Quick Overview

Buying health insurance doesn’t mean everything is covered from day 1. Your policy can be active, but some treatments are payable only after you complete the waiting periods. In simple terms, it’s a fixed time insurers ask you to wait before the full coverage starts.

In this article, we’ll explain what the waiting period in health insurance is, the types of waiting periods, how to reduce them, and the difference between the waiting period and the survival period.

What is the Waiting Period in Health Insurance?

A Waiting Period in Health Insurance is the time you must complete after buying a policy before the insurer starts paying for certain conditions. During this window, your policy is active, but claims for those listed conditions can be rejected.

- Why Do Insurers Apply it: Some treatments are planned or predictable. Waiting periods stop people from buying a plan today and claiming for an already-known treatment tomorrow.

- How it Affects Claims: If your hospitalization is for a condition still under its waiting period, the insurer will deny the claim even if everything else checks out.

- How it Affects Renewals: Waiting periods don’t reset every year; they are applied initially during policy purchase. Once you’ve served them, they are carried forward.

- How to Check It in Your Policy: Look for the “Waiting Periods” section in your policy schedule and full policy wording to see what’s covered now vs what becomes payable later. If anything feels unclear, confirm it with your insurer or advisor.

Types of Waiting Periods in Health Insurance

1) Initial Waiting Period (usually 30 days)

- This is the first waiting period where only accidents are covered from day 1, and non-accident claims are not covered for the first 30 days.

- For example, HDFC ERGO Optima Secure covers only accidents for the first 30 days.

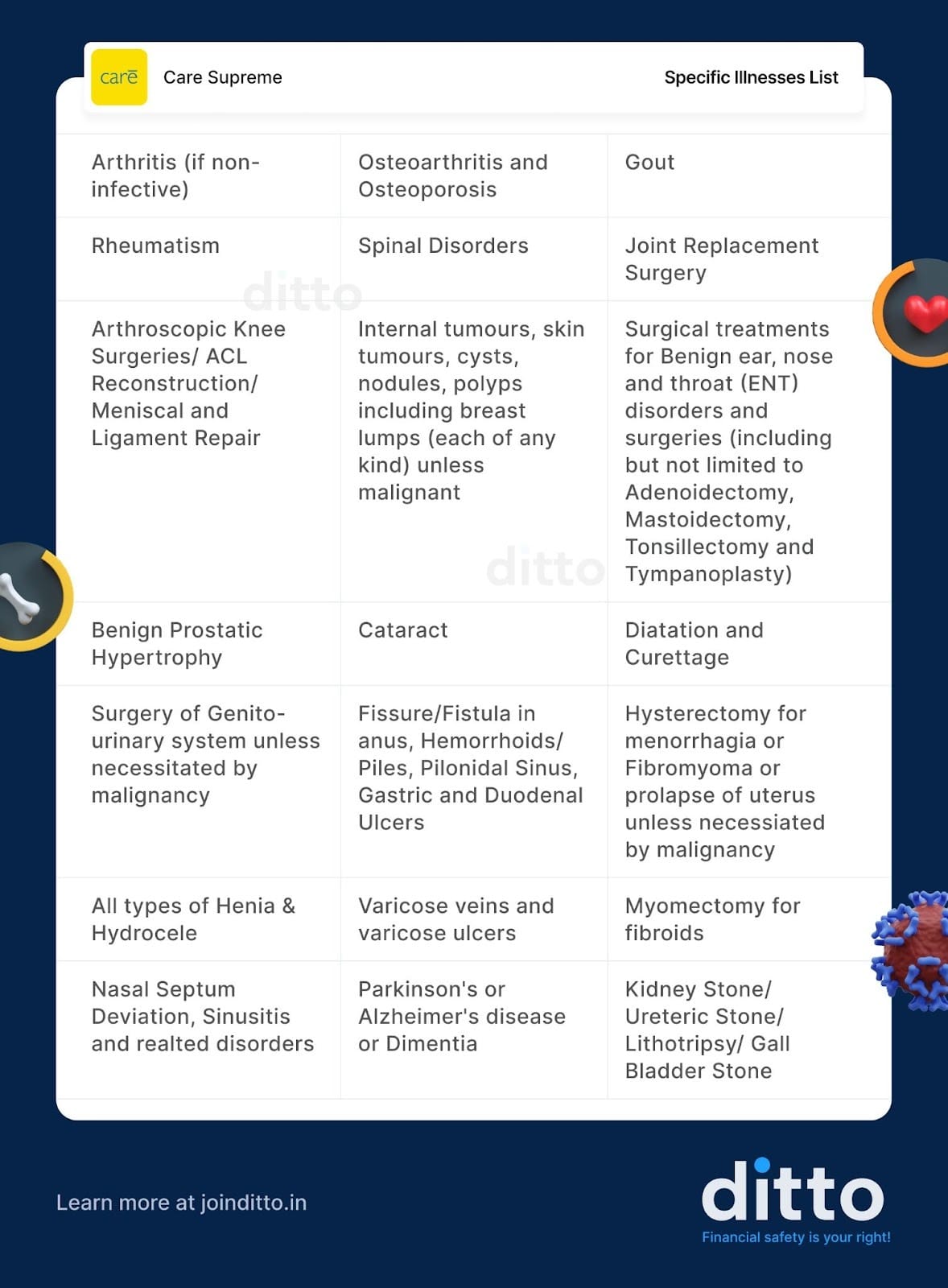

2) Specific Illness Waiting Period

- These are listed conditions and surgeries (like hernia, cataract, piles, sinus surgery, etc.) that insurers cover only after you complete a fixed period, even if you develop the condition after buying the policy.

- In most policies, this waiting period is around 2 years.

- For example, Care Supreme does not cover the following conditions for the first 2 years:

3) PED Waiting Period

- If you already had a condition before buying the policy (say, diabetes or thyroid), the insurer will cover it only after you serve the pre-existing disease waiting period.

- IRDAI caps the PED waiting period at 3 years, and while most plans keep it at 3 years, a few offer shorter defaults like 2 or even 1 year.

- For example, in Aditya Birla Activ One MAX, pre-existing diseases are not covered for the first 3 years.

4) Maternity Waiting Period

- Maternity benefits (delivery-related expenses) come with their own waiting periods, because insurers don’t want someone to buy a plan only when pregnancy is planned.

- The duration can vary a lot by plan and variant, but it’s most commonly between 9 months and 4 years.

- For example, Niva Bupa Aspire offers a 9-month maternity waiting period in its Platinum+ and Titanium+ variants.

5) OPD Waiting Period

- Many health plans either don’t cover outpatient department medical expenses at all, or cover them only through a defined OPD benefit/add-on with its own limits and rules.

- For example, HDFC ERGO Optima Secure’s Optima Wellbeing add-on offers cashless general practitioner consults and discounts on tests and medicines, after a 30-day waiting period.

Note: Waiting periods apply to everyone, including senior citizens. They’re plan-dependent, not age-dependent. What changes with age is pricing and underwriting, not the concept of waiting periods.

How to Reduce Waiting Periods in Health Insurance?

Waiting Period Reduction Add-ons

Some plans let you pay extra to cut down the PED waiting period, so coverage starts sooner for those specific health issues. For example, Aditya Birla Activ One MAX allows the PED waiting period to be reduced from 3 years to 0 days for certain conditions (like asthma, hypertension, diabetes, etc.), and Care Supreme has add-ons that can reduce the PED wait to 1–2 years, or even 30 days for select lifestyle conditions.

Plans With Shorter Default Waiting Periods

If you already know you need faster coverage for a known condition, choosing a plan that starts with a shorter default waiting period can save you years of waiting. For example, SBI Super Health Platinum has a 2-year PED waiting period and a 1-year specific illness waiting period.

Use Corporate Cover

Employer-provided health insurance comes with zero waiting period, this means that everything is covered from day 1, even if it's an existing condition. Use it as a backup while your retail plan’s waiting periods run, but don’t depend on it since corporate cover can change with your job or employer policy.

What is the Difference Between Waiting Period and Survival Period?

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call or chat on WhatsApp with us now!

Ditto’s Take on Waiting Period in Health Insurance

We don’t recommend looking for health insurance with zero waiting periods. Instead:

- If you’re young and healthy, the most cost-effective strategy is to buy a solid plan early and let waiting periods get served quietly in the background.

- If you already have a known condition, a waiting-period reduction rider may be worth the extra cost, but read the fine print and check how long you must keep paying for the rider.

- Always verify the insurer’s policy wording, especially the specific illness list, and remember that anything linked to a PED won’t be covered until the waiting period is over.

Frequently Asked Questions

Last updated on: