| What Does a Staggered Payment in Term Insurance Mean? A staggered payment (or staggered payout) is when the death benefit in a term insurance plan is not paid as a lump sum. It comes generally in two types: 1) Lump Sum + Installments: Part of the death benefit is paid immediately, the rest in regular instalments over time. 2) Income Benefit: The entire benefit is paid as periodic installments. Most instalments stay constant, while some plans increase payouts over time to offset inflation. This structure balances immediate needs with steady long-term support for the nominee. |

When you buy a term insurance plan, one of the first things to consider is how your nominees will receive the payout a.k.a sum assured on death. The way your policy’s death benefit is structured can make a big difference to your family’s financial stability. Instead of a one-time lump sum, you can choose a staggered payment, where the sum assured is paid in regular instalments over time.

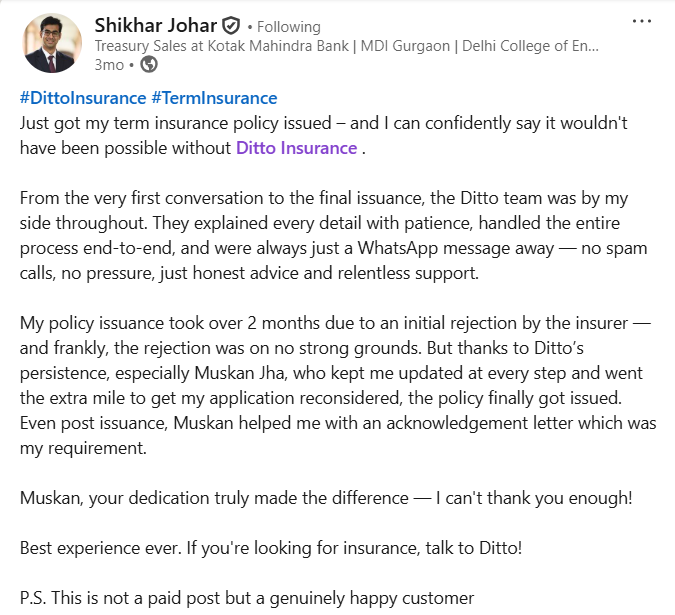

Figuring out term insurance can be confusing, especially when it comes to how your family will get the money after you’re gone. At Ditto, we’ve helped thousands of people make the right choices and even handled a few death claims over the last few years.

Using this experience, we have curated this guide to give you a closer look at staggered payments in term insurance: how they work, the options you can choose, and how they can help give your family both immediate support and long-term financial security.

To make the right choice for your situation, book a free call with Ditto and get expert guidance related to term insurance that best secures your family’s future.

| Key Takeaways 1) By default, term insurance pays the death benefit as a lump sum. With staggered payouts, the same benefit is spread out over time in regular instalments. 2) Staggered payments can be in the form of regular installments, a lump sum + installments, or increasing income. 3) They help cover immediate expenses while providing ongoing financial support. 4) Payout choice can affect premiums; lump sum usually costs more, increasing income costs the most, and combination/regular installments are often cheaper. 5)nSome insurers (like HDFC Life and Axis Max Life) allow changing the payout at claims, while others (like ICICI) require locking it in at purchase. |

What is Staggered Payment in Term Insurance?

Normally, when someone (the life assured) passes away, a term insurance plan pays out the death benefit or sum assured as a lump sum. However, many insurers now offer a staggered payment in term insurance, which allows the sum assured to be paid out in instalments over a period rather than a one-time lump sum. This helps the nominee receive a steady income over time, which can be useful for families needing ongoing financial support.

Now, don’t confuse this with a related concept: Premium Payment Term (PPT). PPT is how long you pay your premiums to the insurer. It could be Regular Pay, Limited Pay, or Single Pay. A staggered payout, on the other hand, is about how your family receives the death benefit. So, PPT is about paying; staggered payout is about receiving.

If you want a deeper breakdown of Policy Term vs Premium Paying Term, check out our detailed guide here.

Curious which term plans offer staggered payouts? Let’s take a look.

Which Term Insurance Plans Offer Staggered Payout Options?

- HDFC Life Click 2 Protect Supreme allows receiving the death benefit as a lump sum, instalments over 5-15 years with flexibility in frequency (monthly to yearly), and the option to convert instalments into a lump sum anytime.

- ICICI Prudential iProtect Smart Plus offers staggered payout options for death benefit. Besides the lump sum option, nominees can choose the Income Option (fixed monthly instalments over 10 years), Lump Sum + Income Option (part upfront, rest in instalments), or Increasing Income Option (monthly payouts for 10 years with a 10% annual increase, totaling 145% of the death benefit).

- Axis Max Smart Term Plan Plus offers multiple payout options for the death benefit. Option 1 offers lump sum payout. Under Option 2 (Monthly Income), the entire benefit is distributed as monthly instalments for 10, 20, or 30 years, while Option 3 (Lump Sum + Monthly Income) allows a portion to be paid upfront and the balance through instalments.

How Does Staggered Payment in Term Insurance Work?

Normally, term insurance pays out the death benefit as a lump sum by default if no payout option is chosen. With a staggered approach, the payout is spread over time through periodic instalments. This helps cover immediate expenses while also providing ongoing financial support for the family.

There are different types of staggered payout options, let’s explore them and see how each one works.

Types of Staggered Payout Options in Term Insurance

1. Income Benefit (Regular Installments):

With this option, the death benefit is paid out in regular installments: monthly, quarterly, or yearly, over a set period (usually 10–30 years). It works like a salary replacement, helping your family cover everyday expenses while reducing the risk of overspending. It also makes budgeting easier.

On the flip side, it may not provide enough cash for big one-time expenses like loans or medical bills. In addition, the fixed payments could lose value over time if there’s no increasing-income feature.

Families relying on the policyholder’s regular income usually find this option very useful.

2.Lump Sum + Periodic Instalments (Combination):

This is a mix of both: part of the death benefit comes as a lump sum, and the rest is spread out in regular installments. It gives immediate cash for urgent needs while ensuring a steady income for day-to-day expenses. The trade-off is that the payout structure is fixed by the insurer, so families need to understand the split.

Claimants can also convert the remaining instalments into a lump sum at any time. To do this, the insurer calculates the present value of the future payments (how much those future instalments are worth in today’s money).

This calculation uses a discount rate, usually around 6% per year or linked to the 10-year Government-Securities yield (the interest rate on government bonds, which is considered a safe benchmark). This ensures the lump sum reflects the true value of the money in today’s terms, rather than just adding up the future instalments as they are.

3.Increasing Income Option (fewer plans offer this)

Some plans, like ICICI Pru iProtect Smart Plus, offer an Increasing Income Option, where the death benefit is paid as monthly instalments over 10 years. Payments start at 10% of the sum assured per year and increase by 10% simple interest annually, totaling 145% of the sum assured over the term.

Benefits of Staggered Payout in Term Insurance

1) Financial discipline for beneficiaries: Receiving the claim amount in instalments helps family members avoid the risk of mismanaging a large lump sum. It ensures steady and predictable income support during difficult times.

2) Support for long-term needs: Instead of exhausting the entire payout at once, staggered payments can be aligned with recurring expenses such as household costs, children’s education, or medical care for dependents.

3) Protection against inflation: Many staggered payout options offer increasing instalments over time. This helps maintain the real value of money and safeguards the family’s financial security against rising costs.

Drawbacks of Staggered Payment in Term Insurance

Despite the benefits, staggered payout has some drawbacks:

- Reduced Flexibility: Unlike a lump sum, you cannot use the full amount immediately. If the family faces a large, unexpected expense, the instalments may not cover it fully.

- Potential Lower Real Value: If the instalments stay the same every month or year, the real value of the payout declines over time because of inflation. Some policies offer increasing payments to help with inflation, but not all plans offer it.

- May Reduce Overall Investment Opportunity: Receiving money in parts rather than a lump sum may limit the ability to invest the entire amount at once which potentially reduces returns.

How is Staggered Payment in Term Insurance Calculated?

The calculation of staggered payments in term insurance depends on multiple factors, including:

- The total sum assured chosen by the policyholder.

- The portion paid upfront as a lump sum (percentage or fixed amount), if any.

- The number of instalments and frequency of payments (monthly, quarterly, half-yearly, or yearly).

- Whether instalments remain level (fixed) or increase periodically.

Unlike a simple division of the remaining sum assured by instalments, most insurers use an annuity-based calculation method involving a discount rate to determine instalment amounts.

This methodology accounts for the insurer's ability to invest the retained corpus, enabling them to offer higher periodic payments than straight division would suggest.

For example, suppose the guaranteed death benefit (sum assured) is ₹1 crore, and the nominee opts to receive payments over 20 years monthly.

If the insurer uses a discount rate of 5% (commonly set as the RBI Bank Rate minus a margin, e.g., 6% - 1%), they calculate the present value of the ₹1 crore and convert it into an annuity. This yields monthly payments around ₹66,000–₹67,000, which is notably higher than simply dividing ₹1 crore by 240 months (which gives about ₹41,667).

If the instalments increase annually (e.g., by 10%) to adjust for inflation, the payment in the first year would be the base monthly amount that rises progressively in subsequent years.

Before we dive deeper, it’s equally important to know what insurers are required to disclose about these payouts so that policyholders and nominees can make fully informed decisions.

Disclosures and Regulations for Staggered Payouts

Insurers are required to clearly disclose:

- The monthly or annual instalment amount payable to the nominee.

- The duration of the benefit period (e.g., 10, 20, or 30 years).

- The discounting or calculation basis used to derive the instalment amounts.

This transparency helps policyholders understand how the lump sum is converted into income streams and facilitates informed decisions between staggered payouts and lump sum options.

IRDAI oversees claims settlement to ensure timely and regular instalment disbursement as per the policy terms, providing added reliability for families dependent on staggered payments.

Things You Must Remember While Choosing Staggered Payout Option

- Assess Your Nominee’s Immediate vs Long-Term Needs: Think about what your family will need right away and what they will need over the coming years. A lump sum upfront can cover urgent expenses like loans or medical bills, while instalments from a staggered payment in term insurance provide steady income for ongoing costs.

- Check the Instalment Structure and Duration: Look at how payments are scheduled monthly, yearly, or quarterly, and how long they will continue. Make sure the payout period aligns with your family’s financial support needs.

- Understand the Tax Implications: The lump sum death benefit is generally tax-free under Section 10(10D) in India.

- Watch for Extra Premium Costs: When choosing staggered payouts, be mindful that some options may carry higher premiums due to growing payouts

For example, ICICI iProtect Smart Plus’s Increasing Income option costs more because payouts rise 10% every year. Cheaper options, like ICICI’s Regular Income or Combination plans, may seem attractive but often lack inflation adjustment.

Plans like HDFC Life Click2Protect Supreme and Axis Max Life Smart Term Plan Plus offer uniform premiums and let nominees choose the payout at claims. In contrast, ICICI iProtect Smart Plus requires locking in the payout upfront, limiting flexibility.

Should You Opt for Staggered Payout Option: Ditto’s Take

If you ask us, a lump sum payout is usually the safer choice. Why? Getting the entire sum assured at once gives your family full control over the money. They can use it to pay off loans, cover urgent expenses, or invest for future needs. And they don't have to depend on periodic payments from the insurer. Plus, a lump sum reduces financial complexity during a stressful time and provides immediate support when it’s needed most.

If you’ve come this far, don’t miss our complete guide on term insurance. It covers everything you need to know about term insurance.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Srinivas below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Staggered Payment in Term Insurance: Final Thoughts

Staggered payment in term insurance offers a balanced way to provide ongoing financial support to your family instead of a one-time payout. It helps maintain financial stability and discipline but may come with limitations like reduced immediate cash and inflation risk. The choice between lump sum and staggered payout depends on the family's financial needs and long-term goals.

FAQs

What is staggered payment in term insurance?

It is a payout method where the insurer pays the death benefit in instalments over time, not as one lump sum.

Are staggered payouts tax-free?

Yes, insurance payouts under Section 10(10D) are tax-exempt. Interest earned on the payout is taxable as per prevailing laws. It is advisable to consult a tax expert.

Which plans offer staggered payout options?

Almost all term plans in the market including popular plans like HDFC Life Click 2 Protect Supreme, ICICI Prudential iProtect Smart Plus, and Axis Max Smart Term Plan Plus provide staggered payment in term insurance as payout options.

Can We Switch from Staggered Payout to Lump Sum Later?

While some insurers like HDFC Life and Max Life provide the option to switch the payout mode at the time of claim, others like ICICI Prudential require the choice at policy inception. It’s important to check the specific insurer’s terms regarding payout flexibility.

Is there a minimum or maximum duration for staggered payouts?

The duration of staggered payment in term insurance depends on the insurer and the plan. Common payout periods range from 10 to 30 years, depending on your selection at the time of buying the policy.

Does staggered payout affect the premium?

Yes, the payout option can influence your premium. A lump sum payout usually costs the most since the insurer has to release the entire amount upfront. Options like regular income or a combination of lump sum + instalments often come with slightly lower premiums because the insurer spreads the payments over time. On the other hand, the increasing income option is the most expensive, as the payouts grow each year and the insurer’s liability ends up higher than the original sum assured.

Can multiple nominees receive staggered payouts?

Yes, multiple nominees can receive staggered payment in term insurance. The death benefit is divided as per the policyholder’s chosen proportions, and each nominee gets their share in instalments under the staggered payout plan. Rules may vary, so it’s best to check the specific policy details.

What happens if the nominee passes away before receiving all instalments?

The remaining balance of the staggered payment in term insurance is paid to the legal heirs of the nominee as per relevant succession acts and will (if any).

Last updated on: