Axis Max Life has emerged as a leading insurer in India’s term insurance sector because of its diverse plan options and its exceptional claim performance, substantial financial backing, and user-friendly features.

At Ditto, we’ve guided thousands of people daily to make smarter insurance choices, so we truly understand what matters most when selecting an insurer. Whether you’re a first-time buyer or a seasoned planner looking for high coverage, this guide breaks down key metrics, plan comparisons, riders, and expert recommendations to confidently make the right call. Let’s dive in.

Still unsure which term insurance you should purchase? Book a free call with us and let our experts guide you in making an informed decision for your and your family's needs.

Axis Max Life Term Insurance: Quick Overview

Axis Max Life Insurance Ltd, originally established in 2001 as Max New York Life Insurance Company Ltd, is a joint venture between Max Financial Services Ltd (MFSL) and New York Life International. After New York Life exited in 2012, the company was renamed Max Life Insurance. Since Axis Bank’s entry as a strategic partner in 2016, it evolved into Axis Max Life Insurance Ltd, with MFSL holding the majority stake of 80.98%.

Today, the insurer operates over 400 branches across India, has reported a 13% year-on-year (YoY) premium growth and manages assets worth ₹1.75 lakh crore. With a claim settlement ratio above 99.62% (average 2022-2025), the best CSR in the industry, the insurer reinforces its position as a reliable, high-performing player in India’s private life insurance market.

Full disclosure, Axis Max Life is one of Ditto’s partner insurers. Their term plans are well-regarded by customers for their strong performance, brand presence, and the comprehensive nature of the coverage they provide. In the few term death claims we have received so far, death claims for the Axis Max term plan have always been settled without delay.

Performance Metrics of Axis Max Life

Axis Max Life stands out not just for its product range but also for its strong performance in claims reliability and customer trust. Let’s take a quick look at Axis Max Life’s performance:

With a claim settlement ratio of 99.62% and an amount settlement ratio of 96.2%, the insurer demonstrates a strong commitment to honoring claims and supporting policyholders when it matters most. Backed by the financial strength of Axis Bank, it also offers the long-term stability customers look for in a trusted term insurance partner.

Note: Axis Max Life tops our list of term insurers ranked by their CSR.

List of Axis Max Life Term Insurance Plans

Looking for the correct term insurance plan from Axis Max Life? Whether you need simple protection or advanced features, the insurer offers a range of plans tailored to different life stages and budgets.

1. Smart Term Plan Plus

The latest flagship offering, the Smart Term Plan Plus (STPP) has six variants tailored to your life stage and financial needs. Whether you're securing your family's future or planning long-term, this plan adapts to your goals, making it a smart, customizable choice for comprehensive life cover.

Features:

- Flexible term plan with six customizable variants.

- Insta-claim payout: partial benefit within one working day.

- 12-month premium break with full coverage but insured will have to pay it back next year so it is more of an interest/penalty free deferment.

- Terminal illness benefit included up to ₹1 crore from the base sum assured as an early death benefit.

- Female-specific benefits include spouse top-up (lifeline plus benefit up to ₹50 lakh or 50% of the original SA), and a 15% premium discount due to higher life expectancy.

Variants:

- Options include regular coverage, return of premium, whole life coverage, smart coverage (150% payout in the first 15 years), early ROP Plus, and income protection (monthly payout).

Ditto’s Verdict: We feel the regular level cover and the smart cover make the most sense from an actual need perspective.

- Critical Illness (up to 64 illnesses) , Accidental Death, Disability benefit, and Waiver of Premium Riders

To know more about the variants provided by the plan, click here.

Now let’s look at how the premium varies for a cover of 1 cr. For non-smoker, the coverage is up to age 70.

P.S. premiums are exclusive of GST

2. Smart Total Elite Protection Term Plan

This one is a premium protection plan offering lifelong coverage, instant claim payout, and long-term benefits. Best suited for high-income earners or those looking for elite, uninterrupted financial security.

One thing to note is that the Axis Max Life Smart Total Elite Protection Plan is not available for purchase across all channels, as the insurer has now shifted focus primarily to Smart Term Plan Plus (STPP).

Features:

- Pure term plan with coverage up to age 85.

- In-built Terminal Illness Benefit (up to ₹ 1 crore).

- Insta-Claim within one working day post claim intimation.

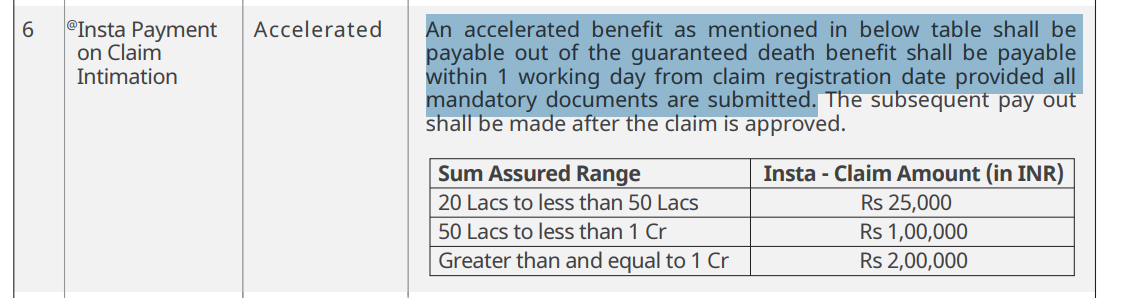

Here’s a snippet from the policy brochure explaining how the insta-claim works:

- Cover Continuance: 12-month premium break after 3 years.

- Special Exit Option: Get premiums back from the 30th year (on long-term policies).

Payout Options

- Death benefit is payable as a lump sum, a monthly income, or a combination.

Riders

- Add Critical Illness, Disability, Accidental Death, or Waiver of Premium riders for enhanced protection.

3. Smart Secure Plus Plan

This plan lets you increase coverage, add your spouse, and even pause premiums. Ideal for those seeking flexibility and family-centric features.

However, it’s important to note that this plan is an older offering, introduced before the launch of the Smart Total Elite Protection Plan, and is not currently available across all channels.

Features

- Choose between Life Cover or Increasing Cover (5% annual growth, up to 200%).

- Terminal illness benefit included (up to ₹ 1 crore).

- Return of Premium and Special Exit Value options available.

- Premium Break: skip up to 2 premiums after 10 years (eligibility applies).

- Voluntary Top-Up Cover: increase sum assured (up to 100%) after the first policy year.

Variants

- Flexible payment terms: Single Pay, Regular, Limited Pay (e.g., Pay till 60).

- Claim payout modes: Lump Sum, Monthly Income, or a combination.

Riders

- Add Critical Illness, Disability, or Waiver of Premium Rider.

- Joint Life Option available for spouse coverage.

4. Saral Jeevan Bima

This straightforward term insurance plan provides only a death benefit, no maturity or survival payouts.

- Designed for individuals aged 18 to 65, it offers flexible policy terms from 5 to 40 years, with coverage up to 70.

- You can choose a sum assured between ₹5 lakh and ₹25 lakh, in increments of ₹50,000.

- Premiums can be paid through regular, limited pay (5 or 10 years), or single pay options, with convenient payment modes, such as annual, semi-annual, or monthly.

The plan comes in multiple variants, allowing you to choose based on your preferred premium payment mode, budget, and policy duration. For added security, you can enhance your coverage with optional riders such as Accidental Death Benefit, Permanent Disability Benefit, and Waiver of Premium.

Who Should Consider Buying Axis Max Life Term Insurance? (Ditto’s Take)

Axis Max Life Term Insurance suits young earners, professionals, and families seeking high life cover at favorable pricing with customized features.

Smart Term Plan Plus (STPP) is ideal for those seeking greater control and flexibility in their term plan. It suits individuals who value higher coverage during financially vulnerable years and are willing to invest more for greater financial confidence. For many, this upfront protection offers a stronger sense of security for their family and future.

Ditto especially recommends Axis Max Life for those prioritizing claims reliability and feature-rich plans, as well as those buying digitally. Above all, the insurer stands out for the high-value coverage its plans offer and transparent processes.

Why Talk to Ditto for Your Term Coverage?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Key Takeaways

Making an informed choice in term insurance depends on facts and trust. Axis Max Life wins on claims, pricing, and flexibility.

- It leads in claim settlement (over 99%), giving policyholders peace of mind.

- The STPP allows a wide variant selection for young professionals, who especially benefit from cost-effectiveness and features.

- Riders enable tailored coverage, from accidental death to critical illness. Just be sure your needs match rider options before you make a purchase.

Still unsure which term insurance you should purchase? Book a free call with us and let our experts guide you in making an informed decision for your and your family's needs.

Frequently Asked Questions(FAQs)

Is Axis Bank Term Insurance the same as Max Life Term Insurance?

No, Axis Bank sells Axis Max Life policies via its network, but the insurance is provided by Axis Max Life Insurance Ltd, not Axis Bank.

Can I buy Max Life Term Insurance directly instead of through Axis Bank?

Yes, buyers can purchase Axis Max Life policies online, directly through Axis Max Life, without going through Axis Bank.

Can I file insurance claims through Axis Bank for my Axis Max Life policy?

You can initiate the claim process through Axis Bank (especially if you purchased the policy there), but the actual claim processing is handled by Axis Max Life Insurance, not the bank.

Which variant of Axis Max Life should I choose?

The Smart term plan plus is its flagship and current term plan offering, which offers affordable coverage, especially for young, salaried buyers.

Does Ditto Insurance offer unbiased advice on Axis Max Life?

Ditto recommends Axis Max Life when facts support its suitability and customer feedback aligns with reliability and value.

Last updated on: