Wondering which health insurers actually pay when it matters? In FY 2026, insurers settled 3.26 crore health claims and paid ₹94,247 crore. With numbers this large, you want an insurer that actually pays when you need it. The claim settlement ratio (CSR) helps you see which companies handled this huge volume most reliably.

Most insurers show claim settlement ratios that seem strong, often above 90%. These numbers look reassuring, but they can be misleading if you do not know how claims are counted. This is why Ditto uses a clear and transparent formula that, in our view, gives a more accurate picture.

This guide breaks down the top health insurance companies with the strongest claim settlement performance. You will also learn how CSR works, how to calculate it, and how to choose a health plan that meets your medical and financial needs with confidence.

What is the Claim Settlement Ratio?

The claim settlement ratio tells you how reliable a health insurer is. It shows the percentage of claims the insurance company pays out compared to the total claims it receives in a year. A higher ratio means the insurer settles most claims and gives you better peace of mind.

For example, if an insurer receives 10,000 claims and settles 9,700 of them, its claim settlement ratio is 97%. This number helps you understand how consistent an insurer is when honouring your medical claims. It also helps you judge whether the company handles claims smoothly or struggles with payouts.

How to Calculate the Claim Settlement Ratio?

IRDAI does not have a standardized formula to calculate CSR. Here is how we calculate it:

CSR = (Total claims settled ÷ Total claims available to settle) × 100

Where:

Total claims available to settle = Claims outstanding at the start + Claims reported during the year − Claims closed without payment − Claims outstanding at the end

It’s worth noting that official CSR figures from insurers can sometimes differ from ours. At Ditto, we follow a consistent approach across all insurers, excluding claims closed without payment and averaging over three years. This gives a clearer, outcome-focused view of how reliably an insurer settles claims.

Let’s take a look at a practical example:

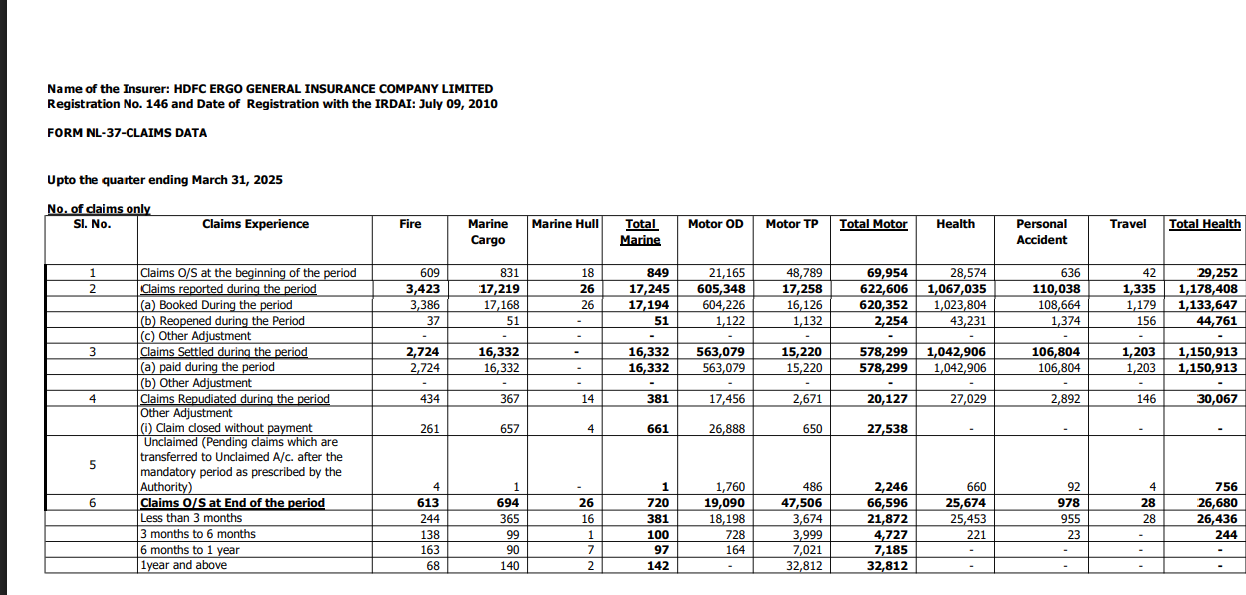

Here’s a snippet of HDFC ERGO’s public disclosure as of March 2025 (NL 37 - Claims Data, Total Health Data).

Now, let’s see how the CSR works:

Claims outstanding (O/S) at the beginning of the year = 29,252Claims Intimated during the year = 1,178,408Claims Paid During the year = 1,150,913Claims O/S at End of the year = 26,680Claims Closed = 0

Applying the above formula gives us the CSR for FY 2024-25, at 97.45%.

Note: When calculating CSR, insurers count only approved and paid claims; rejected ones are not included. Some companies also treat partial claim payments as “settled,” even when the full amount is not paid.

Why is the Claim Settlement Ratio Important?

Shows the Insurer’s Ability to Pay Claims

Helps you Judge Reliability

Checks Long-Term Performance

Useful for Comparing Insurers

Top 10 Health Insurance Companies by Claim Settlement Ratio

Note: All data shown in the table is derived from public disclosures and FORM NL-37 provided by insurers. A three-year average is used because it shows stability. When choosing a health plan, it is important to look for insurers with a steady or improving CSR trend across 3 to 5 years. A single-year spike does not reflect long-term performance.

Top 10 Health Insurance Companies in India

As we looked at the top 10 health insurers in India by CSR, let’s discuss them in detail:

New India Assurance

Digit Health Insurance

Bajaj Health Insurance

HDFC Ergo Health Insurance

Talk to an expert

today and

find

the right

insurance for you.

ACKO Health Insurance

SBI General Insurance

Aditya Birla Health Insurance

National Insurance

Universal Sompo Health Insurance

United India Insurance

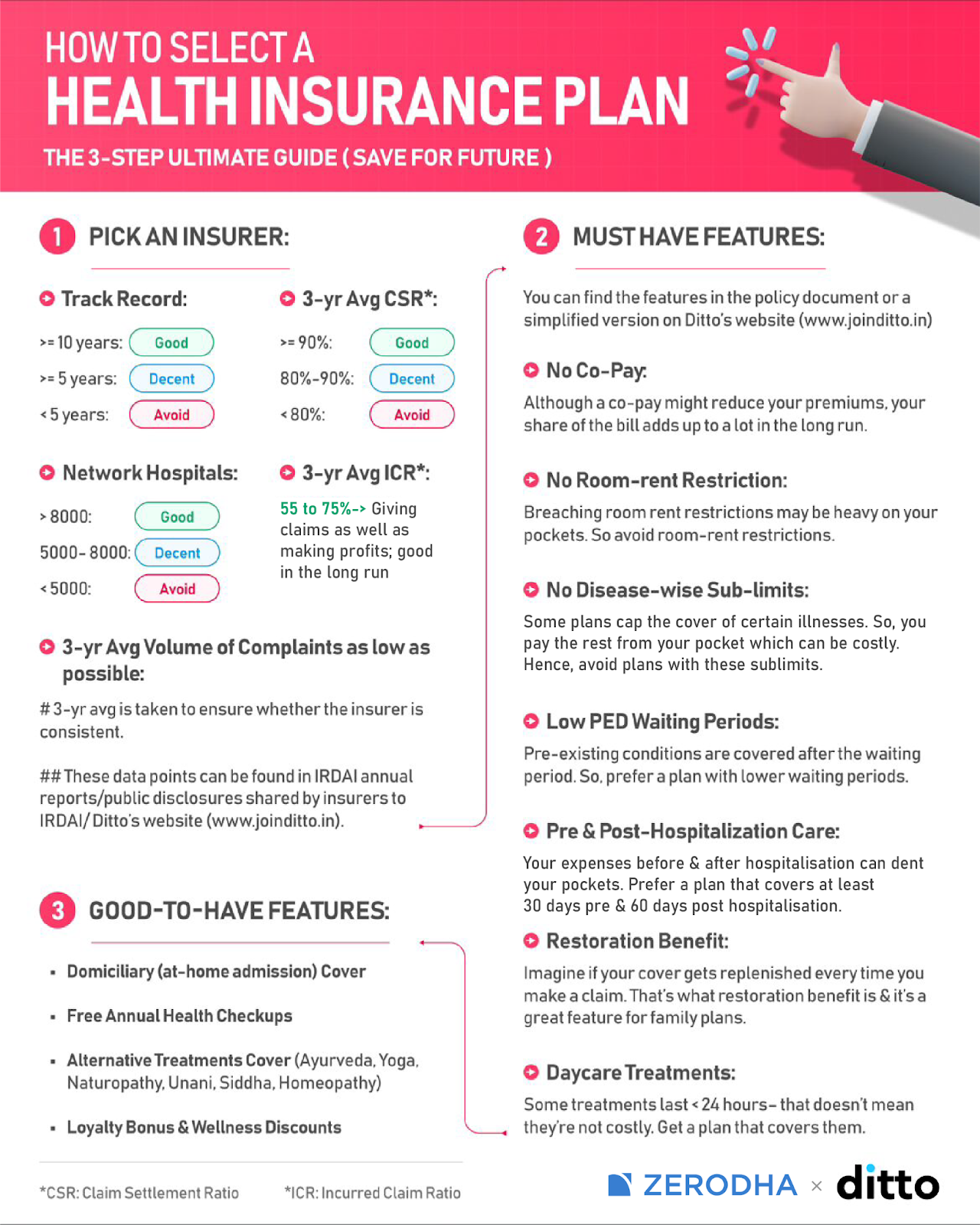

How to Choose the Best Health Insurance Company in India?

Let's break down the steps that will help you pick the right insurance company.

1) Understanding Key Metrics

Incurred Claim Ratio (ICR)

The incurred claim ratio shows how much money an insurer pays in claims compared to how much it earns in premiums. A healthy ratio shows balanced underwriting and stable financial health.

A very high or very low number can indicate pricing issues or sustainability risk. If your insurer's ICR lies between 50% and 80%, it indicates balanced claim payouts.

Solvency Ratio

The solvency ratio shows an insurer’s ability to pay claims even during financial stress. IRDAI requires all insurers to maintain a healthy solvency margin, a minimum of 1.5x. A strong solvency ratio means the company has enough funds to settle claims during emergencies.

Claim Settlement Ratio

The claim settlement ratio shows how many claims the insurer settles during the year. It is important to look for a consistently high number across multiple years.

Consistency is more important than a temporary spike. If an insurer maintains a CSR of 90% or higher, it’s a good pick for you.

Complaints Volume per 10,000 Claims

Low complaints indicate a good customer experience. A high complaint count may suggest slow processing or servicing issues. This number helps you evaluate real-world experiences of policyholders. If an insurer has its complaint volume under 20 per 10,000 claims, it is an ideal purchase.

Annual Business Volumes

Companies with large business volumes usually have stronger networks and more robust servicing systems. High volumes also reflect customer trust. An insurance company with over ₹2,500 crores gross written premiums reflects strong financial strength and stability.

Average Time to Settle a Claim

Fast claim settlement is important during hospitalization. Insurers that resolve claims quickly reduce stress for policyholders. A short turnaround time shows efficient internal processes.

2) Compare Different Health Insurance Plans

After evaluating insurers, compare individual plans. Look at coverage details (inbuilt features and riders offered), room rent rules, waiting periods, and exclusions. Compare benefits across insurers and do a cost-benefit analysis rather than focusing only on premiums. A lower premium sometimes comes with more restrictions. Choose a plan that fits your needs and budget while offering strong protection.

3) Evaluate the Network of Hospitals and Healthcare Providers

A strong hospital network ensures easy access to cashless treatment. Check whether your preferred hospitals are included. A wide network helps reduce out-of-pocket expenses and simplifies the claim process. It is especially important in metro cities where treatment costs are high.

If an insurance company has tie-ups with over 10,000 network hospitals, it indicates a broad presence and strong accessibility for cashless treatment.

4) Seek Professional Advice

Speaking to a trained advisor can help simplify complex policy details. Advisors can explain differences between plans and highlight hidden restrictions. They can also guide you based on your age, health history, and family structure. A neutral advisor like Ditto can help you compare insurers and find the right plan.

5) Review Policy Terms and Conditions

Read the policy documents carefully. Look for waiting periods, coverage limitations, and exclusions. Understand how the insurer handles pre-existing conditions. A clear understanding of terms reduces surprises during claims. Policies with fewer restrictions usually offer smoother claim experiences.

6) Insurer Reviews and Customer Ratings

Customer reviews help you learn about real-world experiences. Look for feedback on claim servicing, cashless approvals, and support quality. High ratings often reflect strong service and trust. Be cautious of insurers with repeated complaints about delays or poor communication.

7) Consider Additional Features

Here are some additional features you should consider while buying health insurance:

No Room Rent Restrictions

Policies with no room rent limits let you choose any hospital room without extra cost. Understanding room rent restrictions is important because choosing a room beyond the limit can increase your out-of-pocket expenses during hospitalisation.

No Co-payment Clause

Plans without co-payment ensure the insurer pays the full claim amount. This is helpful for older individuals or those who expect higher medical expenses.

For instance, If your policy has a 10% co-payment clause and the hospital bills turn out to be 20 lakhs, the insured will have to pay 10% of 20 lakhs, i.e., 2 lakh, while the insurer will cover the remaining 18 lakhs. The extra 2 lakh you pay yourself defeats the purpose of paying hefty premiums.

No-claim Bonus

A no-claim bonus increases your coverage when you do not claim in a policy year. Look for plans that offer a strong bonus without sharply raising premiums. Many insurers now also offer loyalty or renewal bonuses, which add to your sum insured even if you make a claim.

Restoration Benefit

Restoration benefit refills your sum insured if it gets used up during the year. This is useful for families or people at higher medical risk. The ideal restoration feature should offer unlimited restores, work for the same or different illnesses, and activate even after partial exhaustion. It should apply instantly with no waiting period or extra conditions.

Short Waiting Periods

Short waiting periods for illnesses and pre-existing diseases help you access coverage sooner. This is helpful for individuals who have ongoing medical needs.

IRDAI’s latest 2025 guidelines have officially reduced the maximum waiting period for coverage of pre-existing diseases from four years to three years across all individual and family health insurance policies. Insurers often go beyond this and offer riders/ specialised plans to reduce them further.

Daycare Treatments

Daycare treatments are procedures like dialysis, chemotherapy that need less than 24 hours of hospitalisation. Plans that cover a wide range of daycare treatments offer better value, especially since many modern medical procedures no longer require long hospital stays.

Why Talk to Ditto for Your Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Rajan below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Final Thoughts

The claim settlement ratio shows how reliable an insurer is during medical emergencies, but even strong numbers do not guarantee every claim. You should also look at other metrics, the insurer’s reputation, and the product features.

Public sector insurers often rank high in CSR, yet many of their plans offer limited benefits (room rent limits, disease-wise limits, lack of restoration, low bonuses) for the premiums they charge.

Still unsure about purchasing the correct health policy? Book a free call with us and let our experts guide you to make an informed decision.

For more details on how we approach reviews and partnerships, you can refer to our Editorial Policy & Disclaimers.

And as always, remember that this list is based on publicly available information and is not personalised advice. Please review the policy brochure carefully and speak with a licensed advisor before choosing a plan.

Frequently Asked Questions

Why People Trust Ditto

Last updated on: