Aditya Birla Term Insurance: Overview

If you’re looking for a balanced term plan that blends affordability with flexibility, Aditya Birla Term Insurance is worth considering. It offers a range of plans with optional add-ons like critical illness and accidental cover, ensuring protection tailored to your needs.

Though smaller than top insurers like HDFC Life or ICICI Prudential, ABSLI remains a credible choice for those who value transparent coverage and stable long-term protection.

Introduction

Aditya Birla Sun Life Insurance (ABSLI) is one of India’s established private insurers, backed by Sun Life Financial Inc., a leading international financial services organization based in Canada. The company serves over 2 million customers nationwide.

With a claim settlement ratio of 98.45% (FY 2022–25), a solvency ratio of 1.79, and annual business volumes/GWP exceeding ₹8,664 crores (FY 2022–2025), the company demonstrates sound financial health and consistent growth.

In this article, we will explain everything you need to know about Aditya Birla Term Insurance, including its key benefits, inclusions, exclusions, claim process, and renewal options to help you decide if it is the right fit for your family’s financial security.

If you’re unsure whether Aditya Birla’s term plan fits your needs, chat with Ditto’s advisors to compare top insurers and find the best fit for your needs. Book a call now.

Benefits of Aditya Birla Term Insurance

High Coverage at Low Cost

Get a large life cover at a competitive price and secure your family’s future without worrying about high premiums.

Customizable Protection

Add covers like critical illness, accidental death, or waiver of premium to build a plan that fits your needs.

Flexible Premium Options

Pay your premiums yearly, half-yearly, quarterly, or monthly, depending on what works best for you.

Premium Payment Term

Pick how long you want to pay, whether single, regular, or limited pay, based on your comfort.

Tax Savings

Get Section 80C deductions under the old regime, while death benefits stay tax-free under Section 10(10D).

Digital Convenience

Manage your policy, payments, and claims entirely online for a smooth and paperless experience.

Documents Required to Buy Aditya Birla Term Insurance

When applying for an Aditya Birla term insurance plan, you’ll need to submit the following documents for quick and smooth verification:

- Proof of Identity: PAN Card, Passport, Voter ID, Aadhaar Card, or Driving License

- Proof of Address: Utility Bill, Passport, or Rent Agreement

- Photographs and Income Proof: Passport-sized photographs along with salary slips, Income Tax Returns (ITR), Form 16, or recent bank statement

- Medical Records: Health certificates or medical reports may be required depending on your age and the policy’s terms

Aditya Birla Term Insurance Plans

1) ABSLI DigiShield Plan

Ideal for: Individuals or families looking for a flexible and highly customisable term plan with income payout options and coverage that can extend up to age 100.

Sum Assured: Starts from ₹30 lakh with no fixed upper limit, subject to underwriting approval.

Key Features:

- 10 plan options to suit different protection needs

- Coverage up to 100 years of age

- Flexible payout options: lump sum, monthly income, or both

- Survival income from age 60 for a stress-free retirement

- Return of Premium (ROP) if you outlive the policy term

- Advance payout on terminal or critical illness diagnosis (covers 42 illnesses)

- Joint Life option to include your spouse

- Additional riders for enhanced protection

Ditto’s Take: ABSLI DigiShield is the flagship plan from Aditya Birla Sun Life Insurance. It’s an excellent choice for those seeking flexibility, customisation, and multiple payout options in a single term plan.

2) ABSLI Super Term Plan

Ideal for: Individuals or families looking for a term plan that combines life, health, and income protection with built-in wellness tracking and quick claim settlements.

Sum Assured: Starts from ₹25 lakh, with the upper limit determined based on underwriting assessment.

Key Features:

- Three plan options: Level Cover, Increasing Cover, or Level Cover with Return of Premium (ROP)

- Special discounts: 10% off on the first-year premium for salaried customers and female lives

- Cover Continuance Benefit: Option to defer premium payments for up to 12 months without losing coverage

- Includes health management services valued at ₹46,000.

- 100% return of premium at policy maturity under the ROP option

Sample Premiums (2025)

Premiums vary by age, income, policy term, and add-ons. Online and salaried buyers can get up to a 9% discount for women and 7% for men in the first year.

Ditto’s Take: ABSLI Super Term Plan is one of the more modern term insurance options in the market, offering integrated health tracking, quick claims, and flexible income support. It competes closely with peers like HDFC Life Click2Protect Supreme and Axis Life Smart Term Plan Plus, making it a solid choice for families seeking comprehensive and adaptive protection.

3) ABSLI Salaried Term Plan

Ideal for: Salaried individuals and young professionals seeking affordable, flexible life protection with income-based discounts and multiple payout options to secure their family’s financial future.

Sum Assured:

- Minimum: ₹25,00,000

- Maximum: No upper limit (subject to the insurer’s Board Approved Underwriting Policy)

Eligibility:

- Entry Age: 21 to 55 years (age as on last birthday)

- Maturity Age: 31 to 75 years (age as on last birthday)

Premium Payment Term (PPT) & Policy Term (PT):

- PPT Options: 5, 7, 10, 12, 15, or 20 years

- Minimum Policy Term: PPT + 5 years

- Maximum Policy Term: 54 years

If your annual income is ₹5 lakh or more, you can get a 7% discount on the first-year premium (for male or transgender customers) or a 9% discount (for female customers).

Ditto’s Take: ABSLI Salaried Term Plan is ideal for working professionals who want long-term income stability for their families. The rising monthly income option (5% or 10% annual increase) makes it one of the most practical and family-focused term plans in its category.

Inclusions and Exclusions of Aditya Birla Term Plans

Aditya Birla term plans cover death due to natural causes, illness, or accidents during the policy term. Policyholders can enhance coverage through add-ons like critical illness, accidental death, or waiver of premium riders for stronger protection.

However, like all term plans, they exclude deaths related to suicide within 12 months, illegal or hazardous activities, substance abuse, and non-disclosure of health conditions. For a detailed breakdown of what’s covered and what’s not covered, you can refer to this article.

Claim Settlement Process of Aditya Birla Term Insurance

Aditya Birla Sun Life Insurance has a digital-first claim process designed for simplicity and speed.

How to Check Policy Status?

You can easily check your Aditya Birla Term Insurance policy status by logging in to the Aditya Birla Sun Life Insurance Customer Portal or using the ABSLI mobile app.

Alternatively, you can contact customer care or visit your nearest ABSLI branch for assistance.

How to Renew Your Aditya Birla Term Insurance Policy?

You can renew your Aditya Birla Term Insurance policy online by logging in to the customer portal, reviewing your policy details, and paying the premium before the due date. A grace period of up to 30 days (15 days for monthly payments) is usually provided for late payments, but it’s best to renew on time to avoid policy lapses and ensure uninterrupted coverage.

To learn more about the renewal process, visit Ditto’s guide.

Disclaimer: Aditya Birla Sun Life Insurance is not a Ditto partner insurer. All information in this article has been sourced from the insurer’s official website, public disclosures, and other verified online sources to maintain accuracy and transparency.

Why Choose Ditto for Your Term Insurance?

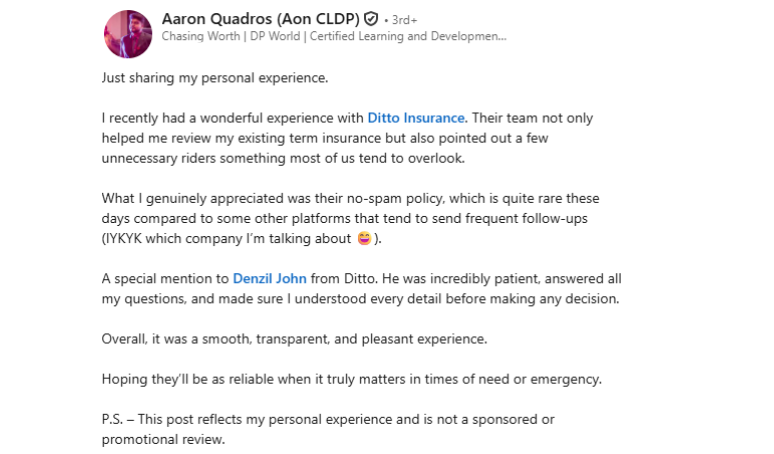

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Aaron love us:

✅ No Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅ Backed by Zerodha

✅ 100% Free Consultation

Final Thoughts

Aditya Birla Sun Life Insurance offers flexible coverage options, a customer-centric claim process, and useful features like life-stage-based protection and advance payouts for terminal or critical illnesses.

While the brand enjoys strong credibility, ABSLI remains a mid-sized insurer compared to larger players such as HDFC Life and ICICI Prudential. Its claim settlement ratio is solid but slightly lower than top performers like Axis Life and Bajaj Allianz Life. Overall, ABSLI provides a reliable and well-rounded term insurance option, though it does not currently lead the market in any single category.

If you’re unsure which plan suits your needs best, Ditto’s advisors can help you choose the right cover for your goals and life stage. Book a call now!

Frequently Asked Questions

How can I pay my premium?

You can pay via net banking, debit/credit card, UPI, or auto-debit (ECS).

What is the policy cancellation process?

Cancel within 30 days of issuance (free-look period) for a refund, minus applicable charges (medical tests, stamp duty, and proportionate risk premium). Cancellation post free-look will not lead to any refund.

Is a medical test mandatory for Aditya Birla term insurance?

Yes, medical tests are usually required for higher coverage amounts or based on age and health profile. It helps determine accurate premium rates and ensures hassle-free claim approval later.

Can I increase my cover after buying the policy?

Yes, ABSLI offers a Life Stage Increase feature that lets you enhance your coverage after major milestones like marriage or childbirth, ensuring continued protection as responsibilities grow.

Last updated on: