Quick Overview

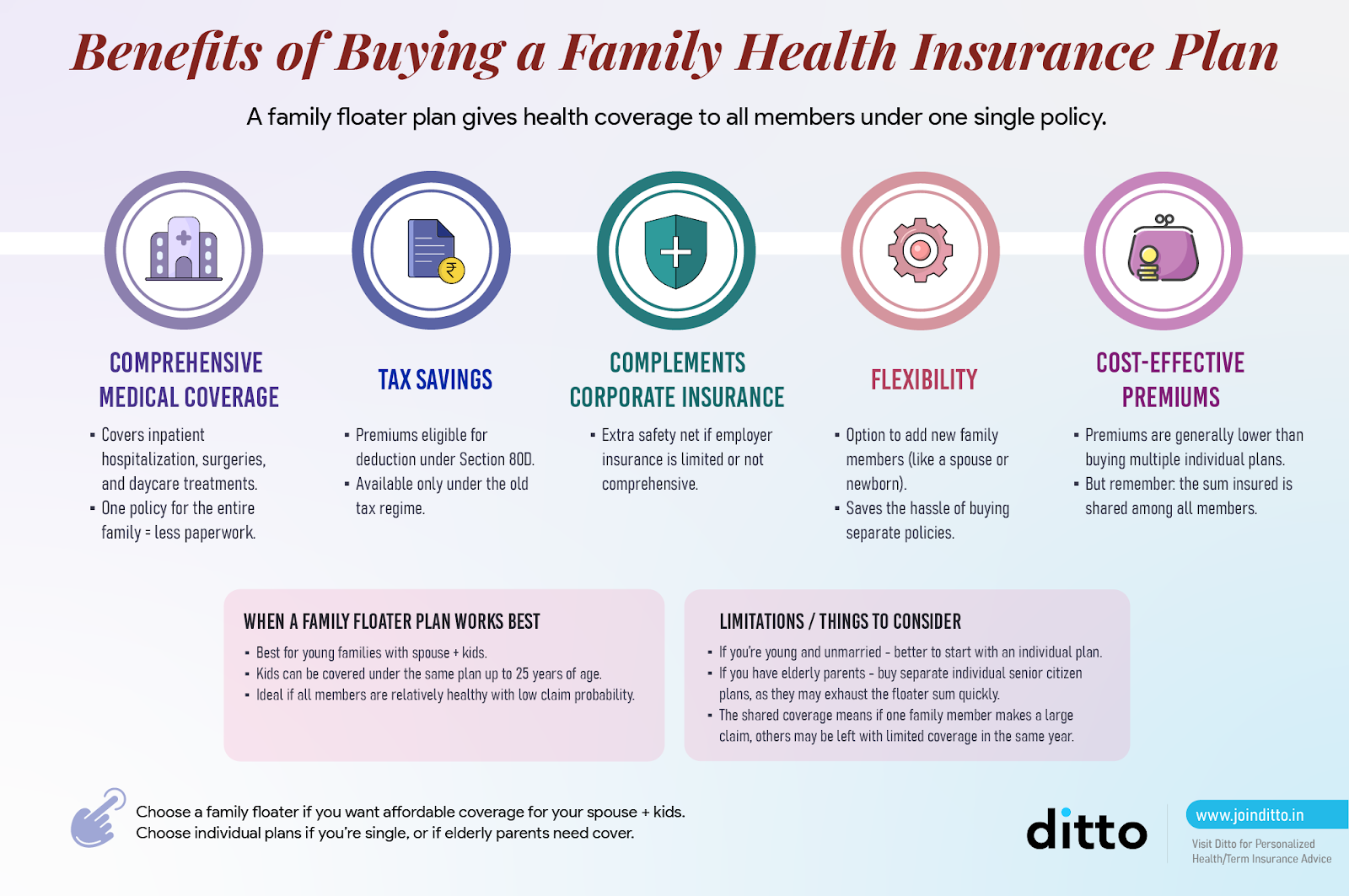

A single hospital bill can be enough to disrupt a family’s finances. When you're responsible for your spouse, children, or aging parents, that financial risk grows even more. As a result, many families start looking for a reliable health insurer to support them during these stressful times.

SBI General Insurance, backed by State Bank of India, has an average annual gross written premium of ₹3,328.51 crore (FY 2022–25), indicating a meaningful presence in the health insurance market.

It reports an average claim settlement ratio of 96.14% (FY 2022–25) and an incurred claim ratio of 81.23% (FY 2022–25), showing a strong claims-paying record and steady utilization of premiums.

The service experience is relatively smoother, with 20.51 complaints per 10,000 claims (FY 2022–25). SBI currently has a network of 16,600+ hospitals across India.

In this article, we break down SBI health insurance family plans in simple terms so you understand what you’re actually buying, what is covered, and whether it's the right fit for your needs.

Best SBI Health Insurance Plans For Family

Premiums for the SBI Health Alpha Family plan

Premiums for SBI Health family plans vary by age, location, medical history, lifestyle habits, sum insured, and the add-ons you choose. Above are the Health Alpha Ultimate plan premiums for different family structures.

Note: Premiums are for people seeking a ₹15 lakh sum insured, residing in Delhi - 110010, with necessary and mandatory add-ons.

What Is Covered And Not Covered In SBI Health Family Plans

Why Choose Ditto for Your Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Here’s why customers like Abhinav love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 5,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation with us. Slots are filling up quickly, so be sure to book a call now!

Ditto’s Take on SBI Health Family Plans

SBI Health Insurance looks reassuring if you focus only on the metrics. Its claim settlement ratio sits in a healthy range, incurred claim ratios are reasonable, and complaint numbers are not alarming. From a credibility standpoint, SBI is not a risky insurer. However, strong numbers alone do not always translate into a smooth family health insurance experience.

Most SBI family plans are either limited in their base coverage or become complicated and expensive with riders. Benefits like maternity, global treatment, higher refills, or enhanced bonuses come with longer waiting periods or extra cost.

As a result, you often end up paying more to reach a comparable level of coverage.

If you want a comprehensive, low-friction family health plan with strong built-in benefits and fewer caps, we recommend comparing SBI’s plans with other insurers.

Note: SBI General Insurance is a non-partner insurer for Ditto. This review is for educational purposes only and is based on publicly available data such as disclosures, annual reports, brochures, and policy documents.

Frequently Asked Questions

Last updated on: