| What is the Ayushman Bharat Health Insurance Eligibility? Ayushman Bharat Health Insurance Eligibility is determined using the SECC 2011 database. It covers deprived rural families, select urban occupational groups, and all senior citizens aged 70+. Beneficiaries get cashless hospitalization up to ₹5 lakh per family annually for secondary and tertiary care at empanelled hospitals. Eligibility can be quickly verified via the PM-JAY portal, mobile app, or helpline 14555. |

Health costs can crush a family in seconds, especially if you don’t have a safety net. That’s why the government launched Ayushman Bharat, India’s flagship health insurance scheme. It provides healthcare coverage to the country’s most vulnerable families. The scheme offers up to ₹5 lakh per family per year for secondary and tertiary care.

In total, it covers more than 12 crore economically disadvantaged families—nearly 40% of India’s population.

To make the most of this scheme, it’s important to understand the Ayushman Bharat health insurance eligibility criteria. This guide will walk you through who qualifies under rural and urban categories, the special provisions for senior citizens, hospital empanelment rules, and simple ways to check your eligibility.

Still unsure how health insurance works for your needs? With Ditto, you can book a free call with an advisor to get unbiased, personalized guidance and clarity before making a decision.

What is Ayushman Bharat Health Insurance?

Ayushman Bharat comprises two key components: (1) Health and Wellness Centres providing comprehensive primary care and (2) Pradhan Mantri Jan Arogya Yojana (PM-JAY).

Health and Wellness Centres (HWCs)

Health and Wellness Centres (HWCs) focus on comprehensive primary healthcare. They provide services like maternal and child health, and non-communicable disease care. They also offer free medicines and diagnostics closer to people’s homes.

Pradhan Mantri Jan Arogya Yojana (PM-JAY)

Pradhan Mantri Jan Arogya Yojana (PM-JAY) is the world’s largest government-funded health insurance scheme. It offers cashless cover of up to ₹5 lakh per family annually for secondary and tertiary care.

Funded jointly by the Centre and states, PM-JAY is free for poor and vulnerable families identified via Socio-Economic Caste Census (SECC) 2011. In addition, the scheme has no cap on family size, age, or gender, and covers all pre-existing conditions from day one.

How to Check Ayushman Bharat Health Insurance Eligibility?

Beneficiaries can confirm their eligibility using multiple convenient channels:

- The official PM-JAY website (https://pmjay.gov.in) features an 'Am I Eligible' tool where individuals enter details like name, mobile number, and state.

- PM-JAY mobile application for Android and iOS provides real-time eligibility checks and scheme information.

- National Helpline (14555) offers 24x7 assistance in regional languages for eligibility queries and grievance redressal.

These simple methods make it easier for eligible families, such as the marginalized rural and urban groups, to confirm their status and access benefits without hassle.

For a detailed breakdown of Ayushman Bharat health insurance eligibility, features, and benefits explained in simple terms, check out this comprehensive guide on Ayushman Bharat Health Insurance.

Ayushman Bharat Health Insurance Eligibility: Criteria for Rural Families

Rural families qualify under Ayushman Bharat based on specific criteria recorded in the SECC 2011 database. Eligible households typically meet one or more of the following criteria:

- Households with no able-bodied adult (16–59 years)

- Female-headed households with no adult male member aged 16-59 years

- Landless households primarily dependent on manual casual labor

- Households without a shelter

- Destitute and living on alms

- Manual scavenger families

- Primitive tribal groups and legally released bonded laborers

Note: Eligible families must be listed under one or more of these categories to qualify for Ayushman Bharat Health Insurance Eligibility under PM-JAY coverage.

Ayushman Bharat Health Insurance Eligibility: Criteria for Urban Families

Urban eligibility is primarily based on occupational categories identified in the SECC 2011, including:

- Rag pickers

- Domestic workers or maids

- Construction workers

- Street vendors

- Cobbler, washerman, barbers, and similar occupations

- Temporary or casual laborers

- Sweepers, sanitation workers, and gardeners

- Home-based workers, artisans, handicrafts workers, and tailors

- Transport workers (including drivers, conductors, cart pullers, and rickshaw pullers)

- Shop workers (assistants, peons, helpers, delivery assistants, attendants, and waiters in small establishments)

- Electricians, mechanics, assemblers, and repair workers

- Watchmen (Chowkidars)

- Coolies

These occupational categories ensure coverage for unorganized sector workers who otherwise lack formal health insurance access.

Ayushman Bharat Health Insurance Eligibility: Criteria for Senior Citizens

A landmark update in September 2024 granted automatic eligibility to all senior citizens aged 70 years and above under Ayushman Bharat PM-JAY, regardless of their income or socio-economic status. This provision ensures that approximately 6 crore senior citizens across 4.5 crore families receive a health cover of ₹5 lakh annually beyond any family coverage they might already have under other schemes.

Key points for senior citizen eligibility:

- Minimum age: 70 years (as per Aadhaar card age verification).

- No income limit or socio-economic qualification imposed.

- Aadhaar-based e-KYC mandatory for enrollment and issuance of a distinct Ayushman card.

- Coverage starts from the date of enrollment without any waiting periods for any disease or condition.

This expanded coverage emphasizes inclusivity of elderly populations who face higher health risks and financial vulnerabilities.

Which Hospitals Are Eligible for Ayushman Bharat Health Insurance?

Only hospitals meeting predefined eligibility criteria are empanelled under Ayushman Bharat PM-JAY. The scheme currently has over 32,000 empanelled centres across India. These requirements work alongside the Ayushman Bharat Health Insurance Eligibility framework and makes sure that beneficiaries receive quality treatment.

Empanelled hospitals deliver cashless treatment to eligible beneficiaries and eliminates out-of-pocket expenses for covered services.

The National Health Authority mandates the following for hospital empanelment under Ayushman Bharat Health Insurance:

- Adequate infrastructure and qualified personnel across relevant specialties

- Availability of essential diagnostic and medical equipment

- Compliance with local/state regulations and quality standards

- Capacity to provide secondary and tertiary care as per Health Benefit Packages (HBP)

- Adherence to package rates and billing transparency defined by the scheme

To find the complete list of hospitals providing cashless treatment under Ayushman Bharat PM-JAY, you can refer to the official PDF.

Why Consider Ditto for Health Insurance?

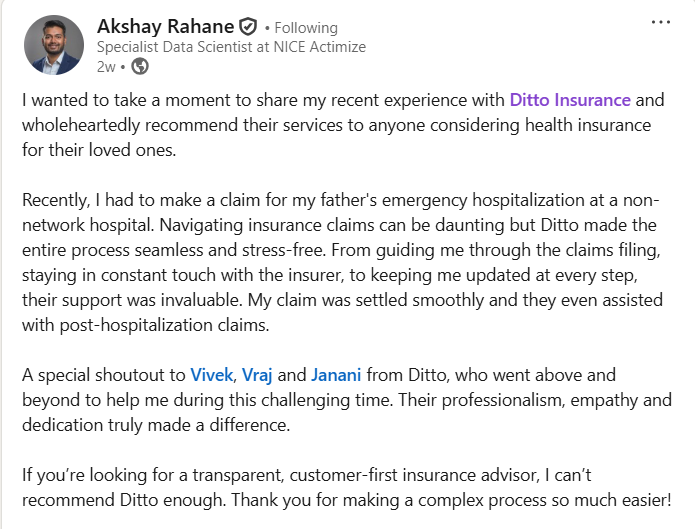

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right health insurance policy. Here’s why customers like Akshay love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

Understanding Ayushman Bharat health insurance eligibility is essential for individuals and families seeking medical security under this landmark scheme. It covers rural and urban poor based on socio-economic and occupational criteria, with special provisions for all senior citizens aged 70 and above.

Eligible beneficiaries can access medical services at hospitals that meet strict quality and infrastructure standards and are empanelled under the scheme. Cashless treatment of up to ₹5 lakh per family per year is available at these hospitals. Beneficiaries can use the PM-JAY portal, mobile app, or helpline to check eligibility and find participating hospitals.

As eligibility gradually expands toward broader population coverage, Ayushman Bharat marks a significant step toward achieving Universal Health Coverage in India.

Still unsure how health insurance works for your needs? With Ditto, you can book a free call with an advisor to get unbiased, personalized guidance and clarity before making a decision.

FAQs

What is Ayushman bharat health insurance eligibility?

Ayushman bharat health insurance eligibility is primarily based on socioeconomic criteria from the Socio-Economic Caste Census (SECC) 2011 database for rural and urban families. It covers the bottom 40% of the population including deprived rural households and designated urban occupational groups.

Who is eligible for Ayushman Bharat health insurance under PM-JAY?

Eligible beneficiaries include economically weaker families identified under SECC 2011, all senior citizens aged 70 and above regardless of income or caste, and families previously covered by Rashtriya Swasthya Bima Yojana (RSBY) who meet the eligibility norms.

Is there an age limit for eligibility under Ayushman bharat health insurance?

There is no upper age limit for eligibility. Special provisions include separate health coverage for senior citizens aged 70 years and above with no income restrictions.For more details: https://nha.gov.in/img/resources/English_FAQs_related_to_the_benefits_for_senior_citizens.pdf

Are pre-existing diseases covered from day one under Ayushman Bharat health insurance?

Yes, all pre-existing conditions are covered from the very first day of enrollment, ensuring immediate comprehensive care without waiting periods.

How can I check my Ayushman bharat health insurance eligibility?

Eligibility can be checked online via the official PM-JAY portal, mobile app, or by calling the helpline number 14555. You can also verify using your Ayushman Bharat health card details.

What types of hospitals are included for cashless treatment under Ayushman bharat health insurance?

Cashless treatment is available at empanelled hospitals approved by the National Health Authority, which includes public and private hospitals meeting predefined quality and infrastructure criteria.

What is the health coverage limit under Ayushman Bharat health insurance?

PM-JAY provides coverage up to Rs. 5 lakh per family per year for secondary and tertiary care hospitalization expenses.

Do I need to pay any premium for Ayushman bharat health insurance?

No, the scheme is fully funded by the Government of India and state governments, so beneficiaries do not have to pay any premium.

What benefits does Ayushman bharat health insurance provide besides hospitalization?

The scheme covers pre and post-hospitalization expenses, transportation costs to hospitals, daycare procedures, and includes cashless treatment for listed 1,929 medical packages.

Last updated on: