Health insurance plans for a family are designed to protect your entire household under one policy, ensuring everyone, from young children to elderly parents, is financially safeguarded against medical emergencies.

With medical inflation soaring, a single hospitalization can cost you lakhs. This justifies the need for a comprehensive family health insurance plan that provides peace of mind by covering large hospital bills. As a result, you can focus on recovery rather than worrying about expenses.

Equally important is choosing the right plan for your family based on coverage, premiums, and benefits.

In this guide, we’ll explore key features to look for, the benefits of family floater plans, essential factors to consider before buying, and review the 5 top family health insurance plans in India for 2025.

Key Features of a Health Insurance Plan for Families

Family Floater Coverage

Family health plans operate on a floater basis, meaning a single policy covers all listed family members under a shared sum insured. If one member falls ill, they can use the full sum insured.

Multiple members can also claim in the same year, as long as the total claims do not exceed the sum insured limit. It’s ideal for nuclear families, ensuring everyone (self, spouse, children, and parents) is protected under one umbrella.

Cashless Hospitalization

Nearly all family floater plans offer cashless treatment at network hospitals, making hospitalization hassle-free. In cashless claims, you show your insurance card at a network hospital, and the insurer settles the bill directly with the hospital. Make sure to check the insurer’s list of network hospitals.

A vast hospital network (often 10,000+ hospitals for top insurers) means you’re likely to find a cashless facility nearby.

High Sum Insured Options

Look for plans with a high sum insured (₹5–10 lakh at minimum, but ideally ₹50 lakh to ₹1–2 crore) for stronger protection from medical inflation. Many insurers now offer high-cover family floaters, such as HDFC ERGO Optima Secure, which ranges from ₹5 lakh to ₹2 crore.

A larger cover ensures that major treatments like cancer care or organ transplants don’t exhaust your limit, even if you face multiple hospitalizations in a year.

Pre- and Post-Hospitalization Coverage

A strong family plan covers more than hospital bills; it also includes medical expenses before and after hospitalization. This means tests, consultations, and medicines leading up to treatment, plus follow-ups and rehab after discharge.

For example, Care Supreme offers 60 days of pre-hospitalization and 180 days of post-hospitalization cover. Such benefits matter because treatment doesn’t end at the hospital; your policy should protect the full care cycle.

No-Claim Bonus (NCB) Benefits

Most family health plans offer a no-claim bonus that boosts your sum insured (often by 10–50% of the base cover) when you don’t make a claim, sometimes even with a renewal discount.

Newer plans are more generous; for example, Care Supreme increases the base cover by 50% each year, up to 100%, and add-ons like “bonus boosters,” that can extend this to 5X growth over time.

These bonuses help your family’s coverage grow with medical inflation, provided you don’t have frequent major claims.

Critical Illness Cover

Many insurers let you add a critical illness (CI) cover to your family health plan, or they include limited CI benefits in the base policy.

Critical illnesses such as cancer, heart attack, or kidney failure can lead to high and sudden expenses, and a CI cover pays a lump sum immediately upon diagnosis.

Some riders even pay 100% of the sum insured as a one-time amount, which you can use for treatment, income support, or any other need.

If your family has a history of major illnesses, it’s sensible to choose a plan with CI protection or add a CI rider for stronger financial security.

Maternity and Newborn Benefits (if Applicable)

For young families planning children, maternity coverage is an important feature. Some family floater plans cover maternity expenses, including delivery, prenatal, and postnatal care, usually after a 2–4 year waiting period.

Newborns may also receive automatic coverage for medical expenses for the first few months, though not all plans include this. For example, HDFC ERGO Optima Secure requires a separate add-on, while Niva Bupa Aspire Titanium+ includes it.

Choose a plan with maternity benefits or an add-on, and note the waiting period, as it can significantly reduce childbirth costs.

Our Takeaway

Benefits of Buying a Health Insurance Plan for Families

Opting for a family health insurance plan comes with multiple benefits, both financial and practical. Here are some key advantages:

Comprehensive Medical Coverage

A good family floater plan provides broad coverage for various medical needs, from large hospital bills to minor day-care procedures. Hospitalization (inpatient) costs form the core coverage, including room rent, doctor fees, surgery charges, and ICU charges.

Beyond that, these plans also cover day-care treatments (procedures such as cataract surgery, dialysis, and chemotherapy that don't require 24-hour admission) up to the full sum insured.

Many include ambulance charges, AYUSH alternative treatments, and domiciliary hospitalization (treatment at home) as part of the package.

Stress-Free Hospitalization

With a family health cover, you can approach any emergency or planned treatment effortlessly. You can take advantage of the cashless claims feature at network hospitals, where the insurer directly settles your medical bill.

This is a huge relief, especially during emergencies. Knowing that your family can get treated at top hospitals without paying upfront provides enormous peace of mind.

You can easily avoid the mental and emotional strain of worrying about finances when a loved one is hospitalized.

In short, family health insurance makes hospitalization worry-free, letting you focus on recovery rather than payments.

Affordable Premiums (Cost-Effective)

Family floater plans are generally more economical than buying separate individual policies for each member. The premium for a floater is calculated assuming not everyone will fall ill at the same time, so it's comparatively lower for a given total sum insured when covering the family together.

For example, instead of paying (say) ₹5,000 each for four individual covers of ₹5 lakh, you might pay just ₹12,000 for a ₹5 lakh floater that covers all four, a substantial saving. This cost-benefit is especially true for young families.

Overall, you get the best possible treatment for each member without a huge premium outlay per person. The combined plan optimizes costs while providing a large pool of funds accessible to the entire family.

Tax Benefits under Section 80D

The premiums you pay for a family health insurance policy are tax-deductible under Section 80D of the Income Tax Act. This is an additional financial perk of having insurance.

You can deduct up to ₹25,000 per year from your taxable income for health insurance for yourself, spouse, and children (₹50,000 if the eldest insured is a senior citizen).

If you also cover parents, you can get an extra deduction of up to ₹50,000 on their premium (if they are seniors) or ₹25,000 (if not). In practice, paying a ₹20,000 annual premium on a family policy could reduce your taxable income by that amount, yielding significant tax savings.

Flexibility to Add New Family Members

Family plans provide the flexibility to add new members with relative ease. If you get married, most insurers let you add your spouse to the policy. If you have a baby, you can include the newborn (often, insurers cover a newborn from day 1 or after 90 days).

Some plans even allow you to cover your parents or parents-in-law by paying an additional premium. Do check the terms, as additions are usually made at renewal, but many insurers will also add a newborn mid-year (with a prorated premium).

Having this option means your health cover can evolve as your family grows. You won't need a separate policy for each new member; they can be added to the existing floater.

Just ensure you inform the insurer and complete any required formalities (such as submitting a birth certificate for a newborn) within the stipulated time.

Personal Insurance vs. Corporate Insurance

Relying solely on your employer's health insurance is risky, and this is where personal family plans shine. Corporate (employer-provided) health insurance is a nice perk.

Still, coverage might be limited (many employers offer only ₹3–5 lakh), and it typically doesn't cover parents. Most importantly, an employer's health insurance ends when you leave the job.

If you or your spouse switch jobs or retire, the family could be left uninsured at the worst time.

Conversely, a personal family health insurance plan stays with you regardless of job changes. You can also choose adequate coverage (like ₹1 crore), which no employer plan offers.

In short, a family plan of your own ensures continuous protection that complements any corporate cover.

This way, you won't be left exposed during job transitions, and you can include all family members (including parents or newborns, which employer policies might not cover).

Things to Keep in Mind Before Buying a Family Health Insurance Plan

Before finalizing a family health insurance plan, it’s important to evaluate several factors to ensure you’re making the best choice. Here are some key things to keep in mind:

Sum Insured Selection

Choose a sum insured that covers your entire family's needs, accounting for medical inflation and worst-case scenarios.

As a rule of thumb, opt for at least ₹10–₹20 lakh if you are a young nuclear family, and consider ₹50 lakh or more if you have older parents or higher health risks.

The coverage should be enough to handle multiple hospitalizations or one primary critical illness treatment.

Remember that healthcare costs are rising 10-15% annually, so a seemingly large cover today might feel average in a few years. If your budget allows, it's wise to err on the side of a higher sum insured for comprehensive protection.

Plans with sum insured enhancement features (like automatic restoration or no-claim bonuses) can also effectively increase your coverage over time, which is a plus.

Network Hospitals Availability

Check the insurer's network hospital list, especially in your city or locality. A vast network ensures you have plenty of choice for cashless treatment.

Top insurers have 10,000+ hospitals empaneled across India. Make sure your preferred hospitals (the ones you'd likely go to in an emergency) are on the network. If you live in a smaller town, see that the insurer has tie-ups with the major hospitals in the nearest city.

Having a strong hospital network means wherever you travel or relocate, you can find a partner hospital for cashless claims.

For example, HDFC ERGO has over 13,000 network hospitals across India, and other big insurers have similarly extensive networks. This is crucial for convenience and quick, cashless claim settlements.

Waiting Period for Pre-Existing Conditions

All health insurance plans impose a waiting period for pre-existing diseases (and certain specified ailments). Typically, this is around 2 to 4 years from policy inception.

If you or a family member has a known pre-existing condition (e.g., diabetes or hypertension), look for a plan with the shortest waiting period so you can get coverage sooner. Some plans have a 3-year standard PED wait, but may offer an add-on to reduce it to 1 or 2 years.

Also check the initial waiting period (usually 30 days for any illness except accidents) and specific disease waiting periods (commonly 2 years for issues like hernia, cataract, etc.). The shorter these waits, the better, particularly if you anticipate needing treatment for those conditions.

For instance, a plan that lets you waive the PED waiting period down to 1 year (possibly at extra cost) could be very valuable if someone in your family needs regular care for an existing ailment.

Co-Payment Clauses

Co-payment is the share of each claim that you must pay out-of-pocket (expressed as a percentage) and the insurer pays the rest. Many family floater plans have no co-payment, which is ideal, meaning the insurer covers 100% of admissible expenses.

However, some policies, especially for higher age groups, might include a mandatory co-pay (e.g. 10-20%). It’s important to understand if your chosen plan has a co-pay clause. A plan without co-pay is generally more beneficial for families, as it ensures you won’t have to bear a part of the bill.

If there is a co-pay (for example, some plans require 20% co-pay for senior members), be prepared for that cost-sharing. Compare this across plans, if one insurer offers a zero co-pay option and another similar plan has 10% co-pay, you might lean toward the former for the added financial relief during claims.

Restoration Benefits

Restoration (recharge) benefit is an increasingly common feature that “restores” your sum insured if it gets used up by claims. For families, this is very useful in case more than one member gets hospitalized in the same year.

Ensure the plan you pick offers automatic restoration of the sum insured (ideally unlimited restorations). Many good plans now provide unlimited restoration, meaning after a claim, the full sum insured is refilled for future use in that year.

Some plans restrict restoration to unrelated illnesses or to one time per year, while others have no such limits. Unlimited restore ensures that even if, say, two or three large claims happen in one year, each time the cover refills up to 100%.

For example, ICICI Lombard’s Elevate plan includes unlimited restoration as a standard feature. This kind of benefit is a lifesaver in a year with multiple health events, so prioritize plans that include it.

Claim Settlement Ratio and Service

The insurer’s track record for settling claims is an important consideration. A high claim settlement ratio (CSR) indicates reliability, it’s the percentage of claims paid out versus claims received. Look for insurers with CSR above 90-95%, as it reflects their willingness and ability to pay claims promptly.

For instance, HDFC Ergo settles 98% of claims within 30 days, and Aditya Birla Health settles 95% within 30 days, these are strong indicators of good claim service. Also research the claim process, is it cashless and smooth, do they have app-based claim intimation, how is their customer support?

An insurer with a high CSR and low complaints per claims is preferred. You might also check the average complaints ratio (complaints per 10,000 claims); lower numbers mean customers aren’t facing many issues.

Bottom Line

Top Family Health Insurance Plans in India (Ditto’s Cut)

To help you narrow down your options, we have compared and selected five of the best family health insurance plans in India (2025). These recommendations are based on coverage amount, benefits, claim experience, and overall value. These family floater plans offer high sum insured options (₹1 crore or more) and strong features suitable for families.

HDFC Ergo Optima Secure

Care Supreme

Aditya Birla Activ One MAX

Talk to an expert

today and

find

the right

insurance for you.

Niva Bupa Aspire Titanium+

ICICI Lombard Elevate

Individual Health Insurance vs. Family Health Insurance Plans: Which is Better?

The answer depends on your family’s situation. Let’s break down who should opt for individual plans vs. family floater plans, and the cost-benefit analysis of each approach:

Who Should Opt for Individual Health Insurance

Individual plans insure one person per policy, with a dedicated sum insured for that person. This might be preferable:

- If you are a single individual (unmarried, no dependents).

- If a particular family member (an elderly parent or someone with chronic illness) has significantly higher health risks or pre-existing conditions.

- If you are a senior citizen or above 45–50 years with health issues.

- If you want very comprehensive coverage for each person beyond hospitalization (like specific critical illness covers).

Bottom Line

Who Should Opt for a Family Floater Plan

A family floater is usually the best choice for a typical nuclear family (young to middle-age parents and children) where everyone can share a common pool of coverage. This might be preferable:

- If you have a relatively young and healthy family, where the likelihood of everyone needing large claims in the same year is low.

- If you are newly married (couple or young parent) or have young kids.

- If the family size is fixed and members are insurable (all under the maximum age limit).

Note

Cost-Benefit Analysis

Family floaters offer better value when the family is young or middle aged. One floater covering four members usually costs less than four individual policies with the same sum insured because the insurer pools risk and expects only one member to claim in a year.

But if one member has a chronic condition and is likely to claim it every year, the benefit of a floater and the family’s NCB can be reduced. In such cases, giving that member a separate policy may be a better choice.

Also, consider how the sum insured is used. In a floater, the limit applies to the entire family, so if one person uses most of it, the others have less left unless the plan has a restore benefit. In individual plans, each member gets their full sum insured independently, ensuring no one’s coverage is reduced by another person’s claim.

For a family of four, a ₹20 lakh floater offers flexibility because any one person can use the entire ₹20 lakh if required, which is a major advantage over four individual ₹5 lakh covers. With individual plans, each person is capped at ₹5 lakh, even though the total theoretical coverage adds up to ₹80 lakh.

Since it is rare for all four members to be hospitalized in the same year, the shared pool of a floater is usually sufficient and far more efficient for most families.

Final Verdict

How to Choose the Best Health Insurance Plan for Families in India?

Choosing the best family health insurance plan can feel overwhelming given the many options. Here’s a step-by-step checklist of factors and tips to help you make the right decision:

Check the Coverage (Inclusions & Exclusions)

- Thoroughly review what the policy covers and excludes.

- Ensure the plan includes all major medical expenses: inpatient hospitalization, day-care procedures, pre and post hospitalization, ambulance, etc.

- Look for any sub-limits or caps (like room rent limits, disease-wise limits), the fewer, the better.

- Read the list of exclusions to know what’s not covered (for example, some policies might not cover certain alternative treatments or have limits on specific surgeries).

- Choose a plan that offers broad coverage with minimal surprises. If you have specific needs (e.g. coverage for psychiatric treatments or advanced therapies), check if those are included.

- Always compare the exclusions of different plans because the one with fewer exclusions will give you more peace of mind.

- Essentially, the best plan will be the one that covers all the treatments you might foresee needing (like maternity, critical illness, etc. if those are priorities) and doesn’t hide too many restrictions in fine print.

Opt for Unlimited Restoration Benefits

Prioritize a plan that offers automatic restoration of sum insured, ideally unlimited times in a year. Restoration means if your sum insured (plus any NCB) gets exhausted by a claim, the policy refills the entire base amount for future claims in the same policy year.

This is extremely useful in a family floater, where more than one member might need hospitalization in a year. Some older policies allowed only one restore per year, but newer ones allow multiple or even unlimited restores.

For example, ICICI Lombard’s Elevate plan allows unlimited restoration of cover for new claims. So, if you had ₹10 lakh cover and one member used the full amount, you get ₹10 lakh back for the next hospitalization in that year (and this can happen any number of times).

Such a feature ensures that your family is never left underinsured within the policy year, even in a high-claim year. When comparing plans, an unlimited (or at least multi-time) restore benefit can be a deciding factor in favor of a plan.

Pick a Plan with a Shorter Waiting Period

Waiting periods can delay when certain coverage kicks in, so the shorter the better. Most plans have: a 30-day initial waiting period for any illness, 2 years for specific listed conditions, and 2–4 years for pre-existing diseases.

- Try to pick a plan that has shorter waiting requirements, especially for pre-existing diseases, if any family member has one. Some plans may offer a 3-year PED waiting period, while another might offer 2 years, that’s a significant difference.

- Look for plans that let you reduce the waiting period through add-ons. For example, some insurers have a rider to cut the pre-existing disease waiting from 36 months to 24 or 12 months.

- If you plan on having a baby soon, a plan with a shorter maternity waiting period (or one where you’ve already accrued time under an existing policy) will be the best choice.

Look for Sum Insured Enhancement Options

- Choose a plan that can expand coverage over time as your needs grow. This can take the form of high no-claim bonuses (e.g., a 50-100% increase in sum insured each year) or features such as the option to upgrade to a higher sum insured at renewal without fresh medical underwriting.

- Some insurers allow you to enhance your base cover at milestone renewals, or offer enhanced protector benefits (such as an inflation-linked increase in the sum insured each year).

- Plans that have a high NCB essentially future-proof your coverage against rising costs.

- For instance, a plan that gives a 20% bonus each year (capped at 100%) means that in 5 claim-free years, your coverage doubles.

- Others give bonuses even if claims are made (like some offer a 10% increase regardless of claims). When choosing, all else being equal, go for a plan with the more generous sum insured enhancement to grow your protection.

- Consider whether the insurer allows mid-policy enhancement: say you start with ₹10L and, a year later, you feel you need ₹20L, can you increase it at renewal easily? Many will let you have a fresh medical evaluation.

- Plans offering features such as “sum insured rebound” or “super NCB” are desirable.

Cashless Treatment Availability

This ties into network hospitals, ensuring the plan offers easy cashless claim procedures at a wide range of hospitals. A hassle-free cashless experience can be a huge plus. Some insurers have specialized tie-ups or their own help desk staff at major hospitals to facilitate this.

Research customer reviews on how quickly and smoothly cashless approvals are for a given insurer. Since you’re buying online, check whether the insurer has a good digital process for claims, e.g., an app or online portal for intimation.

Entry Age Restrictions

- Be mindful of the entry age limits and eligibility criteria of the family plan. Many family floaters allow adults up to a certain age (often 60-65) to be added. Children are usually covered as dependents up to ages like 20-25 (after which they need to convert to individual cover).

- If you plan to include your parents and they are, say, 70, you need a plan that allows senior entries (or else they need a separate senior policy).

- Most newer plans have no maximum entry age, which can be great if you want to add parents above 65.

- If you have young adult children, check up to what age they can remain on the family floater (commonly till 25), and if they can be transitioned smoothly to their own plan later without new waiting periods.

Easy Claim Settlement Process

Consider the ease of claims and overall service. Choose an insurer that is known for an easy, transparent claim process. This includes straightforward documentation, helpful customer care, and quick settlement.

Look for reviews and ask friends or family about their experiences. Plans offered by insurers with a 95%+ claim settlement ratio and low complaints are generally a safe bet.

Pro Tip

How to Buy a Health Insurance Plan for Family Online?

Buying a family health insurance policy online is a straightforward process. Here’s a step-by-step guide to help you through it:

Choose the Right Plan

- Start by deciding on the plan that best suits your family’s needs in terms of sum insured and benefits.

- Use comparison tools or read reviews to narrow down the options.

- Pay attention to coverage features, exclusions, premium amount, and any specific needs you have (for example, if you need a ₹1 crore cover with maternity benefit, identify the plans that meet those criteria).

- Once you have a preferred plan and insurer, proceed to their official website or a trusted insurance aggregator platform.

Compare and Finalize

- Even if you have one plan in mind, it doesn’t hurt to compare multiple policies one last time. Most online platforms allow you to select a few plans and view a comparison chart.

- Check the premiums for different sum insured options; sometimes a slightly higher cover may be only marginally more expensive.

- Ensure you’ve factored in any add-ons you want (like critical illness rider, maternity cover, etc., these can usually be selected on the quote page).

- When you’re confident about which policy to buy, click on the “Buy Now” or “Proceed” option for that plan.

Fill in the Application Form Accurately

- Fill out an online proposal form for the policy. It will ask for the personal details of all members to be insured: name, date of birth/age, gender, relationship to proposer, contact details, address, etc.

- You’ll also need to answer health-related questions for each member, e.g., existing diseases, past hospitalizations, habits like smoking/drinking, current medications, etc.

Upload Necessary Documents

- You may be asked to upload documents. Typically, insurers need KYC documents for the proposer (PAN Card, Aadhaar, etc. for identity and address proof) and sometimes for other adult members.

- You might also need to upload age proof for members if not covered by Aadhaar.

- If anyone declared a medical condition, the insurer might ask for medical reports or records related to that (if readily available).

- Common documents to keep handy are: PAN, Aadhaar, passport-size photo, and any medical reports you have for existing conditions.

- The online portal will have an upload button for each document type. Ensure the files are legible before uploading.

Make Payment

- Once the form and documents are submitted, you’ll reach the payment stage.

- The premium amount will be shown (make sure it matches what was quoted).

- Most insurers accept all major payment modes. After payment, wait for the confirmation screen. Don’t refresh the page during payment.

- When payment is successful, you should see a confirmation message and/or order number. The insurer will also send a confirmation email and SMS.

Receive Policy Documents

- The insurer will process the application after payment. If all is in order, policy issuance can be instant.

- Many insurers generate the policy PDF, which you can download directly from their website. You will also get it via email (check your inbox and spam folder just in case).

- Once the policy is issued, you will have a free-look period of 30 days during which, if you find any discrepancies, you can cancel for a refund.

Remember, our expert advisors at Ditto Insurance will help you every step of the way. So, if you’re looking to buy health insurance, feel free to book a call with Ditto for unbiased advice.

Talk to an expert

today and

find

the right

insurance for you.

How to Claim using a Family Health Insurance Plan?

Filing a claim under your family health insurance can be done in two ways: Cashless claims (at network hospitals) or reimbursement claims (at non-network or if cashless is not used). Here’s a guide to both processes:

Cashless Claim Process

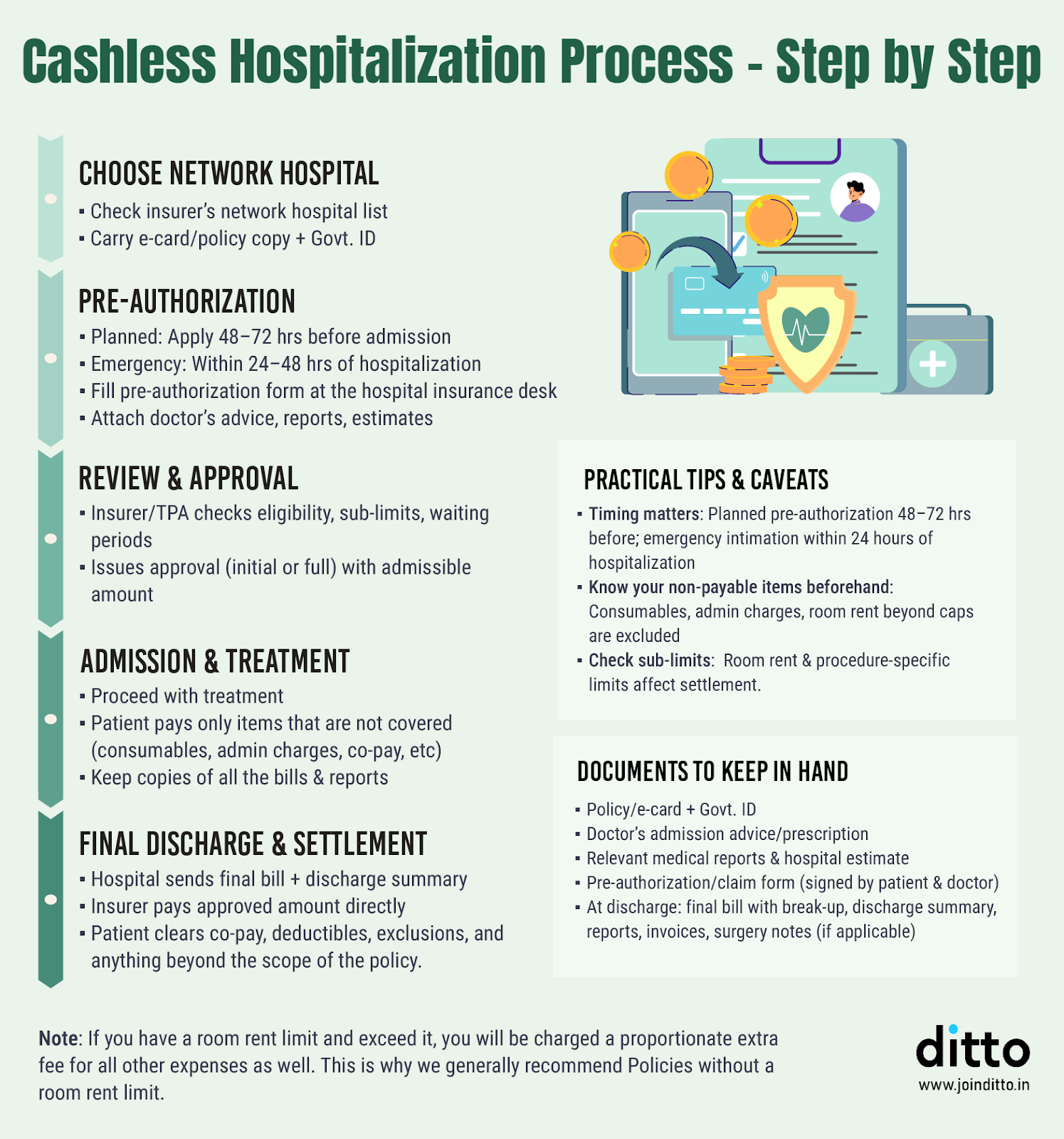

A cashless claim means the hospital bill is settled directly between the insurer and the hospital, and you do not have to pay the major expenses upfront. This is available only at the insurer’s network hospitals. Here are the steps to follow for a cashless claim:

- Inform the Insurer and Hospital

For a planned hospitalization (e.g., a scheduled surgery), inform your insurance company in advance, generally 3-4 days before the admission date. You can do this by calling their toll-free number or through their mobile app/website.

For emergency hospitalization, you or your family member should notify the insurer within 24 hours of admission (or as soon as reasonably possible). It’s important to adhere to these timelines to ensure smooth processing.

When you reach the hospital, go to the insurance/TPA desk and inform them you intend to use your health insurance cashless facility. - Provide Health Card and ID Proof

At the hospital desk, you will need to show your health insurance e-card or policy details, and a government photo ID of the patient (like Aadhaar, PAN, etc.).

The hospital will verify your identity and policy coverage. They will have you fill out a pre-authorization request form (usually, the hospital helps with this).

This form includes details of the patient, diagnosis, proposed treatment, estimated costs, etc., and is sent to the insurer/TPA for approval. - Pre-authorization and Approval

Once the hospital sends the cashless request, the insurer reviews it. If all is in order and the treatment is covered, they will send an authorization approval to the hospital specifying the approved amount.

This can happen fairly quickly. However, if they need more info, they might query the hospital. Keep in touch with the hospital desk to know the status.

After approval, the treatment can proceed, and you don’t have to pay the deposit (in many cases).

During hospitalization, if expenses are expected to exceed the initially approved amount (say complications arise), the hospital can send a query for enhancement to the insurer to approve an additional sum. - Settlement of Bills

Upon discharge, the hospital will and the insurer for final approval. Then, the insurer settles the bills directly with the hospital as per the policy terms.

You will need to pay only the things not covered (for example, personal expenses like registration fees, certain non-payable items like toiletries unless you had a consumables cover).

The hospital will give you a bill for those minor expenses to pay at discharge.

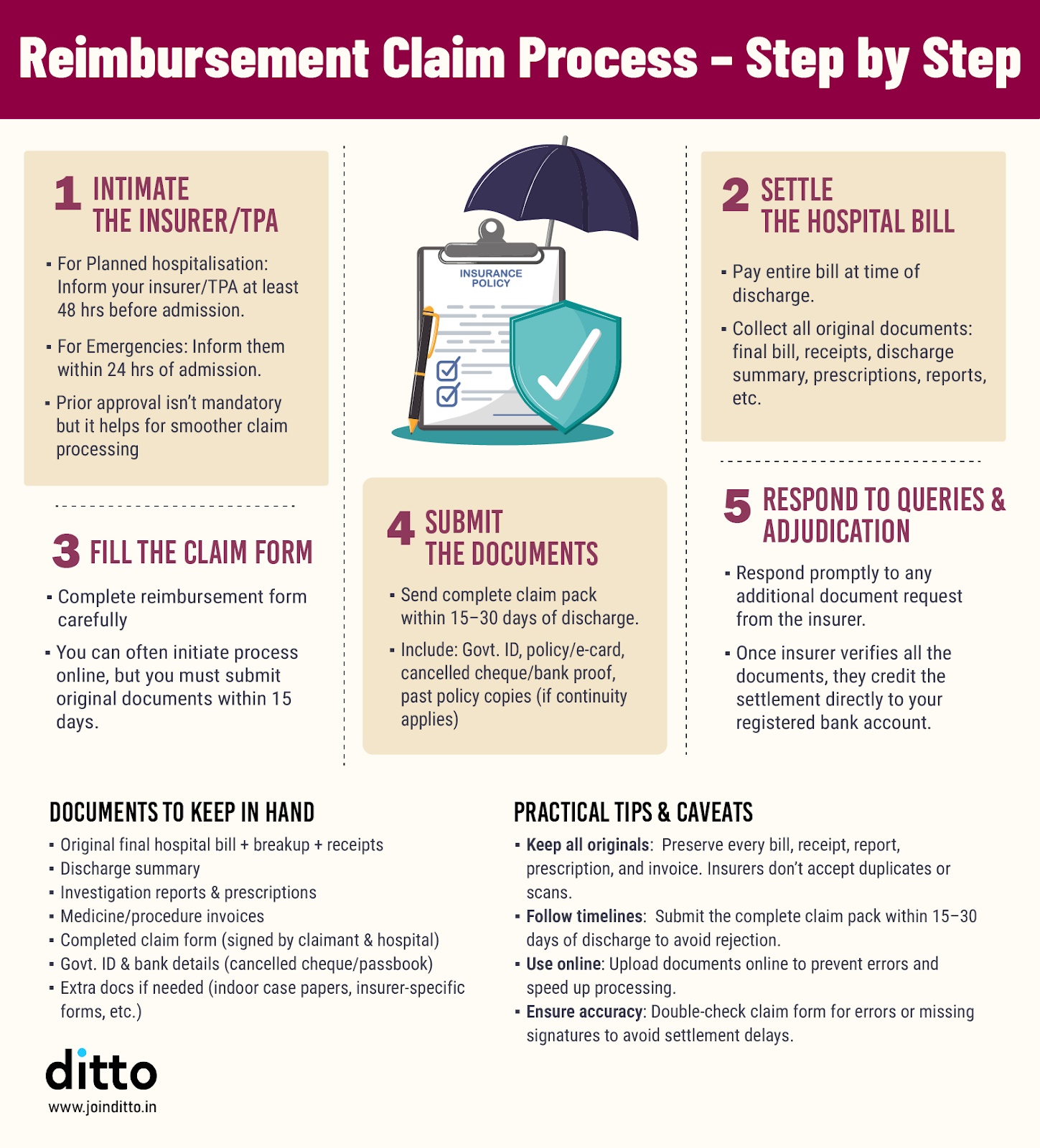

Reimbursement Claim Process

If you are unable to use cashless (either because you went to a non-network hospital or maybe you didn’t get approval in time or chose to pay first), you can file for reimbursement after treatment. You pay all the bills yourself and the insurer pays you back later. Here’s how to proceed:

- Pay the Hospital Bills

Settle all the bills with the hospital at discharge using your own funds.

Ensure you collect all original documents. This includes the final hospital bill with a breakdown, payment receipts, discharge summary, prescriptions, diagnostic test reports, pharmacy bills, consultation papers, basically every piece of paper related to the treatment.

Keep your ID proofs and any claim forms provided by the insurer. It’s wise to make a checklist: Claim form, discharge summary, all bills, all reports, prescriptions, investigation results, etc., as these will need to be submitted. - Notify Insurer and Submit Claim Documents

Although not cashless, you should still ideally inform your insurer about the hospitalization as soon as possible. After discharge, fill out the insurer’s claim form (this can often be downloaded from their website). Attach all the original documents mentioned above to the form. - Verification and Reimbursement

The insurer will review the documents. They might call you or the hospital if any clarification is needed. If all documents are in order and the treatment is covered, they will approve the claim. You will receive the reimbursement amount directly into your bank account (that you provided) or via a cheque.

Insurers usually reimburse up to the reasonable and customary charges for the treatment as per policy. If any expense is disallowed (e.g. items not covered or amounts above policy limits), they will inform you in the settlement letter.

Important Note

Both cashless and reimbursement have their own benefits, but cashless is preferable whenever possible. With a family floater, ensure the hospitalized member’s name is included in the policy and spelling matches the ID, etc., to avoid admin issues.

Did You Know?

In case you have multiple health insurance policies, you can choose to use both. However, you can use only one of the policies on a cashless basis, and file a reimbursement claim for the difference with the other.

Every family is different, and the amount of health insurance coverage you need can vary based on your family size, ages, and specific requirements. Here are some general guidelines on choosing an appropriate cover and plan features based on your family’s needs:

Health Insurance Coverage Based on Your Family’s Needs

Young Families (Parents + Kids)

If you are a young couple in your 20s or 30s with an infant or small children, start with a moderate coverage amount. The risk of severe illnesses is comparatively lower (though not nonexistent) at this stage. A sum insured of around ₹10 lakh to ₹25 lakh can comfortably cover common medical events like normal childbirth, minor surgeries, or a hospitalization for a child’s illness. Young couples planning to start a family soon may also look for plans that offer maternity and newborn coverage.

Families with Senior Citizens

If your family includes seniors (60+), opt for a higher sum insured (₹50 lakh to ₹1 crore or more) because treatments like cardiac surgery, knee replacement, and cancer care are costly and more frequent. In a family floater, seniors may use most of the cover, so choose the upper end or consider a separate senior citizen policy with a high sum insured. Whether combined or separate, prioritize a larger cover to handle multiple or high-value claims in the same year.

Self-Employed Individuals or Families Needing Special Benefits

If you’re self-employed or run a business, you lack employer health cover, secure strong personal insurance (around ₹20 to ₹50 lakh depending on age) for family protection. Consider plans with OPD benefits to claim consultations, pharmacy bills, and tests. If you expect frequent non-hospital expenses or have young children, this can save money. Young entrepreneurs planning a family can choose a policy with maternity cover, as no group policy will provide it.

Missing documents is one of the primary reasons behind claim delays or deductions. That is why you must know which documents to provide for a quick and smooth settlement.

Documents Required for Family Health Insurance Claim Reimbursement

Duly Filled Claim Form

This is the claim application form provided by the insurer (available on their websites). It has two parts, one for the insured to fill (with personal and policy details, and a summary of the claim) and another for the hospital to fill (with treatment details, hospital seal, etc.).

Fill out the form correctly and sign it to ensure a smooth claim settlement process in the future.

Hospital Bills and Discharge Summary

Attach the original hospital final bill (with bill number, date, and detailed cost breakup) along with the payment receipts for each claim. If you paid by card or electronically, attach proof of payment.

Include the stamped and signed discharge summary or card given by the hospital, which summarizes the diagnosis, treatment given, and advice on discharge.

Doctor’s Prescription and Medical Reports

Submit the prescriptions that led to the hospitalization or were given during hospitalization for tests/medications. Include medical reports and investigation results, such as blood test reports, X-ray/CT/MRI reports, surgical notes, or biopsy reports.

If surgery was performed, include the surgeon’s notes or operative summary, and if there were ICU charges, attach the separate ICU chart as well.

Provide all supporting medical documents along with pharmacy bills and corresponding prescriptions, as insurers will verify that every billed medicine was doctor-prescribed.

Policy Documents and ID Proof

Include a copy of your health insurance policy or the policy number and member ID on the claim form. Many insurers also ask for a copy of the health card (though not mandatory if policy details are provided).

A photo ID proof (e.g. Aadhar, PAN, passport, or driving license) of the patient is also required to verify identity.

Attach a canceled cheque from your bank account (or a form with your bank account details and IFSC) so that the insurer knows where to transfer the reimbursement amount.

Additional Documents (if Applicable)

If the hospitalization was accident-related, include the FIR or medico-legal certificate, and for road accidents, add the driver’s licence copy. In case of death, attach the death summary and certificate.

If cashless was denied, include the rejection letter. Add surgery-specific documents like OT notes or implant invoices when relevant.

Overall, include any case-related document; the insurer will ignore what’s unnecessary, but missing paperwork can delay your reimbursement.

Always refer to your insurer’s claim intimation document or policy annexure, they usually list required documents, and use that as a checklist when preparing your claim.

Why Choose Ditto for Your Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Here’s why customers like Abhinav love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 5,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation with us. Slots are filling up quickly, so be sure to book a call now!

Conclusion

When choosing the best family health insurance plan, it’s important to compare and evaluate your options carefully. Don’t just pick the first policy offered or the one with the lowest premium.

Once you have a policy in place, remember to maximize its benefits. Here are a few tips:

- Keep Your Policy Updated: Inform the insurer of any changes (like adding a newborn) and renew on time to maintain continuous coverage.

- Utilize Wellness Programs: If your plan offers health check-ups or wellness rewards (like gym discounts or premium rebates for staying active), take advantage of them. They can improve your health and save you money.

- Emergency Readiness: Keep digital and physical copies of your insurance card and policy handy. In an emergency, you want to access your policy details quickly for a cashless admission.

Frequently Asked Questions

Why People Trust Ditto

Last updated on: