Quick Overview

For most Indian families, one person earns for the entire family. If your spouse or child is suddenly hospitalized, a single bill can wipe out savings meant for school fees, EMIs, or future goals. A family health insurance plan protects all of you under one cover. Star Health Insurance is one of India’s largest standalone health insurers, founded in 2006, and is recognized for its vast hospital network.

It reports an average claim settlement ratio of 84.97% (FY 2022–25) and an incurred claim ratio of 72.84% (FY 2021–24), indicating a solid financial footing but slightly lower settlement rates than its top peers. Its complaint volume is relatively high at 52.31 per 10,000 claims (FY 2022-25), reflecting service friction.

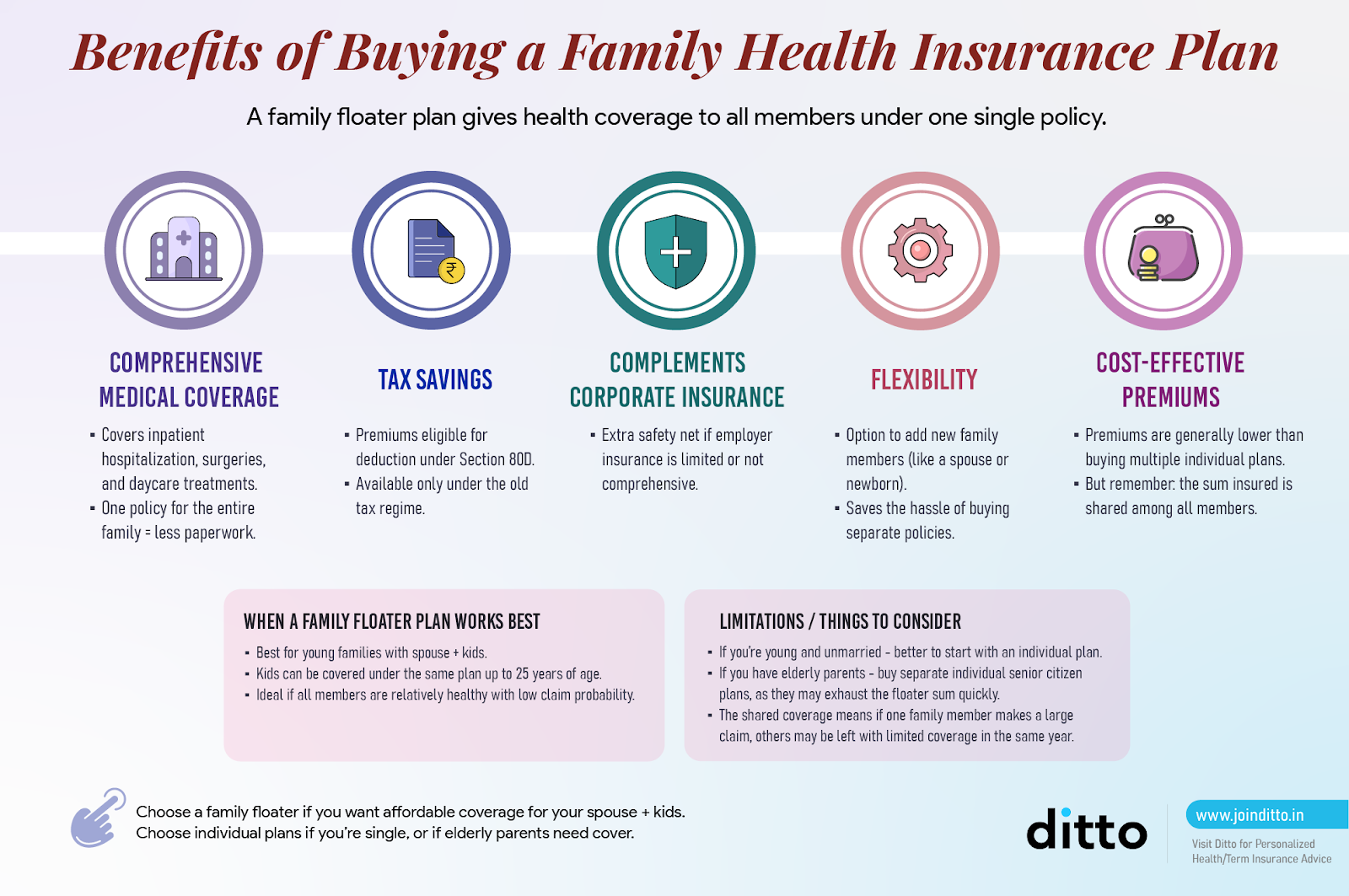

In this article, we will walk you through the best options to consider from Star Health if you want to opt for a family floater, what is covered, what is not covered, and finally, whether you should consider Star for your family’s health insurance needs.

Best Star Health Insurance Plans For Family

Premiums for Star Health family plans vary by age, location, medical history, lifestyle habits, sum insured, and the add-ons you choose. Here are the Super Star plan premiums for different family structures.

Best Star Health Insurance Plans For Family

Note: Premiums are for a ₹15 lakh sum insured, residing in Delhi - 110010, without any add-ons.

Did You Know?

What Is Covered And Not Covered in Star Health Family Plans

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call now, slots fill up fast!

Ditto’s Take on Star Health Family Plans

Star is a standalone health insurer with one of the strongest physical footprints in the country. It has an extensive agent network and a vast hospital tie-up base, so in terms of reach and visibility, it almost feels like the LIC of health insurance.

However, Star’s claim handling record is inconsistent. The claim settlement ratio is lower than the industry average, and complaint volumes are higher, with many customers reporting partial settlements or heavy deductions. Star is a partner insurer for Ditto, but it is not an active recommendation, mainly due to its current claim settlement performance.

Still, Star’s relatively flexible underwriting for pre-existing conditions and its strong offline presence make it a useful option for customers who may not easily get coverage elsewhere. If you prefer buying a Star family plan, we suggest that you work with an advisor who has experience handling Star claims and can support you during hospitalization.

If you want help comparing Star with other insurers for your family, you can always speak to Ditto for a free, conflict-free consult.

Frequently Asked Questions

Last updated on: