| AAWAZ Health Insurance is a free health and accidental insurance scheme launched by the Government of Kerala for interstate migrant workers. Historically, AAWAZ provided ₹15,000 annual medical coverage in empanelled hospitals, along with ₹2,00,000 accidental death and ₹1,00,000 permanent disability benefits, as documented in a 2017 Government Order and a 2018 Lok Sabha reply. |

Kerala’s AAWAZ Health Insurance Scheme is a first-of-its-kind initiative designed to protect the state’s migrant or “guest” workers with free health and accident insurance. Launched by the Government of Kerala, the scheme ensures that those who build and power the state’s economy have access to essential healthcare and financial security, without paying a rupee in premium.

Awaz Health Insurance – Overview

The Awaz Health Insurance Scheme, introduced in 2017, is a welfare initiative by the Department of Labour & Skills, Government of Kerala. Its primary objective is to ensure the health and financial security of Kerala’s vast community of migrant labourers, often referred to as “guest workers.”

This scheme marks Kerala as the first Indian state to formalise a comprehensive health and accident protection plan for migrant workers. The Awaz initiative not only extends healthcare benefits but also helps the state maintain a verified, biometric database of its migrant workforce.

Recent state communication (2025) in Kerala Calling indicates that the medical cover has been enhanced to ₹25,000 per year, while the accident benefits remain the same, with a note on maternity treatment eligibility.

The scheme is managed by the Labour Department in partnership with KILE (Kerala Institute of Labour and Employment) — KILE conducts labour-related research, while the Labour Department handles registration and card issuance, and the Health Department oversees healthcare delivery.

According to a study (Page 29) by the Gulati Institute of Finance and Taxation, Kerala is home to an estimated 20.5 lakh migrant workers, of whom 5.13 lakh have registered under the AAWAZ Health Insurance Scheme. Here is the enrollment form for the Awaz Health Insurance scheme.

| Note: The official name of the scheme is AAWAZ Health Insurance, as used by the Government of Kerala. It is often written as Awaz Health Insurance colloquially. |

Features of the Awaz Health Insurance Scheme

Here are the key highlights of the Awaz Scheme:

- Health insurance coverage up to ₹25,000 for hospitalisation due to illness or injury.

- Accidental death benefit of ₹2,00,000.

- Permanent disability benefit up to ₹1,00,000.

- Free registration – no premium or contribution is charged to workers.

- A biometric Awaz ID card that is valid for one year, renewable annually.

- Cashless treatment in empanelled hospitals across Kerala.

- Covers both inpatient hospitalisation and emergency medical care.

- Explicitly designed for interstate migrant workers employed in Kerala.

- The scheme details are available in multiple languages, including Hindi, Bengali, Odia, Telugu, English, and Malayalam, to ensure accessibility for migrant workers from different regions.

While Awaz Health Insurance offers essential protection for Kerala’s migrant workers, its coverage is limited to ₹25,000 per year and applies only within the state. At Ditto, we help you find affordable, all-India health insurance plans with higher coverage, family inclusion, cashless treatment at over 10,000 hospitals, and added benefits like wellness perks, no-claim bonuses, and tax deductions.

Book your free 1:1 call with Ditto’s experts to choose the best plan for your needs. Alternatively, you can check our article on health insurance in Kerala here.

Eligibility for Awaz Health Insurance Scheme

To register under the Awaz Health Insurance Scheme, a worker must:

- Be an interstate migrant worker employed in Kerala.

- Be between 18 and 60 years of age.

- Complete biometric registration (fingerprints, iris-scan, photograph, and ID verification).

- Provide valid proof of identity and proof of employment or engagement in labour work.

Note: The official guidelines and KILE reports do not mention a fixed minimum residency requirement (such as six months).

Inclusions and Exclusions of the Awaz Health Insurance Scheme

Inclusions

- Hospitalisation expenses due to illness or accident (up to ₹15,000).

- Cashless treatment at empanelled & government hospitals in Kerala.Accidental death benefit (₹2 lakh).

- Permanent disability compensation (₹1 lakh).

- Emergency medical care following workplace or road accidents.

- Maternity-related expenses.

| Note on Maternity Treatment: State communications indicate that maternity treatment may be included under the scheme’s benefits. However, eligibility and availability can vary, so it’s best to confirm the currently applicable rules with your local Labour Office before availing this benefit. Contact & Help: For assistance with lost cards, renewals, or enrollment locations, you can contact the Citizen Call Centre at 155300 or the Labour Call Centre at 1800-425-55214. |

Exclusions

- The scheme’s publicly available documents do not list outpatient consultations (OPD) among the covered benefits. While not explicitly excluded, this likely means OPD treatment is not included under current guidelines.

- Cosmetic or elective surgeries.

- Non-medical consumables during hospitalisation.

- Self-inflicted injuries.

- Dental or ophthalmological treatments, unless medically necessary.

- Treatment obtained outside Kerala or in non-empanelled hospitals.

How to Register for Awaz Health Insurance Scheme

Registration is simple and completely free:

- Visit the nearest Labour Department office or Labour Facilitation Centre in Kerala.

- Fill in the Awaz registration form with your personal and work details.

- Submit identity and employment proofs for verification.

- Complete biometric data capture (fingerprint and photograph).

- Receive your Awaz Health Card, which serves as both an identity proof and an insurance card.

Quick Note: Registration drives are also held in labour camps, industrial areas, and panchayats to make enrolment easier.

Documents Required for Awaz Health Insurance Scheme

You’ll need the following documents while enrolling:

- Proof of identity (Aadhaar card, voter ID, or any government-issued ID).

- Proof of employment (certificate from employer or contractor, wage slip, or registration with local labour office).

- Proof of residence or workplace address in Kerala.

- Passport-size photographs.

How to Apply for a Claim under Awaz Health Insurance Scheme

For Hospitalisation or Medical Treatment Claims

- Visit an empanelled hospital and present your Awaz card.

- The hospital sends a pre-authorisation request to the provider.

- Once approved, the insured receives cashless treatment up to the eligible amount.

- For reimbursement claims, submit original hospital bills, discharge summary, and ID proof to the Labour Department or authorised insurer.

For Accidental Death or Disability Claims

- The employer or nominee must inform the Labour Department immediately.

- Submit the following documents:

- Awaz ID card

- Death or disability certificate

- FIR and post-mortem report (if applicable)

- Bank details of the nominee

- After verification, the claim amount is credited directly to the beneficiary’s bank account.

| Note: The Shramik Bandhu Facilitation Centres operate in every district of Kerala to assist migrant “guest workers” with AAWAZ registration and access to health services. |

Why Should You Approach Ditto for Your Health Insurance?

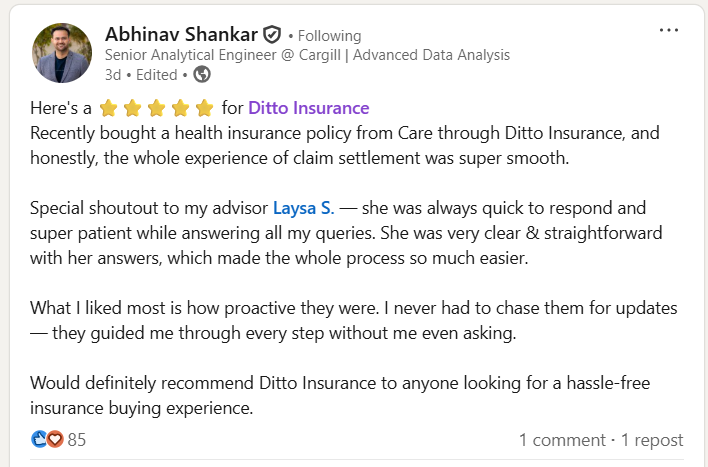

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Abhinav below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

The AAWAZ Health Insurance Scheme is a landmark welfare programme by the Government of Kerala, ensuring healthcare and accident protection for thousands of migrant workers who contribute significantly to the state’s economy. By offering free medical and accidental insurance, it safeguards the most vulnerable section of the workforce from financial distress.

However, a study by Mahatma Gandhi University found that only 9.8% of migrant workers in Kerala have any form of health coverage. Dr. Bijulal M.V., the principal investigator of the study, noted that a key reason for this low coverage is the involvement of middlemen, which complicates access to insurance schemes.

Given these challenges, and the fact that Awaz’s coverage is limited and individual-only, combining AAWAZ with a comprehensive personal health plan is the best way to ensure complete protection for both the worker and their family.

FAQs

Can family members of insured migrant workers avail benefits?

No. The Awaz Health Insurance Scheme is designed specifically for registered migrant workers. Family members or dependents are not currently covered. Government descriptions of the scheme and official Lok Sabha replies describe benefits as limited to “enrolled migrant labourers” only.

Is the Awaz card valid outside Kerala?

No. The Awaz card and its insurance benefits are applicable only within Kerala and can be used in empanelled hospitals within the state.

How long is the Awaz Health Insurance card valid?

Generally, government schemes like AAWAZ are valid for a fixed period, often one year, after which renewal is required. However, there is no official document confirming the exact validity period for the AAWAZ card. It is best to confirm the current rules directly with your district Labour Officer.

What should I do if I lose my Awaz card?

You can apply for a duplicate Awaz card at the nearest Labour Department office by submitting ID proof and registration details.

Is there any premium or registration fee?

No. Enrolment and coverage under Awaz are completely free. The entire cost is borne by the Government of Kerala.

Last updated on: