| What is Risk Pooling in Health Insurance? Risk pooling in health insurance is a core tenet of health insurance, where people contribute premiums to a common fund that pays for medical expenses when someone falls ill. It spreads financial risk across a large group, helping keep premiums affordable for everyone, regardless of individual health needs. By balancing high- and low-risk members, insurance remains fair, stable, and sustainable. |

If you’re paying for health insurance but rarely visit the doctor, you might wonder: Why am I still paying so much? Or, where does all that money go if I don’t make any claims? The answer is simple: risk pooling in health insurance.

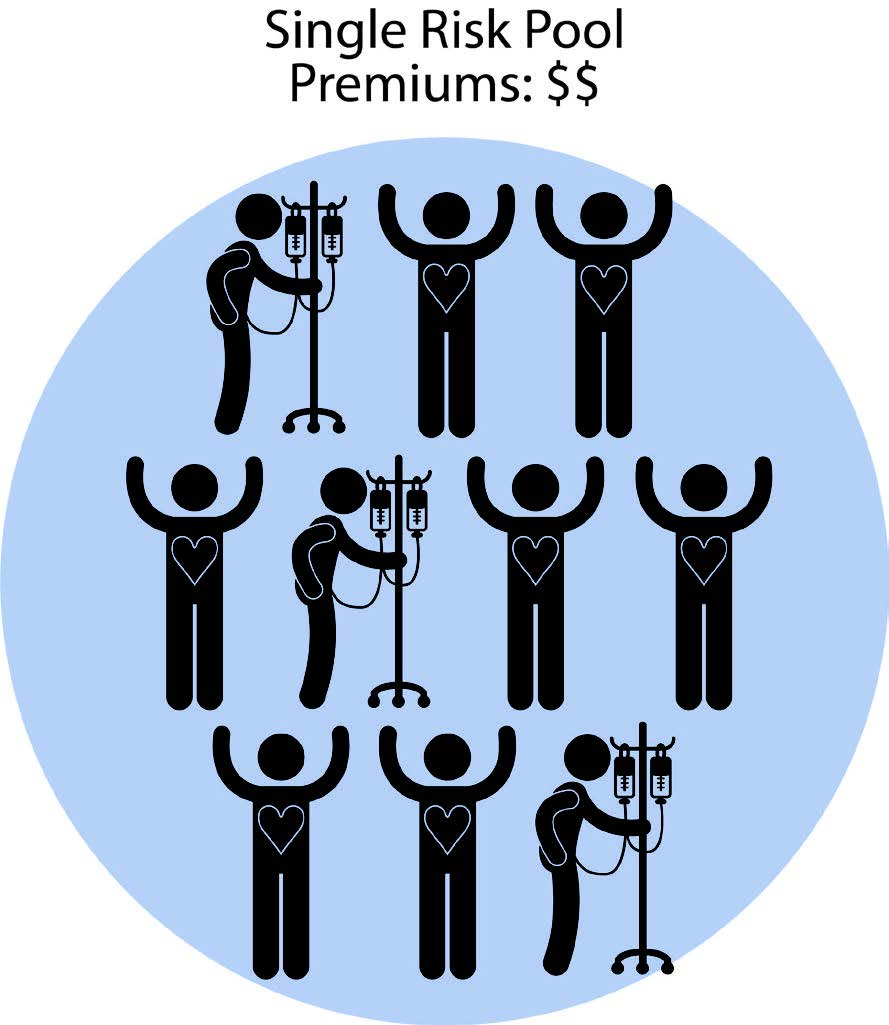

It’s a system where many people contribute to a shared fund, even if only a few require expensive care at any given time. This collective approach allows insurers to combine premiums from a large, diverse group, spreading financial risk more effectively.

How Does Risk Pooling Work?

People of all ages, with various health conditions and lifestyles, enroll in a health insurance plan. This mix is critical, as it includes both healthy individuals who may not require care often and those with existing or future medical needs.

| Let’s understand this with an example. Suppose 500 people each contribute ₹20,000 annually to a shared health insurance pool. This creates a fund of ₹1 crore. Out of this group, 10 people undergo major surgeries costing ₹10 lakh each (₹1 crore total). Instead of each patient struggling to pay ₹10 lakh individually, the collective pool covers these expenses. |

This system works because not everyone will claim at the same time. The premiums from healthy members help offset the costs for those who need more care. In turn, when healthy individuals eventually require treatment in the future, the pool will be there to support them as well.

How Does Risk Pooling Affect Insurance Premiums?

When insurers set premiums, they look at the average expected cost of medical claims across the group. If the pool includes a large number of healthy individuals, their lower usage helps offset the costs of those who require frequent or high-cost care. Broad participation in insurance, especially among healthy individuals, helps ensure that premiums can remain stable.

| Did You Know? Every health insurance policy comes with a set of permanent exclusions (substance abuse, cosmetic procedures, experimental medicine), treatments, and conditions that will never be covered. You’ll find the complete list in your policy wordings, as well as in the IRDAI’s standard list of permanent exclusions. Exclusions exist for three key reasons: a)To ensure people buy insurance before they fall sick (avoiding moral hazard). b) To keep premiums affordable across the pool. c) To protect insurers’ financial stability by leaving out highly predictable or uninsurable conditions. Think of it as the fine print of health insurance. It shapes what you’re really buying, beyond the glossy brochure highlights. |

What Is the Insurer’s Role in Risk Pooling?

Insurers act as the architects and custodians of this system. Their role spans product design, premium pricing, claims management, regulatory compliance, and long-term financial stability. Let’s look at it in detail.

1) Creating and Managing the Pool

Insurers design products, set premiums, and bring together diverse groups of people into one pool.

2) Pricing Premiums Fairly

Using actuarial science, insurers calculate expected medical expenses across the pool and set premiums accordingly.

3) Regulating Entry and Benefits

Insurers define eligibility rules, coverage benefits, and exclusions to maintain a workable pool. They also comply with IRDAI regulations in India, including minimum coverage standards, portability, and reporting solvency margins.

4) Managing Claims

When members need care, insurers process and pay claims from the common fund. By monitoring fraud and abuse, they protect the pool from being drained unfairly.

5) Maintaining Solvency and Stability

Insurers hold reserves and sometimes purchase reinsurance, essentially insurance for insurers, to protect against catastrophic losses. They track incurred claims ratios (ICR) and solvency margins to ensure the pool can cover present and future claims.

6) Encouraging Broad Participation

To prevent adverse selection, insurers design products that are attractive to both young/healthy individuals and older/high-risk individuals. They market wellness programs, and incentives encourage broader participation, which strengthens the pool.

With insurers playing such a crucial role in managing risk and ensuring fairness, the natural next question is: Is risk pooling itself truly fair for everyone involved?

Still Not sure Talk to Ditto’s expert advisors today and get unbiased, personalised guidance - absolutely free.

Is Risk Pooling Fair?

While it may seem unfair if you're healthy and rarely make a claim, risk pooling ensures everyone shares protection. Health is unpredictable, and anyone can suddenly require care. Pooling protects against discrimination and ensures everyone has access to affordable coverage when it matters.

| Challenges of Risk Pooling While risk pooling is a foundational pillar of health insurance, it is not without challenges. 1) Adverse Selection and Shrinking Pools Risk pooling is most effective when both healthy and high-risk individuals participate in the program. However, problems arise when mostly high-risk individuals (those already ill or expecting high medical expenses) purchase insurance, while healthier people opt out. This leads to a smaller, sicker pool, which raises average claim costs and forces insurers to increase premiums. This is a move that can push even healthier people out, creating a “death spiral.” To counter this, insurers and governments often incentivize younger, healthier individuals to join early, thereby maintaining a broad and sustainable pool. 2) Moral Hazard Once insured, people may be less cautious about their health or may overuse healthcare services because they don’t directly bear the full cost. Example: opting for unnecessary tests or hospital stays solely because insurance will cover the expenses. 3) Regulatory Gaps Inconsistent or weak regulation can make pools unstable. Without rules like solvency requirements, portability, claim settlement oversight, or limits on exclusions, insurers may cherry-pick healthy customers or design unsustainable products. Strong regulation (like IRDAI’s role in India) is necessary to keep pools fair, transparent, and solvent. |

How Is Risk Pooling Used in Different Types of Health Insurance?

Risk pooling is the backbone of every form of health insurance, but its application can vary depending on the type of plan. Let’s break it down across different segments:

1) Employer-sponsored plans:

In employer-based health plans, all employees (and often their families) are part of a group insurance policy. This group typically comprises individuals of diverse ages, health statuses, and medical needs.

- Why it works: Since the risk is spread across a large number of people, individual premiums stay relatively low, even if a few employees have high medical expenses.

- Benefit for employers: Larger risk pools also give employers bargaining power to negotiate better rates and coverage options from insurers.

2) Public programs (e.g., Ayushman Bharat in India):

Government-funded health programs establish national or regional risk pools, typically supported by taxes or public contributions.

- Ayushman Bharat, for example, is designed to provide free coverage to economically vulnerable populations in India. The cost of care for millions is covered through pooled public funds.

- Why it works: When the entire population contributes through taxes or subsidies, the financial burden of treating high-risk individuals is distributed broadly, even across people who don’t actively use the healthcare system. This is because the larger the pool, the more effective the risk distribution.

3) Individual/market plans:

In the individual retail insurance market (those offered by IRDAI-approved insurers), risk pools are formed by all individuals who purchase policies independently.

These pools can be more volatile, especially if they attract a higher proportion of high-risk individuals and a lower proportion of healthy ones.

In individual space, premiums are set based on age, number of members, location of residence, and medical history. Giving insurers more flexibility to build a stronger pool. Insurers also have the right to increase premiums on renewal due to age and inflation, which provides the insurer with a significantly higher level of sustainability.

With flagship or comprehensive products, insurers have complete discretion in underwriting. They decide who is allowed to enter the pool and can decline applicants or impose stricter conditions to protect the pool’s balance.

However, for IRDAI-mandated standard products like Arogya Sanjeevani, or for specialised plans targeting people with disabilities, mental health conditions, or chronic ailments, insurers are required to accept a much broader section of the population, often irrespective of pre-existing diseases (PEDs).

To manage this broader risk, insurers typically apply measures such as room rent limits, co-payments, or disease-wise sub-limits, and they may charge higher premiums. In addition, they often balance the financial strain by cross-subsidising with premiums collected from their other products.

Why it matters: Without healthy people in the mix, premiums can skyrocket. That’s why risk adjustment programs and subsidies are often used to stabilize these markets.

Regardless of the model, corporate, public, or individual, the core principle remains the same:

The strength of any insurance system depends on participation and balance within the pool.

Ditto’s Take on Risk Pooling in Health Insurance

At Ditto, we believe that risk pooling isn’t just a technical aspect of insurance; it’s the very reason health insurance works for real people.

When people sign up for a policy, especially for the first time, they often focus on one question: Will I get my money’s worth if I don’t fall sick? But health insurance isn’t a pay-and-claim product. It’s a system built on collective protection, not individual usage.

What many don’t realize is that your premiums aren’t stored in a personal account; they’re added to a common fund. This fund ensures that if anyone in the pool needs medical treatment, their costs are covered immediately, regardless of how much they’ve paid in so far. Even if you’re a new entrant, your claim can be honoured because the pool has been sustained over time by contributions from many others.

This mechanism serves two critical purposes:

- It protects policyholders by ensuring that even significant, sudden hospital bills can be absorbed without financial stress.

- It protects insurers by making costs predictable and manageable through a diversified pool.

For risk pooling to be effective, it requires a balance between high-risk and low-risk individuals, as well as between younger and older people, frequent users, and those who rarely make claims. That’s why we at Ditto often guide users not just toward the cheapest plan, but toward plans that operate within larger, healthier risk pools, because that directly impacts future premium stability and claim reliability.

A good way to assess this is by examining the insurer’s overall solvency position, the size of its annual premium collections from the health insurance segment, and its incurred claims ratio, which indicates how much is being spent on claims relative to the premiums collected. These indicators provide insight into whether the insurer’s pool is both extensive and financially sustainable.

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Ganesh below love us:

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

Risk pooling is the foundation of a functional health insurance system. By spreading medical costs across a diverse group, it ensures that care remains accessible and premiums stay affordable for all.

FAQs

What is risk pooling in insurance with an example?

Risk pooling is the practice of collecting premiums from a large group of individuals to create a shared fund that covers the healthcare needs of those who require it.

Example: If 1,000 people each pay ₹10,000 annually into a pool, and 50 of them need expensive treatment, the cost is covered by the pooled ₹1 crore, rather than individuals paying out-of-pocket.

What are the benefits of pooling of risk to an insurance company?

- Predictable costs: Large pools help insurers estimate claims more accurately.

- Stability: A balanced pool with a mix of low- and high-risk members reduces financial volatility.

- Sustainability: Spreads out the risk of large claims, preventing losses that could threaten solvency.

What are the principles of risk pooling?

- Collective contribution: Everyone pays premiums into a shared pool.

- Shared risk: Costs are distributed among all members, not just those who fall ill.

- Balance: A diverse mix of health profiles is essential for affordability and stability.

Can I get back my premium if I never file a claim?

No. Health insurance isn’t a savings product; it’s a risk protection tool. Your premiums help pay for others' claims today, just as theirs may help cover your costs in the future.

Do young and healthy people pay too much?

Not really. While they may not make frequent claims, their participation is crucial. It helps keep premiums affordable across the board and ensures support is there when they eventually need care.

Can risk pooling lower out-of-pocket costs?

Yes, indirectly. By stabilizing premiums and ensuring broad coverage, risk pooling reduces the likelihood of facing high out-of-pocket expenses for uninsured or uncovered treatments.

What is the role of reinsurance?

Risk pooling doesn’t stop at the level of a single insurer. To protect themselves from extremely large or unexpected claims, such as multiple high-value hospitalizations or a pandemic, insurers turn to reinsurance, which is essentially “insurance for insurers.”

In this system, numerous insurers contribute premiums to a larger reinsurance pool, creating a pool of pools. This spreads risk even further across the global insurance market, ensuring that no single insurer is overwhelmed by catastrophic losses. Reinsurance enhances the stability of individual insurers and, by extension, protects policyholders by ensuring that claims can be paid even in the worst-case scenarios.

What happens if too many people in the pool get sick at once?

If a large number of people in the same pool need medical care at the same time, the claims on the pool rise sharply. In the short term, insurers meet these costs using the premiums already collected and their financial reserves. For extreme situations, such as a pandemic or natural disaster, insurers also rely on reinsurance, which acts as a global safety net by spreading the risk across multiple insurers worldwide.

In the long run, if such events become frequent, insurers may revise premiums for the entire pool to maintain system sustainability. This is why having a large and diverse pool (encompassing both young and old, as well as healthy and sick individuals) is so important. It helps absorb shocks without making coverage unaffordable.

The IRDAI further safeguards policyholders by enforcing strict solvency requirements, ensuring insurers always maintain enough reserves. In worst-case scenarios where an insurer cannot sustain itself, IRDAI can step in to arrange additional funding, facilitate a takeover by a larger insurer or a group of insurers, and prevent systemic risks. This ensures that even if one insurer falters, policyholders remain protected and the broader insurance system stays stable.

Is risk pooling the same as cross-subsidization?

Not exactly. Risk pooling is the broader principle of collecting premiums from many people and using that shared fund to pay the claims of those who need medical care. It’s about spreading risk so that no single individual faces a crushing financial burden.

Cross-subsidization happens within that pool. It means that certain groups, such as the young and healthy, or those who rarely make claims, indirectly subsidize the costs of those who are older, sicker, or require frequent care. This isn’t a flaw; it’s how the system stays fair and sustainable.

So, while all cross-subsidization is part of risk pooling, not all aspects of risk pooling are cross-subsidization. Risk pooling also involves diversification, premium pricing, and regulatory oversight to maintain system balance.

Last updated on: