| What Is the Life Insurance Council? The Life Insurance Council is a statutory body in India that brings together all life insurers for coordination, self-regulation, and industry development. It was constituted under Section 64C of the Insurance Act, 1938 and acts as a bridge between life insurance companies, the government, and the public. It helps shape policy, promote awareness, and foster better service standards across the life insurance sector. |

Curious about who oversees and guides India’s life insurance industry to ensure fairness, ethics, and transparency? It’s the Life Insurance Council. The statutory body represents all life insurers and sets standards that protect both the policyholders and the industry at large by promoting trust and accountability.

So whether you’re a policyholder or an industry professional, knowing how the council operates can help you make more informed decisions about life insurance.

This guide is curated to help you understand:

- The Life Insurance Council’s purpose

- Members of the Life Insurance Council

- Key roles of the Life Insurance Council

- The influence of the Life Insurance Council on India’s insurance landscape.

Do you want to learn more about how the Life Insurance Council of India affects you? Book a free consultation call with Ditto and our advisors will guide you.

| Did You Know? According to Swiss Re's 2025 report, the life insurance sector accounts for 74% of total premiums in India. With a penetration rate of 2.8%, higher than the average for emerging markets (1.9%), total real-life premiums are expected to grow at an annual rate of 6.9% (2025–29). |

Who Are the Members of the Life Insurance Council?

The membership of the Life Insurance Council comprises all life insurance companies operating in India. Currently, 26 member insurers offer a wide variety of traditional and innovative life insurance products. The Council is governed by an Executive Committee that includes elected members from these companies and nominees from the Insurance Regulatory and Development Authority of India (IRDAI).

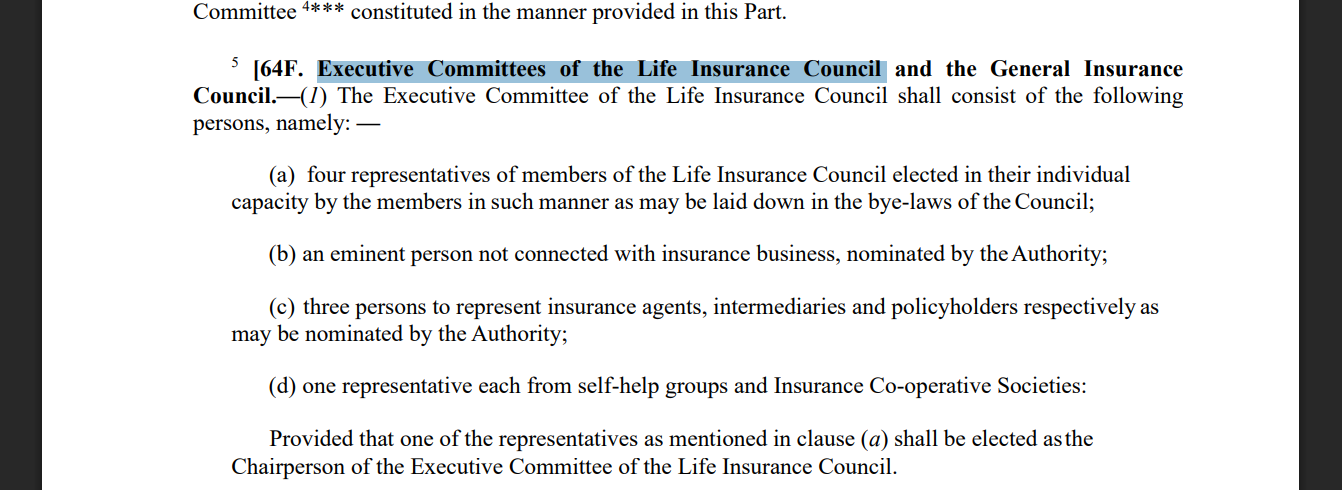

Here’s a snippet from the The Insurance Act, 1938 about the executive committee:

Some notable Executive Committee members include Shri R. Doraiswamy (Chairman and LIC CEO), Ms. Vibha Padalkar (Member and HDFC LIFE CEO), and other leading industry representatives. This diverse membership ensures the Council represents the entire spectrum of the life insurance industry in India.

Let’s take a look at the core functions of the executive committee:

(a) aid/advise insurers on standards and service,

(b) Advise IRDAI on expense control,

(c) bring to IRDAI any insurer acting prejudicial to policyholders’ interests,

(d) carry out notified ancillary tasks (with IRDAI approval).

Some leading Insurance companies that are council members of the institution are Axis Max Life Insurance, HDFC Life Insurance, and Aditya Birla Life Insurance. Click here to see the complete list.

Bottom Line: The council isn’t a regulator or an ombudsman; it’s the industry’s statutory council that coordinates, sets good-practice standards, and formally advises IRDAI.

| Note: One might get confused between IRDAI and LIC. The IRDAI is India’s insurance regulator; it makes rules, licenses insurers, and protects policyholders. The Life Insurance Council, on the other hand, is an industry body representing all life insurers. It promotes best practices, awareness, and coordination, but doesn’t have regulatory powers or handle complaints. |

What are the Roles and Responsibilities of the Life Insurance Council?

The Council displays moral/collective influence, not legal compulsion. Its success as an organization depends heavily on credibility, unity among insurers, transparency, and public trust. This means that the Life Insurance Council works to strengthen, guide, and represent the life insurance industry in India. Here’s what it does:

- Builds trust and awareness: Promotes the importance and benefits of life insurance to create a positive image of the industry and increase public confidence.

- Ensures ethics and good governance: Sets and maintains high standards of professionalism, fairness, and transparency among all member insurers by providing guidelines on ethical sales practices and peer review & monitoring.

- Engages with policymakers: Collaborates closely with government officials, lawmakers, and regulators through structured discussions to support industry growth and ensure consumer protection.

- Supports research and education: Conducts studies, publishes reports, and organizes training, workshops, and conferences to enhance knowledge and skills in life insurance for the insurer staff and agents.

- Connects globally and supports members: Acts as a bridge between the Indian life insurance industry and global markets by sharing insurance practices and participating in international forums, while guiding and assisting member insurers whenever needed, whether it’s for regulatory compliance, market insights, product development, or operational challenges.

- General activities: Appoint staff, collect fees for daily operations, keep an updated member list, make bye-laws (elections, meetings, information submissions, etc.).

| Life Insurance Council: Policyholder Implications As an insured/policyholder, you can watch the mandates and problems the Council flags or lobbies on to sense where the life insurance industry is stressed or shifting. In case they suddenly push hard on fraud controls, claims transparency, and surrender norms, it hints at emerging sector problems (mis-selling, cost pressures, liquidity stress). In this sense, the Council’s agenda serves as an early warning system. |

How to Connect with the Life Insurance Council?

If you’d like to reach out to the Life Insurance Council, here’s how to do so:

- Correspondence address: 4th Floor, Jeevan Seva Annexe Building, S. V. Road, Santacruz (West), Mumbai – 400 054

- Phone: +91-22-26103303 / 06

- Website Contact Page: You can use their “Contact Us” section to send inquiries.

| Take Note: When you contact them, clearly mention your purpose, whether it’s industry queries, consumer grievances, or informational requests. |

What are some initiatives undertaken by the Life Insurance Council?

The Life Insurance Council operates several key programs to enhance the insurance sector and support policyholders. Here are a few notable initiatives:

- Consumer Awareness Campaigns: The Council runs the “Sabse Pehle Life Insurance” campaign, launched in July 2025, which aims to turn awareness into action. Funded by member contributions, the campaign has an annual budget of approximately ₹160 crore.

- Disaster Response & Transparency: Following the Air India AI-171 crash on 12 June 2025, the Council began publishing weekly claim-settlement dashboards by insurer and claim type, ensuring timely updates and transparency for affected families.

- Sector Data & Updates: The Council shares news, reports, and updates on new business and industry trends, like the September 2025 performance summary, to keep everyone informed about recent developments in the insurance sector.

- Policy Advocacy: The Council works with government bodies, such as the GST Council and Finance Ministry, to push for GST relief on agent commissions and support growth in life insurance.

| Life Insurance Council: Key Collaborations The Life Insurance Council also works and collaborates with other government institutions like General Insurance Council (GIC) and IRDAI to make the overall insurance process easy and hassle-free, such as: 1) Jansuraksha Platform – A significant collaborative effort with the GIC and the Indian Banks’ Association to simplify claim journeys for government schemes PMJJBY and PMSBY. 2) Bima Sugam Project – The council plays an active role in developing India’s unified e-marketplace for insurance solutions, envisioned by IRDAI. |

Why Talk to Ditto for Your Life Coverage?

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Arun below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 5,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

Final Thoughts

The Life Insurance Council holds a pivotal position in India's life insurance ecosystem. It works as the collective conscience of India’s life insurance industry, helping make your experience more transparent, responsive, and trustworthy.

By linking insurers, regulators, the government, and policyholders, it supports a balanced, transparent, and consumer-friendly insurance environment. Its efforts in advocacy, education, and governance help strengthen public trust in life insurance, encouraging more people to secure their financial futures.

Still unsure how to go about purchasing a life policy? Book a call with us, and let our experts guide you through the process.

FAQs

Is the Life Insurance Council the same as IRDAI?

No. IRDAI regulates and enforces, while the Life Insurance Council represents and coordinates. The IRDAI has the legal authority to act, while the Council serves as a bridge between insurers, the regulator, and the public.

Does LIC help in addressing claims?

The Council doesn't handle individual complaints or pay claims. For formal redressal, you’ll usually approach the insurance company’s grievance redress officer(GRO) first, then any regulator via the insurance ombudsman and the consumer courts as a last resort.

Do all life insurance companies in India belong to the council?

Yes, membership includes all life insurers operating in India that are subject to its legal mandate.

Does the Life Insurance Council write the laws for life insurance?

No. Parliament makes laws, and the IRDAI issues regulations. The Life Insurance council advises, lobbies, and helps shape those laws based on industry experience.

Why should I care about the Life Insurance Council as a policyholder?

In practical terms, it helps you by maintaining an official list of licensed insurers, allowing you to verify authenticity. It also publishes grievance redressal contacts (GRO matrix) so you know precisely where to escalate complaints, and guides you toward the IRDAI Bima Bharosa portal or the Ombudsman if your issue isn’t resolved.

Last updated on: