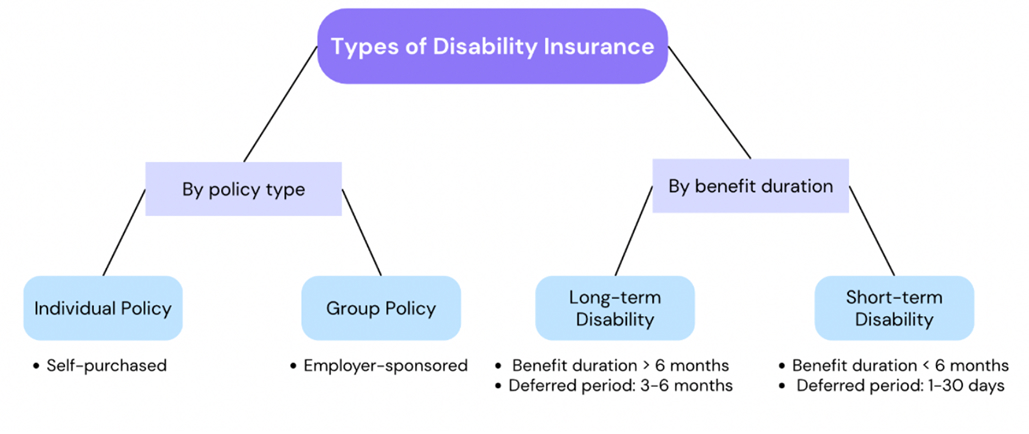

| What is the Difference Between Short and Long-term Disability Insurance? Short-term disability insurance provides income replacement for a limited period, ranging from a few weeks up to six months or, in some cases, up to two years. It is designed to help with temporary disabilities that prevent working but are expected to resolve with time. Long-term disability insurance, on the other hand, offers income replacement for several years or even until retirement age, covering more serious or permanent conditions that keep someone out of work for an extended duration. |

Most people assume disability is rare or something that only happens to others. But the numbers tell a different story: over 1.3 billion people experience significant disability before retirement. In India alone, 2.2% of the population lives with a severe mental or physical disability, according to the 2011 census. Yet, disability insurance remains one of the most overlooked financial products in the country.

At Ditto, we’ve reviewed hundreds of real-world disability claims and spoken to salaried professionals who were blindsided by the financial strain of being unable to work. This gives us first-hand insight into how different types of disability insurance actually step in when income stops.

To create this guide, we looked at claim trends, employer benefit structures, and insurer product details to break down the key difference between short and long-term disability insurance.

Source: https://www.theactuaryindia.org/article/disability-insurance

What is Short-term Disability Insurance?

Short-term disability insurance is a policy that provides partial income replacement when a person is temporarily unable to work due to a non-work-related illness, injury, or medical condition, with recovery expected within a few weeks to several months. It generally covers income lasting from a few weeks up to six months (sometimes up to a year). It is offered by employers as part of a group benefits package or purchased individually.

This insurance helps ensure that a short-term health problem doesn't result in financial hardship, covering everyday expenses such as rent, groceries, and bills until the insured returns to work.

What Qualifies for Short-term Disability Insurance?

In India, short-term disability insurance is not offered as a standalone retail product. Instead, what we have is:

- Personal Accident (PA) Policies: They cover Temporary Total Disablement (TTD), which is the closest thing to “short-term disability.” They usually have the following features:

- These policies do not cover illness (like arthritis, cancer, stroke, depression, pregnancy).

- They only cover accident-related injuries that temporarily stop you from working.

- You also get a weekly income benefit (like 0.2% of the sum insured per week) for up to 100 weeks, subject to waiting periods (usually 4 weeks).

- Illness-related Absence

For disabilities or absences due to illness or maternity, the following options are generally used instead of short-term disability:

- Maternity Insurance (under health covers): Covers hospitalization for pregnancy and childbirth, but does not replace income (for e.g, Aditya Birla Activ Fit – Preferred and Niva Bupa Aspire – Titanium+.

- Critical Illness Insurance: Pays a lump sum on diagnosis of serious illnesses like cancer, heart attack, or stroke (e.g., HDFC ERGO Critical Illness Policy and ICICI Lombard’s CritiShield Policy.

- Employer Sick Leave and ESIC Benefits (for salaried workers): Provides statutory short-term wage replacement during illness or maternity leave.

In short: Accident-related temporary disabilities in India are covered under PA policies, while illness-related absences rely on maternity, critical illness plans, or statutory employer benefits.

What Does Short-term Disability Insurance Cover?

It specifically covers the following criteria:

1. Permanent Total Disability (PTD): This means you become completely and permanently unable to work for the rest of your life. It usually results from a very severe accident or condition.

- Examples: Paralysis of all four limbs, being in a permanent coma, or losing both eyes, or both hands, or one hand and one eye together.

- Benefit: Insurer pays 100% of the Sum Insured as a lump sum.

- Real-life scenario: If someone insured for ₹50 lakh loses both legs in an accident, they will receive the full ₹50 lakh to help cover medical costs, income replacement, and lifestyle changes.

- Plans: HDFC Ergo's Personal Accident plan

2. Permanent Partial Disability (PPD): This means you are partially but permanently disabled, so your ability to earn is reduced but not entirely lost.

- Examples: Losing fingers, toes, one hand, one leg, or hearing in one ear.

- Benefit: A percentage of the Sum Insured is paid, based on the severity of the disability (the insurer has a schedule defining how much is paid for each type of injury).

- Real-life scenario: If a policyholder with ₹20 lakh cover loses one eye, and the insurer’s schedule values this at 50%, they would receive ₹10 lakh.

- Plans: Manipal Cigna Accident Shield

3. Temporary Total Disability (TTD)

This means you are totally unable to work for a short time, but you are expected to recover.

- Examples: A broken leg, a slipped disc, or a temporary spinal injury that keeps you bedridden for months.

- Benefit: A weekly income benefit (for example, 1–2% of the sum insured, capped at ₹50,000–₹75,000 per week) for up to 52–100 weeks depending on the policy.

- Real-life scenario: If you earn ₹1 lakh a month and fracture your spine in a car accident, making you unable to work for 12 weeks, your policy might pay ₹50,000/week, so you would get ₹6 lakh over that period until you are fit to return.

- Plans: Niva Bupa PA plan

| Did You Know? A salaried employee earning ≤ ₹21,000/month (₹25,000 for individuals with disability) is automatically covered under the Employees' State Insurance (ESIC) scheme for: a) work-related accidents and illnesses with free medical care b) 90% wage replacement during temporary disablement c) lifelong pension for permanent disability d) monthly pension for dependents in case of death due to employment injury, plus rehab, prosthetics, and vocational training support. The catch? ESIC is primarily for workplace incidents, but you still need a separate health insurance, a term plan, and personal accident/disability cover for life outside work (at home, on the road, during travel). |

What is Long-term Disability Insurance?

Long-term disability insurance is a policy designed to replace a portion of income (usually around 40–70%) for individuals who become unable to work due to a serious illness or injury that is expected to last several months, years, or even until retirement.

It activates once any short-term disability benefits are exhausted and requires proof of a lasting impairment, covering conditions such as cancer, neurological disorders, severe injuries, or chronic diseases.

The insurance helps maintain financial stability by providing ongoing benefit payments for expenses like mortgage, bills, and daily living costs throughout the disability period, often continuing until the insured can return to work or reaches retirement age.

| Did You Know? The Pradhan Mantri Suraksha Bima Yojana (PMSBY) is one of India’s most affordable accidental insurance schemes. Its premiums start with ₹20 per annum per member and provide: a) ₹2 lakh cover for accidental death or permanent total disability, b) ₹1 lakh cover for permanent partial disability. However, PMSBY does not cover temporary disabilities or illness-led disabilities. This makes it a good baseline accident cover for everyone, especially those in lower-income or high-risk jobs. |

What are the Different Types of Long-term Disabilities Covered by Insurance?

A long-term disability insurance aims to replace income (or a huge lump sum) for years, especially because the disability is permanent. It usually bundles the following benefits:

- Permanent Total Disablement (PTD) or Permanent Partial Disablement (PPD) Benefits: Anyone can leverage these benefits under a standalone personal accident policy. For example, HDFC Ergo's Personal Accident plan pays out the entire sum assured in the event of PTD and PPD.

- Life-insurance Riders: These add-ons pay monthly income for 5–10 years or a lump sum on Total and Permanent Disability (TPD), often accident-only (some riders also cover illness-led TPD). For example:

- HDFC Life’s Income Benefit on the Accidental Disability rider pays 1% of the rider sum assured per month for 10 years on accidental TPD.

- Axis Max Life’s Critical Illness and Disability rider covers TPD from both accidents and illness, offering a lump sum payout for treatment or income support.

- Employer Group Cover: Most mid-to-large corporates (IT, BFSI, manufacturing, logistics) offer this cover (e.g, Bajaj Allianz’s Group Personal Accident cover). The policy can be customized to include medical expenses, weekly benefits for up to 100 weeks, and coverage for both on-duty and off-duty accidents.

| Quick Note: Since April 1, 2021, IRDAI requires all general and health insurers to offer Saral Suraksha Bima, a standard personal accident policy. It must cover Accidental Death, Permanent Total Disability (PTD), and Permanent Partial Disability (PPD), with optional add-ons like Temporary Total Disability (TTD), accidental hospitalisation expenses, and an education grant for dependent children. Because it’s standardized, the features are the same across insurers, making basic accident protection transparent and straightforward. |

Short-Term vs. Long-Term Disability Insurance

This comparison table discusses the key differences between short and long-term disability insurance in detail:

| Feature | Short-Term Disability Insurance | Long-Term Disability Insurance |

| Coverage Duration | Provided through TTD PA policies; weekly income up to 52–100 weeks. | Provided through PTD and PPD under PA policies (lump sum). Life insurance riders may give a monthly income for 5–10 years or lump sum on Total & Permanent Disability. |

| Trigger | Accident-only: fractures, injuries, or trauma that prevent work temporarily. | Accidents (loss of limbs, eyesight, paralysis) and sometimes illness if covered under a TPD rider or Critical Illness plan/rider. |

| Waiting/Elimination Period | Usually 1–30 days before weekly payouts begin. | Often a 180-day continuous disability test before declaring permanent disability. |

| Benefit Style | Weekly income (e.g., up to ₹75,000/week under Niva Bupa PA plan). | Lump sum (100% of Sum Insured for PTD; % of SI for PPD). Some riders offer monthly income for 5–10 years. |

| Purpose | Short-term salary replacement while you recover from accident injuries. | Long-term financial security if you can never return to work or face reduced earning ability. |

| Examples of Use | Fractured leg, temporary spinal injury, road accident recovery. | Loss of eyesight, paralysis, amputation, or stroke, leading to permanent disability. |

| Product Examples | Niva Bupa PA Plan (TTD benefit), Tata AIG Accident Guard, Saral Suraksha Bima (IRDAI standard PA product). | HDFC Life Income Benefit on Accidental Disability Rider (1% Rider SA per month for 10 years), Tata AIG ATPD Rider (Lump sum) & Axis Max Life Critical Illness and Disability Rider |

Are There Any Disability Insurance Benefits Beyond Payouts?

Disability insurance today goes far beyond a simple payout for loss of income. Modern plans have evolved into holistic protection packages that address the ripple effects of an accident or disability on a family’s life. Along with core benefits like lump-sum or income replacement, many covers now include loan and EMI protection, ensuring ongoing financial commitments don’t burden dependents.

They extend to child care and education support, covering school fees, counseling, and even marriage assistance. In addition, recovery-focused benefits such as recuperation allowances, prosthetics, wheelchairs, and home or vehicle modifications help restore normalcy.

Some policies also provide for funeral expenses and transportation of mortal remains, while add-ons like elder care or parent support benefits recognize the wider family responsibilities many policyholders shoulder.

To sum it up, disability insurance has matured from a one-dimensional payout into a comprehensive safety net that cushions not just the insured, but the entire household ecosystem.

Should You Buy Disability Insurance? (Ditto’s Take)

Accidents and critical illnesses often leave people with temporary or even permanent disabilities. In such moments, the ability to earn can vanish overnight, creating a massive financial strain on the household. Disability insurance, whether short-term or long-term, acts as an income shield during these vulnerable times.

In India, personal accident and disability insurance is still underpenetrated, but awareness is slowly rising. Generally, most people first secure their foundation with a comprehensive health plan (to cover hospital costs) and a term life plan (to protect family income in case of death). Once these are in place, disability coverage should be the next step, especially if you

- Spend a lot of time on the road

- Work in hazardous environments

- Simply want to plug a critical gap in your financial safety net

However, most disability riders bundled with life insurance focus only on permanent disabilities. The short-term, temporary loss of income (say, being bedridden for months after a fracture) often gets overlooked. If you’re in the early years of your career and don’t yet have a strong emergency fund, this is a real risk.

That’s where a standalone personal accident insurance plan can step in with weekly income benefits (for short-term disablement) and lump-sum payouts (for permanent disability).

Bottom line, health and term insurance cover medical and life risks, but disability insurance covers your earning power itself. This acts as a true financial protection for many young professionals.

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Ajay love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Final Thoughts on the Difference Between Short and Long-term Disability Insurance

Just like any other insurance, investing in disability insurance is a sensible decision, given what it offers under dire situations. If you wish to add disability coverage to your basic insurance plan, knowing the difference between short-term and long-term disability is essential. This will help you choose the right plan for your requirements.

Still confused about the type of coverage you need? Contact our IRDAI-certified advisors for further assistance now!

FAQs

Can I buy short and long-term disability insurance at once?

Yes, it is possible to buy both short-term and long-term disability insurance at the same time. It's important to note that these are not separate policies, and most personal accident plans cover both features.

Is it possible to transition from short-term to long-term insurance?

Yes, it is possible to transition from short-term to long-term disability insurance if the disability persists beyond the maximum period covered by your short-term policy. In most cases, this transition is not automatic, as individuals generally need to apply for long-term disability benefits before the short-term benefits expire. This requires them to provide updated medical documentation and meet the eligibility criteria for long-term coverage.

Does disability insurance cover illness?

Most accident and disability policies in India cover only accident-related disabilities, not those caused by illness. To stay protected, pair your accident cover with a critical illness plan, which pays a lump sum on diagnosis of serious diseases and can be used for treatment, recovery, or income support.

What is an elimination period for short-term disability insurance?

An elimination, aka waiting period, for disability insurance is the amount of time after becoming disabled before your benefits start. During this time period, you will not receive benefits, but may participate in a company program for salary continuation, use paid time off, or apply for state benefits. For STD benefits, the elimination period is normally up to 30 days.

How long does short-term disability last?

How long your short-term disability benefits last will depend on your provider, but benefits end after six months or until you return to work full-time and are able to perform all of the duties of your occupation.

What are the exclusions in personal accident insurance?

Personal accident insurance covers only sudden, unforeseen accidents. It excludes pre-existing disabilities, illness, or mental health conditions, pregnancy complications, HIV/AIDS, and non-accidental infections. It also won’t cover accidents linked to crime, war, professional sports, armed forces duty, self-harm, suicide attempts, or those under the influence of alcohol or drugs.

Last updated on: