| What is grace period in health insurance? A grace period in health insurance is the extra time you get after your renewal due date to pay and keep the policy active. As per IRDAI, it’s 15 days for monthly premiums and 30 days for quarterly/half-yearly/annual modes. Coverage during grace depends on payment mode. With instalments, cover generally continues (any pending instalments may be recovered from the claim). With annual one-shot payments, cover is usually paused until the premium is paid. So, always check your policy wordings. |

Your health comes first, and a date on the calendar should not come in the way. But when premiums slip past the due date, many treat the ‘grace period in health insurance’ as an extra cover. In reality, it’s the last-minute bell to keep your health cover alive under IRDAI rules.

At Ditto, we help customers decode what really matters with their insurance. If a payment is missed, even during grace, we walk you through the possible consequences-whether the cover pauses, which benefits carry forward, and the exact steps to stay protected.

This article will help you better understand:

- What is grace period in health insurance?

- The benefits of a grace period in a health insurance plan

- How to calculate the grace period?

- How does the grace period in health insurance work?

- The difference between the waiting period and the grace period

- Pro tips to manage your premium payments within the grace period

Book a free call with Ditto’s IRDAI-certified advisors to pick the right health insurance plan.

What is Grace Period in Health Insurance?

The concept of a grace period in health insurance is often misunderstood. Yes, it buys you extra time to renew your policy after the due date. But it's actually the countdown to policy lapse.

There’s no harm in paying your premium during the grace period. However, waiting it out without a genuine reason is a poor habit that does no good.

The math is simple: pay your health insurance premium within the grace period and you continue enjoying the benefits, like No-Claim Bonus (NCB), waiting period credit, moratorium, and even insurance portability under IRDAI norms. Miss it, and you risk policy reset, fresh underwriting, and, above all, a break in cover.

Note: In most yearly or one-time payment plans, your health plan remains inactive during the grace period. So, for any hospitalization during the same time, all claims will be automatically rejected. The cover would only restart from the date you pay.

| Hard truths about grace period that most people miss: 1) Continuity is not the same as coverage: Continuity benefits (like waiting periods served, NCB, moratorium period) are preserved for on-time renewals, but coverage during grace period depends on the payment mode. 2) There’s no late-fee magic to save the day: Insurers don’t charge any penalty for paying your premium in the grace period, but it significantly increases the risk of policy lapse. 3) Grace period is not “free cover”: Many people wait till the last day of the grace period for renewal. They think it’s their “free 30 days of cover.” What they fail to understand is that a grace period only buys you time to protect your continuity benefits. There’s no guarantee to protect your health cover. |

Thinking of buying health insurance on EMI? As a first step, check out our exclusive guide to understand how health insurance on EMI works and avoid surprises later.

Benefits of Grace Period in a Health Insurance Plan

A cash crunch can occur out of nowhere, and that’s when a grace period in health insurance comes in handy. But before you take advantage of a grace period, know the basics right.

Here are the essential aspects of a grace period in health insurance that actually help.

- Duration: The IRDAI allows a 15-day grace period for health insurance plans with monthly premiums. For quarterly/half-yearly/annual renewals, it’s 30 days.

- Coverage: Your health plan remains active if you pay in instalments, even within the grace period (not applicable for annual premiums, where missing the grace period pauses coverage).

- Continuity of benefits: When you renew your health insurance within the grace period, both your sum insured and No-Claim Bonus (NCB) stay intact. The waiting period you serve for a pre-existing disease also counts (applicable for both indemnity plans that pay hospital bills and benefit plans with a fixed amount).Let’s say you’ve completed 18 months out of a 24-month waiting period. If you renew before the grace period, you will have only 6 months to wait. Miss the grace period, and you restart the full 24 months.

- Zero interest for delayed instalments: Clearing overdue instalments within the grace window does not attract any interest or penalty. For example, your policy renewal is due on May 1st, and you pay on the 14th. No extra interest charged for those 13 days.

Remember: Health insurance is an annual risk coverage that can be paid either upfront or in agreed-upon instalments. The grace period is a customer-friendly continuity buffer, not a free extension of benefits. If the premium isn’t paid by the due date, your cover pauses and no claims are payable until you pay.

How to Calculate the Grace Period?

Calculating your grace period is easy. All you need to do is run your calculation in calendar days (not business days). To derive your grace period:

- Make a note of your policy renewal due date.

- Add 15 calendar days after the renewal date (for monthly instalments) and 30 calendar days if it's a quarterly/ half-yearly, or annual payment.

Example:

Renewal Date: 10th October

If monthly instalment → Grace till 25th October (10th + 15 days)

If annual / quarterly / half-yearly → Grace till 9th November (10th + 30 days)

Don’t lose your sleep over policy renewals. Renew your health insurance policy with Ditto’s dedicated support managers.

How Does Grace Period in Health Insurance Work?

Think of the grace period as a buffer for renewing your health insurance post due date.

Let’s understand how the grace period in health insurance affects your claims with examples for both monthly and annual premiums.

For Annual Premiums:

Say, your renewal is due on 10th October. For annual pay, you are eligible for a grace period until 9th November. If you renew on 5th November, you will preserve the continuity benefits (such as NCB and moratorium). However, a claim for a hospitalization on 22nd October will not be considered as your cover was on pause.

For Monthly Premiums:

On the flip side, if it’s a monthly premium due on 10th October, you get a grace till 25th October So, for a hospitalisation claim for 22nd October, it will be considered as the cover continued during the grace period as per IRDAI norms, but all remaining instalment premiums would also become due, either payable upfront or deducted from the claim amount.

| Did You Know? Care Ultimate Health Insurance Plan has a mandatory paid add-on called “Grace Period Coverage” where the policy remains active during the grace period, ensuring no break in cover. |

Difference Between Waiting Period and Grace Period

People often use the terms grace period and waiting period in health insurance interchangeably. However, there are two distinct concepts. The table below draws a clear comparison between “grace period” and “waiting period” across different aspects.

| Aspect | Waiting Period | Grace Period |

|---|---|---|

| Definition | It is the time following the start or enhancement of a policy when specified illnesses or PEDs aren’t covered. | It is the time provided after the due date during which one can still renew their policy without losing coverage. |

| Typical length | Initial - 30 days (Accidents covered from Day 1) Specific Illness - Up to 2 years Pre-existing conditions - Up to 3 years |

15 days (for monthly premiums) and 30 days (for other payment modes) |

| Coverage status | Policy remains active, but coverage can be restricted for specified conditions | Coverage continues for monthly/quarterly/half-yearly instalments, but often paused for one-shot annual renewals |

| Purpose | Prevents anti-selection and staged coverage | Prevents immediate policy lapse and preserve continuity benefits (NCB/waiting period/moratorium credits) |

| If missed | You have to “serve” it over time | Your policy lapses and you lose all continuity benefits |

Note: All regulatory basis and durations mentioned are as per IRDAI’s 2024 Master Circular with coverage nuance reiterated in standard clauses.

Tips to Manage Your Premium Payments Within the Grace Period: Ditto’s Take

Smart work and pre-planning can help you use the grace period in health insurance to your advantage. Here are some expert tips to follow.

- Always renew early, preferably before the due date: Insurers even offer a discount if you renew your health insurance before the due date. For example, the Care Supreme Plan offers a 2.5% discount for renewing your health plan within 30 days early, and a 5% discount for renewing between 31 and 60 days early.

Porting your insurance? Plan at least 45-60 days before renewal (for example, if your renewal is due on October 12th, start porting by mid-August). This will give you enough time to review plans, select an insurer, and allow them time to process your porting request before issuing the policy.

Ready to move your policy? Follow our step-by-step guide on how to port your health insurance in 2025. - Check if your cover is live: Paying your health premium in instalments allows you to keep your cover during the grace period. However, for one-time payments, the cover is paused until payment is made. So, always read your policy wordings thoroughly.

- Work with e-mandates and reminders : Set an e-mandate (UPI or net banking) to run 3–5 days before the due date. Add two calendar reminders—one a week in advance, and the other 2–3 days before.

- Be prepared for set-off on claims: In instalment modes, any overdue instalment can be deducted from an approved claim. For example, the claim is of ₹40,000 and you owe two instalments of ₹1,500 each, the insurer will deduct ₹3,000. So, the final payout will be ₹37,000. [₹40,000 − (₹1,500 × 2)].

- Prioritize continuity benefits protection: Your no-claim bonus, waiting period credit, and moratorium are real assets. Don’t lose them just because of procrastination.

Why Choose Ditto For Health Insurance

A grace period in health insurance often attracts panic and unnecessary drama. So, the first step is to stay informed, follow IRDAI rules, and when in doubt, trust an expert.

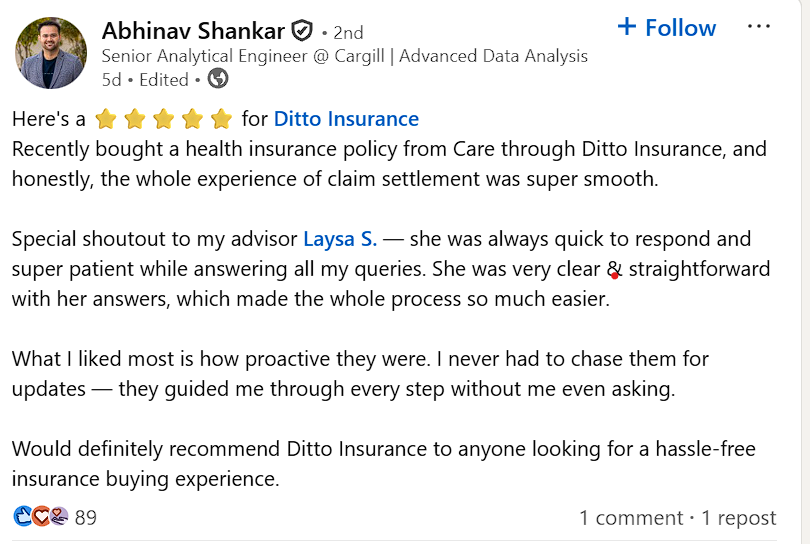

At Ditto, we are committed to making your insurance buying experience hassle-free. Not just by suggesting the best health insurance plans in 2025, but walking a step further to make you a confident and informed insurance buyer.

No wonder 7,00,000+ customers trust Ditto and recommend us to others.

✅ Honest advice – no sales pitches, no commission-driven recommendations

✅ 12,000+ 5-star reviews (Rated 4.9 on Google)

✅ Real claim experience – we've helped customers through actual claims

✅ Backed by Zerodha and other leading fintech companies

Conclusion

Often misunderstood, “grace period in a health insurance” is a buffer, not a free extension of your health cover. It's more like a gesture of good faith from the insurer to protect your continuity benefits by allowing you to pay even if you’ve missed the due date.

Whether you’re actually covered during the grace period depends on your payment mode and policy wording. However, don't leave things to chance. Budget it right for premiums, plan and pay your health premiums early, and stay protected.

Need end-to-end help in selecting the right health insurance plan? Book a free call with Ditto and let our experts guide you.

FAQs:

Can I pay the premium after the grace period ends?

No! Not as a routine. While some insurers may consider reinstatement at their discretion for genuine cases (with fresh application and underwriting), the continuity benefits aren’t guaranteed. In short, missing the grace period lapses your policy and your health cover comes to a halt.

How long is a typical grace period in health insurance?

As standardised by the IRDAI, the grace period for monthly instalments is set to 15 days. For quarterly/half-yearly/annual payment modes, it's set to 30 days.

Are claims payable during the grace period?

For health premiums paid in instalments (monthly, quarterly and half yearly), the claims are covered during the grace period. However, any pending instalments will be deducted from the final claim payout. On the flip side, the coverage is generally paused during the grace period for one-shot yearly renewals.

Can I port my policy during the grace period?

Yes, you can port your policy during the grace period but it can be a risky move if the new insurer rejects or does not make a decision within the grace period. Porting a health plan requires continuity and should ideally be initiated at least 45 days before but not earlier than 60 days from renewal. However, no portability is allowed for a lapsed policy.

Will I be charged a late fee for paying within the grace period?

No, there’s no interest or penalty charged by insurers if you pay your premium during the grace period. But if you miss renewing your policy within the grace window, your health cover will be cancelled which is by far more costly.

Last updated on: