What is Tata AIA Insurance Claim Settlement Ratio?

According to IRDAI public disclosures for life insurers, Tata AIA Life's claim settlement ratio (CSR) for FY 2024–25 is 99.43%. And the 3-year average (FY 22–25) comes to 99.21%. Such consistency reflects Tata AIA's operational excellence and commitment to its policyholders.

TATA AIA Life Insurance Claim Settlement Ratio: Overview

As one of India’s leading insurers, Tata AIA Life leads the way with a positive CSR. According to public disclosures, the CSR of Tata AIA in FY 2024–25 is 99.43%. So one can say the company has a structured and timely claims payout process.

In this article, we deep dive into understanding:

- What is claim settlement ratio?

- How to calculate the claim settlement ratio of TATA AIA Life Insurance?

- Where can you find the claim settlement ratio for TATA AIA Insurance?

- TATA AIA Insurance past 5 years claim settlement ratio

- Top 10 term Insurance providers and their CSR in 2025

Friendly reminder: It’s easy to get lost comparing policies and premiums. Instead of spending hours on it, why not get personalised insurance advice from Ditto? We offer free consultations with zero spam! Just 30 minutes to clarify all your doubts. Book a free call now!

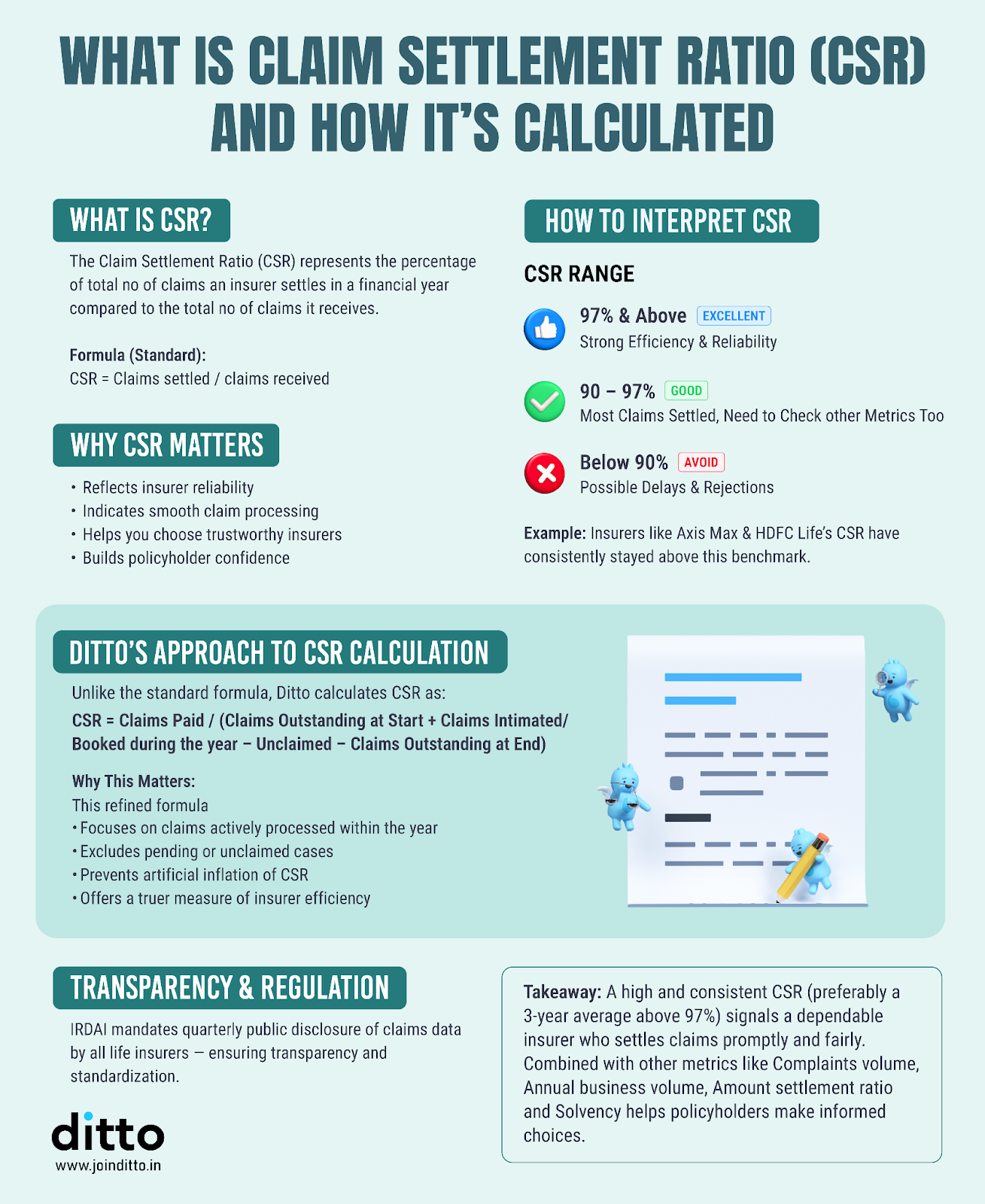

What Is Claim Settlement Ratio?

Claim Settlement Ratio (CSR) is the percentage of death claims paid by an insurance company out of the total claims received in a financial year.

Note: A high CSR (like >97%) means the insurer honors and settles most claims. However, that doesn't guarantee approval for all claims. Sometimes, a claim can be rejected for basic reasons like missing documents, dishonest customer disclosures, and policy exclusions.

Here’s a quick look at some of the common reasons for term claim rejection.

How To Calculate The Claim Settlement Ratio Of Tata AIA Insurance?

Where Can I Find The Claim Settlement Ratio For Tata AIA Insurance?

IRDAI mandates all life insurers to publish their quarterly claims data publicly. This helps customers evaluate insurers' actual claim settlement performance before purchasing a policy.

You can find the official and updated claim settlement ratio data for TATA AIA from:

TATA AIA Insurance Claim Settlement Ratio: Over 5 Years

Now, to compare real-time performance, let’s check out the top 10 insurers in India with a consistent, high CSR across FY 2022-25.

Top 10 Life Insurers Based on Claim Settlement Ratio

To find out how TATA AIA compares against other insurers, read our exclusive guide on best term insurers in India 2026.

Should You Buy Tata AIA Insurance : Ditto’s Take

TATA AIA’s positive CSR is definitely a plus point to buy their term plans, but there are other factors to consider.

Here’s how Tata AIA scores on such vital metrics for FY 2024–25:

- Tata AIA’s annual business volume: ₹10,321.74 Cr. (shows good stability)

- Tata AIA’s amount settlement ratio (ASR): 96.02% (shows higher-ticket claims being settled equitably)

- Tata AIA’s amount paid in death claims: ₹1,226.74 crore (for actual payouts)

- Tata AIA’s 30-day claim settlement: 99.18% (denotes quick and easy settlements)

- Tata AIA’s complaints per 10,000 claims: 3 (pretty low friction)

- Tata AIA’s solvency ratio: 1.8 (well above IRDAI-recommendation of 1.5)

So, should you buy TATA AIA Insurance? Absolutely, considering the high CSR and other positive supporting metrics. However, plan prices and policy terms will always fit differently to one’s budget and needs.

Why Choose Ditto For Term Insurance?

At Ditto, we’ve helped 800,000+ customers find functional term insurance plans that fit their life needs. That’s why customers like Saibabu trust and recommend us.

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a free call now!

Conclusion

TATA AIA's 99% CSR makes it a reliable insurer but there are other insurers with better numbers. Nevertheless, for a successful term claim, the insured must disclose honestly, check specific policy terms, and maintain continuity.

FAQs

Are pre-existing diseases covered in TATA AIA Insurance?

No, term insurance plans pay only on death, not for medical expenses related to pre-existing conditions. But you must disclose your health issues & medical history (if any) during application. If insurer accepts the risk and issues the policy considering your PED, then deaths due to the said diseases will also be covered.

Does a higher CSR guarantee that my claim will be paid?

Not entirely. Claim settlement ratio (CSR) is an insurer-level metric that shows past claim payment records. Your claim approval depends on several other factors, like continuity of policy, honest disclosures, and valid documentation as mentioned in policy wordings.

How fast are claims settled by TATA AIA?

IRDAI mandates term claim settlements within 15 days if no investigation is required, or maximum within 45 days if investigation is needed. TATA AIA follows the same rules as other insurers keeping in line with the prescribed timelines.

Where can I verify the TATA AIA claim settlement ratio?

You can check IRDAI’s official annual reports, TATA AIA’s own annual reports and claims-related section on their official website, and on Ditto’s online platform.

Last updated on: