Quick Overview

Health insurance protects you from high medical costs, but factors like rising premiums, exclusions, and waiting periods can be challenging. Understanding its pros and cons helps you make smart choices, turning potential drawbacks into advantages for long-term financial and medical security. At Ditto, we make health insurance concepts simple and help our customers choose the correct health plan.

In this guide, we’ll walk you through:

- Advantages and disadvantages of health insurance

- Our top 5 recommended health plans

- Reasons to invest in health insurance

What Are the Advantages of Buying Medical Insurance?

Access to Quality Care

A good health insurance plan connects you to a trusted hospital network and lets you file cashless or reimbursement claims. In an emergency, you get timely care without large upfront payments, so you do not have to accept lower-quality treatment.

Tax Benefits

Health insurance premiums qualify for deductions under Section 80D ( under the old regime) of the Income Tax Act. You can claim up to ₹1,00,000 based on the premiums you pay for yourself, your spouse, your children, and your parents.

Cover for Advanced Treatments and Chronic Conditions

Modern procedures like robotic surgery or stem cell therapy can be costly. Insurance gives you access to these treatments without draining your savings. It also covers chronic conditions such as diabetes or hypertension.

Preventive Care and Wellness Benefits

Most plans offer annual health checkups that help you track your health and spot risks early. Some insurers provide wellness rewards, such as premium discounts for an active lifestyle, wellness counselling, or gym benefits. These rewards motivate you to stay active and support healthy habits.

Mental Health Coverage

Insurers now include coverage for hospitalization due to psychiatric and psychological conditions. This ensures your therapy and counselling sessions are covered and helps reduce out-of-pocket costs for mental healthcare.

Maternity and Newborn Benefits

Many plans cover normal delivery, C-section, and newborn care from day 1. But check the waiting period and limits on maternity costs. Also, not all individual plans offer this. Family floaters usually provide better maternity coverage.

OPD Coverage

OPD plans reduce costs for doctor visits, tests, and teleconsultations. However, they may have caps or higher premiums, so review them carefully.

Did you know?

Finance Minister Nirmala Sitharaman announced that, from 22 September 2025, there will be no GST on health insurance premiums. This cuts premium costs by up to 18% and makes your policy cheaper.

What Are the Disadvantages of Buying Medical Insurance?

1. Higher Costs With Age

Premiums increase as you grow older. Buying a health plan late often leads to higher payments (due to loading charges based on medical history, lifestyle habits, or BMI) and more exclusions (like waiting periods for pre-existing conditions), which reduce the value you receive.

Let’s look at how the annual premium varies for HDFC ERGO Optima Secure for a cover of 15 lakhs. Premiums are for an adult residing in Delhi. You can expect loading charges in the range of 10-50% on top of these if you have PEDs like diabetes/hypertension:

2. Waiting Periods

Many plans include waiting periods for specific illnesses and pre-existing conditions. You cannot make claims during that time, which limits early use of the policy.

IRDAI’s 2024 rules cut the pre-existing disease waiting period from four years to three years for all individual and family health plans. Some insurers also offer riders or special plans to reduce it further.

3. Out-of-Pocket Expenses

Room rent limits, treatment sub-limits, and co-pay clauses can lead to high out-of-pocket expenses during claims. If you do not review these terms, you may face unexpected costs at the time of treatment.

At Ditto, we do not recommend choosing plans with disease-specific sub-limits or co-pays, as they cap your coverage for specific treatments.

4. Claim Delays or Rejections

Claims may be delayed or rejected when policy terms are misunderstood or when documents/ disclosures are incomplete. Reading the policy carefully and staying prepared during claims keeps you protected.

What Are the Top 5 Health Insurance Plans in 2025 (Ditto’s Take)?

*Can be reduced with add-ons; **Can be increased with an add-on

Note: You can learn more about how we evaluate health insurance plans here.

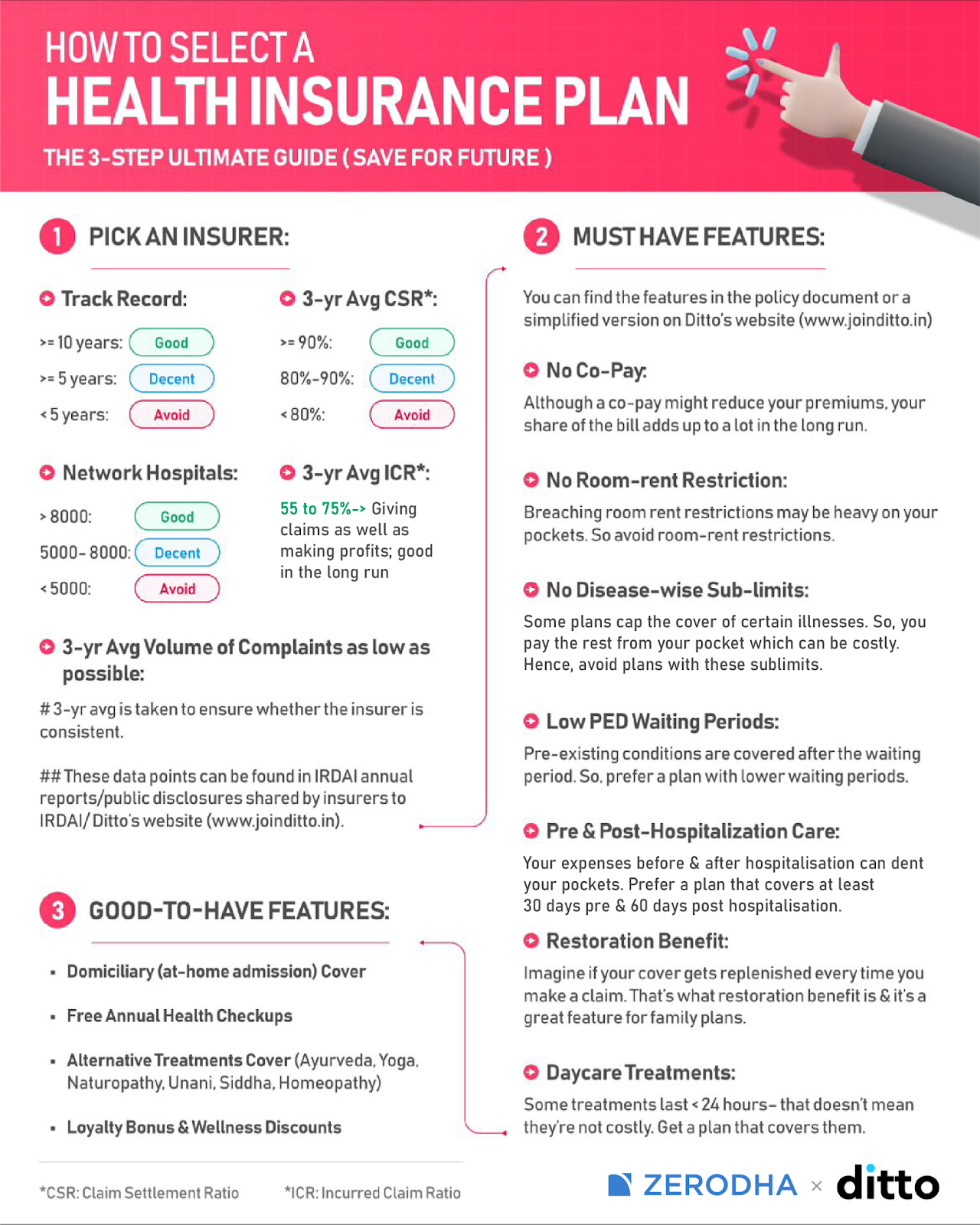

Take a quick look at this infographic, which guides you through the selection process of a comprehensive health plan:

Why Talk to Ditto for Your Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Rajan below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Ditto’s Take on Health Insurance

Health insurance may feel unnecessary when you are young, but that's exactly when you need to buy it. You pay lower premiums and finish all key waiting periods early. The right plan protects your savings and offers peace of mind in uncertain moments.

At Ditto, we recommend comprehensive health policies that protect you from large medical bills and keep your savings safe.

Still unsure about purchasing a health insurance policy? Book a free call with us and let our experts guide you to make an informed decision.

Frequently Asked Questions

Last updated on: