- Introduction

- Key Features in a Health Insurance Plan for Families

- Benefits of buying a health insurance plan for families

- Things to Keep in Mind Before Buying a Family Health Insurance Plan

- Top 10 Family Health Insurance Plans in India

- Individual Health Insurance vs Family Health Insurance Plans

- How to choose the best health insurance plan for families in India?

Top 10 Family Health Insurance Plans in India

Introduction

Prioritising a family’s physical and financial health is the best decision that you can take. Availing of a family health insurance policy is a positive step towards that direction. Such plans promote affordability, comprehensive protection, and convenient management of plans (1 policy for multiple family members).

In general, almost all policies are available across individual and family variants. Hence, you must acknowledge the best health insurance providers and policies that would cater to your family's tailored medical and financial requirements. Considering the importance of such plans, here is a comprehensive look into their key features, benefits, tips for choosing them, and some of the best policies available.

A Quick Word: Did you know that going through insurance policy wordings means simultaneously scanning a financial, medical, and legal document? And well, that sounds taxing!

Here’s what we suggest — leave that part to us! with us and get solid insurance advice from IRDAI-certified advisors! No spam, no cold calls - just a conversation for your customised policy!

Limited slots! Book today!

Key Features in a Health Insurance Plan for Families

Restoration Perk

Managing health insurance for multiple family members can make it challenging to choose the right coverage. Even with careful planning, you may still end up underinsured. That’s where unlimited restoration shines: like a glass of water that’s refilled each time it’s empty, the insurer replenishes your coverage as needed.

The benefits you receive depend on the restoration option you choose. For instance, with a coverage amount of ₹10 lakhs:

| Case 1 | Contribution | Restoration Action | Case 2 | Contribution | Restoration Action | |

|---|---|---|---|---|---|---|

| Complete Exhaustion | A family member is hospitalised. Hospital bill = ₹4 lakhs | Insurer pays ₹4 lakhs | NO RESTORATION Your sum insured is now ₹6 lakhs | Another family member is hospitalised. Hospital bill = ₹8 lakhs | The insurer pays ₹6 lakhs (leftover sum insured) You pay ₹2 lakhs | RESTORATION AFTER THE 2ND CLAIM IS PROCESSED ₹10 lakhs is restored for the year after the 2nd hospitalisation bill is cleared |

| Partial Exhaustion | A family member is hospitalised. Hospital bill = ₹4 lakhs | Insurer pays ₹4 lakhs | RESTORATION IS PROVIDED Insurer restores ₹10 lakhs. The total balance is ₹16 lakhs (₹ 6 lakhs base + ₹10 lakhs restored). However, your plan and insurer will decide whether you can claim the entire amount for a single hospitalisation. | Another family member is hospitalised. Hospital bill = ₹8 lakhs | The insurer pays ₹8 lakhs. You pay nothing | 2ND RESTORATION IN THE SAME YEAR Insurer again restores ₹10 lakhs. Residual coverage = 6 lakhs settled from base + 2 lakhs settled from restoration. Since multiple restorations are available, the remaining 8 lakhs from restoration will be reset to 10 lakhs again. |

The ideal choice is an unlimited restoration feature with partial exhaustion and coverage for the same and different ailments with no cooling period between 2 claims. This ensures that you won’t have to dig into your pockets if there are multiple claims within the same policy year. This is especially crucial for family health insurance, where the likelihood of multiple hospitalisations within a year can be higher.

Friendly reminder: It’s easy to get lost comparing policies and premiums. Instead of spending hours on it, why not get personalised insurance advice from Ditto? We offer free consultations with zero spam! Just 30 minutes to clarify all your doubts.

Loyalty Bonus/ No-Claim Bonus (NCB)

Ideally, when you opt for a health insurance policy, you’re likely to stay with them for the long haul. In return, the insurer offers a loyalty bonus as a financial acknowledgement of your commitment.

Suppose you’ve been with your insurer for a while and haven’t made any claims for several consecutive years. In this case, you receive a No-Claim Bonus each year, which accumulates (hence, called a cumulative bonus). Let’s understand this with an example: You have a health insurance policy that offers a 25% no-claim bonus up to 100%. Even after 4 years, you haven't made any claims, so your cover amount has essentially doubled. One day, you make a claim that exceeds your base cover amount, but thanks to the accumulated NCB, the insurer covers the entire claim.

These bonuses can be quite beneficial, as they can ensure access to higher coverage amounts without any extra cost. For families, these bonuses present an affordable way to enhance coverage for all members included in the plan.

No Room Rent Restrictions

Choosing a health insurance plan without room rent restrictions is essential. If you're assigned to a room not covered by your insurer, you’ll not only pay extra for the room but also a pro-rata share of the entire hospital bill, which can add up quickly. If multiple family members are hospitalised in a year, these costs can be significant. A plan without such restrictions helps you avoid unexpected expenses and ensures you receive necessary care without financial stress.

No copayments

Family health insurance plans are typically more cost-effective than individual policies, but premiums are often based on the age of the eldest member, which can still be high. While opting for a policy with a copayment option may lower your premium, you'll be responsible for a percentage of the medical bills with each hospitalisation. In the long run, these copayments could end up costing you more than the savings on premiums.

No disease-wise sub-limits

Family health plans without disease-specific sub-limits provide better financial protection, especially for critical treatments. When covering a family, including parents, unexpected medical needs for conditions like cataracts, heart surgeries, and dialysis can arise, often requiring extensive procedures. Policies with sub-limits cap your coverage for these treatments, leaving you to pay the difference despite a higher overall coverage. A comprehensive family health plan ensures access to quality healthcare without depleting your savings.

Minimum waiting period

When choosing a family health plan, look for policies with short waiting periods for pre-existing conditions, specific illnesses, and maternity coverage.

- 30-day initial waiting period: During this time, you cannot file any claims except for accidental hospitalisations. This waiting period is standard in all health insurance policies.

- Pre-existing Conditions: As per IRDAI guidelines, the maximum waiting period for pre-existing conditions (PEDs) is now capped at 3 years. So, the ideal waiting period is 2 to 3 years.

- Specific Illness: A waiting period of 2 years is generally sufficient.

- Maternity: Opt for plans where the maternity waiting period is capped at 3 years or less.

After these waiting periods, your policy will cover treatments related to these conditions, as specified in the policy document.

Friendly reminder: It’s easy to get lost comparing policies and premiums. Instead of spending hours on it, why not get personalised insurance advice from Ditto? We offer free consultations with zero spam! Just 30 minutes to clarify all your doubts.

Maternity coverage privileges

Adding maternity coverage to your family health plan can be beneficial, depending on your insurer and the plan chosen.

If this feature is included without a significant premium increase, offers adequate coverage, and has a waiting period of 2 to 3 years, it can be a helpful addition, particularly for families managing prenatal, delivery, and postnatal expenses.

Newborn Care: Ensure the plan also covers treatments, vaccinations, and care for your newborn, at least until they reach 91 days old.

Alternate treatment (AYUSH) coverage

For families with elderly members, AYUSH (Ayurveda, Yoga, Naturopathy, Unani, Siddha, and Homeopathy) coverage can be a valuable addition to a health plan.

Alternative treatments are increasingly popular for managing lifestyle-related conditions, as they offer holistic benefits with potentially fewer long-term side effects compared to conventional treatments.

Free annual health check-ups

With multiple family members, annual health check-ups can be both essential and costly.

Regular check-ups help catch potential health issues early, increasing the chances of effective treatment. A family health plan that includes a free annual health check-up can help reduce this financial burden while ensuring regular medical updates at no extra cost.

However, please remember that free annual check-ups typically cover a limited list of tests, with expenses capped based on your base cover amount.

Benefits of buying a health insurance plan for families

Affordability

Family floater plans are generally more affordable than individual health policies. This is because a single cover amount is shared across the family members in the policy. Let’s take a look at this with an example.

- 10 lakh family floater plan: A healthy family of 3 living in New Delhi between the ages of 48, 44 and 19 will pay an annual premium of roughly ₹33,000 (average of 3 popular insurers) for a ₹10 lakh family floater option.

- 3 individual plans with a sum insured of 10 lakhs: A healthy family of 3 between the ages of 48, 44 and 19 will pay a total premium of ₹42,000 for 3 individual plans with a ₹10 lakh cover.

- As you can see, a family floater policy helps reduce the overall premium you pay, making it a budget-friendly option for comprehensive health insurance coverage.

| Age | Coverage | Premium (Average of 3 popular insurers) |

|---|---|---|

| 48 yrs | ₹10 lakhs | ₹21,000 |

| 44 yrs | ₹10 lakhs | ₹17,500 |

| 19 yrs | ₹10 lakhs | ₹11,500 |

| Total Premium | ₹50,000 | |

Talk to an expert

today and

find

the right

insurance for you.

Easier Management of Plans

If you’re buying a family floater plan, then you’ll only have to fill out the application once, submit a single proposal form, pay your premiums all at the same time and receive updates associated with a single plan. This helps ease the operational load, and it’s unlikely you’ll forget to pay your premiums on time.

Suppose you’re buying several individual insurance policies. In that case, you’ll have to fill out the application multiple times, submit multiple proposal forms, pay your premiums multiple times and receive a whole host of updates associated with all the different insurance policies you hold. This could be an operational nightmare, and if you’re single-handedly responsible for keeping all the documents in order, it’s possible you may forget to pay your premiums.

Coverage for Newborns

Purchasing a standalone health insurance policy for infants can be challenging due to limited options. However, family floater plans typically allow you to include newborn children under the same coverage. This ensures that the youngest of family members receive the necessary healthcare protection from day one.

Flexibility in Adding New Members

Family floater plans offer the convenience of adding new family members, such as a newly married spouse, to the existing policy. This flexibility allows you to keep your entire family’s health insurance under one policy, saving you the hassle and expense of purchasing individual plans for each member.

Things to Keep in Mind Before Buying a Family Health Insurance Plan

Eligibility criteria

While some plans may let you enrol your in-laws or siblings, other plans may have restrictions on this front. So it’s important to talk to your advisor or read the policy wording carefully before buying a family floater plan.

Variability in Individual and Family Insurance Plan Options

While most insurance plans on the market extend both individual and family floater variants, some products are not made available to families. One famous example is HDFC Ergo’s Energy plan for diabetics - a plan only available for individuals. Therefore, it's essential to carefully review each insurance plan's details to ensure it align with your specific individual or family coverage needs.

Coverage Requirements

Family floater plans offer shared coverage for members included in the plan. So, you may need additional coverage, especially if there are multiple hospitalisations in the same year.

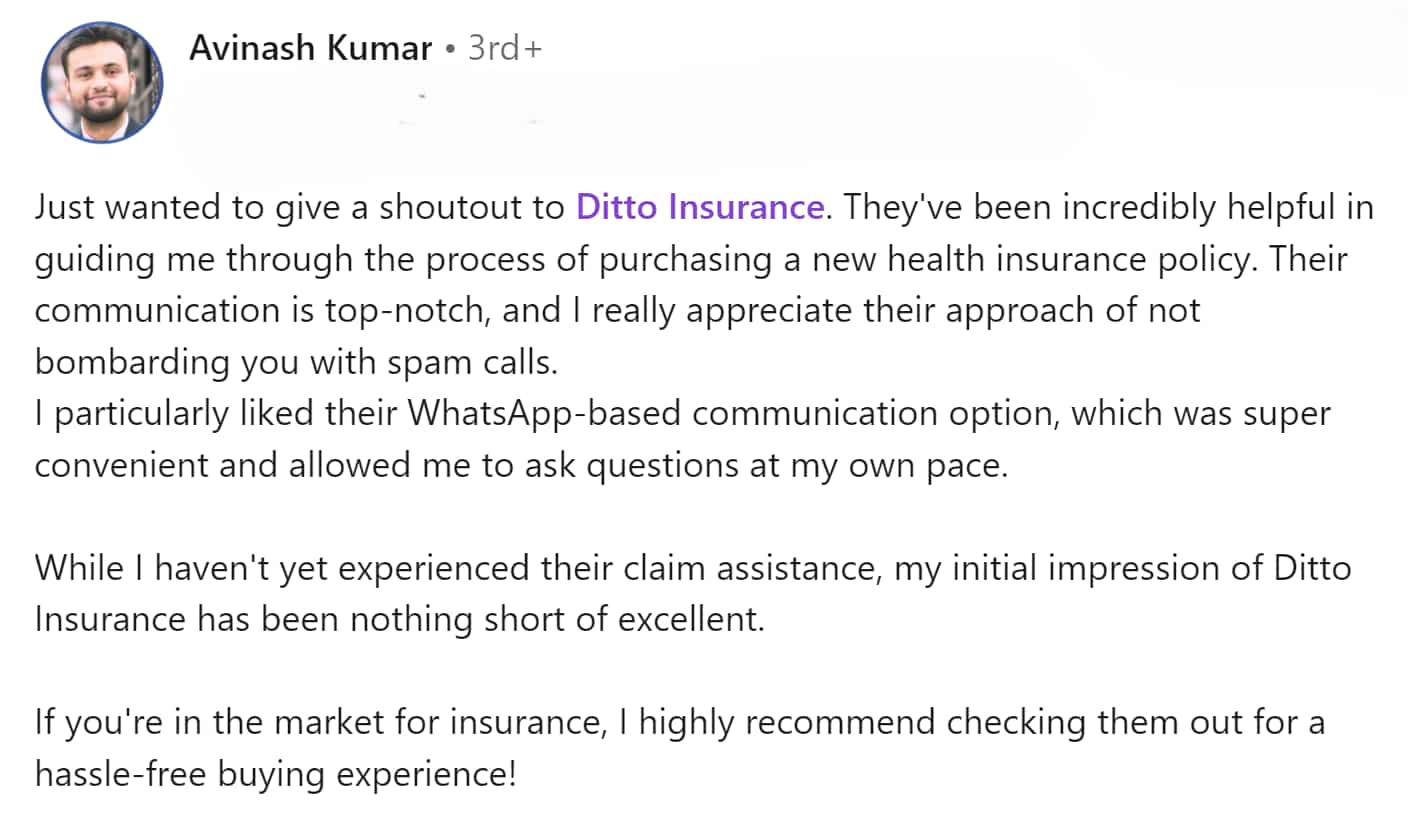

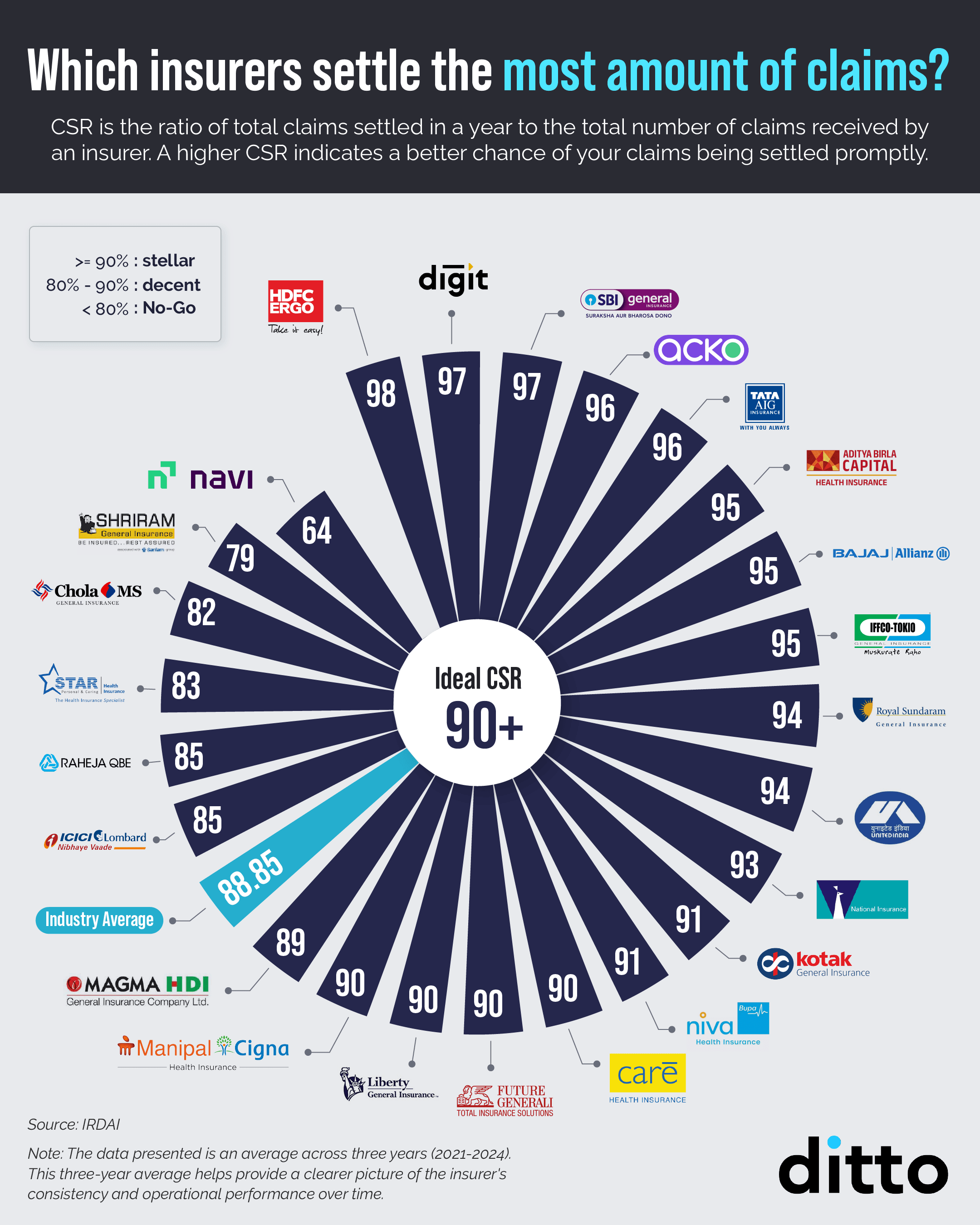

Insurer Credibility

Before diving into family health insurance plans, take a close look at the insurer’s track record. A reliable insurer typically has a high Claim Settlement Ratio (90% or above), an Incurred Claim Ratio ideally between 50-70% (though the 80s can also be solid), and a low Complaint Volume. Reviewing these metrics will help you avoid newer or less reliable insurers.

Pricing Differences

There is significant variation in pricing for individual plans and family floater variants, considering there is shared coverage in the latter. So, if you are looking at affordable options, family floater plans may make sense.

Friendly reminder: It’s easy to get lost comparing policies and premiums. Instead of spending hours on it, why not get personalised insurance advice from Ditto? We offer free consultations with zero spam! Just 30 minutes to clarify all your doubts.

Age restrictions

Like individual plans, family floater plans will also have restrictions on entry age for individuals. Most insurers will have an upper limit, typically between 60 and 65 years, for adults, while children may need to be at least 90 days old to be covered. It’s important to review these restrictions before purchasing a plan.

Co-Payment Clauses

Some plans include co-payment clauses, requiring a certain percentage of the claim to be paid out-of-pocket. Sometimes, insurers may impose co-payments for family members over a certain age.

Loyalty/No-Claim Bonus (NCB)

If no claims are filed during a policy year, you will be eligible for an NCB, increasing the sum insured for the next year. In some plans, you will get a bonus even if you make a claim. You should check if this benefit is available in the family floater plan.

Exclusions

Every health insurance plan comes with exclusions-specific conditions that the insurer won’t cover. It’s important to review these exclusions and ensure the policy doesn’t exclude coverage for conditions that are critical for you or your family. A quick scan of the policy document can help you spot these exclusions and make an informed choice.

Relations among members of the policy

Family floater plans generally cover up to 2 adults and 4 children, but there may be restrictions on who you can include. Some insurers may not allow siblings to be added, while others may ask you to choose between covering your parents or in-laws. However, newer policies are becoming more flexible on these points. Be sure to check which relations your insurer allows to be covered before applying.

Network Hospitals and Cashless Claims

Family floater plans usually offer cashless claims at network hospitals. Ensure the insurer's network includes good hospitals near your residence to avail of cashless treatments, especially during emergencies.

Waiting Periods for Pre-Existing Conditions

Family health insurance plans will often have separate waiting periods for pre-existing diseases and specific illnesses. The pre-existing disease waiting period will usually last 3 years, and the specific illness waiting period will usually last 2 years.

Adding or Removing Members

Confirm if the plan allows easy addition or removal of family members (along with entry and exit ages), such as newborns, spouses, or in-laws, and whether the premium is adjusted accordingly. This flexibility ensures the plan remains relevant as your family structure changes.

Top 10 Family Health Insurance Plans in India

HDFC Ergo Optima Secure Health Insurance (Family Floater)

HDFC Ergo Optima Secure may not be a plan specifically built for families, but its family floater options are as compelling as any other product on the market. It has very few restrictions, a great brand backing it and some very compelling benefits, including:

- Secure Benefit: Your cover doubles in value the moment you buy the policy. This means a policyholder with a Sum Insured of 10 lakhs will have an additional 10 lakhs extended as a “Secure” benefit, i.e. 20 lakhs in total.

- Plus Benefit: You also get a 50% bonus cover every year, irrespective of whether you make a claim. The bonus could go as high as 100% if you renew your policy for 2 consecutive years.

- Protect Benefit: It covers non-medical expenses that could include things like syringes, gloves, bandages and masks.

| Family Member | Age Range | Conditions |

|---|---|---|

| Self | 18 years and above | - |

| Legally wedded spouse | 18 years and above | Must be legally wedded to the Insured Person |

| Parents | 18 years and above | Natural or legal parent of the Proposer |

| Parents-in-law | 18 years and above | Natural or legal parent-in-law of the Proposer |

| Dependent Children | 91 days to 25 years | Natural or legally adopted children |

You can include up to 4 adults and 6 children in a single family floater policy.

Drawbacks to Consider: Optima Secure is generally more expensive when compared to similar plans on the market.

Final Verdict: In our opinion, Optima Secure (Family Floater) continues to be the best plan for most young families seeking comprehensive coverage.

Talk to an expert

today and

find

the right

insurance for you.

Aditya Birla Activ One Max

Aditya Birla Activ One Max makes our list number 2 because this will perhaps be the most compelling product for young couples seeking, with comprehensive features, an attractive price point, and discounts at every turn.

Pros of the plan:

- Super Credit: Under the Aditya Birla Activ One Max plan, every time you renew the policy, you can get a bonus that is equal to 100% of your base insured sum. This perk is capped at 500% of the base sum insured, and since it’s an in-built feature, it can be quite the edge over policies from other insurance stables.

- Health Return Program: Under this feature, policyholders who have stayed fit (a pre-set goal is mentioned in your policy wording) in the last year can enjoy up to a 100% discount on the premium in the following year.

| Relationship | Maximum Number Covered | Age Limits | Additional Notes |

|---|---|---|---|

| Self | 1 | Above 18 | - |

| Legally Married Spouse | 1 | Above 18 | As long as they continue to be married |

| Dependent Children | Up to 4 | 91 days to 26 years | Natural or legally adopted children only |

Drawbacks to Consider: Aditya Birla is a fairly new player in the insurance industry, which leaves the brand with a comparatively short insurance track record. This might be a point to watch out for potential policyholders. Additionally, the company’s relatively high complaint volume (22/10,000 complaints - average complaint between 2021 - 2024) is also a tad bit concerning.

Final Verdict: In our opinion, Aditya Birla Activ One Max is a good option for young couples looking to build a family and seeking comprehensive coverage at an attractive price point.

Care Supreme

Care Supreme is an attractive policy not only for individuals but also families. The plan provides broad coverage and boasts strong performance metrics in Claim Settlement Ratio (CSR) and Incurred Claim Ratio (ICR) alongside an extensive network of hospitals. However, it also registers a higher volume of complaints compared to other top insurers. That said, this plan also offers some compelling benefits, such as:

- No Loading Charges: The insurer ensures that your premiums don't increase further than what they have already quoted due to any pre-existing conditions.

- Cumulative Bonus Super: The insurer offers an add-on through which you get an additional loyalty bonus of 100% up to 500% of the base cover apart from an in-built loyalty bonus of 50% up to 100% of the base cover. This makes it a highly attractive proposition for the low premium.

| Family Member | Age Range | Eligibility Conditions |

|---|---|---|

| Self | 18 years and above | - |

| Spouse | 18 years and above | Must be legally wedded to the Insured Person |

| Dependent Children | 91 days to 24 years | Natural or legally adopted children |

| Parents | 18 years and above | Natural or legal parent of the Proposer |

| Parents-in-law | 18 years and above | Natural or legal parent-in-law of the Proposer |

You can include up to 4 family members (2 adults & 2 children) in one family floater policy.

Drawbacks to Consider:

- Higher Volume of Complaints: Care Health Insurance has a significantly higher complaint volume compared to its competitors.

- No Free Annual Health Checkups: Unlike other policies mentioned in this list, annual checkups are only available as an add-on. This means that you will have to spend slightly more for this benefit.

Final Verdict:

In our opinion, Care Supreme is a good option if you’re seeking extensive coverage with a variety of add-ons and affordable premiums. It has maintained a strong claim settlement ratio of 90% over the past three years (2021-24) and an incurred claim ratio of 58%, which falls right within the metaphorical Goldilocks zone. However, the higher complaint is certainly something to consider, which may make it less appealing for those who prioritise a hassle-free claims settlement.

Niva Bupa Aspire Titanium Plus

Niva Bupa Aspire is an innovative health insurance plan designed to cater to family-focused needs, particularly for those interested in maternity and family planning benefits. The plan includes unique features like the M-iracle maternity benefit, Booster+ (which allows unused sums insured to carry forward), and the Future Ready perk, which provides coverage for future spouses without extra waiting periods. Here is a summary of some of its unique features:

| Key Feature | Description |

|---|---|

| M-iracle | Provides maternity and family benefits, covering maternity, adoption, and assisted reproduction with variant-based waiting periods and coverage limits up to ₹25,000 for the highest variant. |

| Booster+ Benefit | Allows carry-forward of the unutilised sum insured with multipliers that vary by entry age and plan variant, up to a 10x multiplier for younger entrants. |

| ReAssure+ Unlimited Restoration | Enables unlimited restoration of the sum insured within the same policy year triggered by each claim. |

| Lock the Clock Premium Freeze | Locks premiums at the entry age until the first claim is made (available in Diamond+ and Platinum+). Titanium+ offers to Lock the Clock+, where premiums remain unaffected by M-iracle claims. |

| Safeguard+ Perk | Covers consumables, shields the bonus from claims, adjusts coverage with inflation, and increases base coverage based on the Consumer Price Index (CPI). |

Drawbacks to Consider: One concern is Niva Bupa's complaint volume, which is significantly higher than the industry average. Additionally, the M-iracle benefit includes coverage caps that may be insufficient for high-cost services such as adoption or assisted reproduction.

Final Verdict: In our opinion, Niva Bupa Aspire is a strong choice for individuals seeking family planning benefits and competitive pricing. However, given its limited track record, prospective buyers should monitor claims performance and remain cautious of potential premium increases. Those in need of immediate coverage may want to consider the plan's claim settlement process carefully.

Friendly reminder: It’s easy to get lost comparing policies and premiums. Instead of spending hours on it, why not get personalised insurance advice from Ditto? We offer free consultations with zero spam! Just 30 minutes to clarify all your doubts.

ICICI Lombard Elevate Health Insurance plan

ICICI Lombard Elevate makes it into our list because it offers what every family would aspire to have in a comprehensive health insurance plan, i.e. unlimited coverage. You can opt for this coverage by choosing to have no limits on your Sum Insured, or you could choose an add-on (Infinite Care). With this additional rider, the insurer will cover the medical expenses incurred for the hospitalisation of the insured person for any one claim during the lifetime of the policy without any limits on the annual sum insured.

ICICI Lombard Elevate is also considerably lax when it comes to the inclusion of family members. You can add your biological brothers and sisters–a theme you don’t see often in most health insurance plans.

| Relationship | Age Limits | Eligibility Criteria |

|---|---|---|

| Self | 18 years or above | - |

| Spouse | 18 years or above | Must be legally wedded to the Proposer |

| Dependent Children | 91 days to 30 years | Natural or legally adopted children |

| Brother(s)/Sister(s) | 18 years or above | Natural or legal siblings of the Proposer |

| Dependant Parent(s) | 18 years or above | Natural or legal parent of the Proposer |

| Dependant In-Laws | 18 years or above | Natural or legal parent-in-law of the Proposer |

| Note: A maximum of 2 adults and 3 children can be added to a single family floater plan. | ||

Also, if you’re a young couple looking to build a family, you can also find comprehensive maternity benefits included alongside the plan.

Maternity Coverage available for families

- 10% of the Annual Sum Insured, subject to a maximum limit of ₹1 lakh for the delivery of a baby and/or expenses related to medically recommended lawful termination of pregnancy in life-threatening situations. The maternity waiting period is 2 years for this policy, but it can be reduced to 1 year with an add-on.

- Pre-natal and post-natal expenses (up to 30 days from the delivery date of the baby) will be covered up to 10% of the Annual Sum Insured, subject to a maximum of ₹1 lakh.

- With an additional newborn baby cover, you can also cover the medical expenses of a “Newborn Baby” up to twice the maternity sum Insured.

- You also get coverage for surrogate mother and Oocyte donor expenses up to ₹5 lakhs.

Acko Platinum

Acko Platinum made it to our list because of two unique features – this policy offers unlimited coverage and zero waiting periods while offering low premiums. This plan has two cover options – ₹ 1 crore and unlimited cover. Both options have no co-payments, no room rent restrictions, disease-wise sub-limits, and waived waiting periods for certain conditions. However, if a condition is already diagnosed, it’s considered a pre-existing disease (PED) and can attract up to a 3-year waiting period for PED coverage. If you’re diagnosed with any of the specific illnesses listed after purchasing the plan, the 2-year waiting period does not apply, ensuring faster access to coverage.

Key Features of Acko Platinum

- Coverage Options: The plan offers two choices — ₹1 crore and unlimited coverage, making it one of the highest cover amounts available in the health insurance market.

- Consumables Coverage: Unlike many other plans, Acko Platinum covers consumables such as bandages, cotton swabs, laundry, attendant charges, and patient meals. Which isn’t much, but it adds up.

- High Coverage Limits: Restoration and No Claim Bonus features become less relevant with such extensive coverage.

| Family Member | Age Range | Eligibility Conditions |

|---|---|---|

| Self | 18 years and above | - |

| Spouse | 18 years and above | Must be legally wedded to the Insured Person |

| Dependent Children | 3 months to 25 years | Natural or legal children of the Proposer |

| Parents | 18 years and above | Natural or legal parent of the Proposer |

| Parents-in-law | 18 years and above | Natural or legal parent-in-law of the Proposer |

You can include up to 6 family members in one family floater policy.

Drawbacks to Consider:

- Unproven Track Record: The plan was introduced only in 2023, so limited data is available to evaluate its claim performance and service quality. Apart from this, while the initial premiums are low, they may increase sharply if the number of claims rises significantly. This is definitely something you should keep in mind.

- Misleading Zero Waiting Periods: The advertised zero waiting period only applies to the 30-day general waiting period and 2-year specific illness waiting periods; pre-existing conditions can still attract a waiting period of up to three years based on the health profile.

Final Verdict:

In our opinion, Acko Platinum offers extensive coverage options with minimal out-of-pocket expenses, making it an attractive option for those seeking comprehensive features at a low initial cost. However, its short track record, potential for premium hikes, and misleading claims regarding waiting periods are important factors to consider.

Tata AIG Medicare

Tata AIG Medicare is a good choice for families, offering comprehensive and global coverage with minimal restrictions. Known for its consistent Claim Settlement Ratio (CSR) and Incurred Claim Ratio (ICR), the plan provides 60 and 90 days of pre-and-post-hospitalization coverage, ensuring extensive support for recovery. With the trusted Tata brand, it adds a layer of reliability, making it particularly beneficial for families who travel frequently, as it includes international coverage.

| Family Member | Age Range | Eligibility Conditions |

|---|---|---|

| Self | 18 years and above | - |

| Spouse | 18 years and above | Must be legally wedded to the Insured Person |

| Dependent Children | 91 days to 25 years | Natural or legal children of the Proposer |

| Dependent Parents | 18 years and above | Natural or legal parent of the Proposer |

You can include up to 6 family members in one family floater policy.

Drawbacks to Consider:

- Limited Restoration Benefits: The 100% restoration benefit is available only once per year, potentially limiting coverage for high-cost treatments or multiple hospitalisations.

- Expensive plan: This plan is significantly more expensive compared to its peers while offering similar benefits.

Final Verdict:

In our opinion, Tata AIG Medicare offers strong brand credibility, affordability, and essential features. It also includes rare perks like global coverage and an Accidental Death Benefit add-on. However, limited restoration benefits and cost may not suit those seeking extensive, unrestricted coverage. Overall, this is a good policy considering other features.

Talk to an expert

today and

find

the right

insurance for you.

Bajaj Allianz Health Guard

Bajaj Allianz Health Guard Gold is on this list for one primary reason—Bajaj Allianz had the lowest average complaint volume amongst all insurers from 2021-2024. Health-Guard Gold covers 60 and 90 days of pre- and post-hospitalisation, respectively, keeping it on par with other policies. One unique feature of this policy is that it also covers organ donor expenses if you ever need one. The insurer also covers newborns and maternity expenses, albeit after a 6-year waiting period.

| Family Member | Age Range | Eligibility Conditions |

|---|---|---|

| Self | 18 years and above | - |

| Spouse | 18 years and above | Must be legally wedded to the Insured Person |

| Dependent Children | 91 days to 30 years | Natural or legal children of the Proposer |

You can include up to 6 family members in one family floater policy (up to 2 Adults and 4 Children).

Drawbacks to Consider:

- Sub-limits for Specific Conditions: Certain treatments, like cataract surgery, have sub-limits, meaning you will need to bear part of the expenses if they exceed the limit.

- Long Waiting Periods: Some benefits, such as maternity coverage, come with a six-year waiting period, which may not suit those looking for quicker coverage.

Final Verdict:

In our opinion, the Bajaj Allianz Health Guard Gold plan is a robust health insurance option that offers broad coverage, making it suitable for families looking for financial protection against medical expenses. While it has certain limitations like sub-limits and extended waiting periods, its wide-ranging benefits and low complaint volume make it a strong contender in the health insurance market.

Manipal Cigna ProHealth Plus

ProHealth Plus by ManipalCigna is a comprehensive health insurance plan designed to address families' healthcare needs. The plan covers essential benefits like no disease-wise sub-limits, daycare and domiciliary treatments, as well as pre-and post-hospitalisation coverage for 60 and 180 days, respectively. While many insurers do not include maternity and doctor consultation coverage by default, ProHealth Plus offers these features, albeit with limitations (₹25,000 for maternity after a four-year waiting period and ₹2,000 for outpatient coverage).

| Family Member | Age Range | Eligibility Conditions |

|---|---|---|

| Self | 18 years and above | - |

| Spouse | 18 years and above | Must be legally wedded to the Insured Person |

| Children | 18 years and above | Natural or legal children of the Proposer |

| Parents | 18 years and above | Natural or legal parent of the Proposer |

| In-laws | 18 years and above | Natural or legal parent-in-law of the Proposer |

Note: The policy covers a maximum of two adults and up to three children under a single family floater plan.

Drawbacks to Consider:

- Mandatory Co-payment for Senior Family Members: There is a mandatory co-payment clause for insured persons aged 65 years or above, which may be a concern if you have elderly members in your family.

- Higher Premiums for Higher Coverage: Premiums can be high in the upper coverage brackets, making it less economical for the common man.

Final Verdict:

In our opinion, ProHealth Plus by ManipalCigna is a strong contender for families seeking extensive coverage, wellness perks, and health rewards. Its focus on preventive healthcare measures makes it ideal for proactive health management. However, potential buyers should be aware of the mandatory co-payment for senior family members. Overall, it’s a good choice for families looking for a well-rounded plan that emphasises preventive healthcare.

Star Super Star

Star Super Star Family Floater is a fairly recent plan from Star Health Insurance, which aims to offer affordable and flexible coverage for families. It has no room rent restriction, co-payment or disease-wise sub-limits and also offers unlimited restoration, which is excellent for families. Similar to Niva Bupa’s Lock the Clock Benefit, Star Super Star also comes with a unique feature where the insurer will not increase your premium until you make a claim. This policy also comes with over 20 add-ons, making it one of the most customisable plans in the market.

| Family Member | Age Range | Eligibility Conditions |

|---|---|---|

| Self | 18 years and above | - |

| Spouse | 18 years and above | Legally married spouse |

| Dependent | 91 days to 25 years | Natural or legal children of the Proposer |

| Children | - | - |

The plan allows coverage for up to two adults and up to four dependent children under a family floater policy.

Drawbacks to Consider: While the plan's features are commendable, Star Health Insurance's claim settlement ratio has been below the industry average in recent years. For instance, the company's claim settlement ratio was approximately 80.07% last year, compared to the industry average of 91.46%. This indicates that a significant portion of claims may be pending or rejected, which could be a cause for concern.

Final Verdict: Star Super Star offers robust features and extensive customisation, making it a strong option for your family. However, the insurer's Claim Settlement Ratio and other metrics suggest there is room for improvement. If you’re planning to purchase this plan, you should weigh these factors.

Individual Health Insurance vs Family Health Insurance Plans

| Metrics | Individual Health Insurance Plans | Family Health Insurance Plans |

|---|---|---|

| Coverage | Coverage is offered to a single policyholder | Coverage is distributed among multiple members of the family |

| Affordability | A tad bit pricey compared to family health insurance plans | Pretty affordable |

| Customisation Potential | Plans can be customised to meet individual medical requirements and financial bandwidth. | Difficult to customise plans since multiple members are involved. |

| No-Claim Bonus | The hike in sum insured at similar premiums can be enjoyed by a single policyholder. | The hike in coverage offers benefits to the entire group of family members. |

| Renewal | Renewability and management of multiple individual health insurance plans can become pretty cumbersome. | The management and renewal of a single plan for multiple members of the family mitigates the efforts substantially. |

| Ideally suited for | Single members, elderly parents, unique health needs | Families with young children and spouses |

Why Talk to Ditto for Your Health Insurance?

At Ditto, we’ve assisted over 3,00,000 customers with choosing the right insurance policy. Why customers like Avinash below love us:

No-Spam & No Salesmen

Rated 4.9/5 on Google Reviews by 10,000+ happy customers

Backed by Zerodha

100% Free Consultation

You can with our team. Slots are running out, so make sure you book a call now!

How to choose the best health insurance plan for families in India?

There is no one-size-fits-all approach when it comes to choosing a health insurance plan for families in India. What you need to do is focus on your priorities.

Choose the best family health insurance provider

Family floater plans are generally more affordable than individual health policies. This is because a single cover amount is shared across the family members in the policy. Let’s take a look at this with an example.

- Claim Settlement Ratio: This is one of the primary metrics used to determine an insurer's credibility. It measures the number of claims settled by an insurer across a year against the number of claims raised to the insurer for the year. A credible insurer’s rating should be 90 or above. On the other hand, any insurer with a CSR of 80 or below is not worth approaching!

While CSR is a crucial metric, it can often be misleading if considered solely when determining the top health insurance providers.

Here is a quick look at the CSR (average of the last 3 years) of all the health insurance players in the industry -

- Incurred Claim Ratio (ICR): When choosing a health insurance provider, a quick look at the company's incurred Claim Ratio (ICR) can save time and help you consider the insurer's future financial sustainability and claim settlement potential.

The ICR of a health insurer is computed by dividing the total amount paid in claims by the total amount earned by the insurer in premiums over a year.

A credible insurer with transparent and steady future sustainability should have an ICR between 50 and 70; any number below 50 indicates that the insurer is heavily leaning towards setting its business profits straight, and that would indicate higher chances of partial or rejected claims. Again, any provider with an ICR of 80 or higher might seem like an excellent choice for the short term since they are settling claims in full, but in the longer run, such brands (unless they have an extensive track record that proves otherwise) might run into some financial crunch.

Here is a quick look at the ICR (average of the last 3 years) of the current health insurance players in the industry -

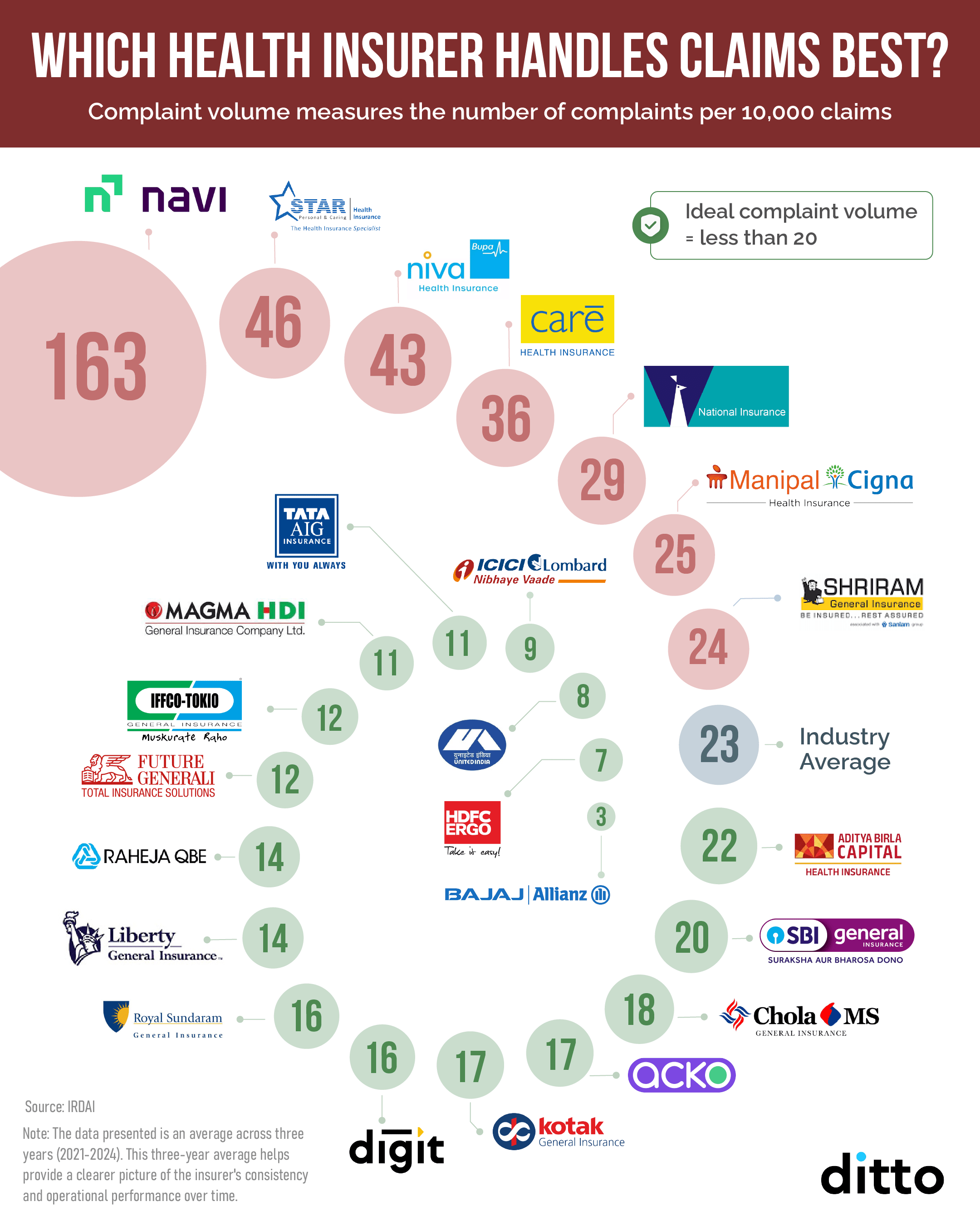

- Complaint Volume: The complaint volume of a health insurance provider records the number of claims filed against the insurer across a year per 10,000 claims. This can be the perfect metric that will help you gauge the quality of the claim settlement experience for the existing policyholders of the insurer (since most complaints stem from issues across the claim settlement process/amount).

In short, the lower the complaint volume (preferably lower than 20), the better the insurer. Here is a quick look at the complaint volume of the health insurance providers across the industry -

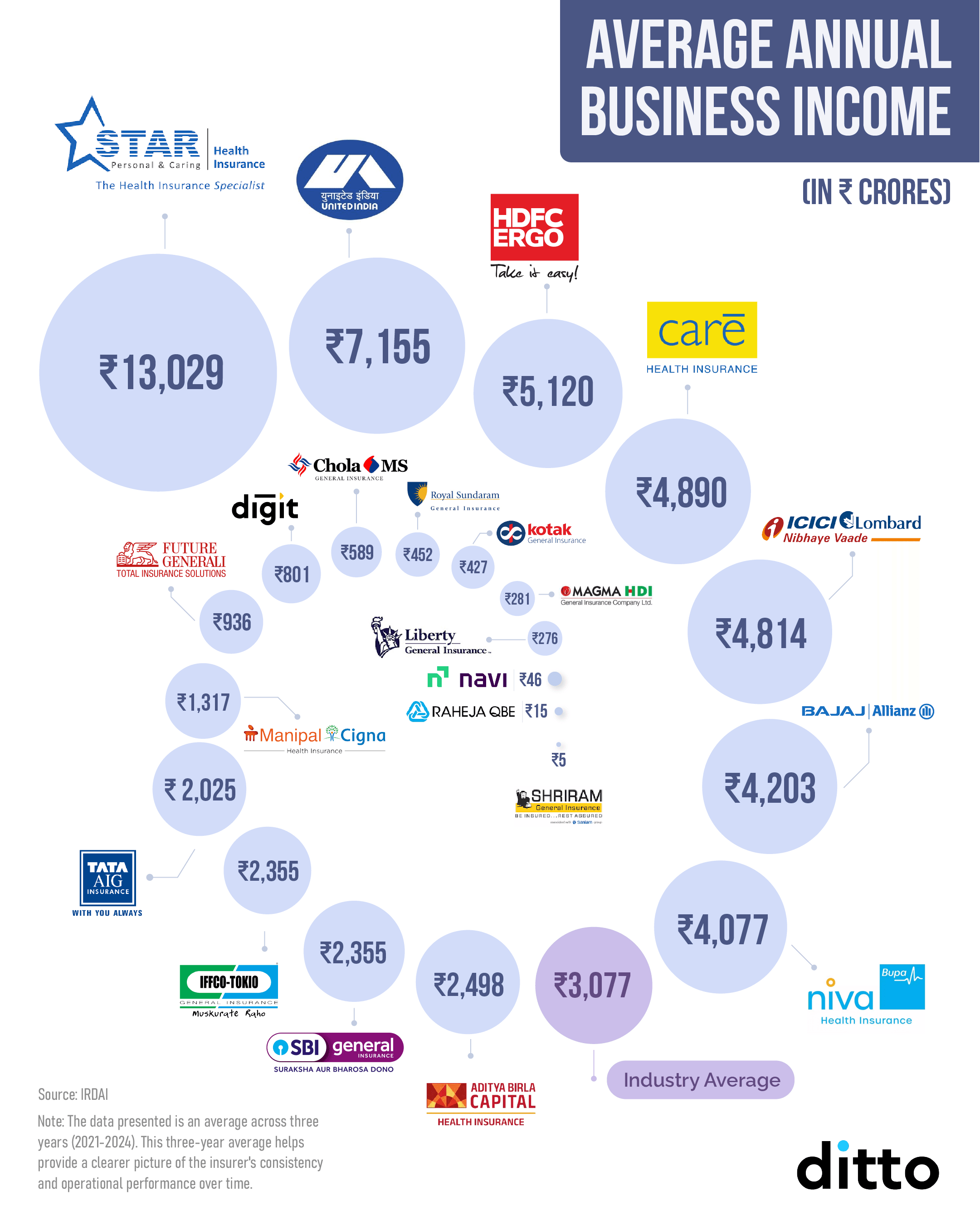

- Annual Average Business Income: Now, traditionally, an insurer's annual average business income is not listed as its credibility-checker. Nevertheless, this metric sheds light on the insurer’s business vertical - whether you are dealing with a small-sized, medium-sized, or large-sized company. A larger business capital-holding insurer can seem more promising, considering it appears to be financially stable to clear your claim settlement requests.

However, as mentioned before, multiple other metrics must be considered before finalising that choice.

Here is a look at the top health insurance providers with their annual average business income (average of the last 3 years) -

Choose the top family health insurance plans

- A family health insurance policy that offers unlimited restoration upon partial exhaustion for the same and different ailments.

- A policy that offers ample coverage against nominal premiums.

- A plan that has fewer restrictions (no room rent restrictions, no disease-wise sub-limits, no copayments, and coverage for consumables).

- A policy that offers 60 and 180 days of pre and post-hospitalisation coverage.

- A family health insurance plan that offers AYUSH, domiciliary and daycare coverage.

- A policy that offers maternity as an add-on with ample coverage, a nominal waiting period, and coverage for newborns.

- A plan that offers a substantial no-claim/loyalty bonus of 100% and above, as well as added bonuses to ensure discounted premiums.

- A health insurance policy that offers free annual health checkups.

Talk to an expert

today and

find

the right

insurance for you.