Quick Overview

With medical expenses rising far faster than most people’s savings, private health insurance has shifted from being a “nice-to-have” to an absolute necessity. Yet, with dozens of insurers, multiple plan types, and complex policy wording, choosing the right coverage can feel overwhelming.

To simplify things, we at Ditto analyzed IRDAI reports, policy brochures, and insurer disclosures to create this comprehensive guide. In this article, we explain what private health insurance is, how it differs from government schemes, the types of plans available, and how to choose a policy that actually protects you when it matters most.

Top Private Health Insurance Companies in India

Each company differs in pricing, coverage benefits, claim experience, and customer support. If you’d like to learn more about these in detail, you can check out our comprehensive guide on the best health insurance companies in India.

How is Private Health Insurance Different From Government Health Schemes?

Government schemes like Ayushman Bharat (PM-JAY) are designed mainly for low-income households and come with eligibility restrictions and limited hospital networks.

Here’s how private health insurance stands apart:

Private Health Insurance vs Government Health Schemes

For most individuals, private health insurance offers better flexibility, wider coverage, and faster access to quality healthcare.

Types of Private Health Insurance Plans in India

Individual Health Insurance

Individual health insurance plans provide coverage for a single person with a dedicated sum insured.

Family Floater Health Insurance

Family floater health insurance covers multiple family members under one shared sum insured. It is a cost-effective option for families, as any member can use the coverage during a medical emergency.

Senior Citizen Health Insurance

Senior citizen health insurance plans offer coverage for age-related illnesses but may come with higher premiums and some feature restrictions.

Critical Illness Plans

Critical illness insurance provides a lump-sum payout if the insured is diagnosed with a listed serious illness such as cancer or a heart attack. The payout can be used for treatment, recovery expenses, or income replacement.

Top-Up and Super Top-Up Plans

Top-up and super top-up health plans increase your existing health insurance coverage once a certain deductible is crossed. They are an affordable way to enhance your private health insurance cover without paying high premiums.

Which Private Health Insurance Plan Should You Choose?

If you’re a young adult or living independently, an individual health insurance plan offers focused, flexible coverage. Families looking for affordable protection should opt for a family floater plan, while those aged 60 and above are better suited to senior citizen health insurance plans designed for age-related needs.

A critical illness policy works best as a supplement for income protection, and top-up or super top-up plans are ideal for anyone wanting higher coverage at a lower cost alongside their base private health insurance.

Benefits of Buying Private Health Insurance

Higher Sum Insured Options

Private health insurance offers significantly higher sum insured options, often ranging from ₹5 lakh to ₹1 crore or more.

Innovation and Value Additions

Private players often lead in introducing newer benefits (telemedicine, wellness programs, digital health assessments, and rewards-based fitness integrations), enhancing the overall value proposition.

Customization Through Add-Ons and Riders

Private health insurance plans can be customised using add-ons that help tailor the policy to your specific healthcare needs and life stage.

Faster Claim Settlement and Service Quality

Private insurers typically offer faster claim settlement processes with dedicated customer support teams.

Access to Quality Care

With private health insurance, you can get private rooms, better equipment, and higher standards of service without any waiting.

What is Covered and Not Covered Under Private Health Insurance

The best private health insurance plan is one that fits your life stage and healthcare needs, not just the cheapest option.

Why Choose Ditto for Health Insurance?

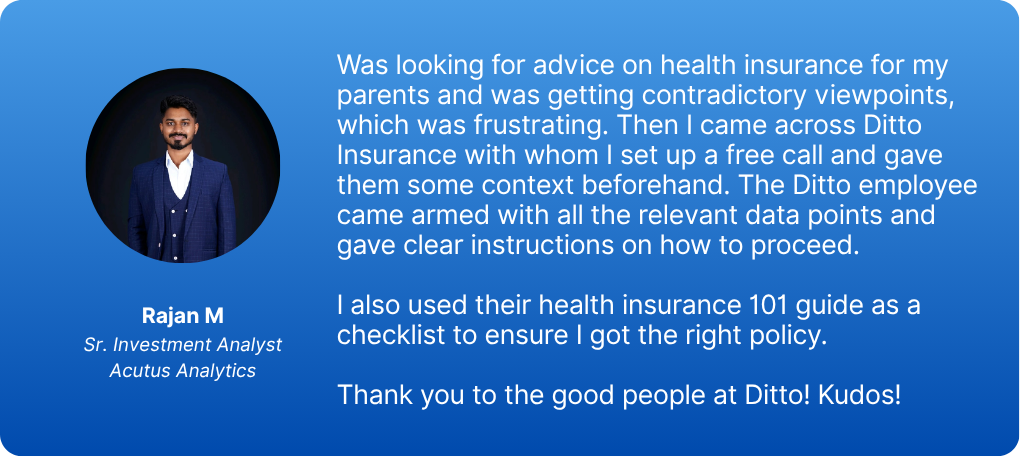

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Rajan below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call or chat with us on WhatsApp now!

How to Choose the Best Private Health Insurance Plan?

Start by choosing the right sum insured. For metro cities, a cover of ₹10-20 lakh is usually recommended due to high medical costs. Next, check the hospital network near you and ensure your preferred hospitals offer cashless treatment. Other than that, also understand the waiting periods, especially for pre-existing diseases. Additionally, look at the insurer’s claim settlement experience, as a smooth claims process is more important than a slightly lower premium.

Need help in choosing the best plan? You can check out our detailed guide on the best health plans in India.

Frequently Asked Questions

Last updated on: