| Can We Claim Term Insurance from Two Companies? Yes, we can claim term insurance from two (or even more) companies simultaneously. However, one must disclose all existing covers while buying each term policy in the proposal form. Your total term cover should also stay within the income-based eligibility and HLV (Human Life Value). This helps the nominee file separate claims with each insurer and receive the full sum assured hassle-free. |

A family that runs on a single paycheck can buy peace of mind with a term insurance policy. But when some people choose to double it up, you can tell there’s more than one reason.

Life responsibilities come pouring in — marriage, kids, a home loan. Having two term policies allows you to pay lower premiums than upgrading a single plan later, add different nominees, and enjoy various term rider benefits, (like permanent disability for one policy and critical illness for the other).

However, to make things work with two term insurance policies, you need to know more than the basics. This article will help you understand:

- How to plan and split your total cover across two different term policies

- Pros and cons of buying term insurance policy from two different companies, and

- How the claim process works with double term insurance

Planning to buy insurance soon? This could be the best time of the year with 0% GST on life & health premiums. Check out our exclusive guide to know how the GST slash affects new policies and renewals.

Book a free call with Ditto’s IRDAI-certified advisors to know your HLV, split cover smartly, and pick the right term plans for hassle-free claims.

Can We Claim Term Insurance from Two Companies?

According to the IRDAI, there is no bar on the number of term insurance plans one can buy. Yet there are certain prerequisites that insurers care about.

- Full disclosure: Be an honest policyholder and disclose all details, including health condition, history of illness, lifestyle, habits, and existing insurance coverage. Remember, willful non-disclosure can lead to claim rejections.

- HLV: HLV or Human Life Value is a significant determiner for the maximum cover one can get. Various factors come into play when determining your HLV, like age, income, education, and existing coverage.

Here’s a quick example to understand how underwriters determine HLV and how you can split the total cover across two different term policies.

Say you’re a 30-year-old man, living in Delhi, with an annual income of ₹10L.

In this case, most underwriters will determine your HLV using the 15×–25× band (higher multiple for lower age due to more number of working years ahead)

So, your total HLV would be ₹2 Cr multiplied by 25x for a maximum coverage of 5 Cr. You can easily split it across two different term insurance plans.

- Term plan 1 of ₹2 Cr till age 65 with a permanent disability rider, protecting against income replacement, and

- Term Plan 2 (taken after major life events like marriage and childbirth) of ₹3Cr for 15–20 years, with a critical illness rider securing your kid’s future and protecting against ongoing debts.

Not sure whether you need one big term policy or two complementary policies?Try Ditto’s term insurance plan calculator to determine your cover.

What are the Pros and Cons of Buying Two Term Insurance Plans?

Before you go with two term insurance plans, here’s a quick comparison table with pros and cons for different scenarios.

| Scenarios | Pros | Cons |

|---|---|---|

|

Goal-based cover split (e.g., Term plan 1 protecting home loan for 15–20 yrs and Term Plan 2 for protecting family income till 60–65) |

|

|

| Buying base cover now and a top-up later with rising income |

|

|

|

Rider mix-and-match (e.g., Disability rider for first term plan, Critical Illness rider for the second) |

|

|

| Pro tips for a hassle-free term insurance claim: 1) Name nominees and their allocation percentage for both term plans. 2) Centralize all documents, like ID proof, medical history, and policy documents, in one folder. 3) Keep the contact information updated with all insurers. 4) If it’s an accidental death, file the FIR, and retain certified copies of the panchnama and post mortem (if ordered). |

Why Choose Ditto For Term Insurance?

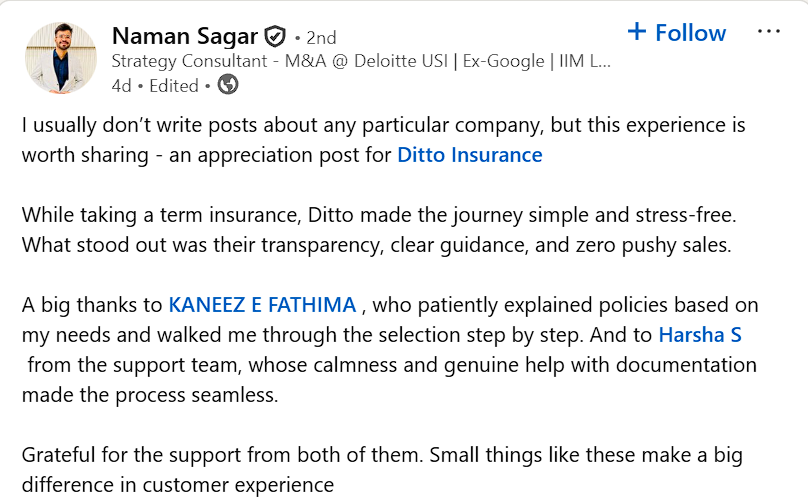

Whether you buy one or multiple term insurance policies, it takes solid math to maximize benefits. At Ditto, our IRDAI-certified advisors work smart to make you a confident insurance buyer.

To date, we’ve helped 7,00,000+ customers with end-to-end guidance, matching their unique life goals to tailored term insurance plans. There’s more than one reason why customers trust Ditto and recommend us to others.

✅ Honest advice – no sales pitches, no commission-driven recommendations

✅ 12,000+ 5-star reviews (Rated 4.9 on Google)

✅ Real claim experience – we've helped customers through actual claims

✅ Backed by Zerodha and other leading fintech companies

Conclusion

You can always hold two term insurance policies from different companies and even claim them together. What matters is how you design each term policy with the right cover amount, goal-based terms, and appropriate term riders. For most people, factoring everything can be tricky. That’s where you need an expert. Book a free call with Ditto for a no-spam consultation and get personalized guidance on term insurance buying.

FAQs:

Should I go for multiple term insurance policies or just increase coverage in one?

If your current insurer allows increasing the cover (life-stage option) and pricing stays in your budget, keeping one term policy is more simple. However, if you’re missing out on rider benefits, have different life goals, and get a better pricing, you can go for another term plan from a different company. Note that in both cases fresh underwriting is needed to increase the coverage.

What if I forget to pay premiums for one policy?

If you forget to pay a premium for one policy, it will lapse. However, insurers offer a grace period and a revival window to save your policy with added interest (penalty). So, always use the auto-pay option and set calendar reminders for each policy premium.

Can I claim both my employer’s group term and my personal term cover?

Yes, you can if both plans are active and properly disclosed.

Does having two policies reduce claim rejection risk?

Well yes and no! While multiple term policies won’t save a claim rejected for fraud or non-disclosure, they can help with operational hiccups. Say if one insurer delays, another may settle the claim sooner and give one faster access to liquidity.

What documents will my nominee need for each insurer?

The documents that a nominee needs for filing a claim are almost the same for all insurers, like death certificate, original policy document, filled-in claim form, claimant KYC, bank details, and FIR/post-mortem reports (for accidental deaths.

Last updated on: