| Can a Minor Be a Nominee in a Life Insurance Policy? Yes, you can nominate a minor as nominee in a life insurance policy. However, minors can’t receive the money directly. So, you must name a trusted adult as an “appointee” or a “guardian”. The appointee or guardian shall receive and hold the payout until the minor turns 18. |

It's only normal to think of your child as a nominee for your life insurance policy. However, if your child is still a minor (i.e., under the age of 18), he/she cannot receive the money directly. That’s where you need a trustworthy person (a “guardian”, also referred to as an “appointee” by insurers) to receive the payout on your child’s behalf.

This article will help you understand:

- Whether a minor can be a nominee for your life insurance policy

- What are the legal provisions for minor nomination

- What is the role of an Appointee or Guardian

- What happens when the minor turns 18

- Pros & cons of choosing a minor as a nominee, and

- What happens if the guardian dies before the nominee turns 18

From choosing the best cover to planning nominee, buying term insurance can be tricky. That’s where Ditto comes in. Free consultations, zero spam, and 100% clarity! Just 30 minutes to clear all your doubts. Book your call now!

Can A Minor Be A Nominee in Life Insurance Policy ?

Absolutely! The nomination rules in India allow one to name their child (or any minor) as nominee. What’s non-negotiable here is that you need a trusted adult to act as a guardian or appointee and receive the money if the claim occurs when the child is still under 18.

Say, if your 10-year-old daughter is the nominee and your 37-year old brother the appointee, any claims before your daughter turns 18 goes to your brother. When your daughter turns 18, the money will be handed over to her.

Remember: In all circumstances, the appointee will be the temporary financial custodian and never the owner of the funds.

| Quick checkpoints for setting up a nominee and appointee for a life insurance policy: 1) Add complete details of the minor accurately (as per birth certificate/aadhar). 2) Pick a trustworthy adult to act as an appointee along with his/her complete KYC. 3) Save the insurer’s acknowledgement or endorsement with your policy document (soft and hard copy). 4) Informed your family about the appointee and where all required documents are stored. |

Want more clarity on who can be a nominee for your life insurance policy? Check out our exclusive guide on nominee for life insurance in India.

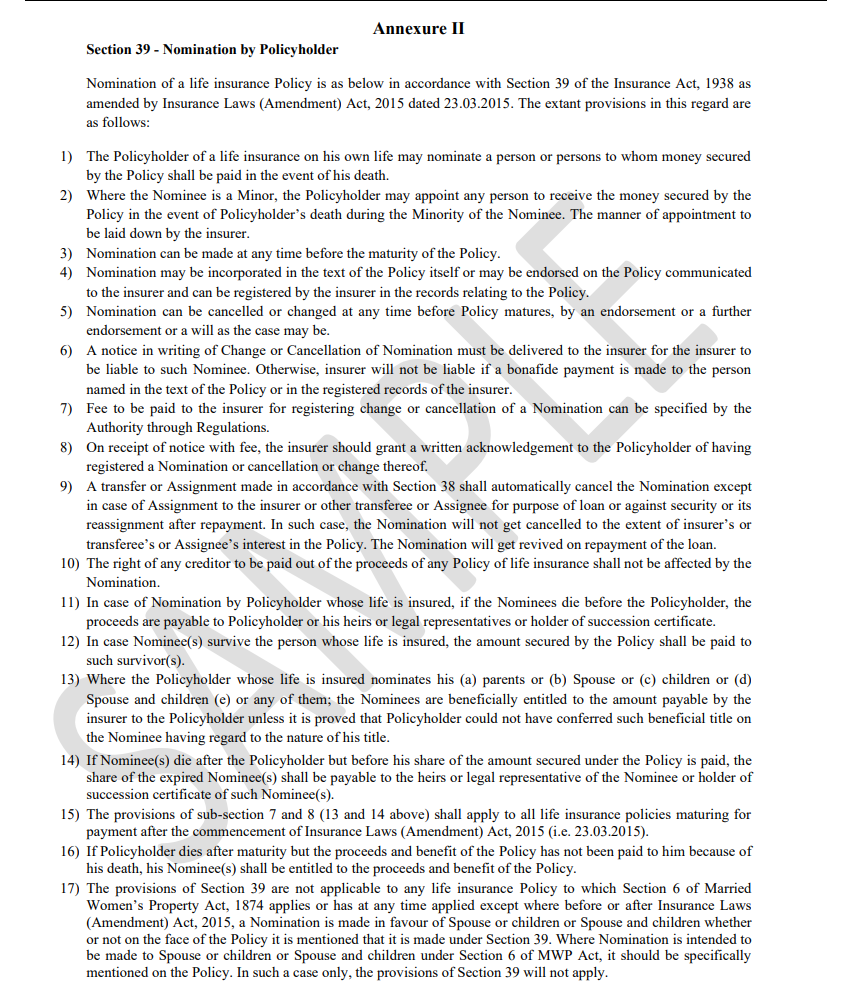

What Are The Legal Provisions For Minor Nomination In India?

Section 39 of the Insurance Act governs the nomination process for a life insurance policy involving mainly three parties; the insured, the nominee, and the appointee. The rules set in place for the nominee and the appointee are only valid until the nominee turns 18.

Note: You can register, cancel, or change your nominee for a term insurance anytime by issuing a prior notification to the insurer.

The following is a sample nomination provision mentioned in the policy wording of a popular insurer:

Next up are the key legal provisions of the nomination process.

Beneficial nominee rule (why spouse/parent/child matters): If your nominee is your spouse, parent, or child, the Indian law treats them as “beneficially entitled” to the policy money, and not just a receiver. This reduces any inheritance disputes where there’s more than one legal heirs. Further protection is also guaranteed if the term policy has been bought under the MWP Act.

- Registering, changing, or cancelling a nomination (what you need to file actually): Submit the insurer’s nomination form or a written endorsement with full details of the minor nominee and appointee.

Always ask for an acknowledgement and keep it attached to your policy document since the insurer will not always go on to update the original policy document.

Other important points to consider:

- Most claim disputes happen due to outdated paperwork. So, update your nominee and appointee details once every year or after any major life event (like marriage, childbirth, divorce, death of a previous nominee or appointee).

- Section 39 of the Insurance Act requires proper recording of nominations by the insurer for a hassle-free claim. So, safely store the insurer’s acknowledgement, the updated policy schedule, endorsement, and required ID proofs.

What Is The Role Of An Appointee or Guardian To A Minor Nominee?

From a legal standpoint, an “Appointee” or “Guardian” is a “temporary fiduciary". It means they simply collect the claim if it arises when the nominee is still under 18 years. They are entrusted to hold the money solely for the child’s benefit.

Here’s what an appointee is expected to do :

- Receive the claim proceeds on the minor’s behalf.

- Prioritize safeguarding of the funds and use them only for the child’s welfare (education, healthcare, maintenance).

- Keep the insurer’s endorsement or acknowledgement copy handy.

- Maintain clear personal records of the funds comprising bank statements, receipts, investment proofs, and a simple ledger.

- Hand over the funds when the nominee turns 18 (i.e., minor to major), along with a detailed accounting of how the funds have been used to date.

- Share all proofs and maturity schedules if the money has been invested on behalf of the nominee.

Red Flags To Avoid For An Appointee or Guardian:

- Depositing all claim proceeds to a personal savings account

- Using the funds for gambling or lending to family and friends

- Not practicing proper recordkeeping for the funds entrusted

What Happens When The Minor Turns 18 in a Life Insurance Policy?

When a minor turns 18 (i.e., he/she becomes a major), the appointee or guardian’s job ends. Now that the nominee is officially an adult, he/she can take full control of the funds.

Here’s what a nominee should do after turning 18.

- Inform the insurer in writing that you are no more a minor and that your status be upgraded to “major”. Ask for an endorsement or acknowledgement in return.

- Submit basic KYC details (Aadhaar card, PAN card, address proof), bank details (either a cancelled cheque or copy of passbook) along with copies of term policy and earlier nominee/appointee endorsement.

- Get a written declaration from your appointee/guardian to transfer the claim proceeds to your individual bank account.

- Update any ECS mandates, email, and phone number with both insurer and the bank.

What Happens If The Guardian Dies Before The Minor Nominee Turns 18?

Insurers can’t pay a minor directly. So, if the appointee or guardian passes away or can’t act anymore (early exit) before the nominee turns 18, one needs to find a new appointee. This could take some time depending on the required documents and the availability of the next person.

Here are a few common scenarios.

- Working with a surviving parent (the fastest way): If there’s a surviving parent to the nominee, he/she can act as the new appointee. This reduces delay and requires minimum documents, like birth certificate of the child (proving parent-child relationship), death certificate of the deceased, and KYC of the surviving parent (PAN, Aadhaar, address proof).

Note: In case of a custody dispute, insurers may pause the appointee change until the case is resolved.

- Court-appointed guardian (time-consuming, from weeks to months): This applies when neither of the parents are alive or unavailable and immediate family members are unwilling or ineligible to act as an appointee.

In such cases, any relative or concerned adult may file an application under the Guardians and Wards Act to be appointed as the guardian of the minor’s property. In turn, the court checks the best interests of the child by taking into account factors like the ability of the person, any existing relationship, and past conduct. If satisfied, the court may be pleased to pass a favourable order.

How it impacts the claim:

In this case, the insurer usually keeps the claim pending (but not rejected) until the court passes the order naming the new guardian or appointee. Once the order comes through and KYC details of the new appointee is verified, the insurer pays the claims proceeds to the new guardian on behalf of the minor.

- Writing a Will (more of a prevention than a cure): A simple will allows a term policyholder to name a preferred appointee for his/her minor ward. This is also a great way to keep a backup appointee if the initial appointee passes away or no longer wishes to be in the role. Wills are also settled faster in court thereby speeding up the claim process.

| Things to include in a will when choosing an appointee for a minor : 1) Name of the appointee and relationship along with their backup (if any) 2) For what purpose the funds are to be used (like nominee’s education, living costs, healthcare) 3) How the appointee must hold hold the money (as liquid cash, low-risk instruments like FDs) 4) How to maintain transaction records until the nominee turns 18 |

Don't let September slip away! It is the best month ever to buy insurance with zero percent GST. Book a free call with Ditto and speak to our IRDAI-certified advisors today!

Pros & Cons Of Choosing A Minor As A Nominee

The table below offers a clear picture of what’s good and bad about choosing a minor as a nominee with best workarounds.

| Factors | Pros of choosing a minor as a nominee | Cons of choosing a minor as a nominee | Workaround |

|---|---|---|---|

| Having a clear intent | Ensures the money reaches your child only | Needs an appointee and legal paperwork | Securely store all insurer endorsement and choose a reliable adult |

| Payout speed | Hassle-free when appointee's KYC details and other papers are in order | Major delay in event of appointee’s death | Keep a backup appointee mentioned in a will |

| Control and use of funds | Good choice to ring-fence funds exclusively for the child's needs | Poor fund management from appointee can ruin the child’s future | Always choose a prudent guardian and insist on keeping records for all financial transactions |

| Minor to major upgrade | Allows clean and automatic handover | Discrepancy in appointee KYC and other paperwork can delay | Insist on keeping a tidy record by updating all related documents with the insurer |

Pro Tip: In India, terms like “nominee” and “beneficiary” are often used interchangeably. However, they are not the same. Know more about life insurance beneficiaries and how it legally differs from the nominee in this guide.

| Key Takeaways: 1) You can always name a minor as a nominee in a life insurance policy but until he/she turns 18, the payouts are held by an adult appointee or guardian. 2) The appointee is a temporary custodian and not the owner of funds. 3) Once the nominee turns 18, the control of funds shifts from the appointee to the nominee. 4) If the appointee passes away or can’t act anymore, the nominee needs a new appointee. A surviving parent is the best alternative followed by a court-appointed guardian. 5) It’s always a wise call to name a backup appointee via a will and review nominations after major life events (like marriage, birth, divorce, death). |

Why Choose Ditto For Your Term Insurance?

Ditto is a one-of-a-kind platform where people come for unbiased insurance-buying advice. In turn, we make them smart insurance buyers. Whether it's helping a first time term insurance buyer or solving claim related issues, we are ready to walk an extra mile to see you smile.

That’s why 7,00,000+ customers trust and recommend Ditto to others.

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅IRDAI-certified advice

✅100% Free Consultation

✅Personalized recommendations

✅Real-time claim support

Final Thoughts

One can always choose a minor as a nominee for a life insurance policy. However, to ensure a hassle-free claim, you need to plan things right. So, choose a trustworthy appointee and keep the paperwork error-free.

Besides, consult a lawyer experienced in wills, estate transfers, and nominations to avoid surprises later. Follow these simple steps and your child will never have to struggle claiming what he/she deserves.

Still unsure about how to plan your term insurance? Fret not! Speak to a Ditto advisor today for a free, no-spam consultation, and get personalised guidance right away!

Frequently Asked Questions (FAQs)

Can a minor directly receive the insurance payout?

No! If the claim occurs while the nominee is still a minor (i.e., under 18), the claim process will need to go through the appointee, who holds and uses it solely for the child’s benefit.

Who can be appointed as a guardian or appointee?

Any trustworthy adult can act as an appointee or guardian for the nominee. However, it is recommended to choose someone who is financially prudent to avoid misuse of the funds.

What happens when the minor turns 18?

It's practically the end of the appointee’s role as the funds are transferred to the nominee after upgrading his/her status from “minor” to “major” with the insurer. He/she will also have to open an individual bank account to receive the funds.

What if the nominee is a special needs child?

If the nominee is a child with special needs and can’t manage money at 18, the insurer won’t pay them directly. A court-appointed guardian under the Guardians and Wards Act or a special-needs trust must receive and manage the proceeds. Be ready to provide disability proof and guardian/trust documents.

Can I change my nominee or appointee ?

Yes, you can. But you will have to notify the insurer to record the changes officially and issue an acknowledgement or endorsement attached to your policy.

What if the appointee dies or refuses to act before 18?

In such cases, a new guardian or appointee needs to take over. If there’s no clear mentioning in a will or elsewhere, the concerned court will appoint one. However, this is a time consuming process and can take anywhere between weeks to months.

Can I choose my child’s grandparents as an appointee?

Sure, you can, but only if they are physically and mentally able, willing to, and competent enough to complete KYC and other paperwork.

Can I name multiple minor nominees?

Yes, you can, however you’ll have to specify splits (for e.g., 50/50 in case of two nominees, like a son and daughter). Depending on the insurer, a single appointee can act on behalf of both nominees or a separate appointee may be required.

Can a Minor “Declare Themselves Adult” Before 18?

No! Under the Indian Majority Act, 1875, majority begins at 18. A minor can’t “self-declare” adulthood earlier. Until then, rights are exercised via the guardian/appointee; at 18, the nominee becomes the legal owner of the proceeds.

Can a Minor Go to Court Against the Appointee?

A minor cannot sue independently because Indian law considers them lacking legal capacity. However, if an appointee misuses funds, a parent/guardian or family member can file on the minor’s behalf, and the court can intervene.

Last updated on: