What is Gross Written Premium in Insurance?

Paying for insurance is one thing. But figuring out if your insurer is financially healthy is another story. That’s why metrics like Gross Written Premium (GWP) are important as they show how much business an insurance company has written in a year and offer a snapshot of its scale, growth, and long-term sustainability.

At Ditto, we speak to thousands of Indians every month about health and life insurance. One common worry we hear is: “How do I know my insurer will still be around 5/10/15 years later, when my family actually needs the cover?”

This article was curated using IRDAI’s official filings, insurer public disclosures, and Ditto’s first-hand advisory experience. By the end, you’ll understand what GWP means, how it’s calculated, and why it matters before you choose an insurance plan.

Friendly reminder: It’s easy to get lost comparing policies and premiums. Instead of spending hours on it, why not get personalized insurance advice from Ditto? We offer free consultations with zero spam! Just 30 minutes to clarify all your doubts. So book a call now.

Key Takeaways

What is Gross Written Premium in Health & Life Insurance?

As discussed above, Gross Written Premium (GWP) is the gross measure of premiums written. The metric is universal and applies across different types of insurers, including:

- Standalone Health Insurers (Care/ Niva Bupa)

- Life Insurers (HDFC Life/ Axis Max Life)

- General Insurers (HDFC ERGO/ ICICI Lombard)

Gross Written Premium represents the insurer’s top-line, showing the total premium collected before expenses are accounted for.

Key Takeaways

How is Gross Written Premium Calculated?

The calculation of Gross Written Premium (GWP) is fairly simple.

According to IRDAI’s Master Circular, GWP is calculated as:

GWP = Gross Direct Premium + Premium on Reinsurance Accepted

For example, an insurer sells 1,00,000 health policies priced at ₹10,000 each. This generates a total premium of ₹100 crore. In addition, the insurer accepts ₹20 crore in reinsurance premiums from another insurer. In this case, the total GWP would be:

₹100 crore + ₹20 crore = ₹120 crore

This means:

- Gross Direct Premium shows the insurer’s own sales to customers.

- Inward Reinsurance (business assumed by a company when it accepts the risks of another insurer, acting as a reinsurer) means extra premium earned.

However, looking at a single year’s GWP can sometimes be misleading. Premiums may fluctuate due to factors like new product launches or large group policy deals.

How Does Gross Written Premium Work?

- For insurers, GWP reflects their growth, competitiveness, and ability to scale operations.

- For regulators like IRDAI, it signals long-term sustainability and helps assess whether an insurer is meeting the required capital adequacy norms.

- For policyholders, it serves as an indirect indicator of the insurer’s financial strength and capacity to pay claims, especially during unexpected crises.

During the COVID-19 pandemic, insurers with consistently higher and stable GWP were better positioned to absorb the sudden surge in claims compared to smaller (or less stable) players.

Key Differences between Gross Premium vs. Net Premium

When evaluating an insurer’s financial health, it’s important to understand the difference between Gross Written Premium (GWP) and Net Premium. While both are measures of premium income, they highlight different aspects of an insurer’s performance.

Gross Premium highlights an insurer’s scale, while Net Premium shows its real financial strength. Together, they provide a complete picture of an insurer’s ability to grow and pay claims.

Industry Snapshot: Popular Insurers by GWP

Using IRDAI reports and public disclosures, here’s a look at leading insurers (Life + Health) and their scale of business:

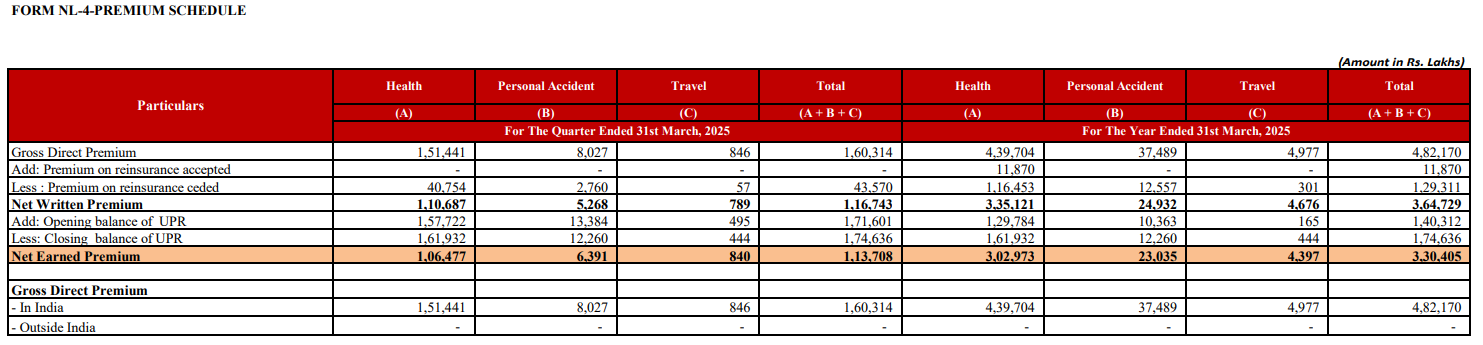

Health / General (Health GWP): Form NL 4 (Premium Schedule)

The schedule below gives a breakdown of gross direct premium, reinsurance, and net earned premium across different business segments such as Health, Personal Accident, and Travel. It presents both quarterly and year-to-date figures, offering a clear view of premium inflows and adjustments during the reporting period.

Popular Health Insurance Companies based on GWP

Did You Know?

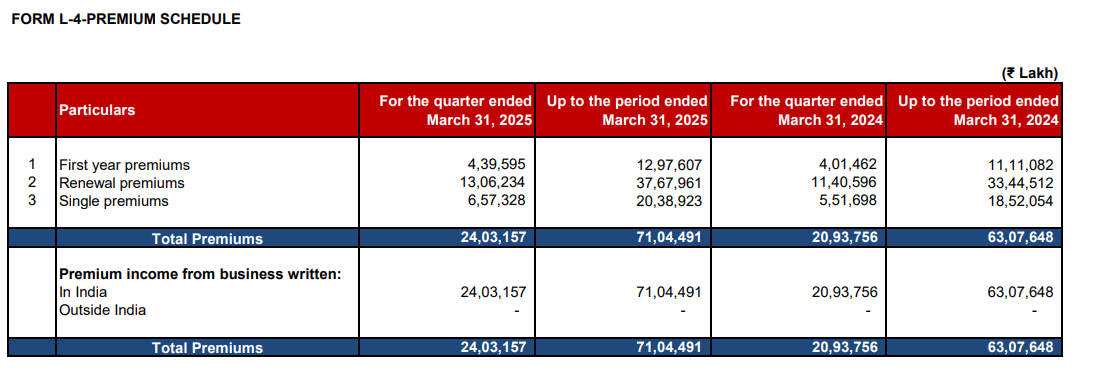

Life Insurance: Public Disclosure Form L4 Premium Schedule

The schedule below shows the insurer’s premium income, split into first-year, renewal, and single premiums. It compares quarterly and year-to-date figures with the previous year, highlighting business written in India.

Here, we take the Total First year + Single premium numbers only so that actual new business premiums that are collected can be ascertained.

Popular Life Insurance Companies based on GWP

A higher GWP signals greater scale for an insurer, but always review its solvency and claims record for a complete assessment of financial strength.

Did You Know?

Why Talk to Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Abhinav below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation here. Slots are running out, so make sure you book a call now.

What is Gross Written Premium in Insurance? (Ditto’s Take)

GWP reflects the insurer’s total business volume, showing how big and active they are. For life insurance, prefer insurers with at least ₹5,000 crores+ GWP, and for health or general insurance, look for over ₹2,500 crores+. However, just because an insurer has a large GWP doesn’t mean claims will be easy to get or that the company is perfectly stable.

That’s why at Ditto, we take a deeper look. We examine the average GWP over the last three years to get a steady view of business scale and trends. Then we combine this with the insurer’s solvency ratio, which indicates their financial health and ability to cover large claims. We also check an insurer’s claim settlement record and complaint volume to see if they’re not just quick to promise, but also reliable in paying what they owe.

In short, GWP shows scale and potential stability, but it must be complemented with solvency and claims data to find insurers who are truly secure and customer-friendly.

FAQs

What is an example of Gross Written Premium?

Suppose an insurer issues 1,000 health insurance policies in a year, each with a premium of ₹10,000. The Gross Written Premium (GWP) = 1,000 × ₹10,000 = ₹1 crore.

Why is Gross Written Premium important for insurers?

GWP reflects the total premium an insurer collects before deductions. It helps insurers measure growth, forecast revenue, and assess market share.

How does Gross Written Premium affect policyholders?

While policyholders don’t directly deal with GWP, it indicates the insurer’s scale and stability. A higher GWP often signals a financially strong insurer.

Is Gross Written Premium the same as Earned Premium?

No. GWP is the total premium written for all policies during a period, while Earned Premium is the portion of that premium corresponding to the coverage/service already provided.

Last updated on: