| What is Long-term Disability Insurance? Long-term disability insurance replaces income if an accident leaves you partially or permanently disabled. In India, it’s usually set up in two ways, via Personal Accident (PA) insurance, where a lump sum is paid for partially or permanently disabled and weekly income for TTD (in some plans), and Disability riders on term or health insurance bundled for easy management and cost effectiveness. |

A road accident. A hospitalization. A critical surgery. And, six months without salary.

What would you lose first? Your savings or your mind? This uncomfortable thought is exactly why long-term disability insurance exists.

In foreign countries, “own-occupation policy” covers disability, but in India, the practice is yet to catch up. So, you need to build your own accident safety net.

If you want full accident protection, choose a Personal Accident (PA) policy. It covers PTD (Permanent Total Disablement), PPD (Permanent Partial Disablement), and TTD (Temporary Total Disability). Term plan disability riders are a simpler and less expensive option, but they typically cover only accident-driven disabilities.

Book a free call with Ditto and get personalised, zero-spam guidance from our IRDAI-certified advisors.

What is Long-term Disability Insurance? An Overview

Long-term disability insurance is your ultimate “income protection cover” for uninterrupted cash flow when you’re unable to work. For most people, it’s a viable option for more than one reason.

- If an accident stops your income for a few weeks, your life expenses will be covered via Temporary Total Disablement rider.

- If the same accident hampers your working ability for a longer time, you still get paid via a partial payout disability rider.

- If you can never work again (like in the case of total, irreversible loss of vision in both eyes or loss of both limbs), a full payout via a permanent total disability rider protects you.

| 💡 Did You Know? A salaried employee earning ≤ ₹21,000/month (₹25,000 for persons with disability) is automatically covered under ESIC (Employees' State Insurance) scheme for: 1) all work-related accidents and illnesses with free medical care, 2) 90% wage replacement during temporary disablement, a lifelong pension for permanent disability, and 3) a monthly pension for dependants in case of death due to employment injury, plus rehab, prosthetics, and vocational training support. The catch? ESIC is primarily for workplace incidents, but for life outside work (at home, on the road, during travel), one will still need a separate health insurance, a term plan, and personal accident/disability cover. |

Not sure which riders to add to your term insurance plan? Check out our exclusive guide on Term Insurance Riders to understand the benefits and pick the right one.

What are the different types of long-term disabilities covered by insurance?

Most policies bundle three disability benefits: Permanent Total, Permanent Partial, and Temporary Total Disablement.

- PTD (Permanent Total Disablement): It pays a lump sum (usually 100% of the sum insured) for policy-defined, life-changing disabilities (e.g., loss of both eyes or limbs), to replace income and cover major expenses.

- PPD (Permanent Partial Disablement): It covers partial losses (e.g., loss of vision in one eye or loss of a thumb in an accident) by paying a percentage of the Sum Insured per the insurer’s schedule.

- TTD (Temporary Total Disability): It applies to a short-term inability to work while you recover and pays a weekly benefit until you’re fit to resume work (or up to the time the weekly cap is reached).

According to the guidelines of the IRDAI, insurers apply a standard formula for TTD and calculate a percentage of the sum insured to be paid weekly. Usually, there’s a four-week waiting period and a cap of up to 100 weeks.

Note: Since 1 Apr 2021, IRDAI requires all general and health insurers to offer Saral Suraksha Bima, a standard personal accident policy. It must cover Accidental Death, Permanent Total Disability (PTD) and Permanent Partial Disability (PPD), with optional add-ons like Temporary Total Disablement (TTD), accidental hospitalisation expenses and an education grant for dependent children. Because it’s standardized, the features are the same across insurers, making basic accident protection transparent and straightforward.

| Quick Tips when Buying a Personal Accident Plan : 1) A personal accident cover strictly covers “accidents” and accidental deaths, and not “illness-led disability”. 2) PTD and TTD payout percentages and definitions are always defined in the policy wordings and determine the amount of the payout. 3)TTD (weekly income) & PPD is essentially a PA feature, not a standard term rider benefit. Under term plans, generally, coverage is only provided for Total & Permanent Disability. |

Benefits of Long-term Disability Insurance

Before we discuss the benefits of long-term disability insurance, you need to know when the benefits start. For example, PTD (lump sum) is paid after a doctor certifies that the disability meets the policy definition. In comparison, TTD (weekly income) starts after the waiting period (which is often 4 weeks).

Here’s a closer look at the key benefits of long-term disability insurance.

- It maintains cash flow while you’re off work.

- It offers one big-time pay to compensate for permanent loss.

- It protects your ongoing EMIs and pays for your essential life expenses.

- It acts as a family buffer via add-ons (like an education grant add-on for your child)

- It stacks easily with other safety nets, reducing income gaps (for example, if you have employer-provided group insurance covering workplace injuries, the PA benefits will be a bonus).

- It involves less paperwork compared to a full-length health insurance plan.

Food for thought: Although health insurance covers accident-related treatments from day 1, the payout from the rider can help cover non-medical expenses, the cost of aids/prosthetics/home or vehicle improvements to support disability.

What does Long-term Disability Insurance Cover?

Long-term disability cover depends on what actually caused the disability and what’s covered in your insurance plan. In India, accident-led disabilities are typically covered by a Personal Accident (PA) policy or a PA add-on, while illness-led disabilities (loss of speech, deafness) need critical illness riders added to your term or health plan. Here’s a clear picture of what’s covered and not covered under long-term disability insurance.

| What’s covered under long-term disability insurance | What’s not covered under long-term disability insurance |

|---|---|

| TPD/ATPD via term riders | Illness-only disability only if you have a Personal Accident plan |

| Accident-led PPD via PA/PA add-on for a certain %age of SI as per the policy schedule. | Disabilities that don’t meet “permanent” or “total” definition as per policy wordings |

| Accident-led TTD (weekly payout after a waiting period, with a cap) | TTD overlapping with PTD for the same period |

| Accidental death (via PA/PA add-on) | Self-harm, intoxication, unlawful acts |

| Illness-led PTD (A lump-sum pay, covered only if your disability/TPD rider allows it) | War/hostilities, nuclear/chemical risks, hazardous/pro sports |

Note: Always refer to the policy wordings to understand the definitions of disability, waiting period, caps, and the PPD schedule.

How do I file a long-term disability insurance claim?

Filing a long-term disability insurance claim doesn't have to be difficult. Here’s a 5-step process to follow.

- Inform your insurer early: Use the helpline number, app, or email and note the reference number.

- Arrange all documents: Keep all relevant documents handy, including the completed claim form, ID, disability certificate from the attending doctor, hospital records, and medical examination reports, as well as any FIR/MLC.

- Share documents online: Scan and upload documents and save acknowledgements (or take screenshots).

- Respond to follow-ups promptly: Be prepared with all necessary medical clarifications and assessments when requested.

- Complete your KYC: Keep a copy of your PAN card or Form 60 ready, along with your bank details and a cancelled cheque.

How to Select the Right Long-term Disability Insurance : Ditto’s Take

When it comes to long-term disability insurance, a Personal Accident plan is often the first option. However, before purchasing one, ask yourself: “Does my current coverage already meet my needs?”

Term insurance already covers all types of death, including accidental death. Health insurance covers accidental hospitalisation expenses from day one. You can enhance this protection with Accidental Disability Riders (Permanent Total Disability) on your term or health policy.

That’s why, in most cases, we suggest you plan your order of priorities in the following manner:

- Consider health insurance first, as it effectively covers hospital expenses from accidents.

- Get term life insurance if you have financial dependents.

- Next comes an Accidental disability cover that you can add via a rider (simpler and usually sufficient). Remember, a standalone PA policy only makes sense if you specifically want additional benefits like:

- Temporary Total Disability (TTD) that promises a weekly income while you recover and can’t work.

- Education allowance to support dependent children in case of disability.

- Funeral expenses to cover post-death costs.

- Loan protection for outstanding debts that are paid off in case of death or disability.

- Mobility and rehabilitation support to help with prosthetics, rehab, or lifestyle adjustments after major accidents.

In short, a combination of health and term insurance with riders offers all-around accident protection without unnecessary overlap. One can always consider a standalone PA policy as a top-up for broader income replacement or family support features that riders may not cover.

| Critical Checkpoints to Plan your Long-term Disability Insurance: 1) Set the TTD weekly payout amount to cover essentials (check for the weekly cap). 2) PTD should be at 100% of the SI (more if allowed). PPD should follow a clear payment schedule. 3) TTD should show the waiting period and week cap in clear numbers. 4) Buy from insurers with clean brochures and digital claim facilities with functional add-ons (like education grant, accident hospitalization). 5) Most of these plans will also have a separate accidental death benefit. 6) Don’t lower your sum insured for add-ons. (e.g., for a tight budget, keep PTD SI at ₹1 crore and skip add-ons rather than dropping it to ₹50 lakh to fit the extras). |

Just received the hard copy of your term plan? Here are 5 things to check in your term policy document to avoid any hassles later.

Popular Long-Term Disability Insurance Plans

| Before we discuss the list, here’s how we decide what plans to feature. At Ditto, every health plan goes through our six-point evaluation framework. It doesn’t mean these are the only good plans, but that they stand out after being scored across all six pillars. You can learn more about how we evaluate health insurance plans here. |

| Category | Plan Example | What it Covers | Benefits | Limitations | Best For |

|---|---|---|---|---|---|

| Term + Rider | HDFC Life Click 2 Protect Supreme + Income Benefit on Accidental Disability Rider |

|

|

|

|

| Term + Rider | Tata AIA Sampoorna Raksha Promise + Non-Linked Comprehensive Protection Rider |

|

|

|

|

| Health + Rider | Niva Bupa ReAssure 2.0 + Personal Accident Cover |

|

|

|

|

| Standalone PA Plan | Generic Saral Suraksha Bima |

|

|

|

|

| Standalone PA Plan | HDFC ERGO Individual Personal Accident Plan |

|

|

|

|

Select the plan that matches you, and review the policy wordings to determine the PTD % age, the PPD schedule, and the TTD weekly cap. If the cover falls short, consider a richer variant without reducing your sum insured.

| Pro Tips to Determine How Much Disability Cover You Need: 1) Start your calculation with 3–5 times your annual take-home income. 2) Add a buffer for ongoing EMIs and occupational risk. 3) Add 1x annual EMI if your home or vehicle loans are significant. 4) Add 25% if your job demands sharp eyesight and steady hands. |

Why Choose Ditto for Long-term Disability Insurance?

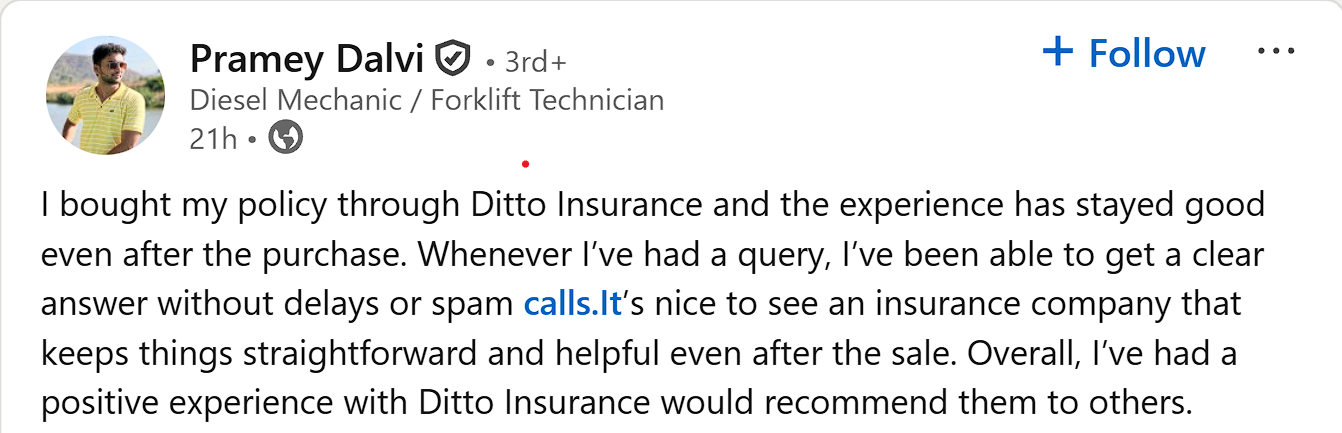

Planning long-term disability coverage demands guidance to make the right choice. That’s where we come in. We call ourselves “Ditto” for a reason; we would never recommend insurance plans to our customers that we won't buy ourselves.

The same philosophy fuels our IRDA-certified advisors, committed to one single goal: making you a smart insurance buyer. To date, we’ve helped 7,00,000+ customers match their unique needs to the right insurance policy. They trust and recommend us to others for all good reasons.

✅ Honest advice – no sales pitches, no commission-driven recommendations

✅ 12,000+ 5-star reviews (Rated 4.9 on Google)

✅ Real claim experience – we've helped customers through actual claims

✅ Backed by Zerodha and other leading fintech companies

Conclusion

Accidents can pause your income at any point. That’s why long-term disability insurance deserves fair consideration. A good way to build your long-term disability cover is through a term insurance plan with disability riders.

In case you already have a term plan, you can opt for a standalone personal accident plan. Start by knowing the definitions right and choosing a substantial sum insured for maximum benefit. However, planning everything on your own can be tricky. That’s where you need an expert by your side. Book a free call with Ditto and let us guide you better.

FAQs

Does disability insurance cover illness?

A standard personal accident plan covers accidental disability only. If you need illness-driven income loss protection, consider a critical illness insurance/rider.

What is the waiting period for TTD?

Generally, all standard PA plans have TTD benefits starting after a 4-week waiting period. It is payable from the date of disablement for the approved duration and is subject to the cap.

Can I get payout from multiple accidental disability policies?

Being a benefit based plan, PA policies are not subject to the principle of ‘contribution’ at the time of claim. Thus, if a person has more than one policy with different insurers, claims would be paid under all the policies.

Are PA and disability payouts taxable?

Accident disability paypouts are generally not taxable when received under a Personal Accident policy. Refer to your policy wordings and consult a tax expert to know more.

Is weekly income (TTD) available on term insurance riders?

No! TTD (Temporary Total Disablement) weekly income is essentially a Personal Accident (PA) feature, not a term insurance rider benefit. Instead, go with a monthly income-on-TPD rider on your term plan to get a fixed monthly amount, provided Total & Permanent Disability (TPD/ATPD) benefits are covered under the policy.

Are there any exclusions with disability insurance policies?

Common exclusions are accidents arising out of disability existing prior to the inception of policy, death or disability are due to mental disorders or any sickness, injury due to war, invasion, culpable homicide or murder, intentional self-injury, suicide, intake of drugs/alcohol, injury while engaging in defined extra hazardous activity like aviation or ballooning. (Note: This is an indicative list and can vary from company to company).

Last updated on: