Manipal Cigna Health Insurance: At a Glance

Manipal Cigna Health Insurance

Headquartered in Mumbai, Maharashtra, Manipal Cigna Health Insurance is a company that blends global healthcare expertise with deep Indian roots. It was launched in 2014 as Cigna TTK Health Insurance; in 2019, the venture transformed with Manipal Group’s acquisition of TTK’s stake, rebranding the insurer as Manipal Cigna.

Today, it operates as a joint venture between Manipal Education and Medical Group (51%) and Cigna Corporation (49%), with a pan-India footprint across 600+ cities and 100+ branches. Though national in reach, the company has been expanding aggressively in southern India, especially Tamil Nadu and Kerala.

While Manipal Cigna proudly calls itself the “best health insurance company in India” on its website and recently won ‘Product of the Year 2025’ for Sarvah, hurdles remain. Its financials have shown losses in recent years, and reports suggest LIC may acquire a 40–50% stake, potentially reshaping its future. So, does it live up to its bold promise — “Health Hai Toh Life Hai”? Let’s find out.

Metrics of Manipal Cigna Health Insurance

Key Insight: Manipal Cigna stands as a mid-tier player when compared to Ditto’s recommended insurers and industry standards. With a 91% claim settlement ratio(CSR), it matches the industry average but is not among the top 10 health insurance companies by CSR in India and trails leaders like HDFC ERGO (97%) and Aditya Birla (96%).

Complaints at 24 per 10,000 are higher than the median, though still better than Care Health and Niva Bupa. Moreover, its ICR at 68% is sustainable but below the industry median.

At the same time, its hospital network (8,500+) falls short of the 10,000+ norm we go by at Ditto. Lastly, Manipal Cigna Health Insurance’s business scale (₹1,215 crores) reflects a smaller footprint against peers’ multi-thousand-crore portfolios, indicating a weaker presence overall.

Manipal Cigna Health Insurance Plans

1) Manipal Cigna Sarvah

Manipal Cigna Sarvah is a comprehensive health insurance solution thoughtfully designed to meet the diverse healthcare needs of every Indian. Whether you are buying your first policy or seeking enhanced protection, Sarvah offers three tailored plan options. Collectively, Pratham, Uttam, and Param combine affordability, flexibility, and robust coverage. Their sum insured ranges from ₹5 Lacs to ₹3 Crore, giving customers the freedom to choose coverage that suits their health and financial requirements.

Key features of the plan include the Anant Benefit, available with the Uttam variant, which offers unlimited coverage for critical illnesses such as heart disease, cancer, stroke, and major organ or bone marrow transplants. The Gullak Benefit ensures a guaranteed cumulative bonus of up to 1000% of the base sum insured, regardless of whether claims are made. With the Tatkal Benefit, policyholders get critical care coverage with absolutely zero waiting period. Additionally, the Surplus Benefit provides an extra 100% sum insured from day one for the first claim in every policy year.

Sarvah offers unlimited tele-consultations with general physicians and no zonal co-pay restrictions, allowing faster recovery in any city of choice. The plan also covers a wide range of services, including pre- and post-hospitalization expenses, domiciliary hospitalization, AYUSH treatments, donor expenses, and ambulance services.

With eligibility starting from 91 days of age and no maximum entry age limit, it supports individual, family floater, and multi-individual options. Add-on benefits like personal accident cover, maternity expenses, and air ambulance further enhance the offering.

Plus, customers enjoy attractive 5% discounts on website purchases and up to 20% on wellness engagement programs, making Manipal Cigna Sarvah a truly consumer-centric and powerful shield against life’s unexpected health expenses.

2) ProHealth Prime

Manipal Cigna ProHealth Prime is a comprehensive health insurance plan offering sum insured options from ₹3 Lacs to ₹1 Crore. It provides unlimited restoration of sum insured for related and unrelated illnesses, covers non-medical expenses, and offers unlimited tele-consultations.

The plan comes in three variants: Prime Protect (the most comprehensive), Prime Advantage, and Prime Active, allowing customers to choose coverage tailored to their healthcare needs and budget.

Key benefits include the Guaranteed Cumulative Bonus (up to 200% of base SI), Switch Off Benefit, and Premium Waiver Benefit. Donor expenses, air ambulance (up to ₹10 Lacs), and bariatric surgery (up to ₹5 Lacs) are also covered.

Customers can optionally upgrade to “Any Room Category” (Suite or above) and choose from packages like Enhance Plus (maternity, health maintenance), Freedom (worldwide emergency hospitalization), and Assure (modern treatments, disease-specific sub-limits).

Apart from that, pre-existing conditions such as Asthma, Diabetes, Hypertension, and Obesity are covered with waiting periods. ProHealth Prime is available as Individual, Family Floater, and Multi-Individual plans, with tax benefits under Sec 80D (old regime)and online purchase discounts.

3) Lifetime Health

Manipal Cigna LifeTime Health is a comprehensive health insurance plan designed for lifelong coverage, offering sum insured options from ₹50 Lacs up to ₹3 Crore. The plan is available in two variants: India, which focuses on domestic healthcare needs, and Global, which extends coverage internationally for those seeking treatment abroad.

It stands out with unlimited restoration of the sum insured for unrelated illnesses, ensuring continuous protection even after multiple hospitalizations. Key benefits also include no co-payment, no disease-specific sub-limits, and annual health check-ups. It also covers worldwide emergency hospitalization.

In terms of optional add-ons, the Lifetime Health plan provides Critical Illness Cover, Health 360 OPD Cover, and Woman+ Rider for enhanced protection. However, maternity benefits and no-claim bonus are not part of the base plan, and room rent covers any category except suites, which require an add-on. Additionally, pre-existing conditions are covered after a 2-year waiting period, making it ideal for those seeking high, flexible, and long-term health security.

4) Prime Senior:

Manipal Cigna Prime Senior is a health insurance plan designed specifically for senior citizens, offering sum insured options from ₹3 Lacs to ₹50 Lacs. the plan comes in two variants, Classic and Elite, giving customers the flexibility to choose coverage based on their healthcare needs and budget.

It provides coverage for pre-existing diseases from the 91st day, with a standard waiting period of 24 months (reducible to 90 days via an add-on). Key features also include the option to choose “Any Room” category (including suites), unlimited restoration of sum insured (Elite plan), and annual health checkups.

Tele-consultation and domestic second opinions are available. However, a mandatory co-payment of 20% applies (modifiable to 0%, 10%, or 30%). The plan is available in Individual, Multi-Individual, and Family Floater formats, making it suitable for elderly individuals seeking long-term, customizable coverage to manage rising healthcare needs effectively.

Still unsure which Manipal Cigna plan is right for you? Speak to a Ditto advisor for unbiased guidance and find the policy that truly fits your needs.

Documents Required to Buy a Manipal Cigna Health Insurance Plan

For the most part, the documents required to buy Manipal Cigna Health Insurance are the same as those for any other health insurance plan. To buy a health insurance policy in India, you’ll typically need the following documents:

- Identity Proof (Aadhaar, PAN, Passport, Voter ID, Driving License)

- Address Proof (Aadhaar, Passport, Rental Agreement, Bank Statement, HR Letter)

- Age Proof (Birth Certificate, Aadhaar, Passport, Marksheet)

- Passport-size Photographs

- Income Proof (Salary Slip, Form 16, ITR, Bank Statement) – for high-value policies

- Medical Reports (when declaring pre-existing diseases)

- Pre-policy Medical Tests or tele/video medical examination (based on age, sum insured, or lifestyle)

- Proposal Form (filled with personal, medical, and lifestyle details)

These help ensure accurate policy issuance and smooth claim processing. You can read more about it in this article.

How do I Raise a Claim Request with Manipal Cigna Health Insurance?

You can raise a claim request with Manipal Cigna Health Insurance through their official website using this link:

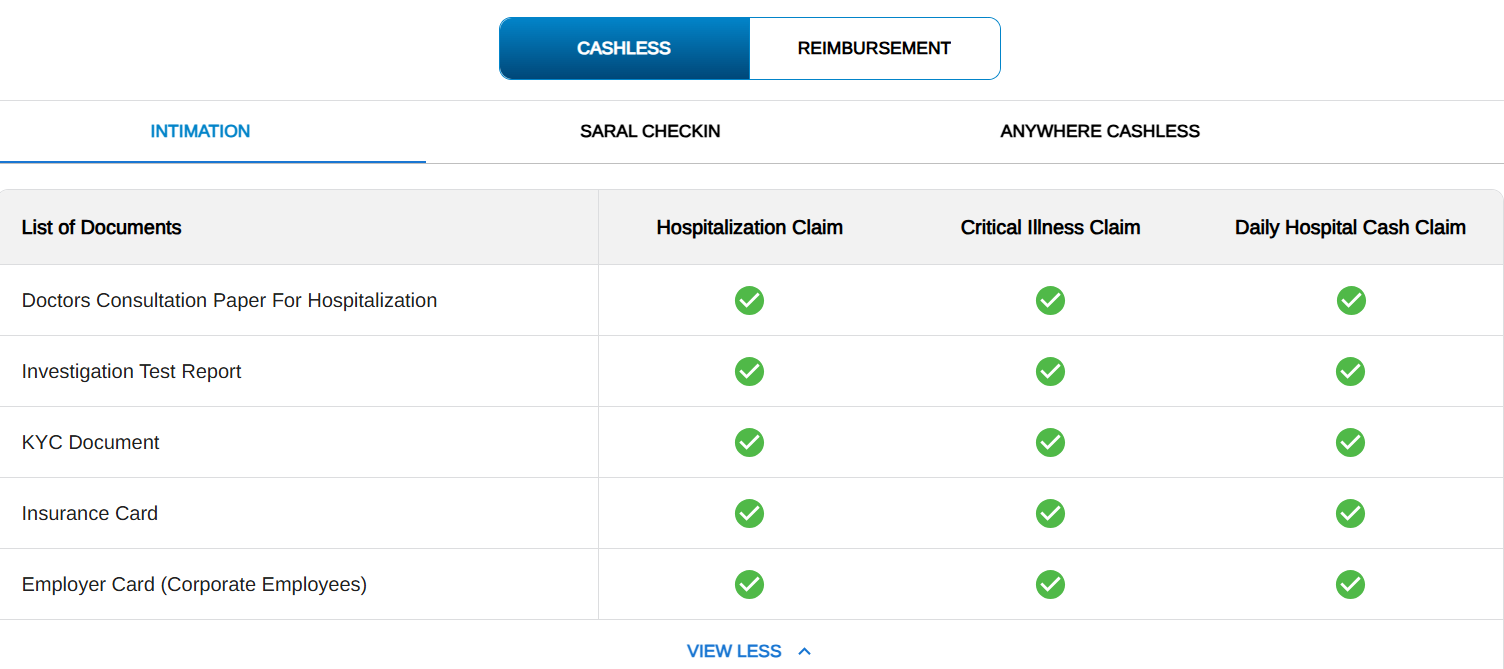

Documents Required for a Manipal Cigna Health Insurance Claim

Again, the documents required for a Manipal Cigna Health Insurance claim are the same as those for any health insurance claim with any insurer. Here’s a list:Documents Required for Cashless Health Insurance Claims with Manipal Cigna

- Pre-authorization form from the hospital

- Health card or policy copy

- Government-issued photo ID (Aadhaar, PAN, Passport)

- Hospital admission card or notes

- Doctor’s prescription or advice for treatment

- Diagnostic test reports (if applicable)

Documents Required for Reimbursement Health Insurance Claims

- Duly filled and signed claim form

- Hospital discharge summary

- Original hospital bills and payment receipts

- Pharmacy/medicine bills with prescriptions

- Diagnostic test reports (lab and imaging)

- Doctor’s prescription or advice for hospitalization

- Indoor case papers or nursing sheets (if requested)

- Implant invoices and stickers (if any)

- Government-issued photo ID and age proof

- Health card or policy copy

- FIR or Medico-legal case report (in case of accidents)

These essential documents ensure your health insurance claim (whether cashless or reimbursement) is processed quickly and without hassle. You can read more about this in this article or on Manipal Cigna’s official website.

Did You Know?

Health insurance can be confusing, but it doesn’t have to be. Book a free consultation with Ditto’s experts and get clarity before you decide.

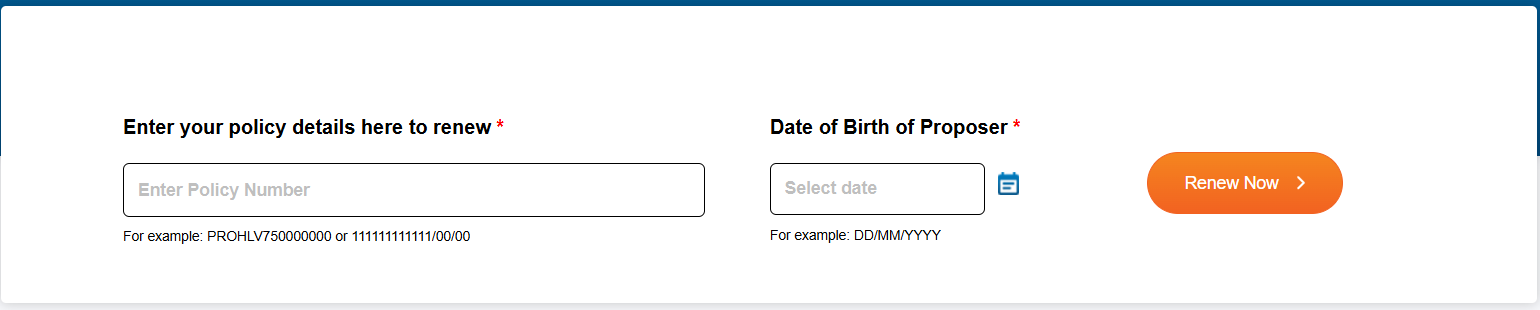

What is the renewal process for Manipal Cigna Health Insurance?

You can renew your Manipal Cigna Health Insurance on their official website through this link.

In case you get stuck somewhere, use these numbers to get in touch with Manipal Cigna agents over the phone:To Renew: 1800 102 4465

For Service: 1800 102 4462

To Buy: 1800 102 4464

Expert Assist (India): 1800 102 4462 (Toll-free)

Expert Assist (Outside India): +91 22 4985 4100 (Call charges as per your plan)

Chat Support: Click the Expert Assist Icon at the bottom right corner of the screen to chat with Manipal Cigna Health Insurance experts.

Why Consider Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Abhinav below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Should You Buy Manipal Cigna Health Insurance?

Manipal Cigna Health Insurance brings a mix of innovation and flexibility with plans like Sarvah, ProHealth Prime, Lifetime Health, and Prime Senior. Features such as unlimited restoration, high cumulative bonuses (even with claims), wellness discounts, annual health check-ups, OPD, maternity, and even global coverage make it attractive on paper.

But while the insurer has fairly good performance metrics and strong parentage, it still operates at a smaller scale than peers like HDFC ERGO, Care Health, or Niva Bupa. Since Manipal Cigna is not a Ditto partner insurer, we cannot comment on post-sales support or claims experience. However, based on publicly available data, it stands out as a decent insurer overall, especially for those seeking comprehensive and customizable protection.

Frequently Asked Questions (FAQs)

How do I know if my claim with Manipal Cigna has been authorized or not?

Once you submit your pre-authorization request, Manipal Cigna or their TPA (Third Party Administrator) will process it as per IRDAI guidelines and notify you via SMS, email, or through their customer portal about the claim status.

What do you mean by Health Insurance Benefit from Manipal Cigna?

It refers to the financial coverage and services you receive under your health insurance plan, including hospitalization costs, pre- and post-hospitalization expenses, domiciliary treatments, and specialized benefits like Anant Benefit and Gullak Rewards.

What happens if I miss submitting a required document for my claim?

Missing documents can lead to delays or rejection of your claim. It’s important to submit all required documents on time and keep copies of everything for future reference.

How soon should I submit my health insurance claim documents after discharge?

Typically, documents should be submitted within 15 days of discharge, depending on your policy terms. Timely submission helps avoid claim rejection due to delays.

Does Manipal Cigna use TPA services or Inhouse claim settlement?

Most insurers use TPAs for empanelment and administration; Ditto prefers that retail (individual) claims be handled in-house for faster turnaround times. ManipalCigna processes claims largely in-house but still outsources a small percentage of individual claims to TPAs.

How do I calculate premiums for Manipal Cigna Health Insurance?

You can use this link to calculate premiums for Manipal Cigna.

Last updated on: