How to Check Star Health Insurance Claim Status?

If you've recently filed a claim with Star Health and Allied Insurance, you're probably wondering: “What’s the status of my claim?”

Filing a health insurance claim can be stressful, and the uncertainty of waiting to hear back from your insurer can make the experience even more overwhelming. The good news? Star Health makes it easier with multiple convenient ways to track your claim.

In this guide, you’ll learn how to check your claim step-by-step on various channels, what documents are needed, and a bonus section on tips for a smooth process.

Need help with your Star Health Insurance claim? Talk to Ditto’s experts today for free claim assistance.

What are the Documents Required to File a Star Health Insurance Claim?

To file a claim with Star Health Insurance, whether cashless or reimbursement, you’ll need to submit certain documents to ensure a smooth and hassle-free process. Here’s a list of commonly required documents:

- Claim form (duly filled and signed)

- Star Health ID card or policy document

- Photo ID proof (government-issued)

- Discharge summary or hospital discharge certificate

- Medical reports (lab reports, prescriptions, etc.)

- Hospital bills and receipts

- Doctor’s consultation papers

- Investigation reports (X-rays, scans, etc.)

- FIR/MLC copy (in case of accidents)

- Cancelled cheque or bank passbook copy (for reimbursement claims)

Note: Cashless claims require pre-authorization from a network hospital, while reimbursement claims require all original documents to be submitted after treatment.

Did you know?

How to Check Star Health Insurance Claim Status?

Star Health offers multiple user-friendly ways to track your claim, both online and offline.

You can monitor the progress of your cashless or reimbursement claim through:

- The official website

- The Star Health mobile app (available on both Google Play Store and Apple App Store)

- WhatsApp chat support

- By speaking directly to customer care via the toll-free number 1800 425 2255

Each method provides real-time updates, giving you complete transparency and peace of mind.

Ditto’s Tip: For a seamless experience, keep your Claim Intimation Number or Policy Number handy while checking the status.

Do you need help with your health insurance claim? Get expert claims assistance with Ditto now.

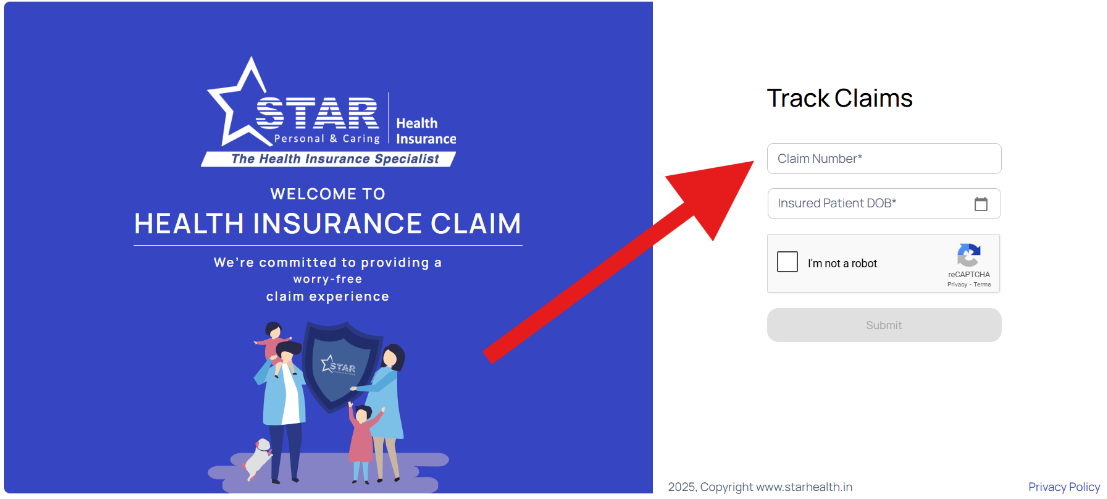

How Do You Track Star Health Insurance Claim Status Online?

You can check your Star Health Insurance claim status easily through their official website. Here’s how:

1) Visit the Star Health Claim Status page.

2) Enter your Claim Number.

3) Input the Date of Birth of the insured.

4) Fill in the captcha code as shown.

5) Click on Submit or Login to view your claim status.

Ditto’s Note: This method is best for those who prefer a browser-based interface and want to avoid installing an app.

How to Track Star Health Insurance Claim Status Through WhatsApp?

You can easily check your Star Health Insurance claim status through WhatsApp without having to log in. Just follow these steps:

- Send “Hi” on WhatsApp to 95976 52225 and choose “Claims” from the menu.

- Then, “Check Claim Status” and choose your “Health Policy”

- Tap on “Options”

- Select “Claim Intimation Number” and click Send.

- Enter your Claim Intimation Number.

- Tap on “Claim Status”.

Now you can view the current status of your claim instantly.

P.S.: This method is fast, mobile-friendly, and available 24×7, which is perfect for busy policyholders on the go.

How to Check Star Health Insurance Claim Status Offline?

If you prefer offline support, Star Health offers multiple options to check your claim status:

- Visit a Star Health branch: Bring your policy details or claim number to your nearest office.

- Call the toll-free customer support for real-time updates.

- Send your query with claim details to support@starhealth.in.

Quick Note: These methods are ideal if you need assistance or clarification while checking your claim.

How Do You Track Star Health Insurance Claim Status Through Their Application?

One of the easiest ways to stay updated is through the Star Health Customer App. It lets you:

- Check claim status instantly

- Access your policy documents.

- Locate network hospitals

- Submit claims directly (for reimbursement)

The app is available for Android and iOS users. Simply download the app from the Google Play Store or Apple App Store, log in with your registered mobile number or email, and then navigate to the ‘Claims’ section.

Remember: This method offers the most comprehensive self-service features and is perfect for regular claim tracking and policy management.

Ditto’s Tips for a Smooth Star Health Insurance Claim Process

When you’re dealing with health insurance claims, the last thing you want is for your claim to be delayed, or worse, denied. By following a few best practices, you can ensure your Star Health Insurance claim moves forward without unnecessary delays or rejections.

1) Inform Star Health Promptly

Always notify Star Health about your hospitalization or planned treatment as early as possible. For cashless claims, this usually means initiating pre-authorization 24-48 hours in advance for planned procedures or within 24 hours in case of emergencies.

2) Organize Your Documents

Ensure all documents, from hospital bills to discharge summaries and prescriptions, are correctly arranged and legible. Missing or mismatched paperwork is one of the top reasons for delays and claim rejections.

Pro Tip: Take photos or make digital copies of every document before submitting.

3) Double-Check Claim Forms

Incorrect or incomplete claim forms are a common issue. Always verify that all fields are filled out correctly, the form is properly signed, and details like the policy or claim number match your documents.

4) Use Digital Tools

Make the most of the Star Health mobile app and WhatsApp service to track your claim in real-time. This helps you stay informed and act quickly if additional documents or clarifications are requested.

5) Know Your Policy Inside Out

Familiarize yourself with what's covered and what’s not. Understanding your policy terms, waiting periods, and exclusions helps you avoid surprises and file claims more confidently.

By staying proactive and organized, you’ll not only make the claims process smoother but also increase your chances of faster approvals. Remember: a little prep today can save a lot of hassle tomorrow.

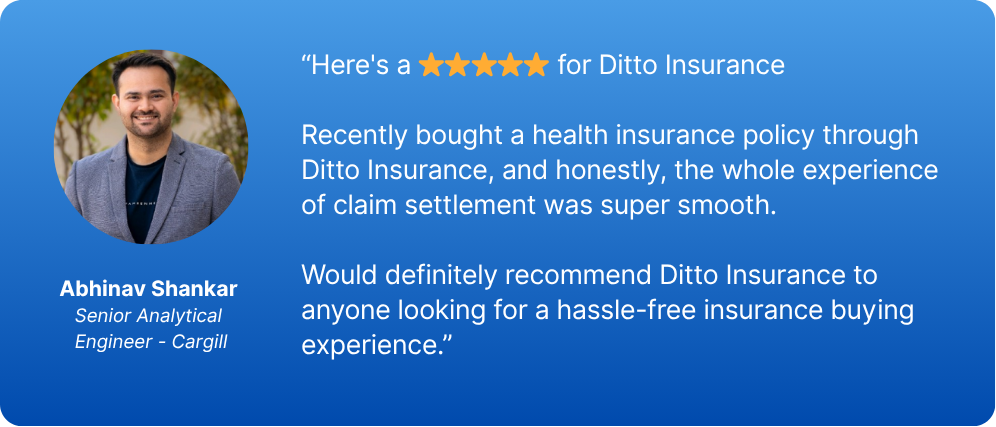

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Abhinav below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

Tracking your Star Health Insurance claim is transparent and straightforward, thanks to multiple online and offline options. Whether you use the official website, mobile app, WhatsApp, or the toll-free helpline, you can stay updated in minutes. Just ensure you have your claim details ready, and remember that being organized with documents speeds up the settlement process.

If you’re still facing delays or rejections, book a call or chat with Ditto’s advisors to get help in escalating or re-filing your claim at no extra cost.

Frequently Asked Questions

What should I do if my health insurance claim is rejected?

You should carefully review the reason for rejection provided by the ensurer and then reach out to the grievance redressal officer of your insurance company. To learn more, you can read our step-by-step guide on how to handle claim rejection.

What are the reasons behind health insurance claim rejection?

Common reasons include an active waiting period, non-disclosure of pre-existing conditions, policy exclusions for specific treatments, and incomplete or incorrect documentation. To learn more, you can read our detailed piece on the reasons behind health insurance claim rejection.

How long does it take to process a claim?

Typically, cashless claims are approved within 2 hours, while reimbursement claims may take 7-15 working days, depending on document submission and verification. Always check your policy terms and submit documents promptly to avoid delays.

Last updated on: