Quick Overview

Two of the most trusted insurers in India are HDFC Life Insurance Co. Ltd and Axis Max Life Ltd. Both companies have built strong reputations over more than two decades, backed by credible parentage, nationwide branch networks, and diversified portfolios.

But which one is better for you? Choosing between them isn’t about finding a winner but about deciding what matters most to you.

Let’s break down the comparison of Axis Max vs HDFC Life using hard data, flagship plan features, and premiums, so you can make a confident decision.

Side-by-Side Comparison: HDFC Life vs Axis Max Life

HDFC Life was incorporated in the year 2000 as one of the first private life insurers to begin operations after the sector opened up. Headquartered in Mumbai, it is backed by HDFC Bank (50.21%). The remaining ownership consists of roughly 24-25% of foreign institutional investors (FIIs), 12-15% mutual funds, and significant public shareholding.

On the other hand, Axis Max Life, originally launched as Max New York Life in 2001, now operates as a joint venture between Max Financial Services (81%) and Axis Bank (19%).

Key Insights:

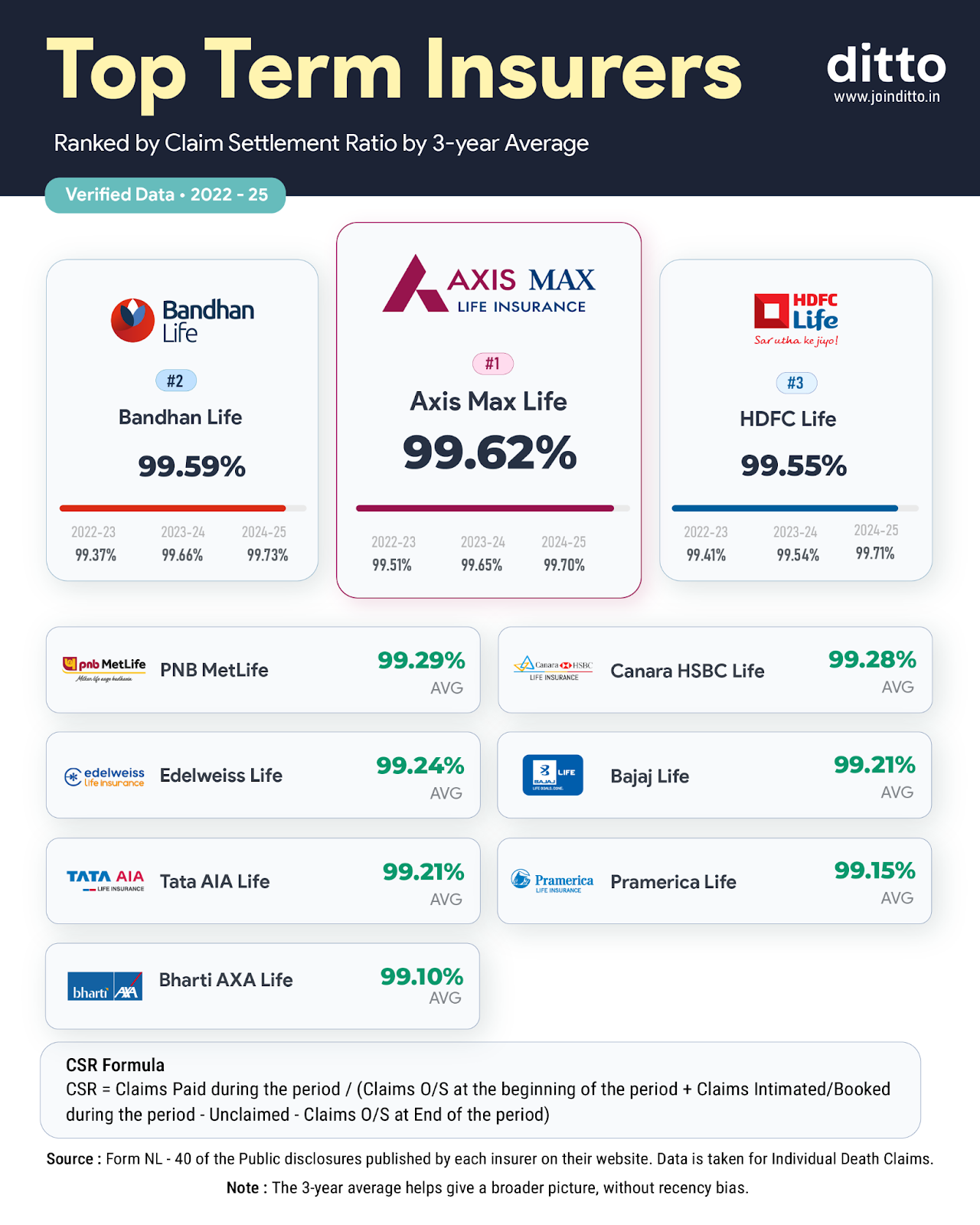

- The Claim Settlement Ratio (CSR) measures the percentage of the number of claims settled out of the total number of claims received. While both insurers are nearly identical, Axis Max Life is marginally better.

- The Amount Settlement Ratio (ASR) shows how much of the total claim amount filed was actually paid. It shows whether an insurer is treating both low and high value claims fairly. Here, Axis Max Life performs better than HDFC Life

- The complaint volume indicates the number of complaints per 10,000 claims. While both insurers perform well here, HDFC Life stands out with a minimal 1.33 (FY 22-25) complaints.

- The solvency ratio measures an insurer’s financial stability. Both insurers surpass IRDAI’s minimum requirement of 1.5x, but HDFC Life is slightly stronger with 1.94x (FY22-25).

- The annual business volume reflects the total premium collected. Here, HDFC Life operates at nearly 3x the scale of Axis Max Life. Moreover, HDFC Life pays out higher total claim amounts annually.

At Ditto, we consider a 3-year average for key performance metrics. This smooths out short-term volatility. One unusually strong or weak year won’t distort the bigger picture.

Also, note that these metrics apply to the overall life insurance segment (term insurance, savings plans, ULIPs, etc.). While insurers don’t disclose these separately for term insurance, they remain strong indicators of overall reliability.

Flagship Plan Comparison: HDFC Life vs Axis Max Life

To learn more about which riders we typically recommend at Ditto, you can check out our detailed guide on term insurance riders.

Premium Comparison: HDFC Life vs Axis Max Life

For this example, we’ve considered healthy, non-smoking, salaried individuals, living in a tier-1 city like Delhi, covered till the age of 70 for a sum assured of ₹2 crores.

Note: The premiums shown above are indicative in nature as they can vary based on your age, medical history, occupation, income, and underwriting outcome.

Top 10 Term Insurance Companies by Claim Settlement Ratio

To know more about the top 10 term insurance claim settlement ratio companies, you can check out our detailed guide.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call or chat on WhatsApp now!

Ditto’s Take on HDFC Life vs Axis Max Life

When comparing Axis Max Life vs HDFC Life, you’re not choosing between a “good” or “bad” insurer. You’re choosing between two well-established private players with consistently strong IRDAI-backed performance.

Choose HDFC Life If:

- You prioritise lower complaint ratios.

- You’re comfortable paying a slightly higher premium for added structural stability and scale.

- You want access to features like Life Stage Benefit, Parent Secure, and flexible cover enhancements.

In short, HDFC Life works well for someone who prioritises operational scale, complaint performance, and feature depth over marginal premium savings.

Choose Axis Max Life If:

- You’re looking for marginally stronger claim efficiency metrics (CSR and ASR).

- You want a reliable insurer that balances cost and high-quality features.

- You prefer structured income variants and flexibility in payout styles.

Axis Max Life may appeal more to buyers who want a cost-efficient plan without compromising on core claim reliability.

Ultimately, the better insurer depends less on headline metrics and more on which policy fits your profile, underwriting outcome, and long-term needs.

Full Disclosure: Axis Max Life and HDFC Life are both partner insurers of Ditto. The information provided in the article above has been sourced from IRDAI reports, insurer disclosures, and publicly available data. If you’d like to know more about how we shortlist plans or insurers, you can check out Ditto’s Cut.

Frequently Asked Questions

Last updated on: