Quick Overview

Even with rising medical costs, many families still struggle to choose the right health insurance plan, often paying more for less protection. At Ditto, we’ve reviewed hundreds of family floater claims and compared top policies to understand what truly offers value.

By the end of this guide, you’ll know:

- How does a family floater plan work and are there any benefits in availing it?

- List of family floater health insurance plans.

- Who should opt for it?

How Does a Family Floater Plan Work?

A family floater allows your entire family to use one combined health insurance cover instead of paying separate premiums. For instance, if you have a ₹10 lakh plan for two adults and one child, all three family members can share that amount in a year.

Premiums are usually lower than buying separate individual policies of the same sum insured for each person.

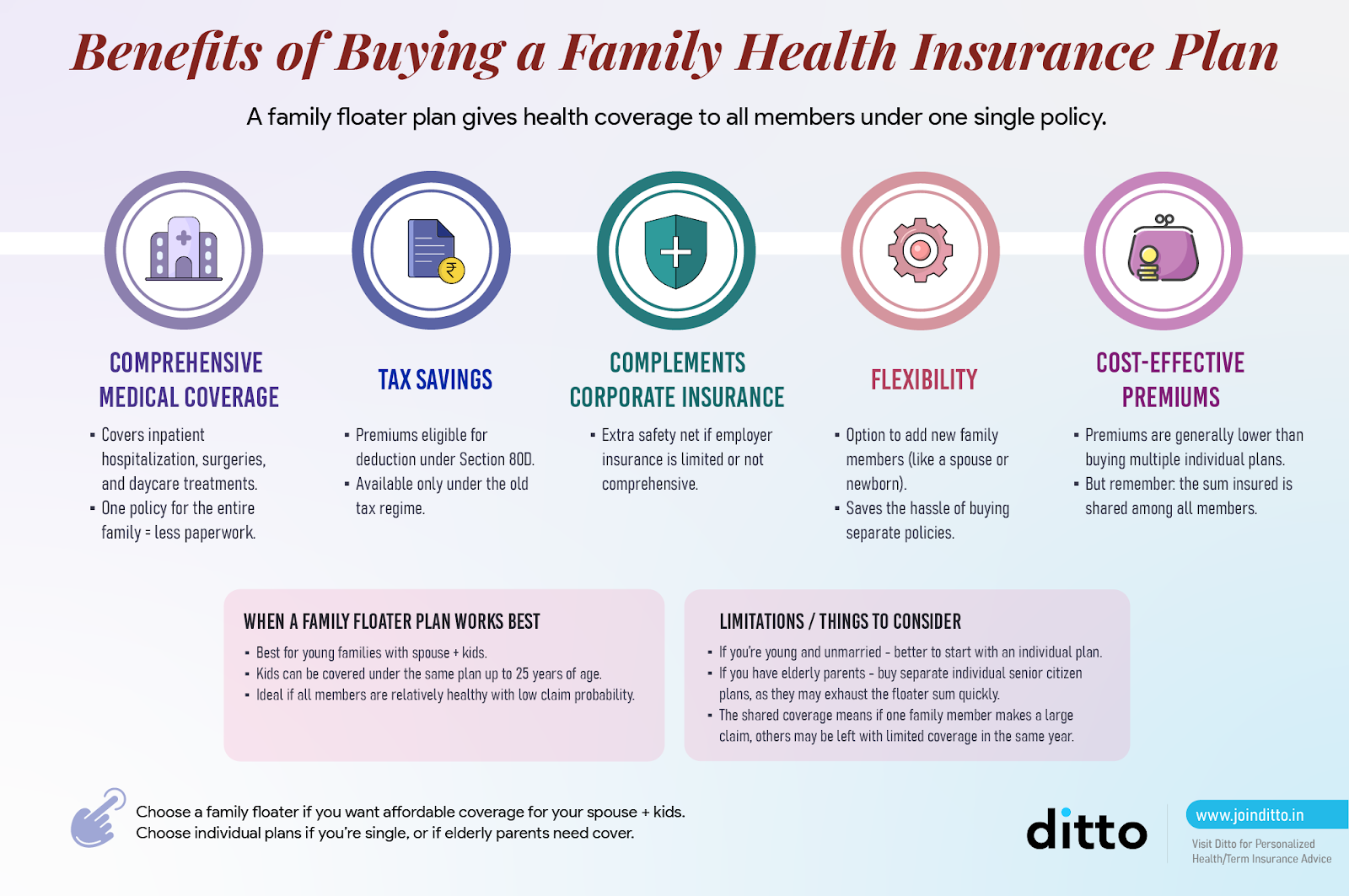

Most individuals may consider a family floater health insurance policy as a shared risk pool, but it also offers shared benefits, as shown in the infographic below.

Read our article on Individual Health Insurance vs Family Floater Health Insurance to get a comprehensive understanding of the differences.

List of Family Floater Plans (Ditto’s Cut)

* Can be reduced with a rider.

Note: SI stands for specific illnesses, PED stands for pre-existing diseases, and p.a. denotes per annum.

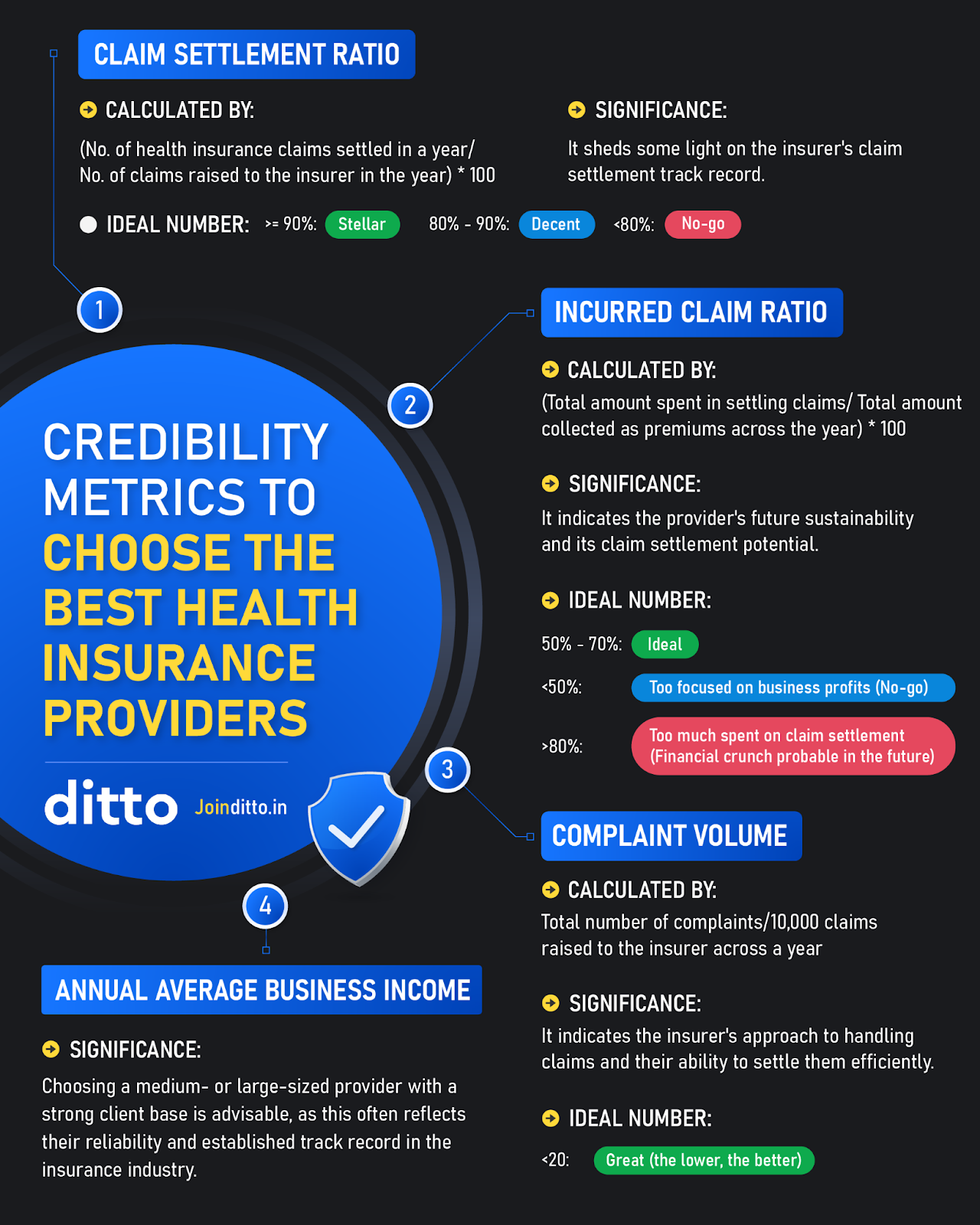

Our top picks are based on a 6-point evaluation framework that balances short wait times, substantial restoration benefits, and fast claims processing.

Factors to Consider While Buying Family Floater Plans

Coverage

Insurers generally allow coverage for the self, legally wedded spouse, and dependent children (usually up to age 25), while some also permit adding parents or parents-in-law, depending on the product structure.

Premium Calculations

Premiums are primarily calculated based on the age of the eldest member in the plan. Younger families get lower premiums, but including seniors may increase costs.

Ideal Amount

With rising medical costs, opting for a coverage amount of at least ₹15–25 lakhs ensures adequate protection against hospital bills in the long run.

Riders and Restrictions

Most plans include waiting periods for pre-existing conditions, maternity benefits, and specific illnesses. Search for policies with shorter wait times, especially if you anticipate upcoming medical needs or choose riders to reduce them.

Hospitalizations

Look for a vast hospital network for better access to cashless treatments. This ensures you don’t have to pay out of pocket during emergencies or worry about reimbursements later.

Plan Comparisons

Check whether restoration applies from the first claim, covers related or unrelated illnesses, and restores per member, per event, or once annually. This ensures continued coverage for additional claims within the same year.

Ideal Recommendations

Policies with sub-limits on room rent, specific diseases, or high co-payment clauses can result in significant out-of-pocket expenses during hospitalization. We usually recommend plans that do not have these restrictions.

Ditto’s Take: The key metrics of family floater health insurance plans should fall within the ideal range showcased below:

The table below highlights the premium range for different family compositions, opting for a sum insured of ₹15 lakh, residing in Delhi:

How Much Do Annual Family Health Insurance Premiums Differ?

Note: You can lower your premiums (via discounts) by choosing multi-year payment options.

Did You Know?

When people talk about “Self + Spouse + Kids + Parents” under one floater, it’s important to note that:

- It depends entirely on the product design. While some plans (like Optima Secure) allow it, many (like Care Supreme) do not.

- Even in products where it is technically allowed, from a risk-pooling and pricing standpoint, keeping parents on a separate floater is usually the more practical and cost-efficient approach.

Why Choose Ditto for Your Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Here’s why customers like Abhinav love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 5,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation with us. Slots are filling up quickly, so be sure to book a call now!

Who Should Consider a Family Floater Health Insurance Plan?

Families with young, healthy members who want a single shared health cover rather than multiple individual policies should consider a family floater plan. It’s ideal for couples or parents with young children looking for cost-effective protection. Conversely, individual plans may be more suitable for families with aging parents or those with chronic health conditions.

To sum it up, continually assess your family’s needs, understand your options, and select a plan that offers comprehensive coverage and financial protection.

Frequently Asked Questions

Last updated on: