| What Are Exclusions in Health Insurance? In health insurance, exclusions are treatments or procedures your insurer won’t cover. They exist for three key reasons: to make sure people buy insurance before they fall sick (avoiding “moral hazard”), to keep premiums affordable for everyone, and to protect the insurer’s financial health by leaving out predictable or uninsurable conditions. To understand what is covered and what’s not across different health insurance plans, use our ‘understand your policy’ page for a detailed overview. |

Are you unsure about what’s covered in your health insurance policy and what’s not? You’re not alone. At Ditto, our advisors get frequent calls from customers confused about these inclusions and exclusions. For instance, a dental procedure is covered only if it's due to an accident, not for routine treatments like cleaning or cosmetic work.

To help you avoid such last-minute surprises, we will walk you through the most common health insurance exclusions in this article.

Did you know? Choosing the wrong insurance plan could cost you a lot in the long run! But our IRDAI-certified advisors offer free consultations to help you pick the right policy! Book a call now – no pressure, no spam, just honest insurance advice.

What are the Common Health Insurance Exclusions?

They fall under two categories: permanent and temporary exclusions. Let’s explore them in more detail:

What Are Permanent Health Insurance Exclusions?

These conditions or treatments are never covered by any health insurance policy. Here’s a detailed list:

| Category | Typical Examples | Why They Are Excluded |

|---|---|---|

| Non-medical & Investigative | - Registration, admission or service charges - Diagnostic scans done without a doctor’s referral | Not “treatment”; regulators allow insurers to omit these costs. |

| Cosmetic & Aesthetic | - Botox, liposuction, rhinoplasty - Dental implants for looks only | Considered lifestyle choices rather than illness. |

| Self-inflicted & Illegal | - Attempted suicide injuries - Conditions arising from substance abuse - Injuries sustained during unlawful acts | Insurers legally cannot encourage illegal activities. |

| Fertility & Pregnancy-related | - IVF, IUI, surrogacy costs - Voluntary termination of pregnancy (elective) | High, predictable expense; available only through specialized add-ons. |

| Congenital Anomalies | - Birth defects present since birth (heart malformation, cleft palate) | Viewed as pre-existing and lifelong; making it difficult for insurers to offer coverage. |

| OPD & Preventive | - Routine vaccinations - Annual health check-ups beyond any free quota | Meant for regular upkeep, not hospitalization—few plans cover via riders. |

| Alternative & Experimental | - Stem-cell therapy, gene therapy (unless IRDAI-approved) - Unproven clinical trials | Uncertain pricing and a lack of proven effectiveness. |

| War & Nuclear Perils | - Injuries due to war, civil unrest, nuclear radiation | Catastrophic, unpredictable losses that health insurance can’t cover. |

| Where Can You Find the Health Insurance Exclusions List? You can find the list in the policy wordings section, as well as in the IRDAI’s standard list for permanent exclusions. Think of it as the fine print that governs what you’re really buying, not just what’s advertised. |

What Are Temporary Health Insurance Exclusions?

These conditions or treatments are excluded from a health insurance policy only for a specific period. The list includes:

1) Specific illnesses such as hernia or cataract with a waiting period of 1-2 year

| Ditto’s Advice: Some insurers may include things like cancer in the specific illnesses list, which is a general no-no. Since cancer is (and should be covered) in most policies. Care Freedom is one such policy that includes this drawback as it only covers cancer after a 2-year waiting period and has a sub-limit on the disease’s treatment expenses. We consider this plan as a last resort when no other policy is available for the person due to a severe pre-existing condition. |

2) Pre-existing conditions like diabetes, asthma, or hypertension with a waiting period of 1-3 years

3) Childbirth, voluntary abortions, and other expenses (unless the policy includes maternity cover either inbuilt or via a rider). It usually comes with a waiting period of 9 months to 4 years before claims are accepted.

4) Hospitalizations won’t be covered for the first 30 days of the policy unless it’s an accident (which are covered from day 1).

Note: Exceptions may apply for complications like ectopic pregnancies which are generally covered under inpatient coverage itself.

| Ditto’s Advice: Search for sections titled “Exclusions,” “Waiting Periods,” ""Standard General Terms and Clauses"" and “Conditions Not Covered” to spot exclusions in policy wordings and prospectus documents. |

How Can Health Insurance Riders Override Exclusions?

Riders are the add-ons that you purchase along with your base policy to customize or improve your coverage. They can easily help cover or override certain exclusions in health insurance policies.

- Maternity Cover Rider: Covers maternity expenses, newborn baby care, C-section, and vaccination costs (after the waiting period). Available in plans like HDFC Ergo Optima Secure, ICICI Lombard Elevate, and Star Health Super Star.

- Pre-Existing Disease (PED) Waiver: Cuts down or removes the waiting period for pre-existing conditions like diabetes, hypertension, high cholesterol, asthma, coronary artery disease, obesity, and Chronic Obstructive Pulmonary Disease (COPD).

- Specific Illness Waiting Period Reduction: Insurers like ICICI Lombard Elevate and Star Health Super Star reduce the 2-year waiting period on certain illnesses to 1 year. Others like Acko Platinum Health and Manipal Cigna Sarvah Param remove it completely.

- Consumables / Non-Medical Expense Cover: Pays for non-payable hospital items like gloves, syringes, PPE kits, gauze, and surgical tape. These can make up 5–15% of your bill. Coverage varies—Care health insurance covers only 68 of 120 items, while HDFC Ergo covers all.

- Hospital Cash Benefit Rider: Gives a daily allowance to cover non-medical costs like travel, meals, or loss of income during hospitalization.

- OPD Cover Rider: Covers outpatient costs such as doctor visits, diagnostic tests, and medicines.

- Durable Equipment Cover: Pays for medically necessary equipment like ventilators, wheelchairs, prosthetic devices, and suction machines, up to a set limit.

- Global Cover Rider: Covers treatment expenses outside India for listed major illnesses.

Quick Note: Some policies already include coverage for certain commonly excluded items as inbuilt features. So, coverage for some exclusions may be provided by the policy itself and not only through riders.

Best Health Insurance Plans With Minimal Exclusions

At Ditto, we have analyzed numerous policies to identify the ones that offer strong riders to override common exclusions. Based on this criteria, here’s a list of the top 5 health insurance plans:

- HDFC ERGO Optima Secure: Covers chronic conditions like asthma, BP, high cholesterol, and diabetes through ABCD Chronic Care. Parenthood bridges maternity exclusions, while Unlimited Restore and Optima Wellbeing fill gaps for multiple claims and wellness needs.

(See page 9, optional covers section, of the policy wording)

- Care Supreme: Instant Cover shortens wait for select PEDs, Claim Shield pays for non-payable items, and OPD benefits cover outpatient costs usually excluded.

(See page 7 of the policy wording)

- Aditya Birla Activ One Max: Chronic Care with day 1 pre-existing condition cover removes waiting period for certain illnesses while Durable Equipment covers medical devices like wheelchairs and ventilators. Vaccine Cover protects against costs related to epidemics and pandemics.

(See Appendix A, section C, of the policy wording)

- Niva Bupa Aspire Titanium+: Safeguard+ covers excluded items and inflation. Conversely, Disease Management gives zero-day wait for hypertension/diabetes.

(See optional benefits section in the policy wording)

- ICICI Lombard Elevate: Multiple wait-period reduction riders speed access for PEDs, maternity, and specific illnesses. Claim Protector covers excluded items; Nursing at Home and Convalescence Benefit support recovery costs.

(See add ons/optional covers section on page 52 of the policy wording)

P.S. Not all the above riders are recommended or mandatory. It’s advisable to read the policy wordings to understand the coverage details.

Why Consider Ditto for Health Insurance

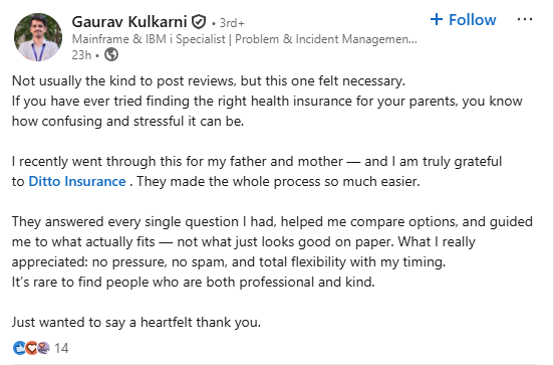

At Ditto, we’ve assisted over 5,00,000 customers with choosing the right health insurance policy. Here’s why customers like Gaurav love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 10,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

Exclusions aren’t just fine print, they form the backbone of every health insurance policy. Always read them first, not last.

- Always check the “Exclusions,” “Waiting Periods,” and “Conditions Not Covered” sections for anything that clashes with your health history or needs.

- Boost your cover with riders like PED waivers, maternity, or consumables add-ons, which are often cheaper than increasing your base sum insured.

- Don’t just compare premiums. A plan with shorter waiting periods or coverage for modern treatments can save you more when you claim.

- Keep your policy up to date. Review exclusions every few years, especially after major life changes, to make sure your cover still works for you.

Still unsure about specific exclusions in your health insurance policy? WhatsApp us or book a free call with a Ditto advisor to get better guidance.

FAQs

Is it possible to bypass exclusions in health insurance?

While it’s not possible to fully bypass exclusions in health insurance, you can significantly reduce their impact through smart planning. Choose policies with fewer exclusions or flexible add-ons like consumables cover, maternity, or OPD. Always declare your pre-existing conditions, so that they are covered after a 1-3 year waiting period.

Do health insurance policies have exclusions for international or foreign individuals?

Yes, health insurance policies in India may exclude foreign nationals from their coverage unless explicitly mentioned and included in the policy. Some insurers may offer special plans for foreign residents or require additional documentation that should be declared during purchase.

Last updated on: