| What is Out-of-Pocket in Health Insurance? Out-of-pocket in health insurance means the part of medical costs that you, the insured person, pay directly from your own pocket, instead of the insurance company covering it. Out-of-pocket expenses arise when: 1) Your medical bill includes items not covered by the policy. 2) You haven’t yet met your deductible (in super top-up plans) 3) A co-payment, room rent limit, or disease-specific cap applies. 4) These payments can occur at the hospital, even in cashless claims (for non-payables or consumables), or later, if you face a shortfall during reimbursement. |

In 2014, Indians paid over 60% of healthcare costs from their own pockets. By 2024, this dropped to around 35%. But even today, many people with health insurance plans face surprise expenses during medical treatment. Why does this happen, especially with cashless claims, and how can you avoid or reduce these extra costs?

This guide breaks down everything you need to know about out-of-pocket expenses in health insurance, from deductibles and co-pays to room rent limits, exclusions, and consumables. We'll also show you how to make smarter policy choices so that your coverage truly protects you when it matters most. Let's start with the basics.

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

| Did You Know? Unlike in the U.S., where most health plans come with a legally mandated “Out-of-Pocket Maximum” that caps your total spend in a year, Indian health insurance plans don’t offer a fixed cap on your yearly out-of-pocket expenses. Even in cashless claims, you may still pay for non-medical items, co-pays, or coverage limits. To reduce this, choose comprehensive plans with fewer restrictions and consider useful features like no limits on room rent, comprehensive bonus and restoration benefit & consumables cover at a slightly higher cost. |

What are the Types of Out-of-Pocket Expenses in Health Insurance?

Here are the main types of out-of-pocket expenses you may face with a health insurance policy:

1. Cost-Sharing by Design:

- Deductibles: A fixed amount you must pay before your insurer starts covering costs (common in top-up/super top-up plans). This can be on a per claim basis or on annual aggregate basis (recommended)

- Co-payments: A percentage (usually 10–30%) of the claim amount you must bear, often found in senior citizen and PED-specific plans with zonal restrictions.

Click here to see how IRDAI defines deductibles and copay in health insurance.

2. Policy Limitations:

- Room Rent Limits: Choosing a higher room category than what is allowed in your plan can reduce your claim payout across multiple services (doctor fees, nursing, etc.) due to proportionate deduction.

- Treatment/Disease wise Sub-limits: Caps on procedures like cataracts or knee replacements may lead to partial claim settlement, and therefore, higher out of pocket expenses.

- Waiting Periods & Exclusions: Claims for specific conditions (illnesses like hernia have a 2 year waiting period while pre-existing diseases can go up to 3 years) or excluded treatments (like cosmetic surgery) are entirely out-of-pocket.

| Take note: While standard waiting periods are common, some insurers now offer add-ons to reduce them, especially for pre-existing conditions. For example, HDFC ERGO Optima Secure’s ABCD Chronic Care Add-on cuts the waiting period from 3 years to 30 days for asthma, hypertension, cholesterol, and diabetes. |

3. Consumable:

Things like gloves, syringes, and PPE kits aren’t covered unless you have a specific add-on like non-medical expense cover or hospital cash. These expenses cost in the range of 5-15% of the total hospitalization bill.

However, Care Supreme’s Claim Shield add-on does the job if you want to cover consumables and non-medical costs. For broader coverage, Niva Bupa ReAssure 2.0’s Safeguard + Rider goes further, covering items like gloves, masks, and nebulization kits often excluded from regular plans.

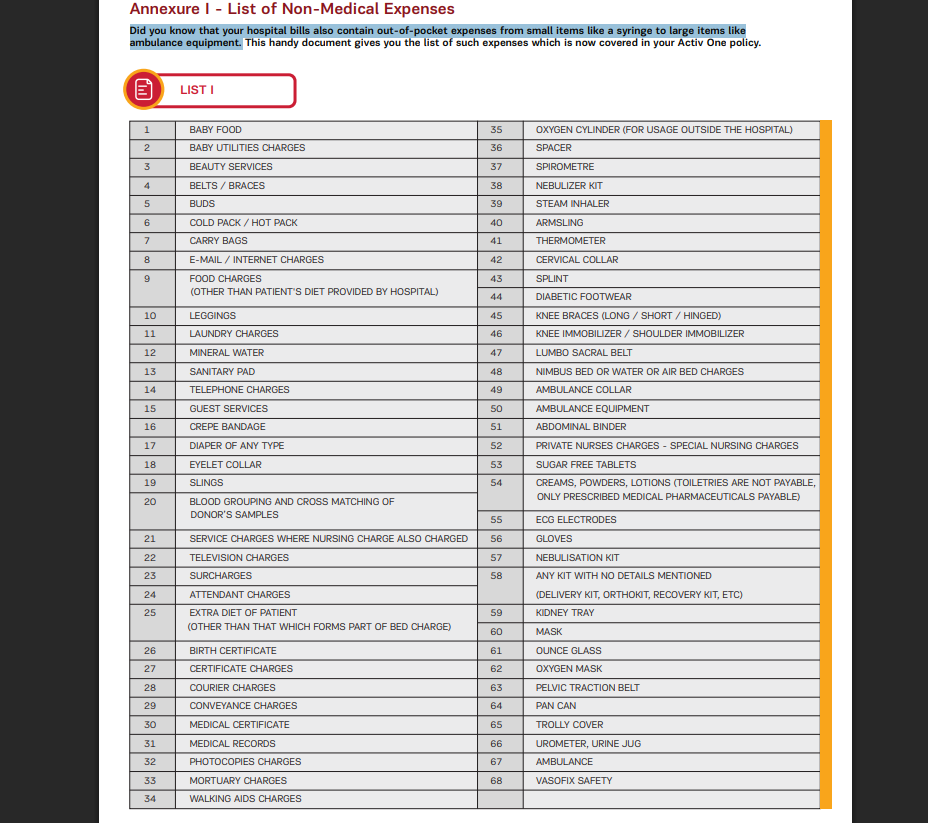

Here’s a snippet from the Aditya Birla Activ One Max about out-of-pocket expenses:

4. Network Packages & Issues:

- Network hospitals and insurers agree on fixed treatment package rates to control costs. You may face extra charges if you use services beyond this package or visit a non-network hospital for your treatment. Some policies also require co-pays for non-preferred/network hospitals, meaning you share part of the bill.

Let’s see how an insurer and network hospitals agree on treatment packages. Suppose a hospital charges ₹50,000 for knee surgery, the insurer negotiates a package rate, say ₹45,000, which includes surgery, room, medicines, and tests. This agreed rate sets a fixed cost for insured patients at that hospital.

5. Coverage Gaps

- Expenses beyond allowed pre-/post-hospitalization days, OPD visits (if not part of the hospitalization), and claims made after the sum insured is exhausted are usually out-of-pocket.

Policy limitations can significantly impact your overall financial burden, even if you have health insurance. Now let’s see how policy caps can lead to OOP (Out-of-pocket) expenses:

Example 1: Room-rent cap leading to proportionate deduction

- Policy: SI ₹10,00,000; room cap ₹5,000/day; no co-pay

- Hospital stay: 5 days in a ₹8,000/day room.

- Key rule: Many associated charges are calculated by cap/actual = 5,000/8,000 = 0.625 (varies by insurer; OT/implants may be exempt)

Illustration

- Room charges billed: ₹8,000 × 5 = ₹40,000 → insurer allows ₹25,000; OOP ₹15,000.

- Associated charges (nursing/doctor/OT etc.) billed ₹2,40,000 → allowed ₹2,40,000 × 0.625 = ₹1,50,000; OOP ₹90,000.

- Total OOP ≈ ₹1,05,000 (plus any consumables).

Takeaway: A room-rent waiver/any-room add-on could avoid most of the OOP in the above example.

Example 2: Senior plan with 20% co-pay + non-payables

- Policy: SI ₹5,00,000; 20% co-pay for all claims; network hospital

- Bill: ₹3,00,000; consumables/non-payables ₹18,000.

- Insurer eligible base = ₹3,00,000 − ₹18,000 = ₹2,82,000.

- Co-pay (20%) = ₹56,400 borne by insured.

- OOP = co-pay ₹56,400 + non-payables ₹18,000 = ₹74,400.

Takeaway: Consider plans without co-pay; or buy consumables add-on.

| Did You Know? Between FY 2015 and FY 2022, government health spending rose from 29% to 48%, while people’s out-of-pocket costs dropped from 62.6% to 39.4%. Schemes like Ayushman Bharat (PM-JAY) helped Indians save over ₹1.25 lakh crore on medical expenses during this period. |

What is the Difference Between Out-of-Pocket Limit and Deductible?

Many people think deductibles and out-of-pocket expenses are completely separate because of how they’re presented in insurance documents and how insurers discuss them.

In truth, a deductible is a type of Out-of-Pocket (OOP) expense. It is the fixed amount you must pay from your own pocket each policy year before your top-up/super top-up health insurance starts covering expenses. Until you meet this amount, you bear the full cost of covered medical services.

Let’s see how it works:

Example: Super top-up with ₹3L deductible

- Base: Aditya Birla Super Health Plus Super top-up: SI ₹20L; deductible ₹3L.

- Bill: ₹6,00,000 eligible.

- Payout: Insurer pays ₹6,00,000 − ₹3,00,000 = ₹3,00,000.

- OOP = ₹3,00,000 (the deductible).

Takeaway: Keep a small base cover (10-15L) or use employer cover to “meet” the deductible.

This example shows why having a base policy or employer health cover is essential; it can cover the ₹3 lakh deductible in your super top-up plan, sparing you from bearing that cost out of pocket.

What Will Happen When the Out-of-Pocket Maximum is Met?

In countries like the U.S., health plans under the Affordable Care Act (ACA) include an out-of-pocket maximum, a yearly cap on what you pay for covered, in-network care. Once you hit this limit, your insurer pays 100% of the remaining costs for that year. It’s a strong financial safety net that protects you from massive medical bills.

However, most health insurance policies in India don’t offer such a hard cap. Even after large claims, you may still pay for non-covered expenses, co-pays, sub-limits, or consumables, unless your plan specifically covers them.

How to Reduce Out-of-Pocket Costs in Health Insurance? (Ditto’s Take)

At Ditto, we believe smart planning and awareness can help you cut down out-of-pocket costs. Here are some practical tips:

- Opt for a plan with no room rent limits to avoid proportionate deductions.

- Choose policies that have no co-pays or sub-limits on treatments.

- Add a consumables cover to reduce non-payable expenses and check the list of expenses eligible under the cover.

- Go for plans with good no-claim bonuses and restoration benefits.

- Ensure you have a high sum insured (₹15L or more); combine with a super top-up if needed.

- Prefer network hospitals and check their pre-negotiated package rates with the insurer.

- Look for wider pre- and post-hospitalization coverage windows.

- Buy early to serve out all waiting and moratorium periods so that when the actual need for a claim arises, the coverage you need is available immediately without hassle.

| Did You Know? Many hospitals ask for a security deposit of ₹10,000–₹50,000 during admission. Insurers don't require this, but it is a standard hospital practice to cover delays in approvals, non-covered items, or claim issues. The amount is later adjusted in the final bill, and any extra balance is refunded once the insurer settles their share. |

Why Talk to Ditto for Your Health Insurance?

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Arun below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 5,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

Key Takeaways

Out-of-pocket expenses are costs that can include deductibles, co-pays, room limits and non-covered services. To manage these better:

- Choose a comprehensive plan with no room rent limits, co-pays, or sub-limits.

- Stay within your insurer’s network to avoid excess charges and partial claim payouts due to reasonable and customary charges.

- Use preventive benefits like free health check-ups and wellness screenings to avoid bigger expenses later.

Still unsure how to go about minimizing your out-of-pocket medical expenses? Book a free call with us and let our experts guide you in purchasing the correct health plan to overcome such costs.

FAQs

Why do out-of-pocket expenses occur even in cashless claims?

Insurers don’t cover non-medical expenses, consumables, or costs beyond policy limits, even in cashless claims. These exclusions become your responsibility at the hospital counter.

Are out-of-pocket expenses reimbursable later?

Usually no. Out-of-pocket costs like co-pays, deductibles, or excluded services/costs are not reimbursable as they are part of your policy terms. The insurer will not pay them later.

Can out-of-pocket costs be planned for?

Yes. You can anticipate possible out-of-pocket expenses by reviewing your insurance terms in detail. For example, knowing your co-pay percentage or room rent limit helps you avoid surprises.

Can I claim out-of-pocket expenses from multiple health policies?

Yes. If you exhaust your corporate plan, you can claim from personal health cover, but only on a reimbursement basis.

What happens if I switch to a higher sum insured mid-term?

Upgrading your policy reduces future out-of-pocket costs, but past claims stay unchanged. However, underwriting is done to increase the sum insured, and a waiting period applies to the expanded portion.

Last updated on: