| What is Coordination of Benefits in Health Insurance? Coordination of Benefits in health insurance refers to the process of determining how multiple health insurance policies share the cost of a single claim. If you’re covered by more than one plan, like a group and an individual policy, coordination of benefits in health insurance ensures that insurers settle your claim fairly without duplication of payment. It helps determine which insurer pays first and which covers the remaining amount within policy limits. |

Having more than one health insurance policy can feel redundant. However, if you know how to make them work together, they can add an extra cushion of protection. Coordination of Benefits in health insurance explains exactly that: how multiple policies share costs so you get the most coverage without overlap. Let’s explore how COB works and why it matters for your health coverage strategy

| Note: “COB” is a generic term (common in the U.S.) for rules used when you have more than one health cover, so you don’t get paid twice for the same expense. In India, the regulator (IRDAI) doesn’t usually refer to it as “COB”; instead, the operative rules are published under “multiple policies” and “contribution” norms. |

Coordination of Benefits in Health Insurance: An Overview

Coordination of benefits in health insurance (COB) describes the rules and steps used when a person has more than one health policy and needs to use them together for a single hospitalization or treatment.

In India, IRDAI permits multiple health policies and gives policyholders the right to choose which policy to file a claim under. COB exists to make sure you are indemnified for actual healthcare expenses (you cannot profit from indemnity policies) while enabling you to use additional policies to cover gaps, co-payments, or amounts disallowed by the first insurer.

Key points:

- There is no legal limit on the number of policies you can own.

- Defined-benefit plans (hospital cash, critical illness, personal accident plans) pay fixed amounts and can stack on top of indemnity payouts.

- Indemnity policies reimburse actual medical costs; total combined indemnity payouts cannot exceed the real hospital bill.'

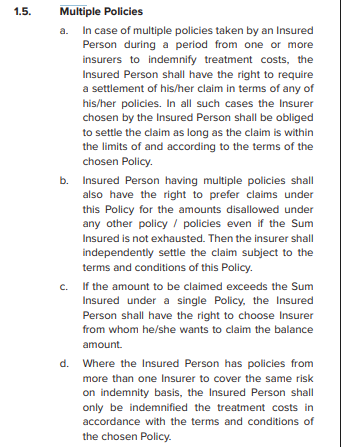

Note: The above screenshot illustrates how the guidelines on multiple policies appear in policy wordings.

| Historical note: Before 2013, the “contribution clause” required multiple insurers to share a claim proportionally. The IRDAI later removed this clause to simplify coordination of benefits and give policyholders the freedom to decide which insurer to claim from first |

Need help coordinating multiple health plans? Ditto’s advisors can help you understand how your policies work together, avoid overlaps, and maximize your coverage. Book a free 1-on-1 call for clear, unbiased guidance.

How Does the Coordination of Benefits in Health Insurance Work?

Here’s an operational view of how coordination of benefits in health insurance works in practice, cashless and reimbursement routes, your rights, and the paperwork you need:

- You can choose which policy to file your claim under; this becomes your primary insurer for that claim. The chosen insurer is obligated to settle the admissible amount in accordance with the policy terms, as per the IRDAI Master Circular on Health Insurance Business (2024).

- Suppose the first insurer disallows certain items or limits, or has cost-sharing mechanisms such as co-payments in place. In that case, you can claim those disallowed amounts from another policy, provided it covers the same expenses.

- If a single policy’s sum insured is insufficient, you can claim the balance amount from other policies you hold.

- For indemnity-based covers, the combined payouts cannot exceed the actual hospitalization cost, ensuring fair reimbursement.These rights are reinforced under the IRDAI (Protection of Policyholders’ Interests and Allied Matters) Regulations, 2024, which emphasize transparency, consent, and fair treatment when holding or splitting multiple insurance policies.

Cashless Claims With Multiple Policies: A Step-by-Step Guide

- Inform a primary insurer and get cashless approval (if the hospital is in their network).

- The primary insurer settles up to its limit (cashless). Obtain the claim settlement summary or invoice copy.

- Submit the settlement summary + original hospital bills + other documents to your secondary insurer for reimbursement of the balance.

Example: Suppose your hospital bill is ₹6,00,000. Your corporate health policy settles ₹3,50,000 through cashless approval. You can submit the settlement summary and remaining bills to your personal (retail) insurer to claim the balance ₹2,50,000, subject to that policy’s terms and conditions.

Reimbursement Claims With Multiple Policies: A Step-by-Step Guide

- Notify all insurers within their specified timelines that you’ve been hospitalized.

- Pay the bill if cashless is not available.

- File for reimbursement with the insurer you choose first (submit original bills, discharge summary, reports).

- After the first insurer issues a settlement statement, submit that statement and the remaining documents to the next insurer to claim the balance.

| Did you know? Your health insurance plan quietly decides which pool of money pays first when you make a claim. This behind-the-scenes rule, known as the sequence of utilization of the Sum Insured, functions like an internal “coordination of benefits.” Instead of juggling multiple insurers, your single policy juggles its own benefit buckets. It first uses your base cover, then dips into bonuses or add-on benefits, and finally, if needed, activates restore or refill features for later claims. The order is specified in your policy document to prevent double payments and ensure that restored benefits are saved for future hospitalizations, not exhausted by a single large claim. So, the next time you see terms like Base Sum Insured, Bonus, or Restore, remember, they aren’t just numbers; they’re part of a carefully sequenced safety net working in the background to stretch your coverage wisely. |

Important operational tips for coordinating multiple policies

- Always disclose other active policies if asked on the proposal form or during claim initiation. Non-disclosure can be considered a material misrepresentation and may lead to claim denial.

- Link follow-up (pre/post) claims to the same policy that paid for the hospitalization (otherwise, those post-hospitalization claims can be rejected).

- Prefer the same insurer for base and super top-up (for smoother cashless settlement). If they’re with different insurers, expect more complex reimbursement processes and additional documentation.

- Keep digital and physical copies of settlement summaries, hospital bills, and receipts.

What are the benefits of Coordination of Benefits in Health Insurance?

| Benefit | Description |

|---|---|

| Higher overall coverage | Coordination of Benefits in Health Insurance lets you combine multiple health insurance policies (like a group and an individual plan) to increase your total protection and reduce out-of-pocket expenses. |

| Gap coverage | You can use a secondary policy to pay for costs not covered by your primary policy, such as co-payments, sub-limits, or non-payable items. |

| Flexibility in claim settlement | IRDAI allows policyholders to choose which insurer to approach first, giving you complete control over how to split or sequence your claims. |

| Continuity of protection | If your employer-provided group coverage ends (e.g., due to a job change), your personal policy ensures continued coverage. |

| Faster claim turnaround | Having multiple insurers can help you avoid delays; if one insurer takes time, the other can step in for the remaining claim amount. |

| Compliance and transparency | Coordination of Benefits in Health Insurance promotes honest disclosure of multiple policies, ensuring fair settlements and reducing claim disputes. |

Why Talk to Ditto for Your Health Insurance?

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Arun below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

Coordination of benefits in health insurance is a powerful tool when used wisely. It helps you expand your effective coverage, fill gaps left by a single policy, and stack defined-benefit payouts for added security. However, it also introduces some process complexity, such as documentation, disclosure, and careful claim alignment, which are key.

The golden rules:

- Keep it purposeful; limit yourself to 2–3 policies unless you truly need more.

- Always disclose all existing covers when buying & when diagnosed with a new one, disclose it to your insurer immediately to avoid future claim hassles.

- Link hospitalization and follow-up claims to the same policy/claim ID for smoother processing.

- Prefer the same insurer for base + super top-up plans to simplify cashless coordination.

Follow these steps, and the coordination of benefits in health insurance becomes a strong pillar of safety, rather than a paperwork burden.

FAQs on Coordination of Benefits in Health Insurance

Can a patient choose which insurance pays first?

Yes. Under IRDAI rules on coordination of benefits in health insurance, you can choose the policy to lodge your claim with. That insurer must settle the claim within its policy limits and terms.

How often should the Coordination of Benefits in Health Insurance be updated?

Update COB details whenever you add a new policy, change jobs (if group covers change), or on renewal, if questions arise on the proposal form. Practically: update at purchase and at each claim.

Can we claim the same amount in both plans?

No. For indemnity policies, you cannot be paid twice for the same medical expense. IRDAI and fundamental insurance law prevent double compensation. Defined-benefit plans (hospital cash, CI) are different; they pay fixed sums and can stack in addition to indemnity payouts.

Can I make cashless claims from all my insurers for a single claim?

Not simultaneously. Cashless is easiest when your base + super top-up are with the same insurer. If policies are with different insurers, typically one insurer will settle cashless, and you will claim the balance via reimbursement from the other insurer(s). Emerging platforms like the NHCX aim to make cross-insurer cashless transactions smoother, but today's scenarios often involve a mix of cashless and reimbursement options.

What documents do I need to claim from multiple insurers?

Standard hospital documents plus: claim settlement summary from the insurer who paid first, original hospital bills, discharge summary, payment receipts for out-of-pocket amounts, claim forms, ID, and bank proofs. Different insurers may ask for additional declarations.

Will splitting policies help save premiums?

Usually, no. Insurers often offer discounts for higher sum insureds under a single policy, so splitting the same product into multiple smaller policies can actually increase your overall premium.

You should opt for multiple or split policies only when there’s a genuine need. For instance, to get specialized coverage (like OPD or maternity benefits) or a higher sum insured for senior citizens. Always do so with informed consent and a clear understanding of the cost implications.

What if one insurer rejects the claim and the other accepts?

You can still claim the admissible portion from the insurer that accepts, and seek the disallowed portion (if valid under its T&Cs) from the other insurer. Document the rejection/denial reason and use it when approaching the second insurer.

Last updated on: