| What Are Health Insurance Plans with Free Medical Check-ups? These policies provide periodic free or subsidized health screenings, enabling the insured to assess their health status and detect potential illnesses early. The plans include coverage for routine medical check-up tests, which may be annual or every few years, depending on the insurer and policy terms. |

Everyone looks at health insurance as a backup for emergencies. But what they miss is that some policies also cover preventive care in the form of free medical check-ups. Although a small benefit, it definitely saves you money and helps tackle health issues early.

Here’s the catch, though: not all health insurance plans offer it upfront. Some offer it as an in-built option, while others keep it as an add-on. While customers often skip the add-on, we found it usually costs less than a standalone check-up at a private lab.

So, are these free medical check-ups worth it? And which policies specifically offer them? In this guide, we’ll break it down, compare costs, and share Ditto’s picks for the best health plans that include free check-ups.

Not sure which riders you actually need? Talk to Ditto’s expert advisors today and get unbiased, personalised guidance - absolutely free.

Why Do Insurers Offer Health Check-ups?

Insurers offer health check-ups as a preventive and risk management strategy for policyholders. Its benefits include:

- Early Detection: Regular screenings help catch health issues early, allowing for timely treatment.

- Cost Savings: Preventive tests reduce out-of-pocket expenses for the insured.

- Better Monitoring: Annual checkups track vital health indicators.

- Fewer Hospitalizations: Preventive care lowers the risk of major illnesses.

- Higher Policy Value: Free checkups enhance overall insurance benefits.

Quick Note: The coverage and limits for free medical check-ups depend on your insurer, the policy you choose, the sum insured, and even your age (differs for minors, adults, and senior citizens).

| Did You Know? Many insurers now link preventive care with wellness programs, rewarding healthy habits, such as regular exercise, with discounts or points. The IRDAI encourages insurers to include such features to promote health awareness and potentially reduce future claims. Even so, health insurance for preventive care remains a discretionary inclusion that varies based on each insurer’s product design and pricing strategy. For more details, refer to the IRDAI’s guidelines on wellness and preventivea features. |

How Often Can I Avail a Free Medical Check-up Under My Policy?

Knowing how often your health plan offers free medical check-ups helps you plan them at the right time. Here’s an overview:

- Annual benefit: Most plans cover health check-ups once every year.

- From the First Year: Some health insurance plans, such as Care Supreme and Niva Bupa ReAssure, provide this benefit from the very first policy year.

- After Completion of a Policy Year: Plans like HDFC ERGO Optima Secure offer check-ups only after you complete one policy year.

- Claim-free Years Only: Some public sector undertaking (PSU) insurers (e.g., Oriental, New India) provide health check-ups only if you haven’t made a claim during the year.

Remember: Free check-ups are available only after a waiting period, usually between 1 and 3 claim-free years (in the case of PSUs).

What Kind of Tests Are Usually Covered in a Free Check-up?

Although the exact type of tests covered in your annual check-up can vary from one insurer to another, all health plans have some tests in common. Some of these tests are listed below:

- Complete Blood Count (CBC)

- Blood Sugar Test

- Blood Pressure Measurement

- Routine Physical Examination

- Urine Analysis

- Lipid Profile

- Liver and Kidney Function Tests

- ECG (Electrocardiogram)

- Chest X-ray and Abdominal Ultrasound

- Vitamin Deficiency Screening

- Women-Specific Tests

| Things to Consider: Health check-up reports are always shared with the insurer. In case of cashless check-ups, the diagnostic center sends the reports directly to the insurance company, which then forwards them to you. For reimbursement claims, you'll need to submit the test reports along with the receipts yourself. These reports also provide insurers with an indication of your overall health, which can influence their assessment of future claims and costs. |

Are Free Health Check-ups Available Only in Network Hospitals and Labs?

Free health check-ups under health insurance are generally offered primarily at the insurer's network hospitals and diagnostic labs, where the process is cashless and the insurer settles the bills directly with the provider.

If the insured prefers to undergo the check-up at a non-network hospital or lab, they must pay for the tests upfront and then file a reimbursement claim with the insurer (if this facility is offered)..

Quick Note: To take advantage of the free health check-up, your insurer may require prior approval. This typically involves filling out a form, obtaining approval, and presenting the authorization letter at the diagnostic center.

Are There Any Limitations on the Tests Covered?

Yes, these limitations vary by insurer, policy type, and the sum insured. Common ones include:

- Pre-determined Test List: Insurers specify a fixed set of basic tests included in the free check-up, such as blood pressure, blood sugar, ECG, and chest X-ray. More specialized/ diagnostic, or extensive tests are usually not covered.

- Sum Insured-Dependent Coverage: The range and number of tests covered often depend on the policy’s sum insured. Higher sum insured plans generally offer more comprehensive free check-up benefits.

- Coverage Amount Cap: There may be a monetary cap on the total cost of tests covered during a free check-up, which can influence the tests that can be performed within that limit.

- Frequency Limits: Free medical check-ups are typically allowed after a specified waiting period or a certain number of claim-free years, limiting the frequency of this benefit's use.

Pro Tip: It's essential to read the specific policy wording to understand the exact tests and limits covered under the free medical check-up benefit.

Health Insurance Plans With Free Medical Check-ups That Make Ditto’s Cut

| Before we discuss the list, here’s how we decide what “best” means. At Ditto, every health plan goes through our six-point evaluation framework. This framework is why we’re comfortable using the word “best.” However, it doesn’t mean these are the only good plans, but that they stand out after being scored across all six pillars. You can learn more about how we evaluate health insurance plans here. |

Although you will find several plans that include free medical check-ups, we recommend the following policies due to their comprehensive features and operational efficiency:

- HDFC Ergo Optima Secure: Offers free health check-ups once every renewal year for individual plans, with a limit ranging from ₹ 1,500 to ₹15,000, depending on the sum insured opted for and whether it’s an individual or a family floater policy. The plan, however, does not provide a list of tests. Instead, it sets a fixed reimbursement amount, and you must get the tests done yourself and then submit a claim for reimbursement.

- Care Supreme: Annual health check-ups are available as an optional add-on with this plan. However, this rider is applicable only for specified tests (see page 14 of the policy wording), with a maximum limit of up to the sum insured on a cashless or reimbursement basis.

- Aditya Birla Activ One Max: It offers free health check-ups once a year on a cashless basis for listed tests (pages 29 and 30 of the policy wording) based on the cover amount. However, there is a 30-day waiting period from the policy issuance date for this.

- Niva Bupa ReAssure 2.0 Titanium+: Niva Bupa’s health insurance plan offers free medical check-ups starting from day one, but only for a specific list of tests (check page 7 of the policy wording). However, if you undergo multiple tests, they must be conducted within 7 days. The medical check-up claims are settled exclusively on a cashless basis through the Niva Bupa app.

Ditto’s Take: If your insurer offers health checkups as an add-on, always do a cost–benefit analysis. In many cases, the add-on works out cheaper than paying directly for tests.

Let’s do a premium comparison of Care Supreme, ICICI Elevate, and Star Health Super Star Plans to understand this better:

This case involves a 25-year-old individual from Bangalore who has opted for a ₹15 lakh cover for 1 year.

| Plan | Add-ons | Cost |

| Care Supreme | Annual health checkup for specified tests | ₹10,306 (₹604 for add-on) |

| ICICI Elevate | Annual health checkup up to ₹5,000 at network providers anytime during your policy for specified tests |

₹13,444 (₹1,475 for add-on) |

| Star Health Super Star | Annual health checkup (1% of SI subject to a maximum of ₹25,000 in a policy year) | ₹12,891 (₹3,962 for add-on) |

n short, adding a rider for health checkups is usually more economical than paying for tests on your own. Plus, you often get extra benefits along with it.

Why Choose Ditto for Your Health Insurance

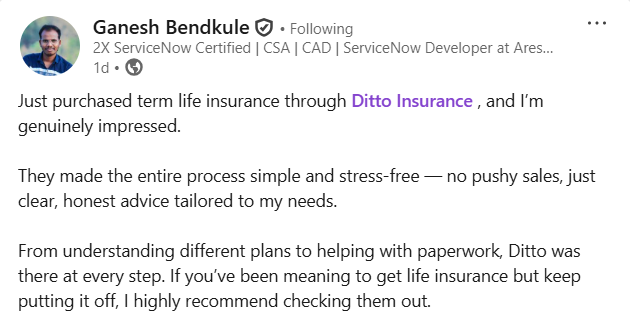

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Ganesh below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Ditto’s Take on Health Insurance Plans with Free Medical Check-up

Free health check-ups promote early disease detection and better health management by providing routine tests at little or no additional cost. However, policyholders need to weigh the costs versus the benefits of add-ons, as they sometimes offer broader coverage at a lower incremental cost. Additionally, coverage terms vary: while some plans offer check-ups from the first year, others require a claim-free period before eligibility.

Comparing insurer offerings with market prices for tests helps you choose the best value option. To sum it up, free medical check-ups can be a valuable preventive care tool when chosen wisely.

Planning to buy health insurance with free medical check-up benefits? Call our experts at Ditto for free, unbiased advice and find the right plan for you - without hidden catches.

FAQs

Will using my free check-up benefit affect my No Claim Bonus (NCB)?

No, using the free health check-up benefit does not affect your No Claim Bonus since it is a preventive service, not a claim for treatment.

How do I book or claim a free health check-up with my insurer?

Contact your insurer or use their app/portal to check eligibility, select a network lab/hospital, obtain authorization, and undergo the check-up on a cashless basis. For non-network centers, pay upfront and submit a claim for reimbursement.

Are ailments diagnosed post-purchase covered by default?

Yes, ailments diagnosed after purchasing the policy are covered, subject to the policy terms and waiting periods; pre-existing conditions have separate waiting period rules.

Do free medical check-ups qualify for tax benefits?

Health insurance premiums, including preventive check-ups, qualify for tax deductions under Section 80D (old tax regime). The benefits are up to ₹25,000 for policyholders below 60 years, and up to ₹50,000 for senior citizens.

Last updated on: