network hospitals and uninterrupted cover, a personal health plan works best.

In this quick guide, you’ll learn:

- What is ESIC number (with format and examples)

- ESIC benefits and eligibility criteria

- How to register for ESIC

- How to find your ESIC Insurance number

- How to download your ESIC card online

- How to contact ESIC Customer Care

- How a private health plan can complement ESIC

What Is ESIC Number?

The ESIC number (also known as the Insurance Number/IP Number) uniquely identifies an individual within the ESI system. The ESIC registration is ideally done by an employer for all eligible employees on day one of their job.

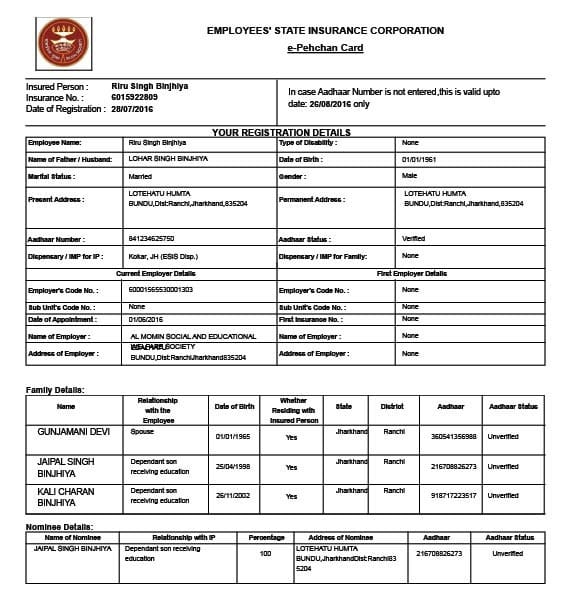

Once the 10-digit ESIC number is generated, one has to login and download their e-Pehchan card. From that point on, the card helps an employee and the dependents avail ESI services (comprising cash and medical benefits).

The old e-Pehchan card (front and back) looked something like this:

And this is how the front and back side of the new e-Pehchan card looks like:

New e-Pehchan Card (Front)

New e-Pehchan Card (Back)

What’s The Eligibility Criteria for ESIC Coverage?

If your company is under ESIC and your pay is within the limit, you’re covered. However, employees need to fulfill all the following conditions:

- Your current monthly wages are within the ceiling, i.e., ≤ ₹21,000 for most employees and ≤ ₹25,000 for a person with disability.

- An employee should be on the payroll of a non-seasonal factory with ≥10 employees, or an establishment (shop/hotel/transport, etc.) within an ESIC-implemented district in a particular state.

Many states have reduced the threshold for establishments to 10 employees. While most states have reduced the threshold to 10 employees, some states still maintain a threshold of 20 employees. - Employees pay 0.75% of wages and employers pay 3.25% towards ESIC contribution (applicable since 1 July 2019).

However, there are a few exceptions:

- If an employee’s salary crosses the ESIC limit, he/she stays covered until the current 6-month cycle ends. Remember, the contributions are determined based on your actual salary, so there’s no option to drop out mid-year.

- Apprentices under the Apprentices Act, 1961 aren’t covered under ESIC.

- If an establishment unit or organization is not located in an ESIC-implemented district, the coverage is not available for employees, even if the headcount and wage ceiling conditions satisfy.

How To Download Your ESIC e-Pehchan Card (Online)?

There are two ways to download your ESIC e-Pechan card online; through the official ESIC IP Portal and through UMANG app.

Steps to download ESIC e-Pechan card from the official ESIC IP Portal:

Go to Insured Person / Beneficiary Login. (New users must sign up)

- Enter your Insurance Number, Date of Birth, and registered mobile.

- Verify the OTP and set a password.

- Log in and open the e-Pehchan Card.

- Download the e-Pehchan Card as PDF.

- Take a printout and paste photos of the employee and dependants.

- Get your employer’s stamp/signature.

Steps to download ESIC e-Pechan card through UMANG app using a smartphone:

- Install UMANG app on your smartphone.

- Open and tap Login/Register.

- Enter your mobile number and verify the OTP.

- Set an MPIN (for first-time users

- Search for “ESIC” on the app and select the Download e-Pehchan Card option.

- Enter your ESIC Insurance (IP) Number and the registered mobile linked to your ESIC profile.

- Once more, verify the OTP and download your e-Pehchan card.

Note:

If you face any issues when downloading your ESIC e-pehchan card, you can always contact at the following toll-free numbers and email ids:

- General Helpline: 1800-11-2526

- Medical Helpline: 1800-11-3839

- IT issues (employer/IP portal): 011-27552237 or email at itcare@esic.nic.in

To lodge a grievance, drop a mail at pg-hqrs@esic.in or use the grievance form.

What Are The Uses of ESIC Numbers?

ESIC ID (or IP number) is permanent and once generated stays valid across all applicable employers (even when switching jobs) and states across India.

Employees can use their ESIC ID to log into the ESIC Insured Person portal to view contributions, update basic details, and access online services (e-Pehchan, etc.).

The ESIC number is also needed when you visit either ESIC or ESIS (Employees' State Insurance Scheme) dispensaries and hospitals, and to avail any ESIC cash or medical benefits due to sickness, maternity, and disability.

How to Find Your ESIC Insurance Number?

What Are The Benefits Of ESIC?

ESIC provides both medical and cash support to all employees registered under the Employees’ State Insurance Scheme. It covers everything, from prolonged illnesses and maternity care to wage replacement during sickness, disablement benefits, and dependents’ pensions in the event of death while in service.

(a)Medical benefits:

From day one of employment, ESIC entitles you to treatment at ESIC/ESIS dispensaries and hospitals, covering primary, secondary, and tertiary care through its network and referral system.

(b)Sickness benefit:

70% of average daily wages for up to 91 days in two consecutive benefit periods is allotted as sickness benefit under ESIC. Extended sickness benefits (for specified long-term diseases) can go up to 730 days @ 80% of average daily wages. For enhanced sicknesses, it can be 100% of daily wages.

(c)Maternity benefit:

ESIC offers up to 100% of average daily wages during the employee pregnancy period. However, statutory conditions like ongoing contributions and employer compliance apply. If you’re specifically looking for maternity coverage, we recommend checking out our detailed guide on Pregnancy Insurance Plans in India.

(d)Disablement benefit:

Temporary disablement provides 90% of your wages while you cannot work. For permanent disablement, the payout depends on the medical board’s assessment. To learn about disability coverage beyond ESIC’s workplace focus, see our guide on long-term disability insurance.

(e)Dependents' benefit:

90% of wages are paid as a periodic pension to eligible dependents, only if death is due to employment injury/occupational disease.

(f)Funeral expenses:

₹15,000 lump sum is payable from day one of insurable employment. However, the insured person’s death should be due to an employment-related injury or occupational disease, not for all causes of death.

A quick look at some of the recent upgrades across ESIC/ESIS hospitals:

ESIC Vs. Personal Health Insurance : Ditto’s Take

ESIC is a job-linked cash and medical cover for individuals with a limited wage per month. And while it promises good benefits, you will always need more than what’s offered, say for a critical illness or a wider choice of network hospitals. That’s where personal health insurance comes in with limited capping or sub-limits for certain illnesses.

The best part? You will never have to worry about switching jobs and losing cover. So, while you’ve already got ESIC, get a personal health plan on the side for absolute peace of mind.

Here’s a clear comparison between ESIC and personal health insurance across different aspects:

ESIC vs Personal Health Insurance - quick comparison

Still unsure how to go about picking the right health insurance plan to compliment ESIC? Book a free call with Ditto and let our IRDA-certified advisors guide you better.

Why Choose Ditto For Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Abhinav below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

What Should You Do Next As An Employee Under ESIC Coverage:

What is ESIC Number? Final Thoughts

A 10-digit ESIC number is your ticket to unlock social security benefits (both cash and medical).

However, the coverage is only good as long as your employer keeps the contributions live or you stay on job. ESIC, undoubtedly is a solid health base but heavily job-linked, wage-capped, and limited to its own network and referrals. For more coverage and flexibility, you will always need personal health insurance.

FAQs

Can I access ESIC benefits without the number?

Yes, an employee can temporarily access ESIC benefits via the Temporary Identification Certificate (TIC) provided right after registration. Once Aadhaar is seeded, TIC becomes the e-Pehchan (permanent card). However, for cash or medical claims, you still need your 10-digit ESIC NUMBER as TIC will not work.

What medical facilities are covered under ESIC?

Once can avail treatment across all ESIC/ESIS dispensaries and hospitals plus referrals as per ESIC rules. Medical benefit is available from day one the employee and eligible dependants.

Is my ESIC number the same as my UAN/PF number?

No. UAN is for your EPF contributions while ESIC IP number is for availing ESI benefits (cash and medical). There are two different systems and portals in place. Also, don't be confused between the Employer Establishment Code and ESIC number if you see them in one place. An employer establishment code is of 17-digits while your ESIC number is always a 10-digit numerical code.

Can a person have two ESIC numbers?

No, it is not possible for an individual to have two ESIC numbers. ESIC number is your unique identification code to avail ESI benefits (cash/medical). Once issued, the ESIC number is for lifetime and is valid across all eligible employers. If a duplicate ESIC number is issued on your behalf, you’re strongly advised to contact the ESIC authority via the helpline or visit a branch office.

Last updated on: