How Much Health Insurance Coverage Do I Need?

Have you ever thought to yourself, “How much health insurance do I need?” Then you are in the right place. In India, families still end up paying 39.4% of healthcare costs from their own pocket.

If your cover is too low, one big hospital bill can force you to dip into savings, break investments, or take out a loan. But if your cover is too high, you might pay for protection you do not realistically need. So what is the right number for you?

In this article, we will break down how to pick the right coverage amount, what an ideal health insurance cover looks like in India, and the key factors that help you decide your sum insured.

How to Choose Your Ideal Health Insurance Coverage Amount?

Most people approach this backwards. They try to predict the exact hospital bill they might face one day, which is almost impossible. Try to pick a cover that prevents the “I had insurance, but still had to arrange a few lakhs” moment.

Swapnil, one of our senior advisors, shared a simple rule of thumb.

Start with ₹5 lakh. Then add ₹5 lakh for every “YES” below:

- Do you live in a metro city?

- Do you prefer chain hospitals over local ones?

- Are you above 45?

- Do you have any pre-existing conditions?

A few notes to make this rule more realistic.

- Your base cover should handle a large bill at the hospital you would actually choose. Restoration and bonus can help later, but it is not a replacement.

- Check for hidden limits. Things like room rent limits can increase what you pay, even if your cover looks high.

- If the budget is tight, increase coverage in steps. Keep a decent base, then add a super top-up for extra protection at a lower cost.

What is the Ideal Health Insurance Coverage in India?

If you want a practical number that can cover you in most situations, ₹15 to ₹25 lakh is a sensible base cover. Then, consider bonus and restoration as the extra cushion that increases your usable coverage much higher over time.

Did You Know?

- ₹10 lakh can work if you are young, healthy, in a smaller city, and fine with local hospitals.

- ₹15 lakh is a strong baseline for metro residents.

- ₹20 to ₹25 lakh is a safer choice if you prefer chain hospitals, are older, have health conditions, or are buying a family floater.

Increasing your cover from ₹10 lakh to ₹20 lakh does not double your premium. The increase is around 20-30%, a relatively small step up compared to the extra coverage you get with the policy.

Claim Story

Factors to Consider While Choosing the Right Health Insurance Coverage Amount

1) Medical Inflation

Healthcare costs rise faster than regular inflation. WTW’s 2026 Global Medical Trends Survey projects Asia Pacific medical costs will increase by 14.0% in 2026. At this rate, a ₹10 lakh hospital bill today can become ₹19 lakh in 5 years

Quick Advice: Revisit your cover when you change cities, add a family member, or cross age milestones like 40/45.

2) Location and Hospital Preference

Bills vary based on the location where you get treated. Metros usually cost more than non-metros, and chain hospitals often charge more than smaller local hospitals.

Reality Check: If you pick a chain hospital in a metro, do not size your cover assuming “small city, local hospital” pricing.

3) Age and Pre-existing Conditions

As you age, the odds of hospitalization and repeat claims increase, especially if you have some medical history.

When in Doubt: Lean towards a higher cover, and do not depend on “future upgrades” to fix an undersized base.

4) Family structure

A family floater costs you up to 50% less in premiums than buying separate individual policies. But the cover is shared, and more members means a higher chance someone uses it.

Planning Tip: If you choose a floater, size it assuming at least one meaningful claim can happen in a year, not assuming “only one person will ever use it.”

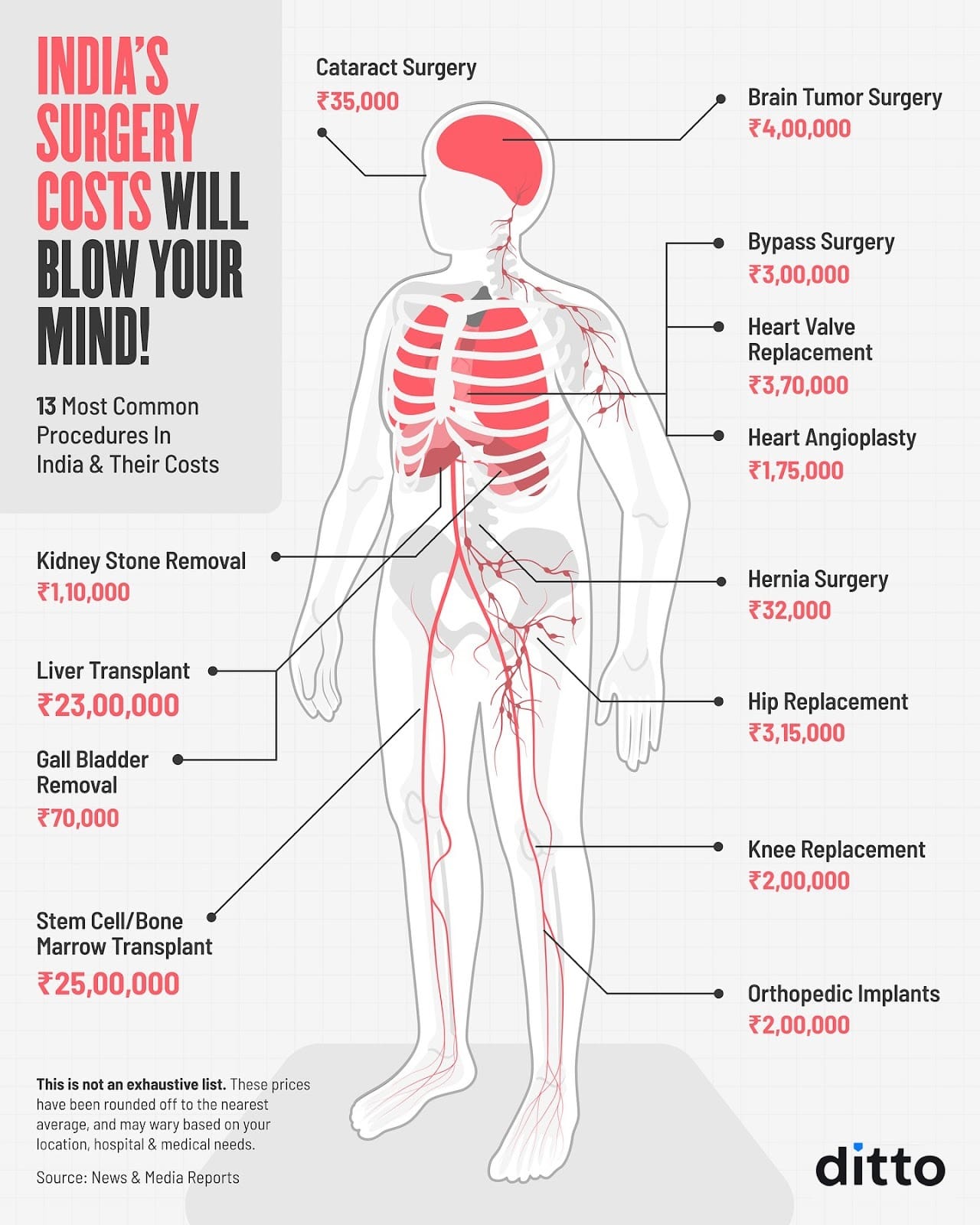

5) Real-Life Surgery Costs

Hospital bills can jump fast, even for common procedures. Use the infographic below as a quick reality check on what surgeries can cost across categories.

Cost Check: Size your base cover so it can handle at least one high-cost hospitalization, not just smaller day-care procedures.

How Much Health Insurance Do You Need in India for a Family?

- For a family floater, aim for a cover that can handle one big hospitalization for any one member, plus some backup in case a second claim happens in the same year (this is where refill-style features can help).

- Remember, the sum insured is shared, so more members means a higher chance the pool gets used up faster.

- If you want a simple shortlist of what to look for in family plans, see our guide on family health insurance plans.

How Much Health Insurance Do You Need for Parents and Senior Citizens?

- Start with a higher base cover than you would for yourself, since claim chances rise with age.

- If premiums feel steep, go for a decent base cover plus a super top-up for extra protection.

- Pay close attention to payout-impacting clauses like co-pay, room rent rules, sub-limits, and waiting periods.

- If retail plans feel too expensive or restrictive, look at employer cover (if available), bank group plans, or government schemes as backup.

- For plan options and a clean checklist, read Ditto’s guides on senior citizen health insurance.

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call or chat on WhatsApp with us now!

Ditto’s Take on Health Insurance Coverage in India

If you are buying health insurance in India today, our default recommendation is to start with a strong base cover, not the minimum. For most people, that looks like a minimum ₹15 lakh base cover, then moving up if you prefer chain hospitals, have health conditions, or are buying for a family. The point is to choose a cover that comfortably handles a major hospitalization in the kind of hospital you would actually go to, without any stress.

Do not buy a low base cover hoping “smart features” will do all the heavy lifting. Use those features as an extra cushion, not the foundation. If you want more peace of mind beyond your base, add a super top-up as the second layer, and make sure your plan’s refill-style feature is designed well (kicks in after partial exhaustion, applies to the same illness, allows multiple restores, no cooling-off). That version holds up best in real claims.

Frequently Asked Questions

Last updated on: