| What Does Fixed Benefit Policy Mean? A fixed benefit policy pays a predefined lump sum when you’re diagnosed with a covered critical illness or medical condition, regardless of actual treatment costs. It provides quick financial support for treatment, recovery, or income replacement. You can get it as a standalone plan or as a rider with health or term life insurance. Pairing it with a term plan is often recommended for comprehensive coverage with affordable premiums. |

When it comes to health insurance, most people focus on getting their hospital bills reimbursed. But what if you could receive a fixed lump sum payout the moment a serious health event occurs? That’s what a Fixed Benefit Policy does.

Also called a lump sum health insurance plan, benefit-based plan, or critical illness fixed benefit plan, this type of policy pays a pre-agreed amount when certain events occur, like a critical illness diagnosis, hospitalization, or accident. Unlike regular indemnity plans, the payout isn’t tied to actual expenses. It gives you the freedom to use the money however you need.

In this guide, we’ll break down what a fixed benefit policy is, how it works, its benefits, terms and conditions, common inclusions and exclusions, who it’s suitable for, and share some popular standalone fixed benefit policies.

If you find any term or wording confusing, or need help deciding which policy is right for you, feel free to connect with a Ditto advisor. Book a free call with our expert to get unbiased, personalized guidance and make an informed choice.

What Does a Fixed Benefit Policy Mean?

A Fixed Benefit Policy is a type of health insurance lump sum plan that pays out a pre-agreed lump sum benefit to the insured when certain events happen, regardless of the actual treatment costs incurred. These events include diagnosis of listed critical illnesses, accidental death or disability, or hospitalization (hospital cash plans). For example, upon first-time diagnosis of cancer or heart attack, the insured receives a fixed payout that can be used at their discretion.

This is different from indemnity health insurance, where claims are reimbursed only after you submit bills for actual expenses. In a fixed benefit policy, the payout is triggered by the diagnosis itself. Once a qualified doctor certifies the illness, you receive the lump sum benefit which is completely independent of your treatment cost

Some plans may require you to survive for a short period after diagnosis (for example, 15 or 30 days) before the payout is made. Others offer a zero-day survival period, allowing an immediate payout.

Fixed benefit plans provide certainty of payout amounts and flexibility in how the insured uses the claim proceeds, whether for medical expenses, lifestyle adjustments, or income replacement.

Term (life) insurance is often categorized as a type of fixed benefit plan, as it pays a lump sum death benefit on the insured’s demise. Similarly, critical illness insurance plans under the fixed benefit model provide lump sum coverage for major illnesses.

How Does a Fixed Benefit Policy Work?

- Pre-Defined Event Coverage: The policy covers specific illnesses or conditions such as cancer, heart attack, stroke, kidney failure, etc. When the insured is diagnosed with one of these covered illnesses, they become eligible for the payout.

- Fixed Lump Sum Payout: Upon diagnosis of the covered illness and submission of a certified medical/diagnosis report, the insurer pays a fixed amount agreed upon when the policy was purchased. This lump sum is paid irrespective of the actual hospitalization or treatment expenses.

- No Medical Bills Submission: Unlike indemnity plans, there is no need to submit hospital bills or proof of expenses. A diagnosis report confirming the illness is sufficient to claim the fixed benefit.

- Flexible Use of Payout: The insured has full freedom to use the lump sum payout for any purpose, including medical treatment, rehabilitation, household expenses, lost wages, or travel.

- Waiting Periods and Survival Periods: Policies generally include a survival period (e.g., 15 or 30 days after diagnosis) before the payout is released, as well as an initial waiting period (usually 90 to 180 days) and longer waiting periods (up to 3 years) for pre-existing conditions.

- Claim Termination: Usually, after the lump sum is paid for a covered illness, the policy terminates for that event (some plans may allow multiple claims for different severity of illnesses).

The fixed benefit policy in health insurance provides quick financial support during critical illness and helps with expenses beyond hospital bills, such as lost income and lifestyle adjustments. However, premiums for fixed benefit plans are often higher than indemnity plans for similar sums insured.

Eligibility for Fixed Benefit Health Insurance

Eligibility Criteria in Fixed Benefit Policy

- Entry Age: Commonly from 5-18 years up to 65 years of age.

- Policy Tenure: Options vary from 1 to 3 years, with some plans offering lifetime renewals.

- Sum Insured: Typically ranges between ₹1 lakh to ₹1 crore based on the plan.

- Waiting Periods:

- Initial waiting period for new illnesses, usually 90 days.

- Extended waiting period for pre-existing diseases, typically 36 months.

- Survival Period: Minimum days (15, 30, or 0 days) the insured must survive post diagnosis to qualify for payout.

- Disclosure: Full disclosure of medical history, age, occupation and lifestyle at application.

Important Conditions

- The fixed benefit payout is triggered only once for each covered condition per policy term.

- The policy may terminate after payout for the diagnosed illness.

- Some plans allow multiple claims for different illnesses or events.

Common Inclusions and Exclusions in Fixed Benefit Policy

| Inclusions | Exclusions |

|---|---|

| Lump sum payout on first diagnosis of covered critical illnesses. | Pre-existing conditions which lead to critical illnesses. |

| Personal accident coverage in some plans, including death and permanent disablement. | Self-inflicted injuries, suicide attempts. |

| Additional benefits like child education support, annual health check-ups, and second medical opinions in specific plans. | Injuries from substance abuse or intoxication. |

| Injuries and illnesses from hazardous activities or acts of war. | |

| Maternity, pregnancy-related complications, and congenital diseases. |

Some Standalone Fixed Benefit Policies: Overview and Comparison

1. HDFC ERGO Critical Illness Platinum Plan Features

- Covers 15 major critical illnesses.

- Sum insured from ₹1 lakh to ₹50 lakhs.

- Survival period options: 15 or 30 days.

- Requires pre-policy medical tests depending on age and sum insured.

2. Care Assure Fixed Benefit Plan Features

- Covers 20 critical illnesses plus personal accident cover (death and permanent disability).

- Sum insured from ₹5 lakhs to ₹1 crore.

- Zero-day survival period for immediate payout.

- Additional child education cover of 10% sum insured.

- Annual health check-ups and second medical opinion services.

Note: Fixed benefit plans, such as Critical Illness (CI) coverage, can be added as riders to term insurance, combining life cover with lump sum payouts for critical illnesses.

A term plan already provides life cover, ensuring your family gets a lump sum if you pass away. By adding a fixed benefit rider, such as Critical Illness cover, you also receive a lump sum if you’re diagnosed with a major illness.

Since riders are usually more affordable than standalone fixed benefit policies and their premiums remain fixed throughout the term, they make long-term planning predictable and give you comprehensive protection.

For instance, the HDFC Click 2 Protect Supreme Term Plan + Health Plus CI Rider provides a substantial death benefit under the core policy, while the CI rider pays a predefined lump sum if you are diagnosed with a covered critical illness like cancer, heart attack, or kidney failure.

Pros of Buying a Fixed Benefit Policy

- Provides a guaranteed lump sum payout upon diagnosis, independent of treatment costs.

- Offers flexible usage of payout for medical and non-medical expenses.

- Faster and simpler claims process compared to indemnity policies.

- No sub-limits on illnesses covered; lump sum payable irrespective of actual costs.

- Can be combined with term insurance or indemnity health insurance for holistic coverage.

- Tax benefits under Section 80D (under the old tax regime) are available towards premiums paid towards the policy.

- Reduces financial uncertainty by locking in payout amounts.

Cons of Buying a Fixed Benefit Policy

- Coverage limited to predefined critical illnesses, unlike broader indemnity plans.

- Premiums for fixed benefit policies are higher and rise with age and inflation, except when chosen as a rider with a term plan.

- Waiting periods limit early claims for some conditions.

- Typically excludes routine or minor health issues.

- Not ideal as a sole health insurance option; best used as complementary cover.

Who Should Buy a Fixed Benefit Policy?

- People with a family history of critical illness: If conditions like cancer, heart disease, or stroke run in your family, a critical illness fixed benefit plan can give you extra financial protection.

- Primary earners or sole breadwinners: Since this type of health insurance lump sum plan pays out immediately after diagnosis, it can help replace income if you need time off work.

- Individuals seeking quicker, hassle-free claims: Unlike indemnity policies that require hospital bills, fixed benefit policies pay based on diagnosis, making them ideal if you want faster, simpler payouts.

- People who want financial flexibility: The lump sum benefit isn’t tied to medical expenses alone. You can use it for recovery costs, travel for treatment, paying EMIs, or everyday expenses.

- Young professionals planning long-term protection: Young professionals early in their careers can benefit from a fixed benefit policy, as it provides coverage for critical illnesses and financial support to offset potential income loss.

- Those with existing indemnity health insurance: A fixed benefit policy works well as a supplement. While indemnity covers hospitalization bills, the fixed benefit payout gives you additional financial cushioning.

In short: Anyone who wants certainty, flexibility, and quick financial support in case of a major health event should consider a fixed benefit policy.

Why Choose Ditto for Health Insurance

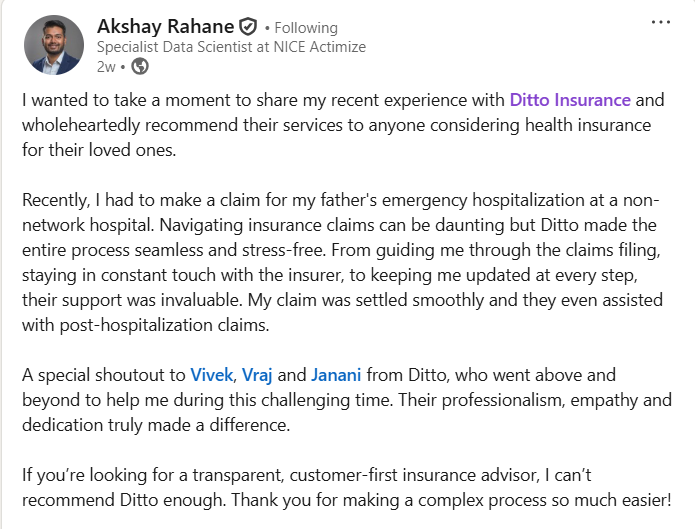

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Here’s why customers like Akshay love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

Conclusion

Fixed Benefit Policy is an important part of a comprehensive health and life insurance strategy. Unlike indemnity-based plans that reimburse actual medical expenses, fixed benefit policy provides a predefined lump sum payout upon diagnosis of critical illnesses, hospitalization, or accidental events.

This payout gives insured individuals financial certainty and flexibility. It helps them cover treatment costs, daily expenses, income loss, or lifestyle adjustments without delays or excessive paperwork.

We hope this article gave you a complete understanding of what a fixed benefit policy is and who might benefit from it.

If you find any term or wording confusing, or need help deciding which policy is right for you, feel free to connect with a Ditto advisor. Book a free call with our expert to get unbiased, personalized guidance and make an informed choice.

FAQs

What is a fixed benefit health insurance policy?

A fixed benefit health insurance policy provides a predetermined lump sum payout to the insured upon diagnosis or occurrence of specific covered events like critical illnesses or accidents, regardless of the actual medical expenses incurred, offering financial flexibility during treatment and recovery.

How does a fixed benefit policy differ from an indemnity plan?

Unlike indemnity plans which reimburse actual medical bills, fixed benefit policies pay a fixed lump sum upon a qualifying event, simplifying claims and allowing the insured to use the funds as needed without submitting detailed expense proofs.

When is the lump sum payout given in a fixed benefit plan?

The lump sum is paid after the insured is diagnosed with a covered condition and typically survives a defined survival period (e.g., 15 or 30 days); the payout is based on diagnosis rather than treatment expenses

Do I have to keep paying premiums until diagnosis?

Yes, continuous premium payment is required to keep the policy active until a claim is made or the policy term expires, Non-payment can lead to policy lapse or denial of benefits.

What illnesses are usually covered under fixed benefit policy?

Commonly covered illnesses include cancer, heart attack, stroke, kidney failure, major organ transplant, paralysis, and neurological diseases, etc.

Are pre-existing diseases covered in fixed benefit policy?

Pre-existing conditions are generally excluded for a waiting period of 3 years, and claims during this time are denied. In cases of severe pre-existing diseases, the insurer may even decline policy issuance altogether.

Can I make multiple claims under a fixed benefit policy?

Most fixed benefit plans allow only one claim per covered condition. This means that the policy terminates for that illness after payout. Some plans may offer multiple claims for different illnesses depending on policy terms.

How does the payout work in a fixed benefit policy?

In a fixed benefit health insurance plan, the lump sum payout is triggered by the diagnosis of a covered critical illness. If the insured is diagnosed after buying the policy and meets the waiting and survival periods, the insurer pays the full sum insured, independent of actual medical expenses. For pre-existing conditions diagnosed before purchasing the policy, most critical illness fixed benefit plans exclude claims for a waiting period of 2–3 years, during which such claims are typically rejected.

Who should consider buying a fixed benefit health insurance plan?

These plans suit individuals seeking guaranteed financial support on critical illness diagnosis, those wanting a simplified claim process, people looking to supplement indemnity plans, or those with hereditary illness risks needing specific lump sum coverage.

Does a fixed benefit policy cover more than one critical illness?

Not really. If the insured is diagnosed with more than one critical illness, most fixed benefit policies pay a lump sum only for the first diagnosis during the policy term. The policy typically ends for that illness and you no longer have to pay premiums

Last updated on: