Yes, you can. The IRDAI places no legal cap or restrictions on the number of policies you own in India.

As Avni, one of our senior advisors, puts it, “It’s completely your prerogative to choose how many policies you want to maintain for better coverage or additional benefits.”

Introduction

With medical inflation in India rising to 12-14%, healthcare expenses have increased so sharply that a single health insurance policy isn’t enough to cover them.

At Ditto, we’re seeing more and more people recognize this gap, with many reaching out to our advisors to explore the idea of having multiple health insurance policies.

So, let’s break down how having more than one health plan works, the key benefits, and best practices to maximize your coverage.

At Ditto, we have a dedicated team of experts to guide you through every step of the claim settlement process. Book a free call now if you need help with a claim or are unsure how to proceed.

Do I Really Need More Than One Health Insurance Policy?

The answer depends on several factors. Let’s break them down below:

1) Your Existing Policy Isn’t Enough for Medical Bills

If your hospital bill exceeds the sum insured under your primary policy, a secondary policy lets you split the remaining claim amount with another insurer. Here’s an example:

- Base Policy: ₹5L

- Treatment Cost: ₹8L

- Amount Paid by Second Policy: ₹3L

Put simply, you won’t have to pay out of pocket if you have another policy that covers expenses beyond your primary health insurance limit.

2) You Only Have a Corporate Policy and Want Other Benefits

Corporate plans often end when you leave your job and may not offer enough coverage for major treatments or include maternity/pre-existing disease benefits.

“We usually advise folks to keep their corporate cover and buy an individual health insurance policy as early as possible. That way, you can serve waiting periods when young and healthy and also avoid high loading charges (due to pre-existing conditions, BMI range, or lifestyle choices),” says Arjun, a senior advisor at Ditto.

If you're considering this route, here's a curated list of health insurance policies that offer the most reliable protection today.

Popular Plans with Comprehensive Coverage

3) You Need Targeted Coverage

Specific needs like maternity, diabetes care, or other pre-existing conditions might not be covered under your main policy. A second plan can help fill those gaps.

For instance, Aditya Birla Activ One MAX is an excellent choice if you want chronic care for certain conditions. The plan offers day 1 coverage for hospitalizations related to asthma, hypertension, diabetes mellitus, obesity, and a few other diseases.

Conversely, if you’re looking for maternity coverage, Niva Bupa Aspire’s M-iracle benefit is a great option for covering expenses related to IVF, surrogacy, adoption, and prenatal checkups.

The key is choosing policies that complement each other, and knowing how to coordinate claims across them.

Best Policy Combinations for Maximum Coverage

Heads Up! Insurers will only reimburse you for the actual medical expenses incurred, not more than the total hospital bill.

When Can I Skip Buying Another Policy?

Sticking to a single plan might actually be the smarter move in either of the following cases:

1) Your Policy Offers Comprehensive Coverage

If your current health insurance policy offers a higher sum insured, lifelong renewability, and key add-ons like maternity benefits or critical illness coverage, then you’re already well-covered.

In that case, we recommend that you:

- Review and upgrade your existing coverage periodically by increasing the sum insured or opting for relevant riders.

- Maintain long-term continuity with your insurer to enjoy loyalty or wellness-linked benefits. For instance, Care Ultimate automatically doubles your sum insured without any additional waiting period if you stay claim-free for 7 years.

2) You Have a Base + Super Top-Up Combo

This combo can give you large coverage (₹20L–₹50L+) at a much lower premium than upgrading your base plan alone.

Let’s say you have a base policy like Aditya Birla Activ One Max with ₹5L coverage. You can pair it with the insurer’s Super Health Plus top-up plan offering ₹20L coverage with a ₹5L deductible (the amount that you pay out of pocket).

Together, you get a ₹25L cover, which is far more affordable than buying a ₹25L base plan outright.

3) You Want to Avoid Claim Confusion

Managing one well-rounded policy reduces confusion during emergencies, especially if you’re new to health insurance.

What Do IRDAI Regulations Say About Claiming Multiple Policies?

Right to Choose Policy for Claim

If you have more than one health insurance policy, you can choose either policy to file your claim. The insurer you opted for must process the claim as long as it's within that policy’s terms and limits.

Claiming Disallowed Amounts from Another Policy

If your claim is partially settled or disallowed under one policy, you can use your second policy to claim the remaining amount. This applies even if you have not completely exhausted the sum insured from the first policy.

If the Claim Amount is Greater Than the Sum Insured of a Policy

If your total bill is more than the sum insured of a policy, you can split the claim across multiple insurers. This involves starting with one and then claiming the balance from another.

No Double Compensation

You cannot claim the same expense from two different policies to receive double reimbursement. IRDAI strictly prohibits this, and insurers have the right to reject such claims or flag them as fraud.

How to Claim Health Insurance from Multiple Insurers?

Let’s consider two cases to understand the claim settlement process.

Case 1: Multiple Policies Taken from Multiple Insurers

If you hold two or more health insurance plans, you can use them together to cover a single hospitalization. Let’s understand how to handle claims in this context:

Step 1: File a Cashless or Reimbursement Claim with the First Insurer

Opt for a cashless claim if possible. The insurer will settle the bill up to the policy limit.

Step 2: Pay the Balance (If Any) Out of Pocket

If the hospital bill exceeds your policy coverage, pay the difference at discharge.

Step 3: File a Reimbursement Claim with the Second Insurer|

Apply for reimbursement claim within 15-30 days of your discharge along with:

- Final hospital bill and discharge summary

- Claim settlement letter from the first insurer

- Hospital bills already paid by the first insurer

- Payment receipts for any out-of-pocket expenses

- Claim form, bank statements and identity documents (as per insurer’s format)

To simplify the claim settlement process, inform both insurers at the time of hospitalization, especially if you anticipate an expensive treatment.

Quick Update:

With IRDAI's 'Cashless Everywhere' mandate and the adoption of the National Health Claim Exchange (NHCX) platform, the industry is moving toward efficient, interoperable claim processing. In the near future, cashless claim settlements might be possible across multiple insurers, even when your policies are from different companies.

Case 2: How to Claim Health Insurance When Both Policies Are from the Same Insurer

Let’s say you have a base plan and a super top-up plan. Since the insurer already has access to both policies and your claim history, the process will be faster compared to dealing with two separate insurers. Here’s how it works:

Step 1: Initiate the Claim Under the Primary Policy

Use cashless mode if available. The insurer will pay up to the sum insured or deductible.

Step 2: If Expenses Exceed the First Policy, Use the Second

If your total hospital bill exceeds the sum insured or deductible in the first policy, the insurer will consider your super top-up policy. In case of a second individual plan, you may need to file a separate claim; in some instances, the insurer can also process the additional payout internally.

Step 3: Submit Additional Documents (If Asked)

The insurer might request a few additional documents or declarations to activate the second policy. Since it’s the same company, you won’t need to repeat any paperwork.

Ditto’s Advice:

1) Mention both policy numbers and your intention of using them when initiating a claim. This helps the claim settlement team process your request efficiently.

2) If the second policy is a super top-up, make sure the deductible threshold is met before expecting a payout from it.

But claim settlement with multiple policies isn’t as easy as it seems!

After a shoulder injury, one of our customers was hospitalized and used his corporate insurance for surgery. Post-discharge, most of his expenses were for some lengthy physiotherapy sessions.

Since his corporate cover was already exhausted, the person turned to his personal health policy, only to face claim rejection.

Why?

Insurers cover pre- and post-hospitalization expenses only under the policy that pays for hospitalization. Since the person had not initiated any claim under his personal policy, the post-hospitalization treatment cost could not be linked to it.

The workaround?

He filed a small, legitimate leftover hospital expense of ₹10,000 under his personal health insurance. This allowed the insurer to generate a new claim ID to submit the physiotherapy bills as post-hospitalization expenses under the same policy.

Ditto’s Take:

When using multiple health insurance policies, make sure both your hospitalization and follow-up claims (like physiotherapy and medication) are filed under the same policy. Otherwise, even valid claims may be rejected if not submitted in alignment with policy terms.

Can I Claim Co-Payments or Non-Payable Items from a Second Insurer?

Yes, but with certain conditions.

As per Clause (b) of IRDAI’s multiple policy guidelines, if the first insurer partially settles a claim and disallows components like co-payments or non-payable items, you can approach your second insurer to claim the remaining amount.

For example, if your first insurer applies a 10% co-pay to the claim amount of ₹2L, they pay only ₹1.8L. In this case, the share you must pay is ₹20,000.

Later, you can file this amount with your second insurer for reimbursement, provided the policy doesn’t have its own co-payment clause. HDFC Ergo Optima Secure, Care Supreme, and Aditya Birla Activ One Max are some health insurance policies that do not have any co-pay clauses.

Please Note:

Retail plans may exclude non-payables by default unless you have opted for an add-on like "non-medical expense cover."

How Do Top-Up and Super Top-Up Policies Work with Multiple Covers?

According to the IRDAI guidelines, top-up and super top-up plans are also eligible for multiple policy coordinations like base plans. However, their functioning differs from primary policies in some crucial ways:

To sum it up, top-up and super top-up plans ensure maximum coverage at minimal extra cost when combined with your base policy.

How to Manage Multiple Health Insurance Policies?

- Store documents carefully — Keep digital and physical copies of bills, prescriptions, and claim forms.

- Disclose all active policies — Let insurers know about existing plans to avoid issues during claims.

- Prefer the same insurer for base + super top-up — Simplifies coordination and enables smoother cashless claims.

- Know what's excluded — Understand non-payable items, room rent caps, and other fine print.

- Stagger renewals — Spread policy renewal dates to reduce financial burden and ensure continuous coverage.

In simple words, managing multiple health insurance policies is all about strategic planning, timely documentation, and clear communication.

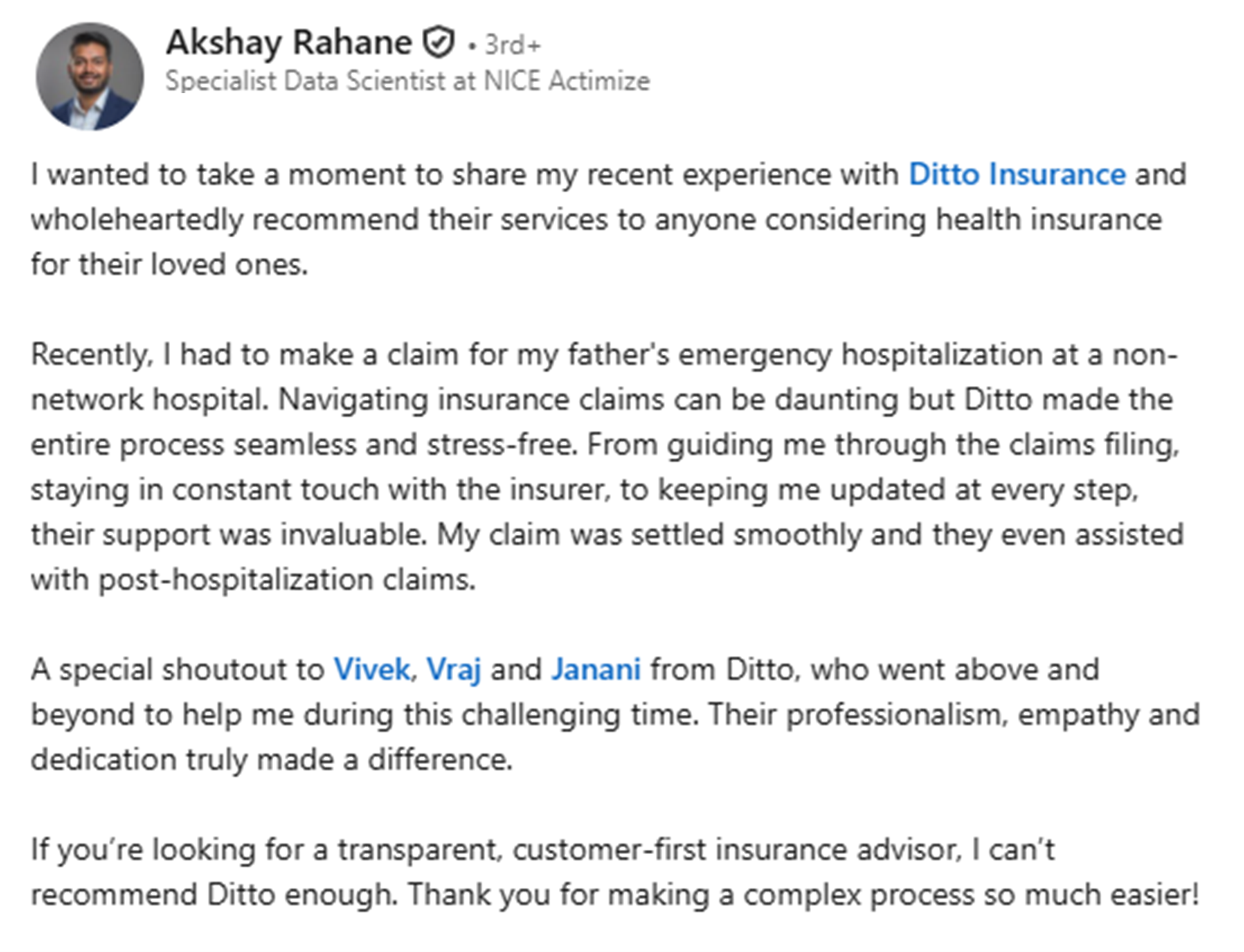

Why Approach Ditto for Your Health Insurance Plan?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right health insurance policy. Here’s why customers like Akshay love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 10,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Can I Have Multiple Health Insurance Policies: Key Takeaways

Having multiple health insurance policies acts as a financial safeguard for you and your family. Keep the following things in mind to avoid complicating your claim settlement process:

- Combine your plans smartly with base, super top-up, and employer policies to cover everything from OPD to major surgeries.

- Always inform insurers upfront and link related claims to the same policy to avoid rejection or delays.

- Don’t overbuy! Review your needs and pick policies that complement each other without unnecessary overlapping coverage.

Still unsure about having multiple health insurance policies? WhatsApp us or book a free call with a Ditto advisor to receive unbiased guidance based on your needs. We're here to help you make the best choice.

FAQs

Do I need to declare my existing policies when buying a new one?

Yes, if the insurer specifically asks for it in the proposal form. In most cases, health insurers generally don’t require you to declare existing policies unless the question is explicitly asked. That said, if asked, always declare. Insurance contracts are based on good faith, and transparency ensures smooth claim processing in the future.

What happens if I hide a policy from another insurer?

It could be treated as material non-disclosure. If you withhold information that was specifically asked in the proposal form, it can lead to denial of future claims or even policy cancellation.

Can I use the cashless benefit from both policies?

Yes, but it’s much easier when both policies (like your base plan and super top-up) are from the same insurer. In that case, the insurer can directly coordinate the claim between the two policies.

Last updated on: