Quick Review

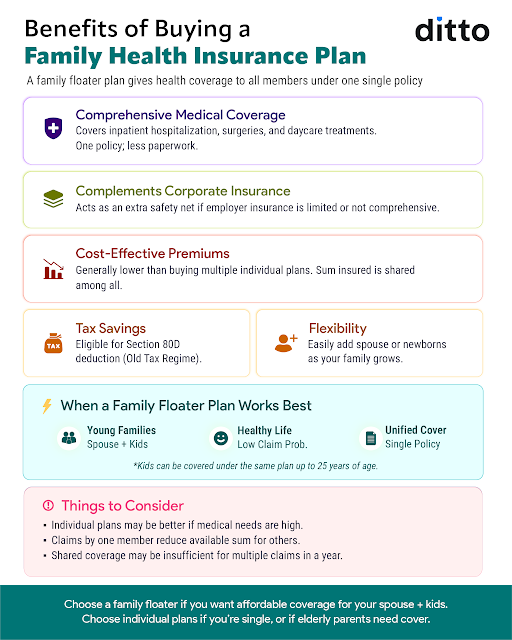

For many Indian households, a single income supports the entire family. An unexpected hospitalization of a spouse or child can quickly drain savings set aside for education, loan repayments, or long-term plans. A family health insurance policy provides shared coverage and helps safeguard everyone’s finances under one plan.

HDFC ERGO Health Insurance, one of India’s leading health insurers, has built a strong reputation over its 20+ year history for reliability and customer-centric offerings. The company reports an average claim settlement ratio of 96.71% (FY 2022–25), reflecting a consistently high rate of claim approvals. Its incurred claim ratio of 85.83% (FY 2021–24) indicates sound underwriting and financial stability. Its low complaint rate of 9.28 per 10,000 claims (FY 2022–25) further highlights efficient operations and effective customer service.

Here, we break down HDFC health insurance plans for family, explain what they cover (and what they don’t), and help you decide whether they deserve a place in your financial plan for 2026.

Best HDFC Health Insurance Plans for Family

Quick Summary:

- Optima Secure is ideal for young families who want high coverage but are on a budget. The main "con" is that you are paying for premium features.

- Optima Super Secure is suited for families seeking very high coverage quickly and who are comfortable with a mandatory 3-year commitment that involves a higher upfront payment.

- Medisure Super Top-Up is a cost-efficient super top-up plan that complements an existing base health insurance policy. The downside is that it kicks in only after the chosen aggregate deductible is fully exhausted in a policy year. For example, a ₹20 lakh plan with a ₹3 lakh deductible covers claims only after the first ₹3 lakh (across multiple hospitalizations) is paid. However, it is not very feature-rich, lacks a Restoration Benefit and No-claim bonus, and does not include free health check-ups.

Beyond the flagship Optima Secure and Optima Super Secure plans, HDFC ERGO also offers specialized health insurance options designed for different budgets and usage patterns:

- Optima Lite (Budget Variant): It is a budget-friendly health plan aimed mainly at Tier 2 and Tier 3 cities, offering sum insured options of ₹5 lakh and ₹7.5 lakh. It provides structured restoration benefits, no disease-wise sub-limits, and cumulative bonuses, making it suitable for basic coverage at a lower premium, though it comes with room rent limits and no availability in Tier 1 cities.

- Health Wallet (OPD-Focused Plan): It is a flexible health plan available on both individual and family floater bases, with a unique Reserve Benefit that covers OPD expenses like diagnostics, vaccinations, and specialist consultations. Unused OPD funds carry forward with a 6% bonus at renewal, and the plan also includes a restore benefit if the sum insured is exhausted.

- Aarogya Sanjeevani (Standardized Entry-Level Plan): HDFC ERGO Aarogya Sanjeevani is an IRDAI-mandated, standardized health insurance plan that offers basic hospitalisation cover at an affordable premium. It includes in-patient treatment, pre- and post-hospitalization expenses, day-care procedures, AYUSH treatment, ambulance cover, and a cumulative bonus for claim-free years. While economical, it comes with tighter limits, including room rent capped at ₹5,000/day, a mandatory 5% co-payment on each claim, specified disease-wise sub-limits, and other limitations.

These plans address specific needs and are not direct substitutes for comprehensive family floater policies.

Premium Comparison for HDFC Health Insurance Plans for Family

Premiums for HDFC family health insurance plans depend on factors such as the age of insured members, family composition, city of residence, and sum insured.

The table below illustrates base premiums for a ₹15 lakh family floater policy in Delhi, for non-smokers with no pre-existing conditions and no optional covers selected:

Note: Actual premiums are subject to underwriting and insurer guidelines. Pricing may change based on optional covers and other risk factors. Please refer to the insurer’s official website for the most current rates.

What Is Covered And Not Covered in HDFC Health Family Plans?

Note: This list is not exhaustive. Always review your policy for full details and to understand how each inclusion is covered, and the terms and conditions.

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call now, slots fill up fast!

Ditto’s Take on HDFC Health Insurance Plans for Family

HDFC Health Insurance plans for family offer comprehensive coverage backed by consistently strong operational performance. These plans deliver broad protection with a wide range of in-built features and optional add-ons, allowing families to customize coverage based on their needs. HDFC ERGO’s high claim settlement ratio, low complaint levels, and extensive hospital network (13,000+) underscore its reliability in both policy servicing and claim settlements.

That said, premiums can be relatively higher for almost all profiles when compared to some peers. However, this pricing is often offset by HDFC ERGO’s scale, stability, and track record of dependable claim handling and post-sales support. We recommend evaluating the benefits carefully and choosing a plan that best aligns with your family’s healthcare requirements and long-term financial goals.

Disclaimer: HDFC ERGO is a partner insurer of Ditto. The information in this article is based on the insurer’s website, policy wordings, official disclosures, IRDAI-published data, and Ditto’s claims-handling experience with thousands of customers. You can read more about how we evaluate insurers on Ditto’s Cut.

Frequently Asked Questions

Last updated on: