Quick Overview

Medical emergencies can derail a household budget overnight, and many employees still end up paying from savings or borrowing during a crisis. NFHS-5 shows 41% of households have at least one member covered under a health insurance or financing scheme, which means many families still face out-of-pocket bills during emergencies.

Small business health insurance can help close this gap. Whether you are a founder, freelancer with a team, or a growing startup, offering health insurance for small business employees can protect your team and strengthen your benefits package.

In this article, we explain what small business health insurance is, why it matters, the types of policies available, the benefits, and how to choose the right plan.

Types of Health Insurance Policies for Small Business Owners

Our Advice: For most small businesses, group health insurance offers the best balance of cost, coverage, and employee experience. ESIC works for statutory compliance, while individual plans are better for very small or distributed teams.

Retail Plans if Group is Not an Option

If your team is too small for a group policy, you can either reimburse employees for a retail plan or buy individual policies for them. Here are some plans we commonly shortlist: HDFC ERGO Optima Secure, Care Supreme, Aditya Birla Activ One Max, and Niva Bupa ReAssure 2.0 Platinum+. Keep in mind retail plans usually come with waiting periods, and some benefits (like maternity or OPD) may not be available right away.

For the full comparison, see our Best Health Insurance Plans pillar page.

Advantages of Health Insurance for Small Business Owners

Stronger Hiring Appeal

Health insurance makes your job offer more attractive, especially for experienced hires who compare benefits before accepting a role. Even a basic group plan can make your small business compete with larger companies.

Lower Attrition Risk

Employees are less likely to leave when they feel their health and family are financially protected. This reduces hiring and training costs, which can be significant for small businesses.

Predictable Healthcare Costs

With group health insurance, you pay a fixed premium instead of handling unpredictable medical reimbursements or emergency salary advances. This makes budgeting easier for founders.

Tax-Deductible Premiums

Premiums paid for employee health insurance are treated as a business expense under the Income Tax Act. This reduces your taxable income and improves overall cash flow.

Customizable Coverage Options

Small business health insurance plans can be tailored with added benefits like maternity cover, outpatient department (OPD) benefits, or higher sum insured limits. You can start small and upgrade as your team grows.

Factors to Consider When Choosing Health Insurance for Small Businesses

Employee Profile Fit

Look at your team’s age, family status, and health needs. A young startup team may prioritize high coverage at low cost, while older employees may value maternity, OPD, and chronic illness cover.

Coverage vs Cost Balance

Do not choose the cheapest plan blindly. Compare sum insured, room rent limits, and co-pay clauses. A slightly higher premium might give much better coverage.

Hospital Network Strength

Check if the insurer has good cashless hospitals in the cities where your employees live. A large network reduces reimbursement hassles and makes the policy more useful in emergencies.

Policy Terms Clarity

Read exclusions, waiting periods, and sub-limits carefully. Some plans exclude maternity, mental health, or OPD by default. Knowing these details upfront prevents surprises later.

Useful Add-Ons

Consider add-ons like maternity cover, OPD benefits, wellness programs, or parental cover. These can significantly increase perceived value without drastically increasing premiums.

Why Choose Ditto for Health Insurance?

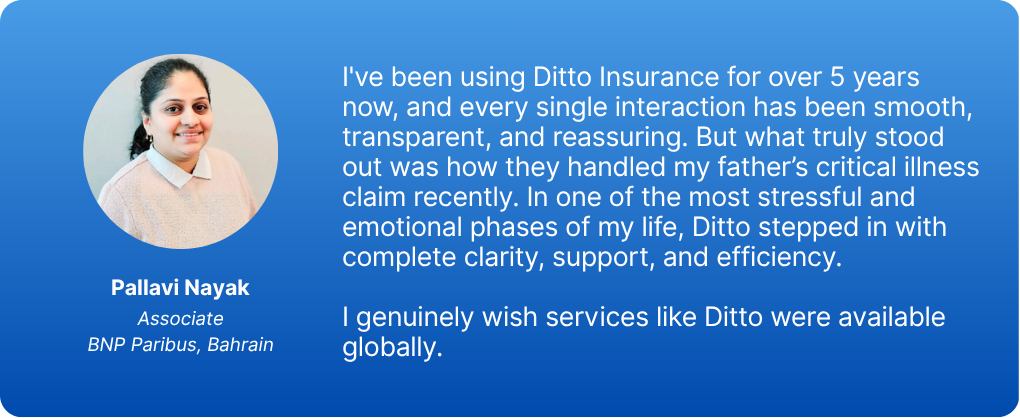

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call or chat on WhatsApp with us now!

How to Choose the Right Health Insurance Policy for Your Business?

If you are building a small business, think of health insurance as infrastructure, not a perk. It protects your employees, but it also protects your business from disruption, financial stress, and high attrition.

For most teams, starting with a basic group health insurance plan makes the most sense. It is easier to manage, offers better coverage than retail plans, and sends a strong signal that you take employee welfare seriously. ESIC should be treated as a compliance requirement, not a benefits strategy. Individual plans work only when you are too small to qualify for a group policy.

The real difference comes down to how thoughtfully you choose the plan. Coverage limits, hospital networks, and exclusions matter far more than saving a few thousand rupees on premiums. A well-chosen plan will actually get used and appreciated, while a cheap one often disappoints when it matters most.

Full Disclosure

Frequently Asked Questions

Last updated on: