| What is mortgage life insurance? Mortgage life insurance is a specific type of life cover that helps repay a loan if the borrower passes away during the loan term. It is commonly offered for home loans as a group credit life policy with a decreasing sum assured mapped to the outstanding balance. According to the IRDAI or RBI, it's not mandatory to buy mortgage life insurance in India. Instead, a smarter alternative for borrowers is regular term insurance with extended coverage and flexible add-ons, assigned to the lender. |

Your bank will NEVER tell you this, but you don’t need mortgage life insurance to protect your loan repayments.

Say, you take a home loan, which is a big financial commitment, and banks start pitching mortgage life insurance, aka HLPP (Home Loan Protection Plan). In case the worst happens to you during the loan term, the life cover promises to pay off the outstanding balance.

But is mortgage life insurance really the best option?

Beyond clearing EMIs, what your family needs is income replacement, flexibility, and control over funds, especially if you are not around. For most borrowers, securing a home loan with a term insurance is the best alternative to mortgage life insurance due to more coverage, beneficial add-ons (riders), and fund reusability.

By the end of this article, you’ll learn how mortgage life insurance works, what it includes and misses, what happens on foreclosure or surrender, and how term insurance offers more value.

What Is Mortgage Life Insurance: An Overview

In India, what lenders refer to as “mortgage life insurance” is predominantly a group credit life policy with a decreasing sum assured tied to the outstanding loan balance. It’s the same framework used for housing, vehicle, education, personal, and secured loans like loan-against-property (LAP).

Borrowers are enrolled under the lender’s master policy at disbursement, and the cover is linked to the outstanding amount. Upon a valid claim, the insurer pays the lender first up to the dues, and any remainder goes to the nominee.

Is mortgage life insurance mandatory in India?

Well, as of 2025, buying mortgage life insurance is not mandatory in India. Neither the RBI nor IRDAI has any law in place. Borrowers say yes to mortgage life insurance as it looks helpful in covering one’s dues in the event of an untimely death during the loan term.

However, if somebody wants to foreclose a loan, transfer or refinance (or at least wants to keep that option open), they're locking in a premium they can’t port or get back.

Borrowers are better off with a regular term insurance assigned to the lender under Section 38 of the Insurance Act. It’s a cheaper and cleaner option that gives control over the total cover for a family, and not just the EMIs.

Can’t decide between a mortgage life insurance and term insurance plan? Fret not! Book your free call with Ditto and let our IRDAI-certified advisors help you make the right decision.

How Does Mortgage Life Insurance Work In India?

Under IRDAI’s 2024 product regulations, a group credit life policy is a “recognized product class”. That’s why the coverage at inception cannot exceed the loan’s outstanding tenure. Here’s a closer look at the core mechanics of mortgage life insurance in India.

Group credit life (the setup)

The bank or the housing finance company (HFC) holds a master policy where the borrower is enrolled as a scheme member. Members get a cover that typically reduces with the loan schedule. Some plans also offer level (and even increasing) phases during moratoriums. It has a single-premium and may allow joint lives/co-borrowers.

Here are some popular group credit life plans in India, their cover scope, premium pay, max term and moratorium, and USPs.

| Group Credit Life Plans | Cover Scope | Premium pay | Moratorium & Max Term | USPs |

|---|---|---|---|---|

| LIC Group Credit Life Insurance | Level / Decreasing / Increasing | Single premium | Moratorium: up to 5 yrs Max term: up to 35 yrs |

Pure group credit life; cover tied to risk schedule |

| HDFC Life Group Credit Protect Plus | Level or Decreasing | Single premium | Moratorium: 1–7 yrs Max term: up to 30 yrs |

Single/joint life lender paid first, balance to nominee |

| ICICI Prudential Group Loan Secure | Reducing (options to start reducing after 3/7 yrs) | Single / Limited (5 or 10 yrs) | Moratorium: 3 or 7 yrs Max term: up to 30 yrs |

Coverage term at inception can’t exceed loan tenure |

| Axis Max Life Group Credit Life Premier | Level or Decreasing | Single premium | Moratorium: 1 month–10 yrs Max term: up to 40 yrs |

Surrender value formula disclosed; lender-pay first |

| SBI Life RiNn Raksha | Group credit life (loan protection) | Single or Limited (5/10 yrs) | Moratorium: 3 months–6 yrs Max term: up to 30 yrs |

Covers multiple loan types; co-borrowers supported |

Note: A moratorium is a 6-month to 10-year window of paused or interest-only EMIs while the life cover stays active. The exact eligibility, surrender amount, and the rider options differ by insurer. So check the latest brochure or term of agreement before you sign.

Premium & tenure (how much you pay)

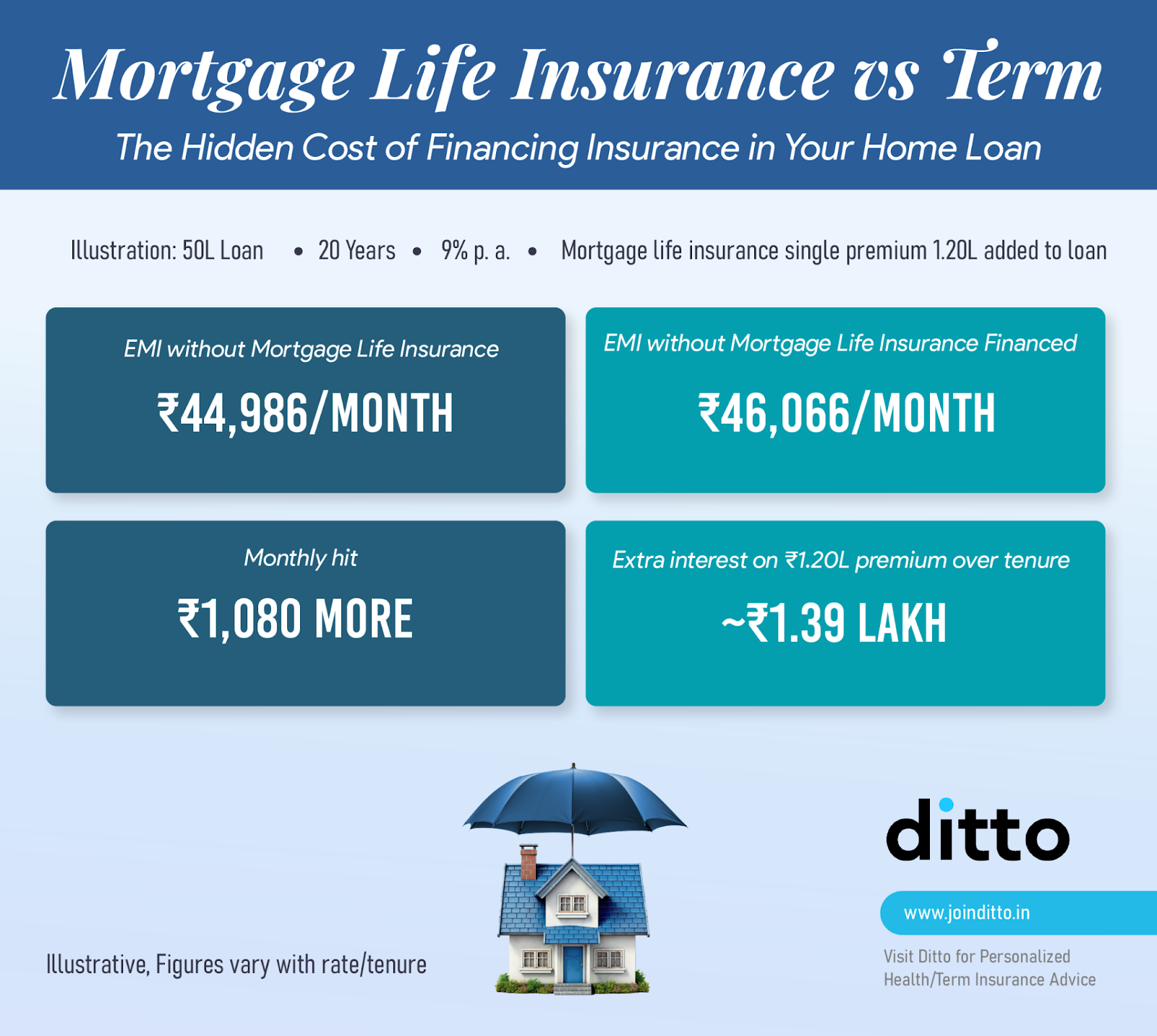

Most mortgage life plans have a single-premium collected upfront (also financed into the loan). That means, a borrower ends up paying interest on the insurance premium too. The policy term mirrors the loan tenure (commonly up to 30 years) with minimal customization, limited control over term and sum assured, and restricted rider choices than an individual term plan.

Claims & beneficiaries (who gets paid first)

Because the policy is tied to the loan and meant for debt settlement, the insurer pays the lender first to clear dues. Any balance amount, (if applicable), goes to the nominee. The assignment protocols are governed by Section 38 and nomination by Section 39 of the Insurance Act.

| What is a Deed of Assignment (Under Section 38 of the Insurance Act)? A Deed of Assignment is a short, official document that transfers certain rights (as collateral) within a particular policy to the lender. Why it’s important : To help the lender recover only what’s due from a claim and anything extra to be transferred to the nominee. However, insurers can vet and even reject an assignment if something looks off (they may ask for supporting docs/clarifications). Here’s how a sample assignment form looks like. How to file a deed of assignment, step-by-step : Step 1: Use the insurer’s assignment/endorsement form or a deed on stamp paper, and state the following explicitly: a)Extent: Full or partial assignment of benefits (e.g., capped to outstanding dues). b) Nature: Absolute vs Conditional (for loans, it’s conditional i.e., collateral). c)Reason & consideration: Why you’re assigning (loan security) and whether any consideration was received (usually NIL for collateral assignments). d) Assignee details: Lender’s legal name, loan a/c number, and any cap/limit wording. Step 2: File it with your insurer and receive written acknowledgment. Step 3: Share the acknowledgment with the lending bank and keep a copy. Step 4: Either on refinance or full prepayment, ask the insurer to revoke the assignment and confirm nomination for family members. Tip: If you already have term insurance, there's no need to buy a new policy. You can use the existing policy to secure your loan directly. |

(plus add-ons for contents, burglary, etc.)

What Is Not Included In Mortgage Life Insurance?

Mortgage life insurance is a narrow tool as it only covers an outstanding loan following the insured’s untimely demise, and that’s it, nothing more! So, before you sign the papers, know what it doesn’t cover and how to fix those gaps.

- No extra benefit beyond loan closure: As decreasing covers are sized to the loan, it doesn't create any extra funds for your family. (A residual fund exists if you choose to buy an oversized cover.)The fix : Get an individual term plan and endorse the policy in favour of the bank (collateral assignment). This helps to settle the outstanding dues and balance goes to your nominee.

- No maturity/savings value: There's no payout if the borrower outlives the term.

The fix: Use a pure term insurance policy for life cover and invest your money separately in mutual funds/PPF/NPS. - No (or limited) living benefits: The base credit-life cover is for death-only. Total Permanent Disability (TPD) / Critical Illness (CI) benefits are optional and vary by product.

The fix : Get a term insurance plan and add TPD/CI riders as needed. - Tenure cannot exceed loan tenure: Credit-life cover (HLPP) is directly mapped to the loan with two separate limits; time and amount. The policy term can’t be longer than the loan tenure and the cover amount at the start can’t exceed the sanctioned loan amount.

The fix: Get a longer-term plan (for e.g., till the age of 65 or 70), and assign it as a collateral-assign to the bank while the loan runs. Once the dues are cleared and assignment is revoked, the policy will continue for your family. - No cover for property damage: Fire/flood/theft/structure damage aren’t counted as life risks.

The fix: Buy home/asset insurance separately. - Job loss isn’t covered by default : Any job-loss add-on (if available) comes with tight caps and waiting periods.

The fix: Maintain a 6–12-month emergency fund and buy a term insurance plan with income-protection, personal accident, and critical-illness riders.

| Clauses to check before signing up for mortgage life insurance: a) Suicide clause in the first year (standard across all life insurance products) b) Accuracy of disclosures (as non-disclosure can void claims) c) Rider specifics (e.g., critical illness definitions, pre-existing disease rules, and survival periods) 4) Surrender/refund formula, just in case you plan to prepay/foreclose 5) Moratorium handling clause and assignment/nomination updates (Under sections 38 & 39 of the Insurance Act). |

Bottom line: Mortgage life insurance only helps your family partially. A wise call is to opt for a combination of term insurance riders, along with home insurance (for property protection), and EMI protection.

If you're a first time term insurance buyer, we recommend checking out our exclusive guide on Term Insurance Riders.

What Are The Advantages And Disadvantages Of Mortgage Life Insurance?

Now that you know how mortgage life insurance works, here’s weighing the pros and cons so you can decide whether it works for you.

| Factor | Advantages | Disadvantages |

|---|---|---|

| Purpose |

Helps clear a specific loan, reduces foreclosure/repayment stress for the family |

Loan-only focus ignores income protection and goals like education and retirement. |

| Underwriting |

Group schemes have simple onboarding, less severe underwriting and coverage for PEDs |

Fewer choices than term plans (tenure, sum assured, and rider options are limited). |

| Premium form | Single premium at disbursal is convenient for many, added to loan outstanding balance. | If refinanced, you end up paying interest on the premium as well. |

| Cover shape | Decreasing cover mirrors loan amortization; efficient for EMIs, but not for life goals. | Prepayments may outpace the repayment schedule as every policy does not auto-rebalance. |

| Joint borrowers | Many plans have joint life or multiple borrower options. | Portability weakens if you refinance or switch lenders during mid-term of your loan. |

Still unsure whether a term plan is a smarter alternative to mortgage life insurance? Find out in detail why term insurance is important and how it can do more than just cover loan repayment in your absence.

Is Mortgage Life Insurance Right For Me: Ditto’s Take

A borrower needs a loan with peace of mind whereas a lender wants repayment assurance. So it boils down to two choices: either take a lender-linked mortgage life insurance cover or assign a term insurance to the lender. Here’s how to decide whether mortgage insurance or term insurance is right for you:

- Prefer simple/no underwriting & quick onboarding?

Go with a lender-linked credit life plan (like HLPP for a home loan). It’s more applicable if you already have adequate term cover and want to ring-fence the loan with a single premium.

The only caveat here is weak portability if you switch lenders and formula-bound refunds. So review surrender/refund terms and compare quotes for the same sum assured and tenure with an individual term plan.

Another option can be co-borrowing, as some group credit life schemes allow. - Want more coverage beyond your loan (like family protection) and rider add-ons?

Go with a term insurance and assign it to the lender. But, before you make a purchase, know how much term cover you need.

You can compare two individual term plans to maximize long-run value. Find out more about how things work with term insurance for couples in 2025.

Here’s a quick comparison of mortgage life insurance vs. term insurance.

| Aspect | Mortgage life insurance (lender-linked group credit life) | Individual term plan (assigned to lender) |

|---|---|---|

| Primary purpose | Clears the specific loan | Protects family and liabilities (loan covered via assignment) |

| Payout order | Lender paid first up to dues; residual (if any) goes to nominee | Nominee receives the payout, decides whether to continue EMI, or pre-pay loan |

| Cover shape | Usually decreasing with loan schedule, some offer choice | Level/Increasing/Decreasing sum assured (choice & plan based) |

| Premium | Often single-premium at disbursal, added to loan balance | Single/Regular/Limited pay — choice based; no loan-interest on premium |

| Portability | Weaker on prepay/refinance | Strong — policy continues across lenders (reassignment may be required) |

| Riders | Limited set; varies by product | Broad options (TPD, CI, WOP) |

| If you prepay | Check surrender value as refunds are formula-bound | No surrender factor as the policy remains intact |

| Best for | Urgent disbursals/simplified onboarding | Most borrowers seeking value and flexibility |

Term Insurance Plans To Replace Mortgage Life Insurance (2025): Ditto’s Recommendations

Before we discuss the list, here’s how we decide what plans to feature.

At Ditto, every term plan goes through our six-point evaluation framework. It doesn’t mean these are the only good plans, but that they stand out after being scored across all six pillars.

You can learn more about how we evaluate term insurance plans here.

Plans mentioned can be assigned to the lender without any hassle.

a) HDFC Life Click2Protect Supreme

A flexible term plan with add-ons you can dial up as life changes. Highlights include Accidental Death Benefit, Accidental Total & Permanent Disability rider, Critical Illness cover (60 illnesses), terminal illness benefit, inflation-linked cover increases, and a premium-break option. You also get wellness perks (discounted health checks, doctor/nutrition consults) and grief counselling for nominees without turning it into a savings plan.

b) ICICI Prudential iProtect Smart Plus

A term plan built for life stages. You can increase the term cover after milestones like marriage/childbirth, add Accidental Death Benefit and Critical Illness (60 illnesses), and get a terminal illness payout on the full sum assured. Zero-cost option and premium-break features add flexibility, with an “instant payout on claim intimation” facility as per product terms.

c) Axis Max Life Smart Term Plan Plus

Besides the Regular variant, there’s also “Smart Cover” (with 1.5× coverage for the first 15 years), which makes it attractive if you want higher early-years protection. It offers Accidental Death & Dismemberment, Critical Illness (64 illnesses), waiver of premium on disability/CI, women-focused perks (Lifeline Plus and discounts), plus zero-cost exit and premium-break options.

d) Bajaj Allianz Life e-Touch II

Designed for simple onboarding with meaningful riders. Highlights include Accidental Death Benefit, terminal illness cover, Life Stage Benefit to boost cover, and Critical Illness (60 illnesses). There’s also an inbuilt waiver of premium on accident-related permanent disability, along with zero-cost option, premium break, and an instant-payout-on-intimation feature.

e) Tata AIA Sampoorna Raksha Promise

A robust protection suite with Accidental Death, Critical Illness (40 illnesses), and Accidental Total & Permanent Disability. Waiver of premium on CI/disability helps keep the plan active through crises, while Life Stage Benefit and Flexipay (premium break) add flexibility. You can bolt on a Hospicare rider, and there’s an instant-payout-on-intimation facility as specified in product conditions.

Banks pitch mortgage life insurance plans to meet sales targets and earn incentives, but that doesn't make them compulsory. As a borrower, always match your unique needs to the loan structure. If you switch lenders going forward or aggressively prepay, assigning a term insurance is always profitable.

Why Choose Ditto For Term Insurance

At Ditto, we're on a mission to make Indians smart insurance buyers with clear, no-fluff advice. If you're looking to buy term insurance, we can help you find the right cover, riders, and payment options. To date, we’re trusted by 700,000+ customers for all good reasons.

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

✅Personalized recommendations

✅Real-time claim support

Conclusion

Mortgage life insurance can help close pending EMIs if the borrower passes away during the loan term. But this one-premium option can be a trap. When life goes south, a family has a lot to worry about than just settling pending dues.

That’s where a term insurance policy comes as a smart alternative, offering all round protection for different life stages. However, designing the perfect term insurance plan is easier said than done. Book a free call with Ditto, get your queries answered, and experience hassle-free insurance buying like nowhere else.

FAQs:

What is mortgage disability insurance in India?

In India, "mortgage disability insurance" is a distinct feature that sits within a Home Loan Protection Plan (HLPP). It promises to pay off the remaining EMIs if a borrower becomes disabled and is unable to earn anymore.

Does mortgage life insurance apply only to home loans?

No! Mortgage life insurance applies to a wide range of loans including home, vehicle, education, loan-against-property, personal, and top-up loans.

Where can I buy mortgage life insurance?

Mortgage life insurance is generally offered during loan disbursal via your bank/lender or from an insurer/broker. Before paying, check and confirm lender acceptance and refund rules on prepayment/refinance.

Is it mandatory to buy home loan protection plans in India?

No! Neither the RBI nor the IRDAI has any rule that makes it mandatory to buy home loan protection plans in India. Yet banks and other lenders cross-sell home loan protection plans calling it a standard process.

What happens to the mortgage life insurance if I prepay or foreclose my loan?

Most mortgage life insurance policies are group credit life cover with member-level surrender option when the cover is no longer needed. The refunds are made using the policy’s surrender value formula.

How does a Deed of Assignment work with a term plan?

A Deed of Assignment assigns your existing (or a new ) term insurance policy to the lender so they can deduct only the dues when a claim arises. The residual or remaining benefit goes to your nominee. The borrower can also ask the lender to revoke or update the assignment if they refinance or foreclose their loan.

Does mortgage life insurance cover job loss or property damage?

No, mortgage life insurance doesn't cover job loss or property damage by default. Job-loss benefits are separate add-ons that come with a cap while property damage is covered under home/asset insurance.

Last updated on: