Quick Overview

Managing multiple insurance policies can feel confusing when everything is on paper. In practice, having an eIA is compulsory while applying for term insurance, and though not yet mandated for health insurance, it is imperative to have one. Here is a simple guide to understand how to open an eIA, and why it can benefit you.

Did You Know?

What is an e-Insurance Account?

IRDAI mandated that all new insurance policies be issued electronically from April 1, 2024. e-Insurance simply means buying and managing your policies in digital form for easier access and smoother servicing. This works like a demat account where you trade in financial securities. Physical copies are generally provided only if the policyholder asks for them.

Read more about the revised guidelines on insurance repositories and the electronic issuance of insurance policies.

What Are Insurance Repositories?

Insurance Repositories keep your policies (from different insurers) safe in digital form and allow you to hold them under one eIA. They also support requests for address changes, KYC updates, and nominations.

Currently, India has four licensed insurance repositories: NSDL National, Centrico (formerly CSDL), Cams and Karvy Insurance Repository Limited.

Quick Note: The insurance regulator is considering a proposal that could allow insurance repositories to offer claims-related services. If approved, this would be a positive step toward faster, more streamlined claims support for policyholders.

How to Open an e-Insurance Account?

Here are the steps to open an eIA:

- Choose one of the four approved repositories.

- Download the eIA opening form from their website.

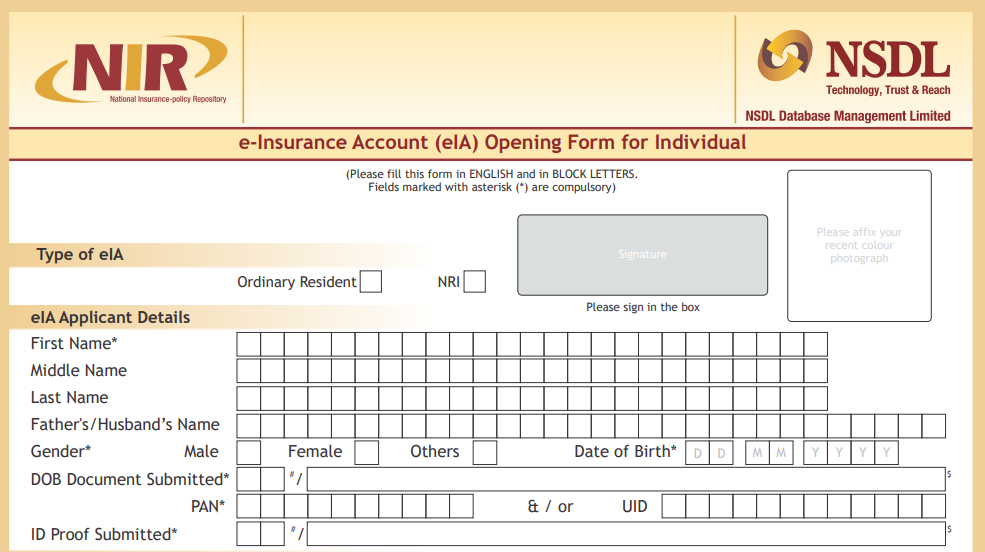

Here’s a snippet from the NSDL eIA opening form:

- Fill in your details and attach KYC documents such as PAN, Aadhaar, and proof of address.

- Submit the form online or drop it off at a branch/insurer’s office.

- Complete the verification step if the repository asks for it.

- Receive your eIA number and login details once the account is active.

Alternatively, you’ll see a question asking whether you already have an existing e-Insurance Account. This is asked during the proposal stage of your insurance policy application.

- If you select “Yes,” the form will ask you to provide your existing eIA details.

- If you select “No,” you’ll be prompted to choose the repository where you want your new eIA to be opened. This is usually created automatically within a week after policy issuance.

What Are the Benefits of Opening an e-Insurance Account?

Access Policies Together

Faster Updates and Purchases

Simplified Claims for Family

Free, Fraud-resistant and Eco-friendly

How to Convert an Existing Policy into an e-Insurance Account?

Once your e-Insurance account is set, you can convert your existing policies into a demat form by following these steps:

- Fill the Policy Conversion Form: Get the conversion form from your chosen insurance repository.

For example, in case you choose NSDL, you can download a policy conversion form here. Alternatively, if you go with Karvy Insurance Depository, fill out this form to convert your existing policies to an electronic format.

- Submit the Form (via Any One Method):

- Visit the nearest branch of the insurer whose policy you hold

- Visit an Approved Person/Service Centre authorised by the repository

- Courier the form to the repository’s designated address

- Scan and email the form to the repository’s support email (and send the hard copy if required).

- Policy Verification: Once the insurer verifies your request, your existing insurance policies will be credited to the eIA.

- Receive confirmation: You’ll get an SMS or email after the digital policy is successfully added.

Remember: Keep physical copies as a backup, even if your existing policies are already converted into e-policies. However, you will not need these physical documents for claims after the conversion.

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s advisors for free and unbiased guidance. Book your free call now, slots fill up fast!

Ditto’s Take on E-Insurance Account

It is a great initiative that makes insurance easier to manage. You can use your e-Insurance account to buy new policies, update personal details, and track everything in one place without any paperwork.

At Ditto, we always suggest opening an eIA if you deal with multiple policies or plan to buy more in the future. It gives you a more secure way to handle everything.

If you have bought your policy through us and need help figuring out your EIA, please contact us.

Frequently Asked Questions

Last updated on: