| What is a Health Insurance Rider? A health insurance rider is an optional add-on provision to a standard health insurance policy that customizes the coverage by providing additional benefits in exchange for an extra premium payment. These riders cover specific medical expenses not included in the base policy, such as consumables, maternity, waiting period reduction, or higher room rent limits. |

A standard health insurance policy easily covers your hospitalization expenses, such as surgeries, room rent, and prescribed medicines during inpatient care. However, many real-world needs, like outpatient consultations or maternity care, are often excluded. This is where a health insurance rider proves valuable. These add-ons can be built into your plan or purchased separately for a nominal extra premium.

At Ditto, we’ve analysed over 200+ health insurance policies to create this guide on how riders work and which ones truly add value.

Did you know? Choosing the wrong insurance plan could cost you a lot in the long run! But our IRDAI-certified advisors offer free consultations to help you pick the right policy! Book a call now – no pressure, no spam, just honest insurance advice.

Types of Health Insurance Riders Available in India

Here’s a comprehensive list of health insurance riders in India categorized based on individual requirements, medical history, and overall suitability.

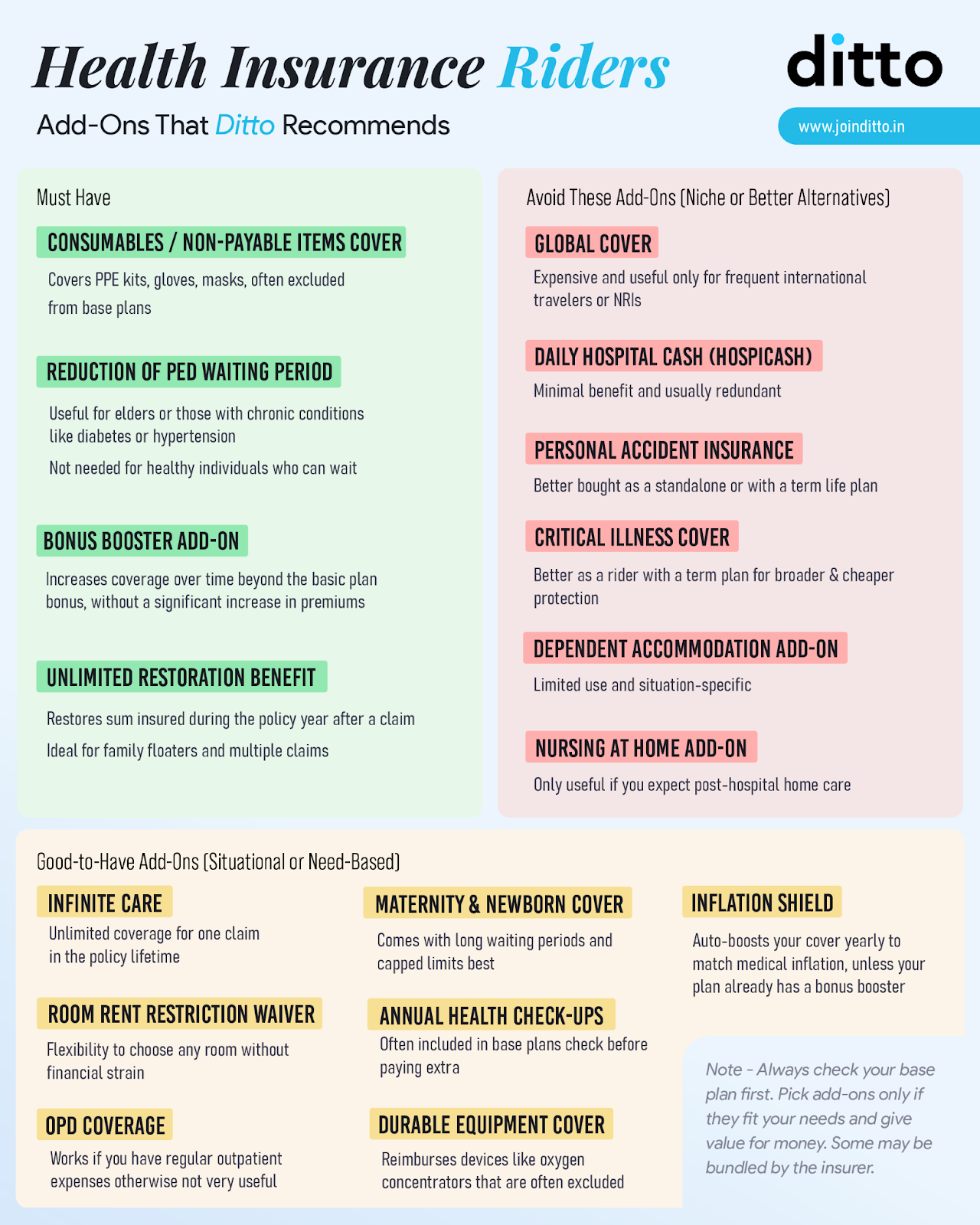

Ditto’s Recommended Add-ons (Must-have)

- Pre-existing Condition (PED) Waiting Period Waiver: Reduces or removes waiting periods for pre-existing diseases, and gives quicker access to claims for chronic conditions like diabetes or hypertension.

- Consumables Cover: Pays for non-medical hospital items like gloves, masks, and syringes, which can otherwise add up to 5-15% of the total bill, payable out of pocket.

- Restoration Benefit: Restores your sum insured after exhaustion, and is ideal for the worst-case situation where multiple hospitalizations in a year happen (e.g HDFC Ergo Optima Secure’s unlimited restore add-on).

- Super Bonus Add-on: Boosts the sum insured every year, even after claims. For example, Care Supreme’s cumulative bonus super rider adds 100% annually, up to 500%.

Good-to-have Add-ons (Situational or Need-based)

- Room Rent Restriction Waiver: Provided by plans like ICICI Lombard Elevate, it removes room rent caps, allowing you to choose any hospital room without extra cost.

- OPD Coverage: Covers consultations, tests, and medicines without hospitalization requirements, helpful for families with frequent medical visits.

- Maternity and Newborn Cover: Covers childbirth, prenatal/postnatal care, and newborn expenses, though often with waiting periods and caps.

- Ambulance and Emergency Transport: Covers full or higher costs of road or air ambulance services, ensuring timely care without cost worry.

- Annual Health Check-ups: Covers yearly diagnostic tests for early detection and better long-term health outcomes.

- Durable Equipment Cover: Reimburses long-term medical equipment, such as oxygen concentrators or wheelchairs (e.g., Aditya Birla ActiveOne Max's add-on covers the cost of durable items up to ₹5 lakh or the base sum insured, whichever is lower).

- Inflation Shield: Offered by plans like Niva Bupa Reassure 2.0 Titanium +, this rider automatically increases the sum insured annually to keep pace with rising healthcare costs.

Add-Ons for Niche Needs

- Global Cover and Zonal Upgrade: Provides treatment abroad and in higher-cost city zones without restrictions or co-payments.

- Daily Hospital Cash: Offers a fixed daily cash allowance during hospitalization for food, travel, or income replacement.

- Critical Illness Cover: Pays a lump sum on critical illnesses like cancer or stroke, useful for expenses or income loss, but better taken with a term plan for broader, cost-effective cover.

- Personal Accident Insurance: Gives financial compensation for accidental death or disability, supporting families in crisis.

- Dependent Accommodation: Pays for the caregiver or family member’s boarding while you’re hospitalized away from home. For example, ICICI Lombard Elevate’s add-on pays a set amount if hospitalization lasts at least 3 days.

- Nursing at Home: Covers professional nursing costs at home after hospitalization for recovery or chronic care. ICICI Lombard Elevate pays a fixed daily amount for up to 15 days after hospitalization with this add-on.

- Vaccine Cover: Reimburses costs of routine and preventive vaccinations, helping families manage wellness expenses.

Ditto’s Advice: Choose riders only if they fit your needs and give value for money. Some of them may already be bundled with your base plan.

| Quick Note: All add-ons for a health insurance plan are listed in the plan brochure and prospectus, while their working and terms and conditions appear in the policy wording or a separate rider prospectus. However, not all listed add-ons are made live by insurers. Always check availability and terms before buying. |

Difference Between Riders and Add-on Covers in Health Insurance

IRDAI does not define “rider” and “add-on” separately in law. Both are treated as supplementary benefits linked to a base health insurance product.

They must be:

- Approved by the insurer’s Product Management Committee

- Filed with IRDAI and given a unique identification number (UIN)

- Withdrawn only with proper notice and alternatives for customers.

The classification (rider vs. add-on) is essentially a matter of insurer product design and marketing, not a regulatory distinction.

| Did You Know? While most health insurers use the terms rider or add-on interchangeably to describe benefits that can only be purchased along with a base plan, there are exceptions. Some policies, such as Star Outpatient Care, HDFC Ergo Dengue Care, or even super top-ups, function as independent add-ons. You can leverage them without having the base plan (and even from a different insurer) to serve a specific purpose, though such cases are rare. |

What are the Benefits of Buying Riders Under Health Insurance Policies?

If you want to expand your insurance coverage affordably, riders are the best option. They offer several benefits, such as:

- Expanded and Customized Coverage: You get extra protection for specific illnesses or scenarios otherwise excluded or limited in the base plan.

- Cost-Effectiveness: Adding riders also prevents the need to purchase multiple separate policies.

- Increased Financial Security: Add-ons provide you with financial backup that can cover unexpected, high-value medical expenses (such as critical illness or accidents) during emergencies.

- Flexibility: You enjoy greater flexibility with riders as they can often be added, changed, or removed during policy renewal to meet your needs.

Ditto’s Verdict: With the right combination of riders, your policy will match your health requirements more closely, ensuring you're not underinsured or paying for irrelevant features.

How Do Riders Affect Your Premiums?

The impact on your premium depends on the type and number of riders you choose, along with your personal risk profile. Here’s an overview:

- Extra Premium Required: Every rider is an add-on benefit, and each requires an additional premium payment on top of the base policy premium.

- Nominal Cost: Rider premiums are generally much lower than the cost of buying an entirely new or separate policy for similar coverage.

- IRDAI Limit: In India, the IRDAI requires that riders be sourced from the same insurer as the base plan.

- Nature and Scope: Riders covering significant risks or higher sums insured will further increase the premium.

- Multiple Riders: Selecting multiple riders will cumulatively raise the total cost, sometimes even going above the premiums of the base plan.

Limitations of Health Insurance Riders

Riders help you avoid being stuck with a “one-size-fits-all” plan and build a tailored solution that fits your life, health, and budget. However, they have their share of downsides.

- Terms and Conditions: Each rider comes with its own limits, exclusions, and conditions tied to the base policy. For example, if the base plan is only for ages 18–65, the same rule applies to its add-ons.

Ditto’s Advice: Never assume that a rider will cover everything, so read the policy wording carefully. If unsure, book a call and consult our advisors.

- Zero Guarantee: Insurers can revise or withdraw add-ons at renewal, so a rider you buy today may not stay the same in future years. It may also have higher premiums, revised benefits, or be discontinued entirely.

- Not all Riders are Compatible: Not all riders can be combined. For instance, Care Supreme allows either a 1-year PED waiting period cut or immediate cover for select diseases, but not both.

Remember: Add-ons are never guaranteed for life unless they are built-in features of the base plan.

- Lack of Flexibility: Some insurers don’t allow removal at renewal, and a few make certain riders mandatory, like Care Supreme’s Air Ambulance, Wellness Benefit, and Cumulative Bonus Super.

Ditto’s Take: Before you buy every rider available with the base policy, understand the cost implications and regulatory caps.

Health Insurance Plans and Riders That Make Ditto’s Cut

| Before we discuss the list, here’s how we decide what plans to feature. At Ditto, every health plan goes through our six-point evaluation framework. It doesn’t mean these are the only good plans, but that they stand out after being scored across all six pillars. You can learn more about how we evaluate health insurance plans here. |

Although all health insurance policies today provide riders, we recommend a few standout plans because of their comprehensive coverage and strong performance in the market.

| Plan Name | Key Riders | Where to Find (in Policy Wording) |

| HDFC ERGO Optima Secure | ABCD Chronic Care (covers asthma, BP, cholesterol, diabetes), Parenthood (maternity benefits), Unlimited Restore, Optima Wellbeing (wellness & multiple claims support) | Page 9, Optional Covers Section |

| Care Supreme | Instant Cover (shorter wait for select PEDs), Claim Shield (non-payable items), OPD Benefits (outpatient coverage) | Page 7 |

| Aditya Birla Activ One Max | Chronic Care with Day 1 PED cover, Durable Equipment Cover (wheelchairs, ventilators), Vaccine Cover (epidemics and pandemics) | Appendix A, Section C |

| Niva Bupa Aspire Titanium+ | Safeguard+ (covers exclusions and inflation), Disease Management (zero-day wait for hypertension/diabetes) | Optional Benefits Section |

| ICICI Lombard Elevate | Waiting period reduction riders (for PEDs, maternity, specific illnesses), Claim Protector (excluded items), Nursing at Home | Page 52, Add-ons/Optional Covers Section |

How to Choose the Right Riders for Your Health Insurance? Ditto’s Take

Your choices of riders should reflect your actual healthcare needs. This involves considering the following:

- Family Size and Dependents: Maternity cover suits young families, while OPD or PED waivers help aging parents.

- Pre-existing Conditions: A waiting period waiver ensures faster claims for existing illnesses.

- Age: Younger buyers benefit from bonus boosters or OPD coverage, seniors from home care or equipment cover.

- High-impact Add-ons: Choose riders with strong value, like restoration benefits for family floaters or critical illnesses.

Pro Tip: Health insurance plans vary widely across insurers, and so do their riders. Ditto’s policy comparison tool and expert advisors can help you understand what’s necessary based on what your base plan already offers.

Why Choose Ditto for Health Insurance

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right health insurance policy. Here’s why customers like Amarnath love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Health Insurance Riders: Key Takeaways

Riders are the best way to fill coverage gaps and avoid unnecessary premiums. You can easily customize your health insurance plan to match your medical needs, lifestyle, and financial goals.

Remember:

- Riders are only effective when chosen wisely.

- Review your base plan, analyze your health risks, and use expert tools like Ditto’s advisory to avoid overbuying or missing out on benefits.

Still confused about which insurance add-on is the right choice for you? Book a call or chat with us on WhatsApp at a convenient time.

FAQs

What is the process to add an insurance rider to my health policy online?

You can add a rider mostly during the purchase of the policy. You can also add it during renewals, provided the insurer's underwriting allows it.

What is the process to remove an insurance rider from my policy?

You can get a rider removed from your insurance policy during free look periods or at renewals if the insurer’s underwriting allows it.

What are the tax benefits of health insurance premiums and add-ons under Section 80D?

Under the old tax regime, you can claim deductions up to ₹25,000 for self and family (below 60) or ₹50,000 (60+), and the same limits apply for parents, making the maximum possible deduction ₹1,00,000.

Last updated on: