Quick Overview

Established in 2008 as a joint venture between Max India and the UK-based Bupa, the company commenced operations in 2010. Niva Bupa is a well-known private health insurer in India.

With over 10,000 network hospitals, the insurer operates as a standalone health insurance company and focuses primarily on medical coverage. This guide walks you through the key aspects of the plan, helping you understand whether it fits your needs.

Performance Metrics of Niva Bupa

Note: The values have been sourced from Niva Bupa Public disclosures. While the insurer has strong claims experience in retail health, recent customer feedback has highlighted rising service issues and increased complaint volumes.

Eligibility Criteria of Niva Bupa Aspire Health Insurance

Did You Know?

What Are the Key Features of Niva Bupa Aspire Health Insurance?

- Short Hospitalization Coverage: The plan allows claims for hospitalizations lasting at least 2 hours, provided all standard inpatient documents are submitted. This removes the usual 24-hour minimum requirement followed by many insurers.

- Free Health Check-ups: Free health check-ups are available from day one on a cashless basis. The benefit applies to a defined list of tests, capped at ₹500 for every ₹1 lakh of base sum insured.

- No-Claim Bonus (Booster+): The feature rewards you with an increase in sum insured at renewal by carrying forward unused base cover. Unlike a classic no-claim bonus, it can apply even beyond strictly claim-free years, strengthening your overall coverage over time.

- Restoration Benefit (ReAssure+): The plan offers unlimited restoration of the sum insured in a policy year after the first claim. It applies to the same or different illnesses, and both base and restored cover can be used for one claim after the first.

- Waiting Periods: There is a 30-day initial waiting period for illnesses, except accidents. Certain listed diseases, like cataract and glaucoma, also carry a mandatory 2-year waiting period before claims are allowed. There is a 3-year waiting period for pre-existing diseases.

- M-iracle Benefit: Covers maternity, IVF, adoption, and surrogacy expenses. Any unused sum insured can be carried forward(linked to Booster+ limits), up to 10 times the base cover. The newborn will be covered from day 1 in the policy.

- Lock the Clock+: Your premium stays linked to your entry age and does not increase with age until you make a claim. In the Titanium + variant, even a maternity claim does not impact the premium.

- No Sub-Limits: Aspire offers no room rent caps, no co-pay, and no disease-wise limits on covered treatments if you are hospitalized.

Add-ons That You Can Opt with Niva Bupa Aspire

Safeguard+

This reduces out-of-pocket costs and protects your cover growth. It includes coverage for non-payable and consumable items during claims. Booster+ remains unaffected if claims in a policy year stay below ₹1 lakh. It also increases your base sum insured annually, linked to inflation.

Fast Forward

This add-on lets you buy a 2-year or 3-year policy and combine the entire sum insured, including Base and M-iracle, into one pooled cover. You can use this pool anytime during the policy term, giving higher flexibility across years.

Future Ready

Future Ready allows guaranteed addition of your future spouse to the policy. Any waiting periods you have already completed will be transferred to your spouse. In order to use this benefit, the spouse must be added within 90 days of marriage.

WellConsult (OPD)

Covers unlimited teleconsultations, physical consultations up to ₹10,000 per year, diagnostics up to ₹10,000, and pharmacy expenses up to ₹2,500, all with a 20% co-pay. It also includes emotional wellness sessions, fitness coaching, and limited gym access.

Hospital Daily Cash

This add-on offers a fixed daily payout during hospitalization to help manage incidental expenses. The benefit is ₹1,000 per day for a sum insured up to ₹5 lakh, ₹2,000 per day for ₹7.5–₹15 lakh, and ₹4,000 per day for covers above ₹15 lakh.

Cash-Bag

Earn cashback for every claim-free year. You get 10% cashback on the first renewal and 5% on each renewal after that. Cashback can be used for premiums, OPD costs, deductibles, and co-pays.

Besides these, Niva Bupa Aspire provides add-ons for global health coverage, disease management, and an annual aggregate deductible.

Annual Premiums Across Variants and Profiles

Note: Listed annual premiums are for a sum insured of 15 lakh, residing in Delhi, with the safeguard+ add-on. The premiums can vary according to the medical underwriting and the city you reside in.

Inclusions and Exclusions of Niva Bupa Aspire

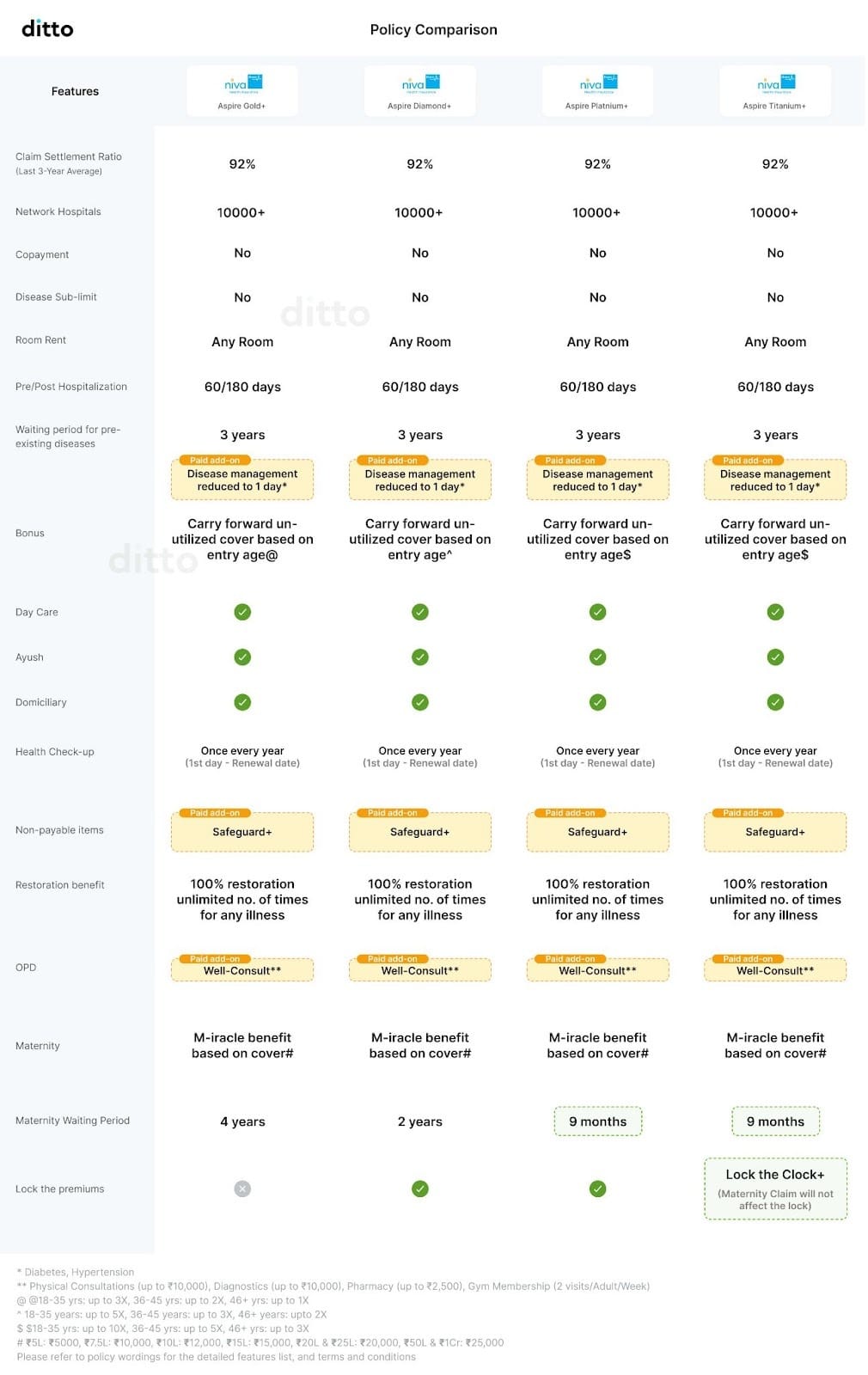

Check out the infographic for a comparative analysis of the policy variants.

Why Choose Ditto for Your Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Here’s why customers like Abhinav love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 5,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation with us. Slots are filling up quickly, so be sure to book a call now!

Ditto’s Take on Niva Bupa Aspire

Aspire offers an impressive set of features, especially for maternity and newborn coverage, but features alone aren’t enough. Before buying, it’s important to look at the insurer’s claim settlement history, service quality, and overall reliability. Speaking with an insurance advisor and checking real customer experiences can help you make a more balanced and confident decision.

Niva Bupa is our partner. If you’d like expert advice on whether Niva Bupa Aspire fits your maternity needs, book a call with us. At the same time, it’s wise to benchmark it against the best health insurance plans in India to understand how it compares on maternity waiting periods, newborn coverage limits, and overall claims experience before making a final choice.

Frequently Asked Questions

Last updated on: