Quick Overview

If you’ve seen Volo Health Insurance TPA mentioned on your health insurance card or policy document, it’s natural to wonder what role it actually plays during a claim.

A third party administrator (TPA) like Volo acts as the operational bridge between you, your insurer, and the hospital. The insurer decides the policy rules, the hospital provides treatment, and the TPA coordinates approvals, documents, and claim communication.

This article explains Volo Health Insurance TPA’s role, how cashless and reimbursement claims work, the documents required, how to track your claim, and how to contact Volo.

About Volo Health Insurance TPA

Volo Health Insurance TPA is an IRDAI-licensed third party administrator operating in India. It was formerly known as East West Assist Insurance TPA. Volo provides claim administration services to insurers, primarily for group and corporate health insurance policies.

Volo’s core responsibilities include:

- Coordinating cashless hospitalization approvals

- Processing reimbursement claims

- Verifying medical and billing documents

- Facilitating communication between hospitals and insurers

Note: Volo does not issue policies or decide coverage. All approvals, deductions, or rejections are based on your insurer’s policy wording. A TPA only executes those rules during the claim process.

What is The Cashless Claims Settlement Process At Volo TPA?

Choose A Network Hospital

To avail cashless treatment, ensure the hospital is part of Volo’s cashless network before admission. Since hospital tie-ups may change, reconfirm the network status before hospitalization.

Patient Identification At Hospital

At the hospital’s insurance or TPA helpdesk, present your Volo/EWA ID card or policy number along with a valid government photo ID. Carrying previous medical records, if available, can help speed up approvals.

Submit The Pre-authorization Request

Request the pre-authorization form from the hospital’s TPA desk. The hospital will complete and submit the form to Volo on your behalf for cashless approval.

Cashless Approval Decision

Once all required documents are received, Volo reviews the request as per policy terms and communicates the approval decision to the hospital and the policyholder.

What Is The Reimbursement Claims Settlement Process at Volo TPA?

If cashless hospitalization is not availed, you can file a reimbursement claim with Volo Health Insurance TPA. Here are the steps to follow:

Step 1: Claim Intimation

Reimbursement claim intimation must be done within 24 hours of hospitalization, whether treatment is taken at a network or non-network hospital. Intimation can be registered via call center, WhatsApp, website, or email. A unique claim reference number is generated for tracking.

Step 2: Submission Of Claim Documents

After discharge, pay the bill out of pocket, fill out the reimbursement claim form, and submit all required documents in original to the nearest Volo/EWA branch or send them via courier.

Documents Required for Reimbursement Claims

- Duly filed claim form

- Copy of Volo/EWA ID card and health policy document

- Photo ID proofs (Aadhaar, PAN, employee ID, CKYC documents if applicable)

- Original prescriptions and consultation notes

- Final hospital bill with a detailed break-up

- Discharge summary

- Original cash receipts

- Investigation and diagnostic reports

- Cancelled check with IFSC code

Remember: Additional documents are often requested on a case-to-case basis.

How Do I Track A Claim Status With Volo TPA?

Once registered, every claim is assigned a unique claim reference number.

You can easily track the claim status through:

- Volo’s official online claim portal

- SMS and email updates

- Customer care support

- The Volo Wallet mobile app

Network Hospitals Partnered With Volo

Volo works with an empanelled network of over 7,500 hospitals and healthcare providers across 500 locations in 29 states. The exact hospital network available to you depends on your insurer and policy type.

Before admission, always:

- Confirm the hospital is currently active in the Volo network

- Check for exclusions or blacklisted hospitals

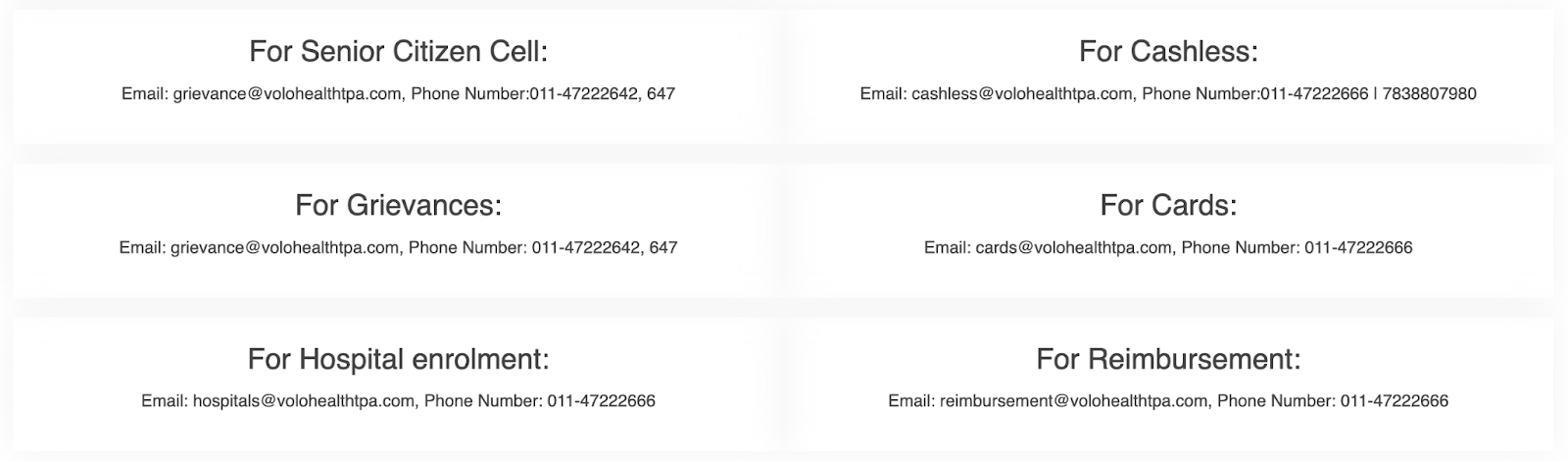

How Can I Contact Volo TPA?

Volo Health Insurance TPA offers multiple support channels to help policyholders resolve queries quickly.

- You can also reach out via their toll-free helpline (1800 202 030) or the support email ID (support@volohealthtpa.com) for assistance.

- Volo’s head office is located in New Delhi, and the company also operates regional offices across major Indian cities.

- For hospitalization-related issues, coordinating through the hospital’s insurance desk along with Volo customer care is usually the fastest way to resolve cashless or admission-related concerns.

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call now, slots fill up fast!

Conclusion

When a TPA like Volo is involved, the health insurance claim process becomes more layered than it needs to be. Instead of dealing directly with your insurer, your claim passes through an additional party. This often results in:

- Slower approvals because multiple teams need to review the same claim

- More paperwork and repeated document requests

- Delays caused by coordination between the hospital, the TPA, and the insurer

- Lower accountability, since the insurer isn’t handling the claim from start to finish

TPAs are generally appointed by insurers to manage and reduce claim costs. This can mean stricter checks, more queries, or guidance toward certain hospitals, even when the policy technically allows your claim.

At Ditto, we usually do not recommend TPAs for retail health insurance policies and prefer insurers that handle claims through in-house claims teams.

When the insurer manages the claim directly, there’s no third party involved, fewer handovers, and clearer responsibility if something goes wrong.

Note: Volo health insurance is not a partner insurer of Ditto. Therefore, all the data for the article has been taken from publicly available sources, the insurer’s website, and policy documents.

Frequently Asked Questions

Last updated on: