Quick Overview

Non payable items may seem minor, but they quietly add up to a big shock to the final bill. When clubbed together, these small exclusions can eat into your savings without warning.

This guide walks you through the items excluded from your health cover, plans that cover these, and ways to minimize non-medical expenses.

What Are Non Payable Items in Health Insurance?

Non payable items in health insurance are expenses incurred during hospitalization that insurers do not cover because they are considered non-medical or related to personal comfort, like attendant charges and consumables like gloves.

IRDAI excludes these items to prevent misuse, so insurers will not pay for them, and you must bear these costs yourself. IRDAI has grouped these non payable expenses based on the type of treatment and hospital stay.

Why Does IRDAI Exclude These Items?

These costs are excluded to curb overbilling of small items, keep premiums affordable, and ensure insurance focuses on essential treatment costs rather than comfort or administrative expenses.

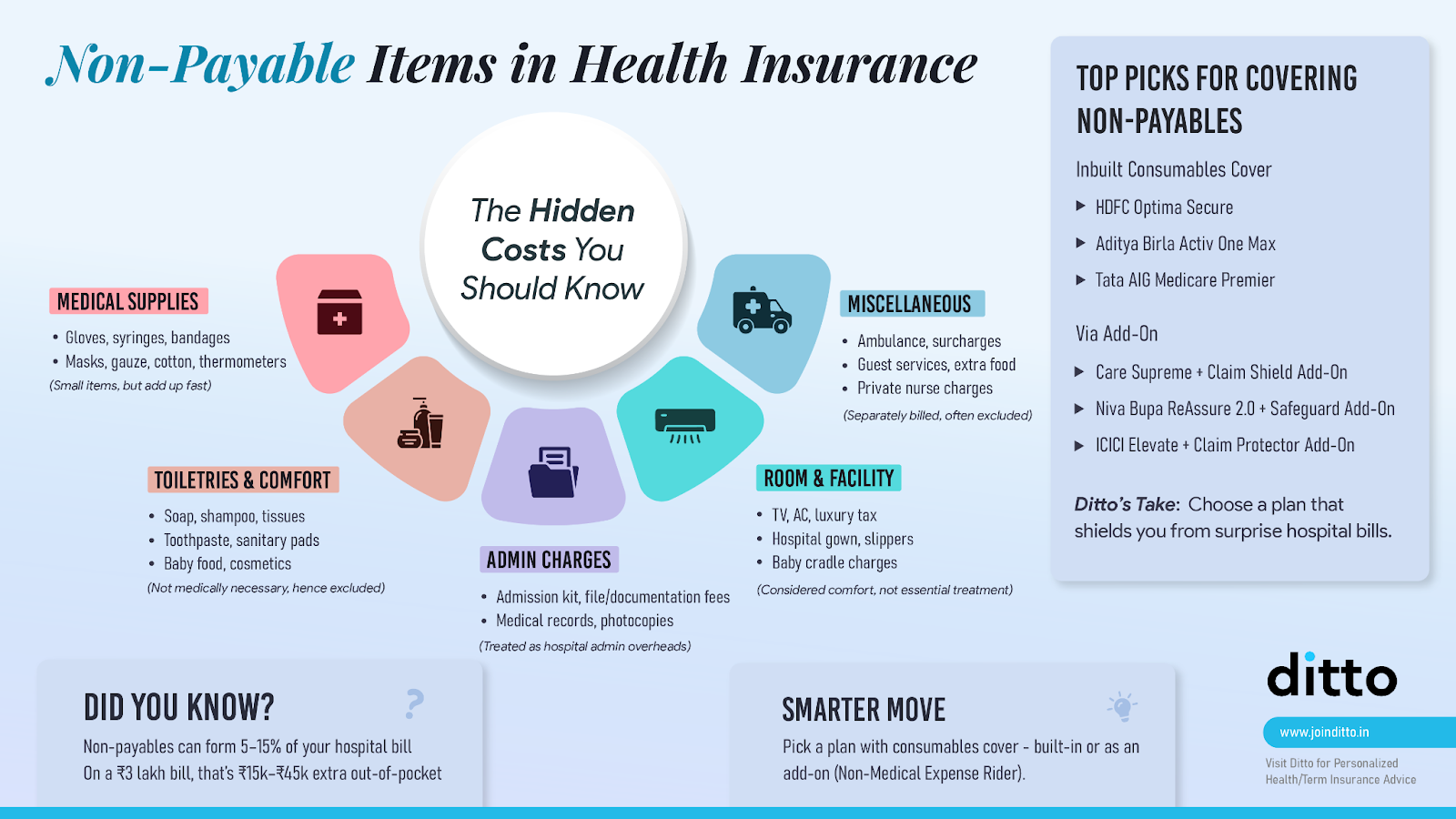

Check out the infographic about common non payable items you may be charged for during hospitalization.

Types of Non Payable Items in Health Insurance

Note: Such exclusions regarding non payable items in health insurance vary from policy to policy. Download the PDF to view the IRDAI list of non payable items in health insurance.

How Does Non Payable Items Affect Your Final Claim?

Non payable items affect both reimbursement and cashless claims by increasing what you pay from your own pocket. In a reimbursement claim, these charges are deducted from the approved amount. In a cashless claim, the hospital bills you directly for non payable items at discharge, even if the rest of the bill is settled by the insurer.

For instance, if the insured undergoes surgeries above ₹2 lakh, they often pay an extra ₹15,000 to ₹25,000 out of pocket for non payables. Certain comprehensive health plans like HDFC ERGO Optima Secure and Aditya Birla Activ One Max have in-built consumable cover features, which save you from paying non payable items out of your own pocket.

However, such non payable items are not covered under some policies. In case you wish to purchase comprehensive plans like Care Supreme and Niva Bupa Reassure 2.0 (Platinum), you can purchase their add-ons for consumable cover.

Annual Premiums for Care Supreme

Note: Listed premiums are for a sum insured of ₹15 lakh, residing in Delhi. The premiums include add-ons like an annual health check-up and a cumulative bonus super. The premiums can vary according to the medical underwriting and the city you reside in.

Annual Premiums for Niva Bupa Reassure 2.0 (Platinum)

Note: Listed annual premiums are for a sum insured of ₹15 lakh, residing in Delhi. These premiums can vary according to the medical underwriting and the city you reside in.

Key Takeaway: Choosing the consumables add-on usually increases the premium by only about 8–10%, but it can save a significant amount during a claim by covering everyday medical items that are otherwise paid out of pocket. This makes it a cost-effective option for better overall protection.

Real Claim Scenario

Result: The customer paid nothing for consumables and saved ₹45,000. Even if only 70% had been approved, he would still have saved ₹31,500.

Why this matters: Surgeries like ACL reconstruction are consumables-heavy. A low-cost add-on can prevent large out-of-pocket expenses during claims.

Things to Remember About Non Payable Items in Health Insurance

- Even with a consumables add-on, some costs can still be out of pocket because coverage is limited to items listed in the policy’s annexure.

- Any consumables not mentioned in the approved list will have to be paid for by you.

- All base policy rules, exclusions, and conditions still apply to your health claim.

- Expenses that go beyond your available sum insured are not covered.

- Deductions can also happen due to policy features like co-pay, deductibles, room-rent limits, or disease-specific sub-limits.

Ditto’s Advice: Pick a plan with no room-rent cap, no co-pay, and no sub-limits, and add a consumables cover to keep out-of-pocket expenses low. We recommend that our customers opt for consumable add-ons, which help mitigate the extra consumable charges.

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Here’s why customers like Abhinav love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 5,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

You can book a FREE consultation with us. Slots are filling up quickly, so be sure to book a call now or chat with us on WhatsApp!

Conclusion

Exact inclusions, exclusions, and the final item list can vary by plan. Always verify against the latest policy wording and annexure for your specific plan.

If you are looking for a health plan from insurers with established track records, we recommend comprehensive plans for 2026, which align with your long-term goals. Explore more about how our experts evaluate health plans through Ditto’s cut.

Note: All information in this article is based on details available on IRDAI’s official website and publicly available data.

Frequently Asked Questions

Last updated on: