Quick Overview

Staying healthy shouldn’t just feel good; it should pay off, too. So, what exactly does the no-claim bonus mean in health insurance? This guide helps you to understand how NCB works, its types, benefits, and limitations.

What is No Claim Bonus in Health Insurance?

If you stay healthy and don’t make any claims in a policy year, the insurer rewards you with a No Claim Bonus. This means your sum insured (SI) can increase at renewal (for example, by 50% each year) without raising your annual premiums.

This bonus keeps adding up until it reaches a fixed limit, such as doubling your original health cover (100% of the base sum insured or more). Insurers offer NCB to promote healthy living and responsible use of the policy, while giving you added protection when you need it most.

How Does No Claim Bonus Work in Health Insurance?

- If the insured makes no claim in the first policy year, they either receive a premium discount or an increase in SI.

- If your health plan remains claim-free in the second year as well, the discount or increase in SI applies again and may continue to rise in the same manner for every consecutive claim-free year.

Example

Note: The calculations are based on a sum insured of ₹5 Lakh with an NCB of 20% added for every claim-free year. This bonus of ₹1 Lakh each year increases your total coverage without any extra cost, up to a maximum limit of 100% of the base sum insured.

Types of No Claim Bonus in Health Insurance

Features of No Claim Bonus in Health Insurance

- Grows Every Claim-Free Year: NCB increases your cover for each year you don’t make a claim. Insurers usually add a fixed percentage, such as 10% or 20% of the base sum insured, every claim-free year.

- Boosts Cover Without Raising Premium: NCB increases your total sum insured without charging extra for the bonus portion. Your premium may still rise due to age or medical inflation, but the added NCB cover itself is usually free.

- Has a Maximum Cap: Most policies limit NCB growth to a fixed percentage of the base sum insured, commonly 50% to 100%. Once this cap is reached, the bonus stops growing even if you remain claim-free.

- Claim Can Reduce or Reset It: If you make a claim, the accumulated NCB is usually reduced or reset at renewal. Many insurers offer an NCB Protection add-on that lets you retain your bonus even after making a claim.

- Doesn’t Transfer Directly When You Switch Insurers: When you port your policy, the NCB does not move as a “bonus” to the new insurer. However, most insurers allow you to increase your new base sum insured up to your old base plus earned NCB, often without fresh waiting periods, treating it as continuous coverage.

Take Note: Some policies, like Star Comprehensive, follow a clawback rule, where the earned bonus is reduced if a claim is made. The reduction is always calculated on the base SI, not on the total coverage.

If you made a claim, your earned cumulative bonus may be reduced at the same rate it was added. For example, if your bonus increased by 20% each year, a single claim could cut it by 20% at renewal. Today, many modern plans like Star Comprehensive don’t reduce the bonus after a claim, or they offer add-ons that protect it from being reduced.

Did You Know?

Benefits of No Claim Bonus in Health Insurance

Stronger Financial Buffer

Works for Both Plan Types

Can Be Shielded with Add-ons

Rewards Long-Term Policyholders

Why Approach Ditto for Health Insurance?

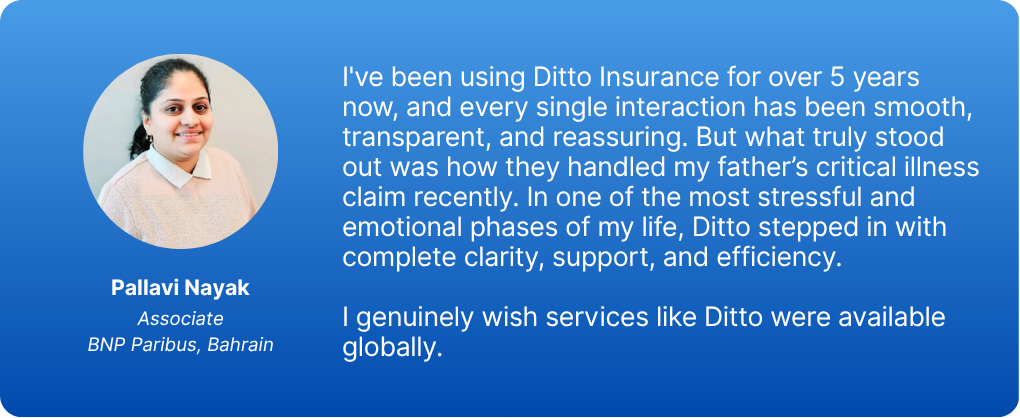

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call or chat with us on WhatsApp now, slots fill up fast!

Ditto’s Take on No Claim Bonus

Choosing a health insurance plan with a No Claim Bonus is a smart move because it boosts your cover every claim-free year without increasing your premium. You get more protection at the same cost.

NCB is especially useful in family floater plans, where one big hospital bill can drain the sum insured quickly. Remember, NCB does not replace the need for a strong base cover. In our view, you should still start with an adequate sum insured of at least ₹15 to ₹25 lakh as this usually strikes the best balance between affordability and coverage.

If you are looking for a health plan from established insurers, we recommend comprehensive health insurance plans without any restrictions for 2026, which align with your long-term goals. Explore more about how our experts evaluate health plans through Ditto’s cut.

Frequently Asked Questions

Last updated on: