Quick Overview

Imagine you’re a student who just turned 26 and never had to worry about health insurance. It may seem unnecessary, but that’s where many go wrong.

While you can manage your day-to-day health, you can’t predict sudden hospitalizations or unexpected diagnoses like cancer.

A good health insurance plan protects you from these unpredictable, high costs, safeguarding both your finances and education.

At Ditto, we’ve helped over 8,00,000 people choose the right health insurance plans. Many students over 26 ask, "What’s the best plan for me?"

Here’s the thing: the IRDAI doesn’t define "student health insurance," and there’s no one-size-fits-all solution.

In this article, we’ll break down the different health insurance options for students over 26 and explain how each one works.

Types of Health Insurance Plans for Domestic Students

Personal Health Insurance

This is offered directly by insurers and provides long-term, flexible coverage. Personal health insurance for students over 26 is a solid choice because you can keep it even after you graduate. Later, you can add your spouse or kids to the same policy, if needed. The best examples are HDFC Ergo Optima Secure and ICICI Elevate.

University-Sponsored Health Insurance Plans

These plans are provided by universities, often as group health insurance. Several institutions in India, such as IITs, IIMs, and IISc, offer group health insurance plans to enrolled students.

Types of Health Insurance Plans for Students Studying Abroad

- University-sponsored Health Insurance

These are group health insurance plans provided directly by universities, and in some cases, they’re mandatory for enrolled students.

They often include additional benefits, such as dental and vision care, features rare in typical retail health insurance plans.

However, these plans are usually not renewable once the course is completed. The best example is the MIT Student Health Insurance Plan (MIT SHIP). - Personal Health Insurance

These are regular individual or family health policies sold by local insurers in the country you move to. They usually work like Indian retail policies but are aligned with local healthcare costs and regulations.

Personal health insurance plans are helpful if you’re not fully eligible for public cover or plan to settle abroad long-term.

Rule of Thumb

- International Student Health Insurance

These plans are designed specifically for students studying abroad and are offered by Indian insurers.

They cover a range of things, from medical expenses to baggage loss. These plans are often cheaper than buying a plan in your destination country.

Common examples include HDFC Ergo Student Suraksha plan and Tata AIG student travel insurance. - Government-Provided Health Cover

This plan is available (sometimes mandatory) only in certain countries. Common examples include the NHS in the UK and the CPAM in France.

Pro Tip: No special plans are available for students enrolled in distance-learning or online courses (often with international universities). They can enroll in regular health plans if the plans do not require attending the course in person.

Top Health Insurance Plans for Students Over 26

Note: To know the methodology behind why these plans are recommended, refer to Ditto’s Cut.

Key Insights

Getting a plan early comes with clear advantages:

- You start serving waiting periods right away.

- Reduce the chances of insurers adding loadings (extra premiums) due to medical conditions or high BMI.

- Lock in a solid policy with adequate coverage while you’re still young and healthy.

Sample Premiums for Health Insurance

Note: These are approximate premiums for a 26-year-old living in Delhi, for a ₹15 lakh cover.

How To Choose the Best Health Insurance Plan for Students Over 26 (Ditto’s Take)?

- Identify where you’re likely to live in the long term. This will help you decide which type of health plan makes the most sense for you.

- If you’re an international student, check with your university to see whether they, or the destination country, require a specific health insurance policy.

- Look for key features like no co-payment, no room-rent capping, no disease-wise sub-limits, and lifetime renewability. These make your coverage far more dependable.

- Plan for the long term because your health insurance should support you well beyond your student years.

Why Choose Ditto for Health Insurance?

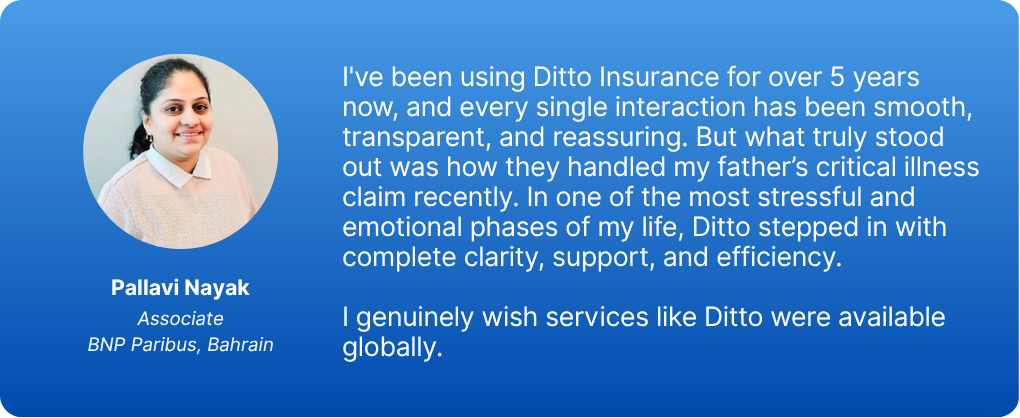

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call now, slots fill up fast!

Conclusion

Whether it’s to cover medical emergencies or safeguard your finances, getting health insurance for students over 26 is a smart move. Just make sure to compare your options carefully and pick a plan that gives you solid coverage at an affordable price.

Frequently Asked Questions

Last updated on: