The Insurance Regulatory and Development Authority of India (IRDAI) allows you to switch your health insurance policy from one insurer to another without losing your accumulated benefits. This ensures continued coverage and fair treatment for policyholders.

Here are the key rules:

- You can port your health insurance policy only at the time of renewal, with no break in coverage.

- All earned benefits, such as waiting, moratorium periods and no-claim bonus credits, are transferred to the new insurer.

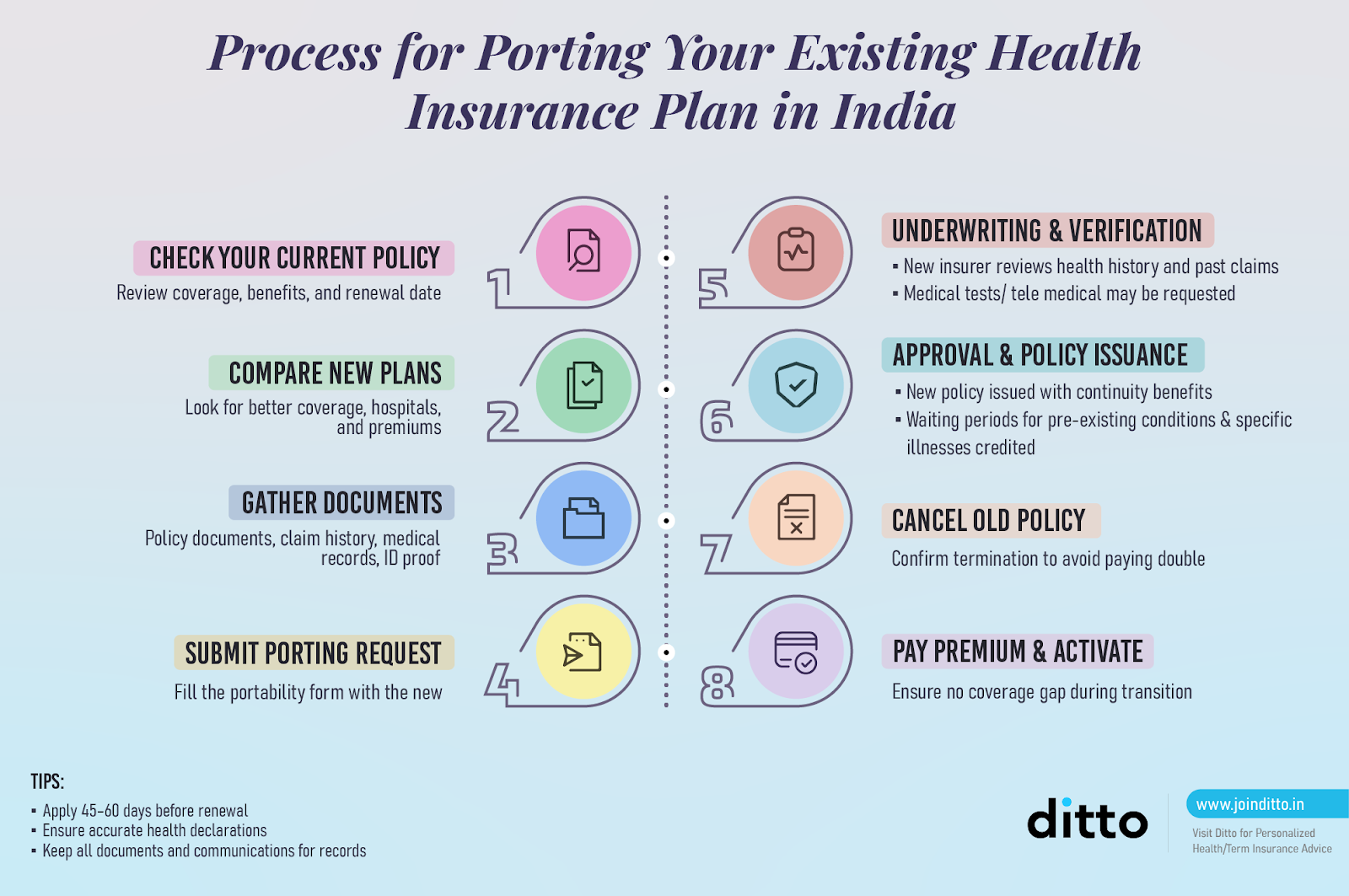

Curious about how you can switch health insurance policies in India without losing your hard-earned benefits? Thanks to IRDAI’s Health Insurance Portability Guidelines, policyholders can move their policy to a new insurer while retaining waiting period credits, moratorium period, and no-claim bonuses.

At Ditto, we make health insurance portability stress-free and straightforward. Our experts help you with the policy transition, and ensure that you retain all your earned benefits.

This guide is curated to help you understand:

- What IRDAI health insurance portability rules and guidelines

- Your rights as a policyholder during portability

- The difference between portability and migration

- Key rules, timelines, and steps to ensure a smooth, uninterrupted transition to a new insurer.

Still unsure about porting your health plan? Book a free call with us and let our experts guide you in making an informed decision.

Point to be noted:

As per the IRDAI 2024 regulations, all indemnity-based health insurance policies, whether individual or group, can be transferred to a new insurer, except for Personal Accident and Travel Policies.

What are the IRDAI Health Insurance Portability Guidelines?

According to the Master Circular on Protection of Policyholders' interests 2024, health insurance portability has been made smoother and more transparent.This ensures policyholders don’t lose their benefits when switching insurers. Here’s what you need to know:

- Portability is allowed for all individual indemnity-based health insurance policies, including family floater plans and group insurance plans.

- You must apply for portability 30-60 days before your current policy’s renewal date.

Note: Some insurers are flexible when it comes to porting, and they consider applications even two weeks before the renewal date. This is not safe as there is a risk of coverage lapse and formality delays. - Your existing insurer must share policy and claim details through the Insurance Information Bureau (IIB) portal within 7 working days of receiving the request.

- The new insurer has 15 days to review and decide once all documents are submitted.

- If there’s any delay from the old insurer, your coverage will continue uninterrupted under IRDAI rules.

These guidelines were introduced under the IRDAI (Health Insurance) Regulations, 2016, and further outlined in the IRDAI Health Insurance Regulations and Circular on Protection of Policyholders' Interest.

What Are Your Rights as a Policyholder?

IRDAI’s health insurance portability rules protect policyholders and facilitate a smooth and secure switching process between insurers. Here’s what you should know:

- Guaranteed Continuity: Time served under your old health plan counts toward all waiting periods in the new plan.

Note: Although regulated by IRDAI, porting is not a right and depends on the new insurer’s underwriting policy.

- Transparency: Both your old and new insurers must share policy and claim details via the IRDAI IIB portal.

- Regulated Timelines: Strict deadlines ensure quick decisions and avoid gaps in coverage.

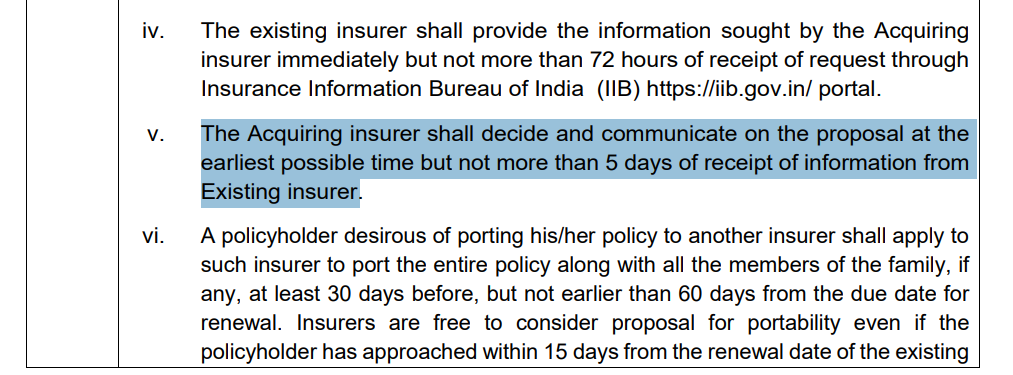

Here’s a snippet from IRDAI’s Master Circular, 2024 regarding timelines:

- Data Protection: Insurers must follow IRDAI’s 2025 Cybersecurity Master Circular when handling your health data.

What is the difference between Portability vs. Migration under IRDAI?

Let’s take a look at how the two differ:

Ditto’s Take on porting

Thinking of porting your health insurance? It makes sense if you’re unhappy with your current insurer, facing claim issues, rising premiums, or need better coverage.

However, if you’re satisfied with your plan, nearing the end of a 5-year moratorium, or managing ongoing health conditions, it’s better to stay put. We usually recommend porting only for genuine reasons, not minor upgrades or small savings.

Plans such as HDFC ERGO Optima Secure, Care Supreme, Aditya Birla Activ One Max, Niva Bupa Aspire Titanium+, and SBI Super Surplus Platinum Infinite are worth considering as they align with Ditto's six-point evaluation framework for policies.

Why Talk to Ditto for Your Health Coverage?

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Arun below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 5,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Final thoughts

Before you wrap up, here are some final thoughts you should consider before porting your health plan:

- At Ditto, we strongly recommend our customers initiating the portability process 45–60 days before the policy renewal date.

- Avoid porting if you have upcoming treatments or high-risk conditions.

- Don’t switch to save money; use portability only for genuine insurer or coverage issues.

- At Ditto, we do not recommend porting if the policy is 4 years or older. Currently, we help in porting plans to HDFC Optima Secure and Care Supreme only.

Still unsure about porting your health plan? Book a free call with us and let our experts guide you in making an informed decision.

FAQs

Are IRDAI portability rules applicable to all insurers?

Yes. All general and standalone health insurers authorized by the IRDAI must follow the portability and migration rules outlined in the 2016 regulations and the 2020 circular.

Will I need new medical tests when switching to a new insurer?

It's possible, depending on age, medical history, and the sum insured (whether increased or any additional benefits opted for).

What if my old insurer delays sharing data?

Your coverage continues, and the new insurer cannot deny portability due to delays beyond your control.

Can I port from a group to an individual policy?

Yes, continuity benefits are maintained when switching, but availability is dependent on the insurer accepting this request.

Will portability increase my premium?

Premiums may change based on the new insurer’s pricing or coverage, but accrued benefits remain intact.

Last updated on: