Quick Review

When planning your financial future, health insurance is a non-negotiable pillar. Yet, many policyholders get confused by eligibility criteria, especially the health insurance age limit. Whether covering a newborn, yourself, or elderly parents, understanding entry and exit ages is crucial for continuous protection.

In this guide, we break down the nuances of the health insurance age limit in India, how it affects premiums, and the impact of IRDAI reforms, including lifelong renewability and senior citizen coverage.

Minimum and Maximum Age Limits for Health Insurance in India

Note: Most health insurance plans today offer lifelong renewability, so coverage continues as long as you renew on time. However, a maximum entry age still applies and varies across individual, family floater, and senior citizen plans. Always check the plan’s prospectus or Customer Information Sheet (CIS) for the exact entry age limits.

Why the Health Insurance Age Limit Matters in Family Floater Plans?

In family floater plans, the health insurance age limit is not a single number. Instead, it is defined by how three age-related rules work together: entry age, exit age, and renewability. Understanding this is critical because family floaters combine multiple lives under one sum insured, and age directly affects both eligibility and pricing.

Entry Age: Who Can Join and When

The health insurance age limit at entry varies by plan. Most retail indemnity plans allow children to be added as dependents from 91 days and covered under a family floater until their early-to-mid 20s. For adults, the health insurance age limit differs across plans. Some maternity coverage plans also extend benefits to newborns, offering coverage from day 1 (as soon as they are born), provided the maternity-related claim is accepted under the policy.

Exit Age: Mostly Relevant for Children

For most indemnity health insurance plans (individual or family floater), exit age is not a concern for adults since these policies usually offer lifelong coverage. Exit age mainly applies to dependent children. In contrast, benefit-based plans such as critical illness, personal accident, or hospital cash plans, often have fixed exit ages (like 70 or 75) and should not be confused with core health insurance.

Renewability: The Rule That Matters Most

The most important part of the health insurance age limit is whether your policy can be renewed as you grow older. Under IRDAI rules, insurers cannot deny renewal of indemnity health insurance due to age or past claims. They also cannot re-underwrite your policy at renewal unless you request a higher sum insured and even then, underwriting applies only to the increased portion.

How Age Affects Premiums in Family Health Insurance

In family health insurance, age is the biggest factor affecting your premium, as insurers use it to assess the risk and likelihood of medical claims.

Here is a breakdown of how age dynamics impact your premiums and what the current landscape looks like in India.

1. The "Oldest Member" Rule:

In a family floater, the premium is determined by the eldest member’s age. For example, a 30-year-old and a 55-year-old parent on the same plan pay higher premiums than two 30-year-olds. This is why we recommend separate senior citizen policies to avoid inflating the health insurance age premiums for younger members.

2. Age Slabs and Premium Hikes:

Insurers usually price health insurance using age slabs, not yearly increases. Everyone within a band (for example, 36–45) pays the same base premium, which jumps when you renew into the next slab. Care Supreme follows broader slabs, where premiums can rise 15–30% at slab changes.

HDFC ERGO Optima Secure uses near age-wise pricing, with 2–4% annual increases till 60 and 8–10% post 60. Premiums depend on attained age at renewal; insurers may also reprice periodically due to medical inflation.

3. The Impact of Entry Age:

The age at which you enter a policy affects waiting periods and the base premium you start with. Entering at 60 instead of 30 often means higher premiums due to age-related risk and possible health-based loadings.

However, a person who buys at 30 and renews the same policy until 60 will generally pay the same age-based premium at 60 as someone entering at 60, any difference usually comes from health-related loadings, not age alone.

When is the Right Time to Buy a Health Insurance Policy?

The ideal time to buy health insurance is as early as possible, before health issues arise. Early entry allows you to stay comfortably within the health insurance age limit, complete waiting periods while healthy, and secure lower long-term premiums.

As you age, insurers may require pre-policy medical tests, apply loadings for risk factors, add co-payments, or enforce tighter sub-limits. Buying earlier also builds continuity, reduces the risk of exclusions, and starts premiums from a lower base. Later entrants can still obtain coverage but may face higher premiums and stricter underwriting.

Why the 60-Month Moratorium Matters

After 60 months of continuous coverage, claims cannot be contested for non-disclosure or misrepresentation, except in cases of proven fraud. This makes continuity extremely valuable for seniors navigating the health insurance age limit.

Where to Check Entry and Exit Ages

The exact health insurance age limit, including entry and exit ages, is always specified in the plan prospectus and policy wording. For a quicker overview, refer to the Customer Information Sheet (CIS), which must clearly mention renewal rules, waiting periods, and age-related conditions. Ditto also publishes entry and exit age details on its website to make comparisons easier. Example: HDFC ERGO Optima Secure plan.

What If Your Plan Is Withdrawn?

If a product is withdrawn, coverage is not lost due to age. Insurers must provide options to renew or migrate to an alternative plan. This ensures continuity, even if your original plan is no longer sold (another safeguard beyond the health insurance age limit).

What are the IRDAI New Rules on Health Insurance Age Limit?

There is no single legal maximum entry age for health insurance in India anymore. Following recent IRDAI reforms, insurers are encouraged to design products catering to all age groups. However, each product can still define its own entry age limits, underwriting rules, co-payments, and conditions.

IRDAI also mandates lifelong renewability for indemnity health insurance. Once issued, a policy cannot be cancelled due to age or pre-existing diseases, except in cases of fraud or non-disclosure. If a product is withdrawn, insurers must offer renewal or migration options, as outlined in IRDAI circulars.

Why Approach Ditto for Health Insurance?

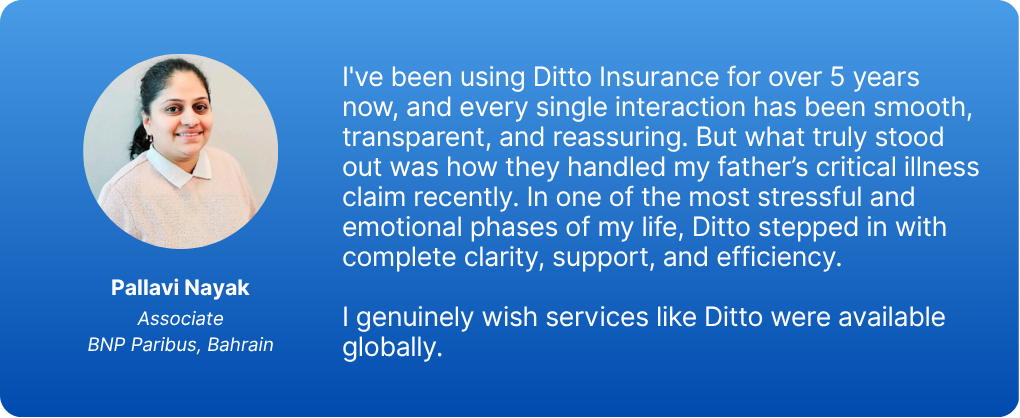

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book a free call or WhatsApp us slots fill up fast!

Conclusion

Understanding the health insurance age limit is less about restrictions and more about when you buy. While India’s regulatory maximum age limit has been relaxed, your premiums and plan features still depend on your entry age. By buying early, you secure access to better policies, complete waiting periods sooner, and preserve your long-term continuity.

Frequently Asked Questions

Last updated on: