Quick Overview

Standalone health insurance companies have grown rapidly due to their exclusive focus on healthcare and are regulated by IRDAI. Star Health Insurance became India’s first standalone health insurer in 2006, while Narayana Health Insurance is among the newest entrants.

This guide walks you through the list of standalone health insurance companies in India, their features, benefits, and how to choose the correct one.

7 Standalone Health Insurance Companies in India

Note: CSR stands for the claim settlement ratio, which indicates an insurer's reliability. It measures the percentage of claim payout compared to the total claims received in a year.

Key Features of Standalone Health Insurance Companies

- Wide Product Range: Standalone health insurers offer multiple plan options with specialised add-ons like maternity, critical illness, and disease-specific covers. This lets customers customise policies beyond basic hospitalization. For instance, Star offers specialized plans like Star Cancer Care Platinum and Cardiac Care.

- Health-Only Expertise: Their sole focus on health insurance enables tailored products with innovative features such as renewal bonuses and wellness rewards.

- Coverage for Every Segment: Plans are designed for diverse needs for low-income individuals, families, senior citizens, and critical illness patients, ensuring affordability and relevance across demographics. For example, Care Health offers Care Freedom as a last resort plan for people with severe PEDs.

- Specialized Offerings: Standalone insurers now shorten pre-existing disease (PED) waiting periods through riders and offer chronic-care plans for conditions like diabetes instead of rejecting applicants. Plans such as Aditya Birla Activ One Max offer add-ons like Chronic Care, covering listed conditions from day 1 and PED Reduction to reduce the waiting period from 3 years to 2 or 1 year.

Benefits of Choosing Standalone Health Insurance Companies Over General Insurers

Stronger Hospital Network

With healthcare as their core business, they build extensive hospital tie-ups to support smoother cashless claims and quicker approvals

Strong Support

Dedicated health-only claims teams ensure faster processing, higher settlement efficiency, and 24×7 assistance during hospitalization.

Greater Flexibility

Policies are highly customizable with disease-specific riders, OPD cover, no room-rent caps, and international treatment options, often with simpler medical checks and quicker issuance.

Wellness Benefits

Many standalone health insurers include wellness features like free health check-ups, fitness or gym discounts, and health-tracking programs that encourage a healthier lifestyle while lowering long-term medical risks. Care Supreme offers add-ons like BeFit, with which you get unlimited access to empanelled fitness centres/Gyms.

Difference Between Standalone Health Insurance Companies and General Insurers

How to Choose the Right Standalone Health Insurance Company?

- Claim Settlement Ratio (CSR): You must check the CSR to understand how reliably an insurer pays claims. Looking at a 3-year average helps you avoid being misled by one good or bad year. A higher CSR means you should expect more consistency in settling valid claims.

- Complaint Volume: You should review complaints per 10,000 claims to judge service quality. Fewer complaints usually mean you will face fewer problems and a smoother claims process.

- Gross Written Premium (GWP): You must look at GWP to gauge an insurer’s size and financial strength. A higher GWP suggests the insurer is more capable of handling large claim volumes when you need support.

- Hospital Network: You should choose an insurer with a wide hospital network so you can easily access cashless treatment near you and avoid large out-of-pocket payments. Aditya Birla has 12,000+ network hospitals, while Star Health has a strong network of over 14,000+ hospitals.

- TPA Model: You must check whether claims are processed in-house or through TPAs. In-house claim handling is usually faster, more accountable, and works in your favour during settlements.

- Online Services: You should prioritise insurers with strong online services for buying policies, renewing them, and tracking claims. Good digital support makes it easier for you to manage your policy and improves transparency.

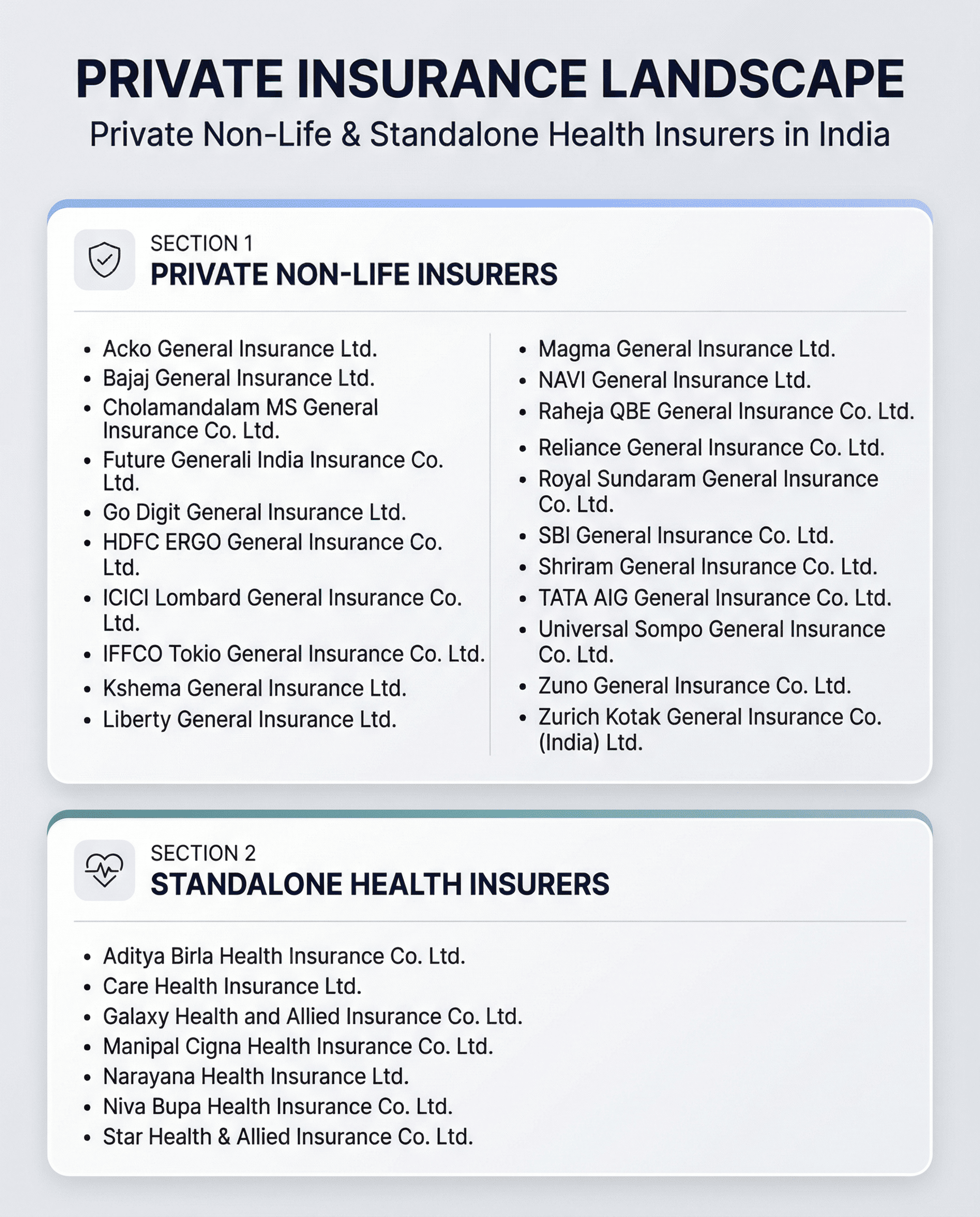

Check out the IRDAI-approved list of health insurers in India:

Source: IRDAI Annual Report 2024-2025

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Here’s why customers like Abhinav love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 5,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

You can book a FREE consultation with us. Slots are filling up quickly, so be sure to book a call now or chat with us on WhatsApp!

Conclusion

From well-known general insurers like HDFC ERGO and Bajaj General to health-focused players like Star Health and Aditya Birla Health Insurance, India’s health insurance market offers options for almost every need and budget.

If you are looking for a health plan from insurers with established track records, we recommend comprehensive plans for 2026, which align with your long-term goals. Explore more about how our experts evaluate health plans through Ditto’s cut.

Disclaimer: Ditto Insurance currently partners with a limited set of health insurers, including Care Health, Aditya Birla Health, Star Health and Niva Bupa. However, this article evaluates both partner and non-partner insurers. The selection, ranking, and analysis are based solely on publicly available IRDAI data and objective performance metrics, not on commercial relationships.

For a detailed explanation of our methodology, partnership policy, and key disclosures, please refer to our Editorial Policy and Disclaimers page.

Frequently Asked Questions

Last updated on: