| What is a Proposal form in a health Insurance? A proposal form is the first crucial step to follow when applying for a health insurance plan. By answering its questions, you share key personal and health details that help the insurance company assess your risk and decide your premium and policy terms and conditions. This form is the legal link that makes your agreement with the insurer valid and binding. |

Filling out a health insurance proposal form may look like routine paperwork, but it’s the backbone of your policy. This form determines your premium, coverage, and how easily your claims are processed, so getting every detail right is crucial.

This guide walks you through everything you need to know: what the form includes, why it matters, insurer requirements, expert tips, and common pitfalls to avoid. Let’s get started.

| Did You Know? As per IRDAI rules, insurers must ensure that proposal forms are written in clear, easy-to-understand language and made available in scheduled regional languages when required. They are also required to share complete and transparent product details and provide a Customer Information Sheet (CIS) in the prescribed format, with acknowledgement of receipt from the policyholder. Also, according to IRDAI guidelines, each approved form comes with a Unique Reference Number (URN) assigned by the insurer. The same form can be used for multiple products, but if it’s modified for any reason, a new URN and fresh approval are required. |

What Are the Components of a Proposal Form?

Health insurance proposal forms can be comprehensive. Here’s what you’ll need to fill out to apply for your desired policy:

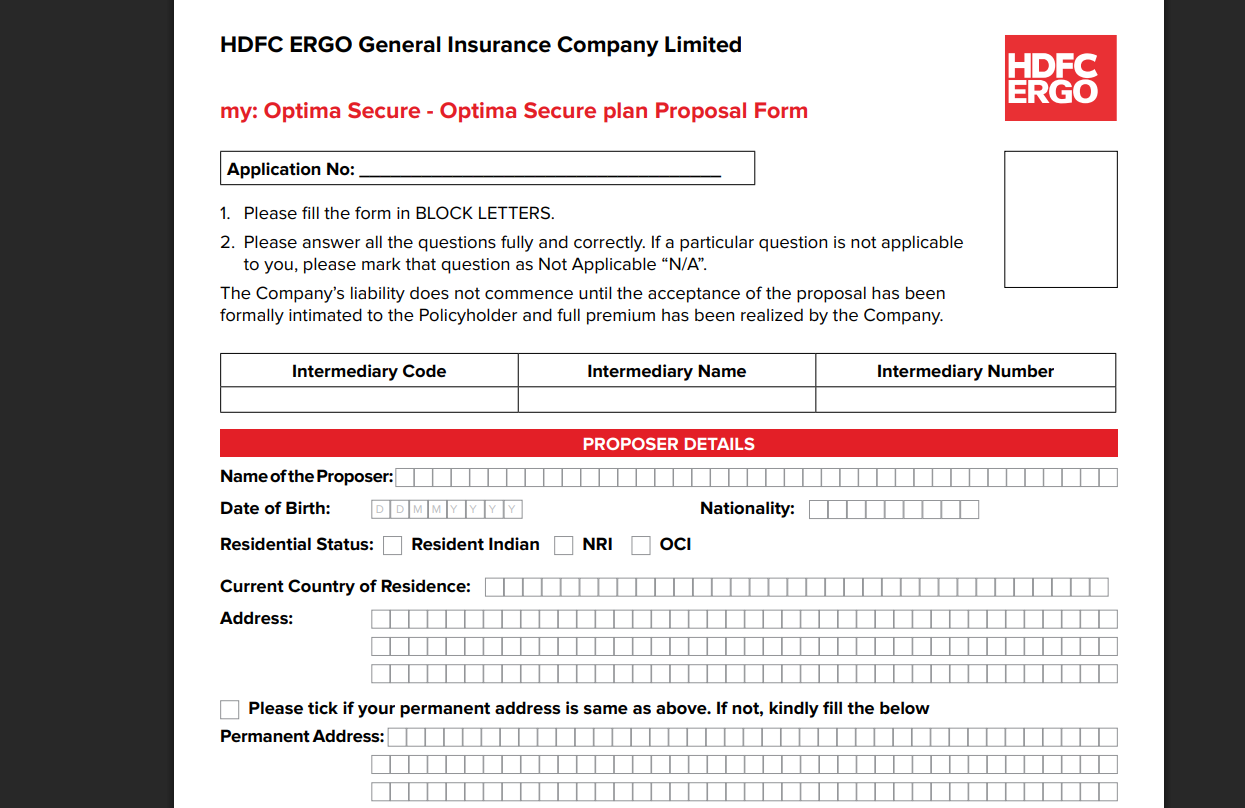

1) Personal Details: Basic information about the applicant and all family members to be insured, including name, age, gender, address, and contact information. This enables insurers to verify the identities of all individuals covered.

Here’s a snippet of the proposal form of HDFC Ergo:

2) Coverage Requirements: Your desired coverage amount (sum insured), type of policy (individual or family floater), and specific benefits (add-ons or riders). This is essential for insurers in matching their offerings to your needs.

3) Medical History: Questions about current and past health status, pre-existing diseases (PEDs), surgeries, ongoing treatments, medications and any previous hospitalizations. This is central to the risk assessment and helps determine waiting periods or exclusions.

NOTE: ABHA number (Ayushman Bharat Health Account) can be used for easier sharing of health records. Insurers may help create your ABHA ID with your consent, but they must take explicit consent every time your medical data is shared.

4) Lifestyle Information: Disclosure of habits like smoking, drinking, and activities such as adventure sports along with BMI details. These help insurers calculate your overall risk.

5) Financial and Occupational Details: Income and occupation details sometimes affect what you pay in premiums since they show your ability to afford higher coverage (₹1 crore+) and possible work-related risks.

6) Nominee Details: The name and relationship of the person who will receive policy benefits if the proposer dies. This ensures claims are settled without disputes.

7) Previous Insurance Information: Record of other health policies, past denied insurance applications, and claim history. This prevents over-insurance and confirms eligibility.

Still unsure how to fill your health insurance proposal form? Book a call with us, and let our experts guide you through the process.

Why is the form important for policyholders?

For insurers, the proposal form is both a risk assessment and a legal reference tool. Here’s how it helps:

- Risk Assessment: Insurers review your personal, medical, and lifestyle details to determine the level of risk associated with insuring you.

For example, a smoker or someone with a chronic illness may be considered higher risk. - Premium Calculation: Your policy premium is decided based on your risk profile and age. A healthy, non-smoker usually pays less than someone with pre-existing conditions or a habitual tobacco consumer.

- Policy Customization: The insurer tailors your policy terms, such as waiting periods, exclusions, or special conditions, to fit your health profile and coverage needs.

- Legal Reference: Once signed, the proposal form becomes a legal document. During a claim, insurers use it to verify your details. If they find any false or missing information, they can deny the claim.

What are some Important Tips for Filling the Proposal Form?

Getting your health insurance proposal form right is crucial for smooth approvals and hassle-free claims, when needed. Here are some simple expert tips to help you fill it correctly at different stages of your application:

1) Before You Begin:

Fill out the form yourself: Always try to complete the form independently. Don’t let an agent do it for you; if any details turn out wrong, you’ll be held responsible.

- Keep your documents ready: Have your original ID, proof of age, and address, along with any relevant medical records (as far back as you remember/can procure), handy. This ensures the details you provide are accurate and the process moves more efficiently.

- Understand the policy: Read the policy documents carefully, know its coverage, exclusions, waiting periods, and limits. This helps you fill out the form correctly and choose the right plan.

2) During the Process:

- Double-check your personal details: Ensure that your name, birth date, and contact information match the information on your official documents. Even minor errors can cause unwanted delays.

- Be completely transparent: Share all past diagnoses, abnormal test results, procedures that were advised but not done, and your current medications. Attach medical reports wherever possible.

- Include timelines: mention the month and year of each diagnosis, surgery, or last symptom. List your doctors and hospitals along with their contact details to help make the underwriting process smoother and faster.

- Share lifestyle habits honestly: If you smoke or drink, mention it clearly. Non-disclosure can lead to claim denial later.

- Declare other insurance policies: If you have additional health plans, even a corporate policy, make sure you share the details if it's asked. This prevents overlaps and helps with smooth claim coordination.

- Cooperate with medical underwriting: If your insurer requests you to undergo a medical test or arranges a tele-medical call with a medical professional, have it done promptly. It confirms your health status and helps avoid disputes in the future.

3) After Completing the Form:

- Review before signing: Go through every detail carefully before signing carefully. Once you sign, the information becomes legally binding, and you cannot retract it.

In case a policy is bought online, the insurer must use an e-proposal form that’s the same as the physical version. The customer’s consent should be taken directly through their registered mobile number or email using a secure system. The insurer must also keep proof of this consent for future reference. - Keep a copy: Always save a copy of the filled and signed form. It’ll be helpful for future reference or if any claim issue arises.

| Friendly Reminder: Sometimes the insurer may not ask about your daily lifestyle per say if you drink or smoke. But it is imperative that you be honest about such habits (past or present) and inform your insurer or medical underwriter upfront. |

How long does it take to process a proposal form?

Your insurer should review and process your proposal promptly and in a fair manner.

- If more details are required, the insurer must request them all together within 7 days of receiving your proposal.

- You should share the information promptly to avoid delays.

- A decision must be made within 7 days of receiving your form or additional details.

If Accepted: You’ll be informed immediately and provided with the premium amount.

Coverage ideally begins on the date the premium is received; however, if loading charges are applied, the date of payment will be considered the effective date of coverage. In the case of porting, the end date of the old plan will be taken into account, not the payment date.

If Rejected: The insurer must inform you within 7 days, clearly stating the reason.

Once your proposal form is accepted and you pay the premium, you become the policyholder, and the person covered is the insured.

Ditto’s Take on Health Insurance Proposal Form

At Ditto, all client interactions are recorded and closely monitored by our compliance team to ensure complete transparency and accountability. For IRDAI audit purposes, our advisors are always available to guide customers through the proposal form and clarify any doubts.

We encourage our customers to fill the form at ease with sufficient time in hand. Before filling out the proposal form, create a list of all past medical procedures, including their dates (or at least the year of the procedure). This makes the process smoother and faster, typically taking anywhere from 15 minutes to an hour, depending on your medical history, policy type, and number of members covered.

So, fill the proposal form carefully and review every detail. Seek expert help if required, as an accurate form ensures a smooth plan purchase.

Why Talk to Ditto for Your Health Coverage?

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Arun below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 5,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

Final Thoughts

Here are the key takeaways to keep in mind when filling out your health insurance proposal form:

- The proposal form is a legally binding document and marks the beginning of your health insurance journey.

- It gathers essential details about your personal, medical, lifestyle, and financial background to help the insurer assess risk and decide your premium.

- Accurate and complete information ensures smooth coverage and hassle-free claim processing.

- Keep the insurer updated on change in address, contact, nominee and even diagnosis of new ailments immediately to avoid future claim hassles

- Always try to fill out the form yourself, be honest about your health and habits, and keep a copy for future reference.

Still unsure how to fill your health insurance proposal form? Book a call with us, and let our experts guide you through the process.

FAQs

What personal details are required in a proposal form?

You’ll need to provide basic information such as the name, age, gender, address, and contact details of every person you want to insure.

Can I edit the proposal form after submitting it?

Once submitted, you usually can’t edit the proposal form. However, if you notice an error, contact the insurer right away; they may allow minor corrections before final approval.

What happens if I hide a medical condition in my proposal form?

Hiding or misreporting medical details counts as non-disclosure, which is a policy violation. This can lead to claim rejection or even policy cancellation, sometimes years after purchase.

Who can help me fill out the proposal form?

You should fill out the form yourself, but getting help from a trusted insurance expert can be helpful. They can clarify confusing questions and help you avoid costly mistakes.

What role does the Insurance Information Bureau of India (IIB) play in proposal forms?

IIB doesn’t create or approve proposal forms. Instead, it helps insurers verify customer details, check claim histories, and detect fraud using its central data repository. This ensures the provision of accurate, transparent, and reliable information, enabling better underwriting decisions and supporting IRDAI in maintaining industry compliance.

Last updated on: